Mortgage rates slide following bank turmoil

source link: https://finance.yahoo.com/news/mortgage-rates-slide-following-bank-turmoil-160117696.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Mortgage rates slide following bank turmoil

that the housing

Mortgage rates dropped this week after two bank failures inflamed investor fears.

The rate on the average 30-year fixed mortgage fell to 6.60% this week, down from 6.73% the week prior, according to Freddie Mac. The rate tracks the 10-year Treasury yield, which has fallen over 40 basis points from last Thursday’s close as investors bet the Federal Reserve could slow its interest-rate hiking campaign after Silicon Valley Bank and Signature Bank collapsed and worries emerged over Credit Suisse and First Republic Bank.

Freddie Mac’s survey runs from Thursday to Wednesday, with results published on Thursday.

The sudden drop in rates revived some activity in the housing market, encouraging some sidelined buyers to make moves. Still, the high volatility of the market could keep other folks on pause.

“I think there’s still a lot of uncertainty, but in the near term, I do expect rates to drop,” Daryl Fairweather, chief economist at Redfin, told Yahoo Finance on Monday. “I expect buyers to take advantage of those mortgage rates because we’ve seen buyers be incredibly sensitive to those interest rates.”

Buyers rush to lock in lower rates

As rates slid toward the end of last week, some homebuyers rushed to capitalize on that window of opportunity, uncertain how long it would last.

The volume of applications to purchase a home increased 7% from one week earlier, the Mortgage Bankers Association’s survey for the week ending March 10 found. Overall purchase activity remained 38% lower than the same week one year ago.

“People are right to lock in a rate during a dip,” Jeff Reynolds, broker at Compass and founder of UrbanCondoSpaces.com, told Yahoo Finance on Monday. “Around the first week of March, rates were up in the 7s. If you lock today, you’ll be saving almost 50 basis points, which is crazy. It’s a significant payment difference.”

Will a rate drop last?

Rates likely will remain volatile as markets weigh which will affect the Federal Reserve’s decision more next week on interest rates — the shockwaves from this week’s bank failures or the latest still-hot inflation reading. The European Central Bank on Thursday hiked its short-term interest rate by a half-point despite the banking turmoil.

Yahoo Finance

Yahoo FinanceTreasury Secretary Yellen to tell Congress 'our banking system remains sound'

Treasury Secretary Janet Yellen's prepared remarks ahead of Senate testimony on Thursday seek to assure lawmakers the U.S. banking system remains "sound."

5h ago Yahoo Finance

Yahoo FinanceAudi: record profit as 'biggest product initiative' in its history gets underway

Even as the Audi Group, VW’s luxury division, is in the midst of a huge EV transformation it still needs to perform where it counts - the bottom line. On Thursday the Audi Group - which is dominated volume-wise by Audi but also includes Bentley, Lamborghini, and Ducati - posted record revenue and operating profit in 2022. That shouldn’t be a surprise given what the industry has been seeing at the highest end of the market - record performance despite macroeconomic jitters across the globe.

50m ago Yahoo Finance

Yahoo FinanceGoldman boosts US recession odds after slashing GDP forecast

Goldman ringing some alarm bells.

6h ago Yahoo Finance

Yahoo FinanceHousing activity perked up on brief dip in mortgage rates after SVB collapse

The volume of all mortgage applications rose 6.5% compared with the previous week, the Mortgage Bankers Association said.

1d ago Yahoo Finance

Yahoo FinanceWall Street is letting Netflix know how it feels about price cuts

Time for Netflix to reverse those price cuts?

4h ago Yahoo Finance

Yahoo FinanceSavers could end up being big winners after SVB collapse

Several banks increased the yields on their deposit account products following the collapse of two banks.

21h ago Yahoo Finance

Yahoo FinanceA bank failure, a panic, and a race to close on a home

A mortgage professional in Seattle rushed to close a home loan with First Republic Bank before conditions got worse.

20h ago Yahoo Finance

Yahoo FinanceStock market news today: Stocks reverse higher after shock ECB decision

U.S. stocks were higher early Thursday, reversing early losses after a decision from the ECB to raise rates by 50 basis points initially surprised investors amid concerns of global financial market stability.

43m ago The Wall Street Journal

The Wall Street JournalFirst Republic Bank in Rescue Talks With Biggest U.S. Lenders

The beleaguered lender is working on various potential options to shore itself up including a capital raise.

21m ago MarketWatch

MarketWatchI’m 70 and weighing whether to ‘sell everything’ and put it all in Treasuries, or hire a financial adviser even though it would cost $20K a year. What should I do?

THE ADVICER MarketWatch Picks has highlighted these products and services because we think readers will find them useful; the MarketWatch News staff is not involved in creating this content. Links in this content may result in us earning a commission, but our recommendations are independent of any compensation that we may receive.

1d ago Investor's Business Daily

Investor's Business DailyStock Market Gains Ground; Bank Stocks Recover While Warren Buffett Makes Big Move

The stock market traded higher Thursday morning after regional banks bounced. Big Tech and the Nasdaq composite bucked the early downward tide, trading higher, while small caps shed opening losses. Regional bank stocks are back in the hot seat.

1h ago TipRanks

TipRanksCharles Schwab CEO says he took advantage of the recent dip. Here are 3 other bank stocks insiders are buying now

‘Buy the dip’ has not become the ubiquitous phrase it is for no reason. With bank stocks recently falling in unison whether they are in danger of meeting the same fate as SVB and Signature bank or not, there are plenty of ‘buy the dip’ opportunities investors can take advantage of right now. And that’s what one CEO has been doing. Having watched shares of his firm Charles Schwab drop by more than 30% since the crisis began, CEO Walter Bettinger said on Tuesday that he purchased 50,000 shares for

22h ago SmartAsset

SmartAssetSwitch to Roth Contributions If You Have This Much Money

Deciding whether to save in a pretax or Roth account for retirement just got a little easier – at least for people 50 and older. T. Rowe Price has pinpointed how much late-career workers who want to leave money to … Continue reading → The post Switch to Roth Contributions If You Have This Much Money appeared first on SmartAsset Blog.

21h ago Bloomberg

BloombergChina to Let Power Prices Turn Negative in Solar-Rich Province

(Bloomberg) -- Power traders in China’s Shandong province can now ask to be paid for taking electricity as the province’s growing rooftop solar capacity threatens to overwhelm the grid. Most Read from BloombergCredit Suisse Fights to Win Back Confidence as Stock SlumpsBofA Gets More Than $15 Billion in Deposits After SVB Fails‘Old-School’ Signature Bank Collapsed After Its Big Crypto LeapSignature Bank Faced Criminal Probe Ahead of Firm’s CollapseRussian Fighter Jet Collides With US Drone Over B

1d ago Bloomberg

BloombergUS Bank Stocks Sink as Credit Suisse Fear Spurs Renewed Rout

(Bloomberg) -- Stocks of major US lenders sank with a sector gauge hitting the lowest level since November 2020 on Wednesday, following European banks down after Credit Suisse Group AG plunged.Most Read from BloombergFirst Republic Bank Is Said to Weigh Options Including a SaleCredit Suisse Reels After Top Shareholder Rules Out Raising StakeRyan Reynolds-Backed Mint Is Bought by T-Mobile for $1.35 BillionIn New York City, a $100,000 Salary Feels Like $36,000Traders Dash for Cover as Bank Drama R

20h ago Yahoo Finance

Yahoo FinanceDip in mortgage rates after bank collapse is fleeting

The average rate on the 30-year fixed mortgage increased to 6.75% on Tuesday, according to the latest Mortgage News Daily quote.

2d ago AP Finance

AP FinanceCredit Suisse shares soar after central bank offers lifeline

Credit Suisse shares surged Thursday after the Swiss central bank agreed to loan the bank up to 50 billion francs ($54 billion) to bolster confidence in the country’s second-biggest lender following the collapse of two U.S. banks. Credit Suisse announced the agreement before the Swiss stock market opened, sending shares up as much as 33% before they settled around a 17% gain, to 2 francs ($2.15), in late afternoon trading. The Swiss National Bank said Wednesday that it was prepared to back Credit Suisse because it meets the higher financial requirements imposed on “systemically important banks,” adding that the problems at some U.S. banks don’t “pose a direct risk of contagion” to Switzerland.

12h ago Investor's Business Daily

Investor's Business DailyDow Jones Futures Fall: Credit Suisse Taps Swiss National Bank; First Republic Dives On Sales Report

Credit Suisse borrowed up to $54 billion from the Swiss National Bank after the Nasdaq eked out a gain Wednesday.

4h ago Yahoo Finance

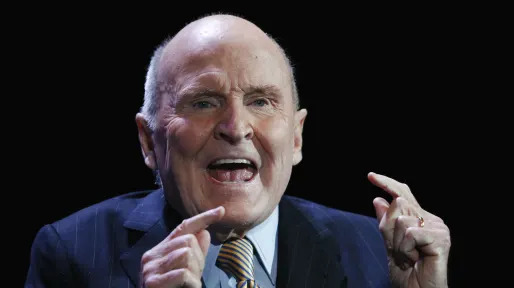

Yahoo FinanceJack Welch's GE legacy ended last week: R.I.P.

Jack Welch, the legendary long-time chief executive of General Electric, died on Mar. 1, 2020, almost two decades after he left the company. His corporate legacy died at GE’s recent Investor Day event: Mar. 9, 2023.

1d ago Reuters

ReutersFTX transferred $2.2 billion to Bankman-Fried via related entities, new managers say

Overall more than $3.2 billion was transferred through payments and loans to company founders and key employees, FTX said in a statement on Wednesday. These payments were made chiefly from Alameda Research hedge fund, FTX said, adding that it made these disclosures by filing schedules and statements of financial affairs with the bankruptcy court. The crypto exchange said the transfers did not include over $240 million spent to purchase luxury property in the Bahamas, political and charitable donations made directly by the FTX debtors, and substantial transfers to non-debtor units in the Bahamas and other jurisdictions.

11h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK