What Silicon Valley Bank’s Collapse Means for Climate Tech

source link: https://finance.yahoo.com/news/silicon-valley-bank-collapse-means-232742521.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

What Silicon Valley Bank’s Collapse Means for Climate Tech

(Bloomberg) -- As the buoyancy drained out of the tech sector last year, leading to almost 100,000 job cuts in the US, cleantech looked like a bright spot. Investors pumped some $59 billion into climate technology companies in 2022, more than the year before, across 1,182 deals tracked by researchers at BloombergNEF.

Most Read from Bloomberg

The collapse of Silicon Valley Bank, on which the dust is just settling after a white-knuckle weekend, is throwing a wrench into that outlook. It’s the first major headwind to blow against a boom in climate-tech investing that was capped off by incentives in the US Inflation Reduction Act last year. SVB was known as a climate bank — one that lent big to renewable energy companies, specialized in small solar projects and by its own accounting served more than 1,550 customers doing climate and sustainability work.

Clean-energy developers with smaller projects received a welcome reception from SVB that they didn't get at Manhattan-based giants like Morgan Stanley and JPMorgan Chase & Co., said Pol Lezcano, BloombergNEF’s lead US solar analyst. "Silicon Valley Bank was more than happy to pick up the tab for portfolios that were less than 100 megawatts,” said Lezcano.

That is, until the bank went into receivership on Friday and set off a feverish few days in which startups wondered how they’d make payroll, VCs worked to shore up support and regulators moved in to contain the damage. On Sunday, US regulators said they would guarantee all SVB deposits. The bank sent out a notice to its depositors on Monday, informing them that domestic transactions could resume. International payment services remain suspended.

Bloomberg

BloombergChina Self-Driving Startup WeRide Files for $500 Million US IPO, Sources Say

(Bloomberg) -- Chinese driverless technology startup Guangzhou WeRide Technology Co. has filed confidentially for an initial public offering in the US and is looking to raise as much as $500 million, according to people familiar with the situation.Most Read from BloombergCredit Suisse Finds ‘Material’ Control Lapses After SEC PromptBonds Rocket, Stocks Steady as Fed Rate Path Eyed: Markets WrapBillionaire Charles Schwab’s Fortune Is Slammed by SVB FalloutGlobal Banking Stocks Hold Steady After $

12h ago Zacks

ZacksEnphase Energy (ENPH) Gains As Market Dips: What You Should Know

Enphase Energy (ENPH) closed the most recent trading day at $211.53, moving +0.62% from the previous trading session.

15h ago Bloomberg

BloombergFirst Horizon Plunges 38% Below TD Bid in Regional Bank Nightmare

(Bloomberg) -- First Horizon Corp. fell by the most since September 2008 as the crisis in regional banks cast doubt on whether Toronto-Dominion Bank will follow through with its planned $13.4 billion takeover of the lender. Most Read from BloombergCredit Suisse Finds ‘Material’ Control Lapses After SEC PromptBonds Rocket, Stocks Steady as Fed Rate Path Eyed: Markets WrapBillionaire Charles Schwab’s Fortune Is Slammed by SVB FalloutUS Backstops Bank Deposits to Avert Crisis After SVB FailureGloba

15h ago MarketWatch

MarketWatchClimate tech risked becoming a banking-crisis casualty. What’s next for solar and the rest of fledgling sector?

Silicon Valley Bank was a major funding source for 1,500 solar, carbon capture and VC-backed climate companies. How vulnerable is climate tech moving forward?

13h ago Bloomberg

BloombergUkraine Rebuffs Russia’s Offer of a 60-Day Extension on Grain Deal

(Bloomberg) -- Ukraine pushed back on Russia’s apparent offer to extend the landmark grain-export deal by just 60 days when it comes up for renewal later this week.Most Read from BloombergBonds Rocket, Stocks Steady as Fed Rate Path Eyed: Markets WrapBillionaire Charles Schwab’s Fortune Is Slammed by SVB FalloutUS Backstops Bank Deposits to Avert Crisis After SVB FailureHow to Safely Store Deposits If You Have More Than $250,000Signature Seized by Regulators as Pain Spreads From SVB’s FallRussia

16h ago Bloomberg

Bloomberg‘Everything Everywhere’ Wins at Oscars Over Big-Budget Films

(Bloomberg) -- Everything Everywhere All at Once, a film made for under $20 million by the independent studio A24, was the big winner at the 95th Academy Awards, picking up best picture and six other trophies over some of the highest-grossing movies in Hollywood history.Most Read from BloombergCredit Suisse Finds ‘Material’ Control Lapses After SEC PromptBonds Rocket, Stocks Steady as Fed Rate Path Eyed: Markets WrapBillionaire Charles Schwab’s Fortune Is Slammed by SVB FalloutGlobal Banking Sto

15h ago Bloomberg

BloombergWork Just Doesn’t Pay for Thousands of People in Sunak’s Britain

(Bloomberg) -- Saira Hussein almost decided to give up hiring an assistant when one candidate said all he wanted from her was to sign a form so he could keep drawing benefits.Most Read from BloombergCredit Suisse Finds ‘Material’ Control Lapses After SEC PromptBonds Rocket, Stocks Steady as Fed Rate Path Eyed: Markets WrapBillionaire Charles Schwab’s Fortune Is Slammed by SVB FalloutGlobal Banking Stocks Hold Steady After $465 Billion SVB WipeoutUS Backstops Bank Deposits to Avert Crisis After S

7h ago MarketWatch

MarketWatchSilicon Valley Bank: Here’s what happened to cause it to collapse

Here are the events that led up to the collapse of Silicon Valley Bank, which caused the government to put in place an emergency backstop for all banks.

18h ago MarketWatch

MarketWatch20 banks that are sitting on huge potential securities losses — as was SVB

SVB Financial faced a perfect storm, but there were plenty of other banks with high levels of unrealized securities losses as of Dec. 31.

1d ago Bloomberg

BloombergMoody’s Puts First Republic, Five US Banks on Downgrade Watch

(Bloomberg) -- Moody’s Investors Service placed First Republic Bank and five other US lenders on review for downgrade, the latest sign of concern over the health of regional financial firms following the collapse of Silicon Valley Bank.Most Read from BloombergCredit Suisse Finds ‘Material’ Control Lapses After SEC PromptBonds Rocket, Stocks Steady as Fed Rate Path Eyed: Markets WrapBillionaire Charles Schwab’s Fortune Is Slammed by SVB FalloutGlobal Banking Stocks Hold Steady After $465 Billion

8h ago TipRanks

TipRanks‘Buy the Dip in Bank Stocks,’ Goldman Sachs Says. Here Are 2 Names to Consider

Last week ended with the worst day for bank stocks since the financial crisis of 2008. The collapse of Silicon Valley Bank, the country’s 16th largest banking firm and the lender of first resort for the start-ups of California’s tech world, has sparked fears of a larger bank run, or even a repeat of the systemic financial troubles. That’s the worst-case worries – but according to Goldman Sachs’ chief credit strategist, Lotfi Karoui, these fears may be overblown. “We think the risk of contagion f

1d ago Benzinga

BenzingaJeff Bezos, George Soros, Mark Cuban, and Ray Dalio All Have One Thing in Common: They're Making a Big Bet on This Industry

When billionaires jump on the same trend, it’s important for investors to take notice. The pieces often don’t come together immediately, but these investors have millions of dollars in resources dedicated to getting the most up-to-date information as quickly as possible. They might see trends months in advance that others might not notice until it’s too late. Hedge fund manager George Soros is a polarizing figure, but you’d be foolish not to take notice of some of his investing trends. The Soros

18h ago Fox Business

Fox BusinessInvestor who called Lehman collapse predicts the next big US bank failure

Robert Kiyosaki, who originally forecasted the Lehman 2008 crisis, predicts the next bank to collapse in the Silicon Valley Bank contagion will be Credit Suisse.

18h ago Yahoo Finance

Yahoo FinanceStocks moving in after-hours: United Airlines, First Republic, Charles Schwab

These are the stocks making moves after the bell.

14h ago TheStreet.com

TheStreet.comCharles Schwab, Snagged Into Banking Mess, Could Be a Bargain

As fear ripples through the banking industry, Charles Schwab was swept into the mess last week and continued to sink Monday. The stock is now down around 30% for the past few days and around 35% for the year, over concerns of mark-to-market losses on its held-to-maturity bond portfolio. Schwab has faced a steady flight of cash from accounts in search of higher returns in money markets and other instruments, which it calls cash sorting.

19h ago Investor's Business Daily

Investor's Business DailySchwab Stock Drops Amid Financial Freakout — Is Your Money Safe?

Looks like the financial stock market freakout is taking down more than just regional banks. Charles Schwab is feeling the heat too.

15h ago Barrons.com

Barrons.comBank of America Has Biggest Losses in Bond Portfolio Among Peers

The bank was sitting on an unreallized loss of nearly $109 billion in a large bond portfolio at the end of 2022

16h ago TheStreet.com

TheStreet.comBank of America and Wells Fargo: Here's How I'm Trading This Bank Mess

I sold half of my bank positions last week before news of the SVB collapse. This is my plan for them now.

23h ago Yahoo Finance

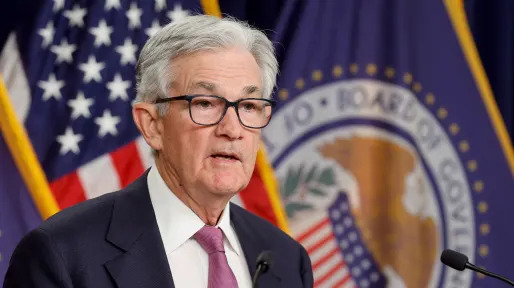

Yahoo FinanceInflation: February CPI expected to show slowest annual rise since September 2021

February inflation data will be an important indicator of the Federal Reserve's rate hike plan following the stunning collapse of Silicon Valley Bank.

2h ago TipRanks

TipRanksThis 14.5%-Yielding ETF Pays Huge Monthly Dividends, but There Are Risks to Consider

With inflation at 6.4%, many investors are looking for investments that can beat the rate of inflation. The Global X Super Dividend ETF (NYSEARCA:SDIV) not only helps investors beat inflation, but it more than doubles it with a massive dividend yield of 14.5%. SDIV also holds additional appeal to income-seeking investors because, unlike many other dividend stocks and ETFs, which pay dividends quarterly, this ETF pays a dividend each month. However, there are also some potential drawbacks that in

9h ago Barrons.com

Barrons.comRivian Stock Falls on Amazon News. It Might Be an Overreaction.

Amazon told Barron's it is committed to Rivian and still plans to purchase 100,000 Rivian vans by 2030.

13h ago TipRanks

TipRanksDown More Than 30%: Insiders Call a Bottom in These 2 Regional Bank Stocks

The week got off to a rocky start as the markets digested the collapse of Silicon Valley Bank last week, and the Federal regulators’ shutdown of Signature Bank over the weekend. Sparking fears of contagion, on Monday, stocks in the banking sector saw shares drop dramatically, as investors scrambled to figure out the new patterns of risk and reward. The effect was most pronounced among the mid-sized and regional banking firms. In that niche, sudden drops in share value prompted trading halts for

3h ago TheStreet.com

TheStreet.comBuffett's Berkshire Hathaway Financial Stocks Slide on Silicon Valley Bank Fallout

Warren Buffett is famous for his long-term approach to investing and for a relatively broad diversification of his holdings in the Berkshire Hathaway portfolio. Indeed, the five biggest decliners in Berkshire's portfolio Monday were all financial names. Shares of Bank of New York Mellon Corp fell 6.7% to $44.12.

14h ago Barrons.com

Barrons.comThese Stocks Are Moving the Most Today: First Republic, United Airlines, GitLab, Uber, Amylyx, and More

First Republic trades higher after closing down nearly 62% on Monday, United Airlines issues a first-quarter profit warning, and a revenue forecast from software company GitLab misses analysts' expectations.

39m ago The Telegraph

The TelegraphCredit Suisse warns of ‘material weakness’ in financial controls

Credit Suisse has identified “material weaknesses” in its reporting and controls procedures for the last two years in the latest blow to the scandal-hit lender.

3h ago Bloomberg

BloombergSell Any Post-SVB Stocks Bounce, Says Morgan Stanley

(Bloomberg) -- Morgan Stanley’s Michael Wilson, known for being one of Wall Street’s most bearish strategists, recommended that investors sell any rebound in US stocks that may result from regulators’ support measures after the collapse of Silicon Valley Bank.Most Read from BloombergBonds Soar, Stocks Gain as Fed Pause Weighed: Markets WrapFed’s New Backstop Shields Banks From $300 Billion of LossesFDIC Auction for Failed SVB Underway, Final Bids Due SundaySignature Seized by Regulators as Pain

1d ago TheStreet.com

TheStreet.com3 Regional Bank Stocks to Buy After SVB's Collapse

The failure of Silicon Valley Bank has sent shockwaves through the U.S. banking industry, particularly affecting smaller banks. The SPDR S&P Regional Banking ETF has declined over 20% just in the past week on fears of contagion. Investors are selling bank stocks indiscriminately in this environment, but this could be an opportunity for dividend investors.

3h ago Yahoo Finance

Yahoo FinanceWall Street analysts make big calls on bank stocks in wake of SVB failure

Let the wagers begin.

20h ago Yahoo Finance

Yahoo FinanceStock market news today: Futures march higher, regional banks rally ahead of CPI

U.S. stock futures edged higher Tuesday morning ahead of critical inflation data, with regional bank stocks rallying, clawing back some of its losses in the wake of the SVB fallout.

1h ago Zacks

ZacksShould Investors Buy Disney or Netflix Stock on the Dip?

Two popular stocks that investors may consider are Disney (DIS) and Netflix (NFLX), let's see if it's time to buy either of these consumer discretionary giants after last week's selloff.

14h ago Reuters

ReutersUS expected to report strong consumer price increases in February

U.S. consumer prices likely rose at a solid pace in February amid sticky rental housing costs, but economists are divided on whether the data will be enough to push the Federal Reserve to hike interest rates again next week after the failure of two regional banks. The report from the Labor Department on Tuesday, which is also expected to show goods inflation picked up in part due to an anticipated rebound in prices of used motor vehicles, will be published amid financial market turmoil triggered by the collapse of Silicon Valley Bank in California and Signature Bank in New York, which forced regulators to take emergency measures to shore up confidence in the banking system. It will also be released a week before the Fed begins a two-day policy meeting, and follow on the heels of a report last Friday showing a still-tight labor market, but cooling wage inflation.

8h ago Barrons.com

Barrons.comBoeing Deal for Jets From Saudi Arabia Might Be Bigger Than First Imagined

Two Saudi Arabian airlines are on the verge of buying 80 Dreamliner jets from Boeing, according to The Wall Street Journal.

1h ago Fortune

FortuneTop economist Mohamed El-Erian says unlimited deposit guarantee will be hard to reverse after SVB fallout: ‘We are now in a different world’

The economist also said that the Fed will likely now “retreat” on interest rate hikes.

19h ago TheStreet.com

TheStreet.comThree U.S. Banks Down. One More in Focus. Does It End Here?

Silvergate, Silicon Valley Bank and Signature Bank collapsed in the same week. All eyes are now on First Republic Bank.

19h ago Forkast News

Forkast NewsBitcoin jumps above US$24,000, leading crypto gains as U.S. acts to backstop banks

Bitcoin continued to gain in morning trading in Asia, as regulators acted to backstop the U.S. banking industry. Most of the top 10 cryptocurrencies gained.

9h ago Investopedia

InvestopediaTop 5 Positions in Warren Buffett's Portfolio

Warren Buffett is undeniably the most famous and influential investor in modern history, based on his extraordinary performance record. Not surprisingly, the investment portfolio of Berkshire Hathaway Inc. (BRK.A), the holding company employing the Oracle of Omaha as chairman and CEO, receives wide media attention and scrutiny, even though Buffett is no longer making every investment decision. Despite his unparalleled success, Buffett's investment model has long been transparent, straightforward, and consistent.

16h ago MarketWatch

MarketWatchThese 3 banks now offer 5% on checking and savings accounts: A ‘potential measure of protection against financial instability.’

It’s been over a decade since savings rates have been this high. Balances up to $10,000 are eligible for one of the highest available rates in the high-yield savings market today with this high-yield checking account from Consumers Credit Union.

2h ago Bloomberg

BloombergCredit Suisse Finds ‘Material’ Control Lapses After SEC Prompt

(Bloomberg) -- Credit Suisse Group AG said it found “material weaknesses” in its reporting and control procedures for the past two years, after questions from US regulators last week. Most Read from BloombergCredit Suisse Finds ‘Material’ Control Lapses After SEC PromptBonds Rocket, Stocks Steady as Fed Rate Path Eyed: Markets WrapBillionaire Charles Schwab’s Fortune Is Slammed by SVB FalloutGlobal Banking Stocks Hold Steady After $465 Billion SVB WipeoutUS Backstops Bank Deposits to Avert Crisi

4h ago Yahoo Finance

Yahoo FinanceInflation data arrives at critical moment for Fed after bank failures, jobs data

In the wake of the failure of Silicon Valley Bank, investors will be closely monitoring February's upcoming inflation print as Wall Street debates the Federal Reserve's plans to raise interest rates later this month.

17h ago Bloomberg

BloombergFirst Republic, PacWest Lead US Bank Rebound From Post-SVB Rout

(Bloomberg) -- Regional US bank stocks rallied on Tuesday, set to claw back some losses from the six-day selloff seen in the wake of Silicon Valley Bank’s collapse, as concern eased about wider contagion in the financial system.Most Read from BloombergCredit Suisse Finds ‘Material’ Control Lapses After SEC PromptBonds Rocket, Stocks Steady as Fed Rate Path Eyed: Markets WrapBillionaire Charles Schwab’s Fortune Is Slammed by SVB FalloutGlobal Banking Stocks Hold Steady After $465 Billion SVB Wipe

2h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK