TSMC’s Container Maker is Hidden Jewel of Japan’s Chip Industry

source link: https://finance.yahoo.com/news/tsmc-container-maker-hidden-jewel-210000354.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

TSMC’s Container Maker is Hidden Jewel of Japan’s Chip Industry

(Bloomberg) -- The world’s most advanced and delicately fine-tuned semiconductors wouldn’t be possible without the aid of giant steel storage tanks built by a little-known Tokyo company founded in 1927.

Most Read from Bloomberg

Valqua Ltd. makes specialized, super clean containers for storing essential chipmaking chemicals, and it expects to hit its highest sales ever this fiscal year. It’s by far the world’s largest supplier of such tanks, dwarfing a clutch of smaller competitors in places like Taiwan, and providing almost every tank used by the world’s biggest contract chipmaker, Taiwan Semiconductor Manufacturing Co., according to Ichiyoshi Research Institute analyst Mitsuhiro Osawa.

Valqua is part of a loose network of Japanese manufacturers that dominate a niche but indispensable segment of the global chip supply chain. Disco Corp., for instance, is the industry’s go-to supplier of silicon wafer cutters, while JSR Corp. provides the high-purity chemicals that Valqua stores at chip plants.

“A molecular-level impurity would make the whole chemical solution in a tank useless, as it would drastically degrade the production yields of cutting-edge chipmaking,” Valqua President Yoshihiro Hombo said in an interview. “We and chemical makers support the complete supply chain by making, transporting and storing these solutions under ultra-clean conditions, and that is not something that can be easily replicated.”

Valqua gets more than half its sales from semiconductor makers and its close-knit relationship with the chip sector helps it stand out among industry peers. At $470 million, it’s Japan’s most valuable supplier of mechanical rubber products after doubling its share price over the past three years, from just before the pandemic. Valqua shares jumped in January after it reported a 41% leap in operating profit, and its president is confident revenue will grow by at least 30% over the next four years.

Bloomberg

BloombergJPMorgan Owned the LME ‘Nickel’ That Was Actually Bags of Stones

(Bloomberg) -- JPMorgan Chase & Co. owned the London Metal Exchange nickel contracts that turned out to be backed by bags of stones rather than metal, according to people familiar with the matter.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisCredit Suisse’s $17 Billion of Risky Bonds Are Now WorthlessThe One Big Winner and Many Losers of UBS’s Credit Suisse RescueMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndStocks Stage Relief Rally as Ba

3h ago MarketWatch

MarketWatchFirst Republic Bank’s stock plummets and Peloton’s stock falls while New York Community Bank shares soar, and other stocks on the move

MOVERS & SHAKERS Here are some of the biggest movers on Monday with banks again in focus, after Swiss authorities forced the takeover of Swiss bank Credit Suisse by its peer UBS. Stock gainers: New York Community Bancorp Inc.

6h ago AP Finance

AP FinanceChina says deadly 2022 plane crash still being investigated

Experts are still investigating the cause of the crash of a China Eastern Airlines jetliner that killed 132 people one year ago, China's government said Monday. The March 21, 2022, disaster was a rare failure for a Chinese airline industry that dramatically improved safety following deadly crashes in the 1990s. The Boeing 737-800 en route from Kunming in the southwest to Guangzhou, near Hong Kong, went into a nosedive from 8,800 meters (29,000 feet), appeared to recover and then slammed into a mountainside.

10h ago Bloomberg

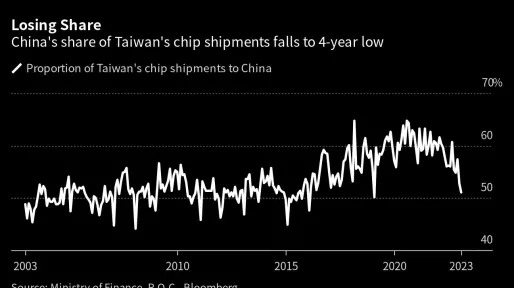

BloombergTaiwan Chip Exports to China Sputter on Tensions, Falling Demand

(Bloomberg) -- Taiwan’s exports of integrated circuit chips to China and Hong Kong fell for a fourth month in February as Washington-Beijing tensions simmer and demand for electronics continues to drop off. Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisCredit Suisse’s $17 Billion of Risky Bonds Are Now WorthlessThe One Big Winner and Many Losers of UBS’s Credit Suisse RescueMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndStocks Stage Relief

22h ago Bloomberg

BloombergTesla’s Vision of EVs Without Rare Earths Will Spur Magnet Race

(Bloomberg) -- Tesla Inc.’s ambition to remove rare earths from future models has producers in the sector reeling, but it also should spur global efforts to deliver alternatives for electric car motors that currently rely on the materials.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisCredit Suisse’s $17 Billion of Risky Bonds Are Now WorthlessThe One Big Winner and Many Losers of UBS’s Credit Suisse RescueMorgan Stanley Strategist Says Bank Stress Signals Bea

13h ago The Wall Street Journal

The Wall Street JournalCredit Suisse Collapse Burns Saudi Investors

Saudi Crown Prince Mohammed bin Salman last year directed government-backed Saudi National Bank to make a $1.5 billion investment in Credit Suisse that his financial advisers harbored doubts about.

2h ago MarketWatch

MarketWatchBillionaire investor Leon Cooperman sees a ‘self-induced’ crisis and a stock picker’s market. Here’s what he’s buying.

Hedge-fund manager Leon Cooperman said the current financial crisis isn't much of surprise. He divulged some sectors and one stock that he's buying now.

6h ago Investor's Business Daily

Investor's Business DailyAnalysts Warn Investors To Dump 10 Big Stocks Before It's Too Late

Analysts don't usually tell investors to sell S&P 500 stocks. So when they do, it's wise to pay attention.

11h ago Investor's Business Daily

Investor's Business DailyDow Jones Pops, First Republic Craters As Powell Looms; Donald Trump Stock Surges

The Dow Jones rallied even as the latest Fed meeting, led by Jerome Powell, looms. First Republic stock plunged. A Donald Trump stock surged.

2h ago Bloomberg

BloombergFirst Republic Dives 47% to Record Low on Downgrade, Bank Talks

(Bloomberg) -- First Republic Bank’s shares tumbled 47% to an all-time low after S&P Global lowered its credit rating for the second time in a week and as executives from major banks discussed fresh efforts to stabilize the lender.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisCredit Suisse’s $17 Billion of Risky Bonds Are Now WorthlessThe One Big Winner and Many Losers of UBS’s Credit Suisse RescueMorgan Stanley Strategist Says Bank Stress Signals Bear Market

52m ago TheStreet.com

TheStreet.comElon Musk Warns the Banking Crisis May Lead to Something Bigger

The crisis of confidence affecting regional banks poses a serious risk to the economy, the billionaire entrepreneur warns.

8h ago Bloomberg

BloombergJPMorgan’s Kolanovic Sees Increasing Chances of ‘Minsky Moment’

(Bloomberg) -- Bank failures, market turmoil and ongoing economic uncertainty as central banks battle high inflation have increased the chances of a “Minsky moment,” according to JPMorgan Chase & Co.’s Marko Kolanovic.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisCredit Suisse’s $17 Billion of Risky Bonds Are Now WorthlessThe One Big Winner and Many Losers of UBS’s Credit Suisse RescueMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndStocks St

3h ago Investor's Business Daily

Investor's Business Daily16 Top Growth Stocks Expecting A 50% To 439% Rise This Year

Palo Alto Networks and Salesforce lead this list of 16 top-rated growth stocks eyeing 50% to 439% EPS growth this year.

2h ago MarketWatch

MarketWatchAnger and tears from shocked Credit Suisse staff after historic UBS takeover

Credit Suisse’s fate is sealed, as Swiss rival UBS acquired the bank for 3 billion francs ($3.2 billion) in a historic deal that has shaken the financial sector. Credit Suisse (CS) (CH:CSGN) asked staff to return to work as usual this morning, but employees greeted the news that the 167-year-old bank will cease to exist with a mix of anger, surprise, tears and, in some cases, resignation that it had to happen, according to conversations with around a dozen staff at the bank. “Everyone is stunned by the speed of the downfall,” said another senior investment banker.

10h ago Benzinga

BenzingaIs Silver the Next Gamestop? How Retail Investors Challenged Wall Street Giants Again

In the wake of unprecedented short squeezes involving stocks like GameStop and AMC in early 2021, a group of retail investors from the Reddit forum r/WallStreetBets (and the spinoff called r/WallStreetSilver) set their sights on the silver market, attempting to challenge Wall Street giants with a so-called "silver short squeeze." The silver short squeeze movement was sparked on the r/WallStreetBets forum, where users urged each other to buy silver and silver-related assets to drive up prices and

8h ago MoneyWise

MoneyWise'Crash and crisis just starting': Robert Kiyosaki just blasted the US central bank, calls The Fed both the 'fireman and the arson' — here are 3 assets he likes for shockproofing

Prepare. The author sees more pain ahead.

8h ago TheStreet.com

TheStreet.comWarren Buffett Offers Safety During New Bank Scare

Other financial institutions have been affected, including Signature Bank , First Republic Bank , and even Credit Suisse . During the chaos, prominent figures have been talking with Warren Buffett and his Omaha, Neb.-based diversified holding company Berkshire Hathaway . "We were not too surprised to see stories pop up over the weekend about Warren Buffett, CEO of wide-moat Berkshire Hathaway, being in conversations with the Biden administration about the banking crisis, as well as reports from the major news outlets that a large number of private jets have made their way to Omaha this weekend," wrote Morningstar's Greggory Warren on March 19.

4h ago Bloomberg

BloombergThe 11 Days of Turmoil That Brought Down Four Banks And Left a Fifth Teetering

(Bloomberg) -- The speed with which four banks collapsed — and one continues to struggle — has left investors reeling. While the failures came in the span of just 11 days, the scenarios that brought them down were each unique.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisCredit Suisse’s $17 Billion of Risky Bonds Are Now WorthlessThe One Big Winner and Many Losers of UBS’s Credit Suisse RescueMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndS

5h ago MoneyWise

MoneyWise'Meltdown to zero': Kevin O'Leary says there's a 100% chance of another crypto debacle — and that it will happen 'over and over and over again.' Here's what he likes instead

Is Mr. Wonderful bailing on crypto? Not quite.

10h ago Investor's Business Daily

Investor's Business DailyDow Jones Leader Microsoft Breaks Out Past New Buy Point; 2 Other Top Stocks To Watch

Dow Jones software giant Microsoft broke out past its latest buy point, while HubSpot and Monolithic Power are top stocks to watch.

2h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK