SVB Blowout May Drive SoftBank Shares Below Son’s Pain Point, Trigger Buyback

source link: https://finance.yahoo.com/news/svb-blowout-may-drive-softbank-055039457.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

SVB Blowout May Drive SoftBank Shares Below Son’s Pain Point, Trigger Buyback

(Bloomberg) -- The sudden collapse of Silicon Valley Bank looks set to increase scrutiny of SoftBank Group Corp. investments, and possibly drive its share price to Masayoshi Son’s pain point.

Most Read from Bloomberg

The US tech lender’s failure has fueled investor concern over the exposure to startup firms in the SoftBank Vision Funds. SoftBank shares have plunged 13% in four sessions to below 5,000 yen and are nearing a level that some see as Son’s threshold for announcing a buyback.

The SVB crisis has trained a spotlight on private tech investments, especially following a flight from highly valued stocks as the Federal Reserve started tightening last year. While SoftBank said it expects almost no impact from the US lender’s collapse, few investors think it will emerge unscathed.

SVB Crisis Exposes Lurking Systemic Risk of Tech Money Machine

“Startups’ funding conditions were getting tougher and the window for IPOs was narrowing even before SVB’s failure,” said Tetsuro Ii, chief executive at Commons Asset Management Inc. “One thing that is certain is that things will get worse.”

SoftBank may have to mark down the value of private companies it has invested in. That’s on top of the slide in the company’s publicly traded investments, most notably Alibaba Group Holding Ltd., whose shares are down 30% from a January high amid a selloff in Chinese stocks. SoftBank declined to comment for this article.

That will not go down well with investors after losses that have helped drive SoftBank down 30% from a November peak. The company has posted a cumulative net loss of about $22 billion over the past four quarters amid declines in portfolio holdings including WeWork Inc.

Decrypt Media

Decrypt MediaCoinbase Chief Legal Officer on SEC Crypto Approach: ‘Is This the Best We Can Do?’

The way the SEC is approaching crypto regulation in the U.S. is “pretty broken,” according to Coinbase Chief Legal Officer Paul Grewal.

18h ago Bloomberg

BloombergUnlikely Venture Star Bags 35% Returns Mining Science Papers

(Bloomberg) -- Japan isn’t known for its startup culture. Tomotaka Goji, a bureaucrat-turned-technology guru, is working hard to change that.Most Read from BloombergCredit Suisse Reels After Top Shareholder Rules Out Raising StakeRyan Reynolds-Backed Mint Is Bought by T-Mobile for $1.35 BillionFirst Republic Bank Is Said to Weigh Options Including a SaleIn New York City, a $100,000 Salary Feels Like $36,000Traders Dash for Cover as Bank Drama Rattles Globe: Markets WrapThe 50-year-old runs a low

20h ago Reuters

ReutersGoldman Sachs cuts U.S. GDP forecast after banking crisis

Regional banks in the United States have been on a bumpy ride since SVB Financial Group was shuttered by regulators after a bank run last week. The rapid unraveling of the startup lender has fueled worries of potential bank runs at peers that could leave them scrambling for funds to meet deposit withdrawal requests. Goldman Sachs said stress at some banks persists despite federal agencies having acted aggressively to bolster the financial system.

12h ago Bloomberg

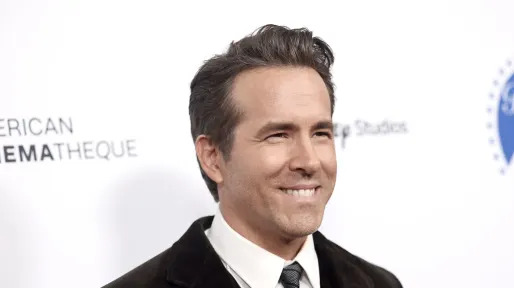

BloombergRyan Reynolds-Backed Mint Is Bought by T-Mobile for $1.35 Billion

(Bloomberg) -- T-Mobile US Inc. is buying Mint Mobile, the budget wireless provider partly owned by actor Ryan Reynolds, for as much as $1.35 billion in an effort to bolster its prepaid phone business and reach more lower-income customers.Most Read from BloombergCredit Suisse Reels After Top Shareholder Rules Out Raising StakeRyan Reynolds-Backed Mint Is Bought by T-Mobile for $1.35 BillionFirst Republic Bank Is Said to Weigh Options Including a SaleIn New York City, a $100,000 Salary Feels Like

7h ago USA TODAY

USA TODAYWe love saving on everyday essentials with Amazon Subscribe & Save—here's how to get up to 15% off

Want to start saving on all the everyday products you need? Here's how to save up to 15% with Amazon Subscribe & Save.

9h ago Bloomberg

BloombergWeb of Secret Chip Deals Allegedly Help US Tech Flow to Russia

(Bloomberg) -- For years, Artem Uss had appeared in Russian media as the owner of fancy real estate, luxury cars and Italian hotels. Now US officials allege he’s at the center of a suspected secret supply chain that prosecutors say used American technology to support President Vladimir Putin’s war in Ukraine.Most Read from BloombergCredit Suisse Reels After Top Shareholder Rules Out Raising StakeRyan Reynolds-Backed Mint Is Bought by T-Mobile for $1.35 BillionFirst Republic Bank Is Said to Weigh

1d ago Bloomberg

BloombergApollo to Buy Univar in $8.1 Billion Deal, Including Debt

(Bloomberg) -- Apollo Global Management Inc. has agreed to acquire chemical maker Univar Solutions Inc. for $8.1 billion including debt.Most Read from Bloomberg‘Old-School’ Signature Bank Collapsed After Its Big Crypto LeapRussian Fighter Jet Collides With US Drone Over Black SeaUS Core CPI Tops Estimates, Pressuring Fed as It Weighs HikeCredit Suisse Finds ‘Material’ Control Lapses After SEC PromptBillionaire Charles Schwab’s Fortune Is Slammed by SVB FalloutUnivar shareholders will receive $36

1d ago Investor's Business Daily

Investor's Business DailyIBD Screen Of The Day: AMD, Chipotle Boast Rising Profit Estimates

AMD stock is nearing a new buy point in today's stock market sell-off, while Chipotle boasts rising profit estimates.

10h ago Fox Business

Fox BusinessSilicon Valley Bank committed 'one of the most elementary errors in banking,' Larry Summers says

Former Treasury Secretary Larry Summers said Silicon Valley Bank made an "elementary" mistake in banking that led to its collapse and takeover by federal regulators.

2d ago MarketWatch

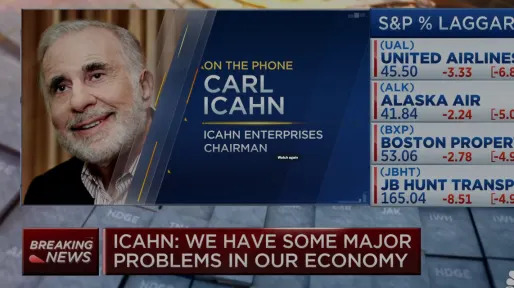

MarketWatch‘Net worth of median household is basically nothing,’ says Carl Icahn. ‘We have some major problems in our economy.’

Carl Icahn is worried about the economy in the wake of action taken by the government to mitigate one of the largest bank failures in U.S. history.

1d ago MarketWatch

MarketWatchI’m 70 and weighing whether to ‘sell everything’ and put it all in Treasuries, or hire a financial adviser even though it would cost $20K a year. What should I do?

THE ADVICER MarketWatch Picks has highlighted these products and services because we think readers will find them useful; the MarketWatch News staff is not involved in creating this content. Links in this content may result in us earning a commission, but our recommendations are independent of any compensation that we may receive.

19h ago Investor's Business Daily

Investor's Business DailyReport: 10 Banks Are Most Exposed To Uninsured Deposits

High levels of uninsured deposits helped do in Silicon Valley Bank and Signature Bank. But it turns out they're not alone.

17h ago Yahoo Finance

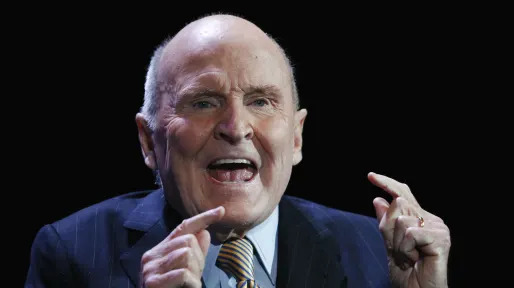

Yahoo FinanceJack Welch's GE legacy ended last week: R.I.P.

Jack Welch, the legendary long-time chief executive of General Electric, died on Mar. 1, 2020, almost two decades after he left the company. His corporate legacy died at GE’s recent Investor Day event: Mar. 9, 2023.

15h ago Zacks

ZacksUpstart Holdings, Inc. (UPST) is Attracting Investor Attention: Here is What You Should Know

Upstart Holdings, Inc. (UPST) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2d ago TheStreet.com

TheStreet.comThree U.S. Banks Collapsed in a Week. Here's Why Others Might Follow.

Global markets fear that other banks will fail after the collapse of Silicon Valley Bank, Silvergate and Signature Bank in New York. Here's why.

13h ago TipRanks

TipRanksInflation at 6%: 2 ‘Strong Buy’ Dividend Stocks That Beat This Rate

Markets are in a state of flux right now, with heavy changes on the near horizon. The collapse of Silicon Valley Bank – and the Fed’s takeovers of it and the crypto-heavy Silvergate and Signature banks – have sparked fears of a new banking or financial crisis, as well as calls for the Federal Reserve to pare back on its policy of interest rate hikes and monetary tightening. The inflation numbers for February were in-line with expectations, with a monthly gain of 0.4% and an annualized rate of 6%

2d ago Zacks

ZacksUnited Rentals (URI) Outpaces Stock Market Gains: What You Should Know

United Rentals (URI) closed the most recent trading day at $416.09, moving +1.95% from the previous trading session.

1d ago Barrons.com

Barrons.comRivian Stock Is Really Just About Free. Investors Shouldn’t Forget Cash.

The electric vehicle maker's cash balance at the end of 2022 almost equals the company's market capitalization.

8h ago Reuters

ReutersTyson Foods to shut two US chicken plants with nearly 1,700 workers

CHICAGO (Reuters) -Tyson Foods Inc will close two U.S. chicken plants with almost 1,700 employees on May 12, the company said on Tuesday. The closures show the biggest U.S. meat company by sales is still trying to figure out how to improve its chicken business that has struggled for years. Tyson will shut a plant in Glen Allen, Virginia, with 692 employees and a plant in Van Buren, Arkansas, with 969 employees, according to a statement.

2d ago The Telegraph

The TelegraphHow Credit Suisse turned Switzerland’s banking industry into a national embarrassment

Once the pride of the Swiss banking industry, Credit Suisse’s fall from grace shows few signs of abating.

16h ago TipRanks

TipRanksDown More Than 30%: Insiders Buy the Dip in These 2 Beaten-Down Regional Bank Stocks

The week got off to a rocky start as the markets digested the collapse of Silicon Valley Bank last week, and the Federal regulators’ shutdown of Signature Bank over the weekend. Sparking fears of contagion, on Monday, stocks in the banking sector saw shares drop dramatically, as investors scrambled to figure out the new patterns of risk and reward. The effect was most pronounced among the mid-sized and regional banking firms. In that niche, sudden drops in share value prompted trading halts for

2d ago Fortune

FortuneBank of America won big from the Silicon Valley Bank collapse

Sources familiar with the matter say former Silicon Valley Bank customers are looking to put their money in the safest institution possible.

17h ago Reuters

ReutersSwiss government holds talks on options to stabilize Credit Suisse - Bloomberg News

Credit Suisse leaders and government officials have talked about options that range from a public statement of support to a potential liquidity backstop, the report said. Other suggested potential moves for Credit Suisse could be a potential separation of their Swiss unit and a tie-up with their larger Swiss competitor, UBS Group AG, the report said, adding that it's unclear which, if any of these steps will actually be executed. Switzerland is under pressure from at least one major government to intervene quickly on Credit Suisse, a source familiar with the situation told Reuters, after the Swiss bank led a rout of European bank stocks on Wednesday.

10h ago Bloomberg

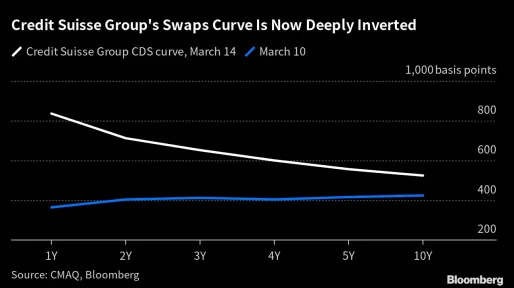

BloombergCredit Suisse Default Swaps Are 18 Times UBS, 9 Times Deutsche Bank

(Bloomberg) -- The cost of insuring the bonds of Credit Suisse Group AG against default in the near-term is approaching a rarely-seen level that typically signals serious investor concerns.Most Read from BloombergCredit Suisse Reels After Top Shareholder Rules Out Raising StakeRyan Reynolds-Backed Mint Is Bought by T-Mobile for $1.35 BillionSignature Bank Faced Criminal Probe Ahead of Firm’s CollapseBofA Gets More Than $15 Billion in Deposits After SVB FailsWall Street’s Fear Gauge Surges With B

18h ago Zacks

ZacksZacks.com featured highlights include Steel Dynamics, Primerica and CVR Energy

Steel Dynamics, Primerica and CVR Energy are part of the Zacks Screen of the Week article.

16h ago Zacks

ZacksClearfield, Inc. (CLFD) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Clearfield (CLFD). This makes it worthwhile to examine what the stock has in store.

2d ago Investor's Business Daily

Investor's Business DailySemiconductor Stocks Climb Yet Inventories Bedevil Chip Industry; A Reality Check May Be Coming

Investors are profiting in semiconductor stocks this year, but analysts are wary. Here's what you should know about the chip industry right now.

9h ago Benzinga

BenzingaYou'll Never Guess the Top-Performing Stock of the Last 20 Years

If a time machine could take you back to the start of the 2000s — without the desire to open up a crypto wallet — what’s the No. 1 investment you would make? Maybe Apple Inc. (NASDAQ: AAPL), which has sold 1.3 billion iPhones since 2007 and reported a $19.4 billion profit last quarter? Or Tesla Inc. (NASDAQ: TSLA), which went from selling just 937 cars in 2009 to over 300,000 last year? Some savvy income investors might consider Altria Group Inc. (NYSE: MO). The tobacco giant, formerly Phillip M

1d ago Reuters

ReutersU.S. banks' CDS prices surge as contagion concern widens

A jump in the cost for Wall Street banks to insure bonds against default on Wednesday was another worrisome indicator of credit stress for investors amid the crisis at Credit Suisse and at U.S. regional banks. According to S&P Global Market Intelligence, spreads on five-year credit default swaps on JPMorgan Chase & Co, Bank of America Corp, Morgan Stanley and Wells Fargo shot up to their highest since October, while those for Goldman Sachs and Citigroup Inc are highest since November. "Credit spreads are telling you there is systemic risk in the system," said Lance Roberts, chief investment strategist at RIA Advisors.

10h ago Zacks

ZacksPhillips 66 (PSX) Is a Trending Stock: Facts to Know Before Betting on It

Phillips 66 (PSX) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

2d ago The Telegraph

The TelegraphMore banks could go under, warns Larry Fink

The chief executive of the world’s biggest money manager has warned that more banks could collapse, as Swiss regulators were last night forced to reassure investors that Credit Suisse was not at risk.

9h ago MarketWatch

MarketWatchIt’s raining money on Bank of America. Inflows of over $15 billion reportedly seen amid SVB fallout

Rattled by the collapse of three U.S. banks within a week, customers poured $15 billion into the too-big-to-fail bank.

18h ago Zacks

ZacksShould You Buy the Regional Bank Stocks?

The regional bank ETFs are down double digits in just a few days. Is it a buying opportunity?

9h ago Zacks

ZacksUiPath (PATH) Q4 Earnings and Revenues Beat Estimates

UiPath (PATH) delivered earnings and revenue surprises of 114.29% and 10.93%, respectively, for the quarter ended January 2023. Do the numbers hold clues to what lies ahead for the stock?

7h ago MarketWatch

MarketWatchBlackRock’s Larry Fink warns of ‘slow rolling crisis’ as Fed’s inflation fight drags on for years

BlackRock Inc. co-founder and CEO Larry Fink warned his firm's investors that the Federal Reserve's aggressive interest-rate hikes were the "first domino to fall" in what could be a "slow-rolling crisis" similar to other "spectacular financial flameouts" of the past.

16h ago Investor's Business Daily

Investor's Business DailyChevron, Exxon Mobil Falter As Oil Prices Skid To 15-Month Lows

U.S. oil prices dropped Wednesday to their lowest levels since December 2021 and energy stocks responded.

9h ago Yahoo Finance

Yahoo FinanceSavers could end up being big winners after SVB collapse

Several banks increased the yields on their deposit account products following the collapse of two banks.

10h ago Investor's Business Daily

Investor's Business DailyDow Jones Futures Rise As Credit Suisse Taps $54 Billion From Swiss National Bank

Futures rose as Credit Suisse borrowed up to $54 billion from the Swiss National Bank after The Nasdaq eked out a gain Wednesday.

2h ago Investopedia

InvestopediaFirst Republic, Regional Banks Won’t Benefit Much from Fed's New Funding Program

The Fed's new funding program for ailing banks may not be of much use to regional banks because they don't hold the securities they need to pledge to get the Fed's help.

1d ago Investor's Business Daily

Investor's Business DailyIs It Time To Buy XOM Stock As Exxon Mobil Gets Beaten Down By Banking Crisis?

XOM stock is down 15% from February's all-time high. Did XOM get unduly punished during the bank crisis, giving investors a chance to buy?

6h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK