Roku Among Most-Exposed Firms With Assets Caught in SVB Failure

source link: https://finance.yahoo.com/news/roku-among-most-exposed-firms-003444160.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Roku Among Most-Exposed Firms With Assets Caught in SVB Failure

Roku Among Most-Exposed Firms With Assets Caught in SVB Failure

(Bloomberg) -- Of the companies listing assets caught up in the collapse of Silicon Valley Bank on Friday, Roku Inc. is among those reporting the heaviest exposure.

Most Read from Bloomberg

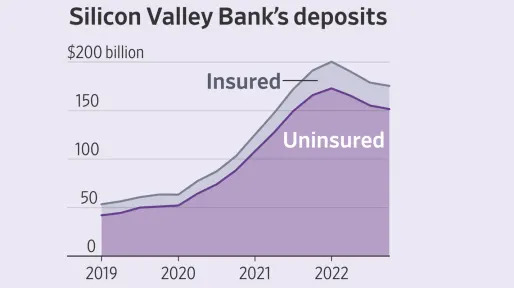

Dozens of companies have reported exposure to the bank, which in its four-decade history cultivated deep ties within the technology sector. The Federal Deposit Insurance Corp. has said SVB’s customers will have full access to insured deposits up to $250,000 on Monday. However, the vast majority of funds held at the bank far exceed that limit. The agency is racing to sell assets and make a portion of clients’ uninsured deposits available as soon as Monday.

The maker of set-top boxes used for streaming film and television, had $487 million, or about a quarter of its cash and cash equivalents held at the bank. The disclosure late on Friday sent the stock down 3% in after-hours trading.

Rocket Lab USA Inc., a space launch startup, said it had about $38 million of cash and cash equivalents at SVB. Meanwhile, video-game company Roblox Corp. had about $150 million of its $3 billion in cash and securities at the bank.

Here’s a look at many of the companies that have disclosed exposure to Silicon Valley Bank:

In its filing with the SEC, Roku disclosed that about 26% of its cash and cash equivalents balance as of March 10 — roughly $487 million — is held at SVB. Roku said it isn’t sure how much of those deposits it will be able to recover. The filing also notes that it has approximately $1.4 billion of additional cash and cash equivalents “distributed across multiple large financial institutions.”

Roblox

The company said Friday it its filing roughly 5% of its $3 billion of cash and securities balance as of Feb. 28 is held at SVB. “Regardless of the ultimate outcome and the timing, this situation will have no impact on the day to day operations of the Company.” Shares of the video-game maker fell about 0.9% in post-market trading Friday.

TheStreet.com

TheStreet.comSVB Collapse: Vox Media, Etsy Hit by Bank Shutdown

Countless companies and investors have disclosed that they had accounts at Silicon Valley Bank, the failed financial institution that was shuttered by a regulator. Legendary investor and entrepreneur Mark Cuban says he has an exposure between $8 million and $10 million to the California bank that was closed after a massive run on the bank. Numerous non-tech companies were also affected when the FDIC took over Silicon Valley Bank on March 10 after a run on its deposits after losing $1.8 billion on bond investments and failing to attract new capital to shore up its liquidity.

4h ago TechCrunch

TechCrunchRoku, Roblox and others disclose their exposure to SVB in SEC filings

The fallout from the collapse of Silicon Valley Bank is impacting a range of startups and larger firms including, as we know now from SEC filings, publicly traded companies like Roku, Roblox, Quotient, and others. Roku said in a filing that it had around $487 million held at SVB, representing around 26% of its cash and cash equivalents as of March 10, 2023, as Variety was first to report. "At this time, the Company does not know to what extent the Company will be able to recover its cash on deposit at SVB," Roku's filing stated.

15h ago TheStreet.com

TheStreet.comElon Musk May Buy Failed Silicon Valley Bank

Tesla's CEO says he's open to the idea of Twitter acquiring the Californian bank that was shut down on March 10 by regulators.

11h ago TechCrunch

TechCrunchInvestor Mark Suster says a "handful" of bad actors in VC destroyed Silicon Valley Bank

Yesterday at around noon in Los Angeles, investor Mark Suster of the venture firm Upfront Ventures began urging "calm" on Twitter. Silicon Valley Bank had bungled its messaging on Wednesday around an effort to strengthen its balance sheet, and startup founders were beginning to fear that their deposits at the tech-friendly, 40-year-old institution were at risk. "More in the VC community need to speak out publicly to quell the panic about @SVB_Financial," wrote Suster, saying he believed in the bank's health and arguing that the biggest risk to startups, the VCs to whom the bank has long catered, and to SVB itself would be "mass panic."

1d ago Reuters

ReutersMeta to end news access for Canadians if Online News Act becomes law

The "Online News Act," or House of Commons bill C-18, introduced in April last year laid out rules to force platforms like Meta and Alphabet Inc.'s Google to negotiate commercial deals and pay news publishers for their content. "A legislative framework that compels us to pay for links or content that we do not post, and which are not the reason the vast majority of people use our platforms, is neither sustainable nor workable," a Meta spokesperson said as reason to suspend news access in the country.

12h ago Bloomberg

BloombergKhosla Ventures Tells Some Startups Firm Will Cover Payroll

(Bloomberg) -- Khosla Ventures sent an email to founders saying that the venture capital firm would step in and cover payroll for some of its portfolio companies if they had shortfalls because of funds tied up with Silicon Valley Bank. Most Read from BloombergUS Discusses Fund to Backstop Deposits If More Banks FailSVB Fallout Spreads Around World From London to SingaporeStartup Bank Had a Startup Bank RunSVB’s 44-Hour Collapse Was Rooted in Treasury Bets During PandemicSVB’s Auction Block Inclu

3h ago Bloomberg

BloombergSVB Draws Support From More Than 100 Venture Firms, Investors

(Bloomberg) -- More than 100 venture capital and investing firms have signed a statement supporting Silicon Valley Bank, part of mounting industry calls to limit the fallout of the bank’s collapse and avoid a possible “extinction-level event” for tech companies. Most Read from BloombergUS Discusses Fund to Backstop Deposits If More Banks FailSVB Fallout Spreads Around World From London to SingaporeStartup Bank Had a Startup Bank RunSVB’s 44-Hour Collapse Was Rooted in Treasury Bets During Pandem

6h ago Bloomberg

BloombergUS Discusses Fund to Backstop Deposits If More Banks Fail

(Bloomberg) -- The Federal Deposit Insurance Corp. and the Federal Reserve are weighing creating a fund that would allow regulators to backstop more deposits at banks that run into trouble following Silicon Valley Bank’s collapse.Most Read from BloombergUS Discusses Fund to Backstop Deposits If More Banks FailSVB Fallout Spreads Around World From London to SingaporeStartup Bank Had a Startup Bank RunSVB’s 44-Hour Collapse Was Rooted in Treasury Bets During PandemicSVB’s Auction Block Includes VC

3h ago Investor's Business Daily

Investor's Business DailySilicon Valley Bank Panic Crashes 10 Bank Stocks — Is Yours OK?

The halt of trading shares of Silicon Valley Bank is setting off a cascade of selling throughout the financial sector.

1d ago TheStreet.com

TheStreet.comSVB Collapse: Roku Had $487 Million In Cash At Failed Bank, Rocket Lab, Roblox Also Affected

Several companies disclosed late Friday evening the amount of cash they had no deposit at failed Silicon Valley Bank.

1d ago Reuters

ReutersSolar firms Sunnova and Sunrun shed light on exposure to Silicon Valley Bank

Sunrun stated SVB was one of the lenders in two of its credit facilities, but said it was less than 15% of its total hedging facilities and does not anticipate significant exposure. Sunrun has cash deposits with SVB totaling nearly $80 million, while SVB's undrawn commitment in the non-recourse senior aggregation warehouse facility is about $40 million.

1d ago Barrons.com

Barrons.comEtsy, Bill.com, and Others Disclose SVB Exposure

The online marketplace and the software firm joined other companies citing deposits held at Silicon Valley Bank, which regulators closed on Friday.

6h ago TheStreet.com

TheStreet.comMark Cuban Had Millions at Failed Silicon Valley Bank

The legendary investor and entrepreneur says he has an exposure between $8 million and $10 million to the California bank, which was closed on March 10 by regulators, after a run on the bank.

8h ago Fox Business

Fox BusinessSilicon Valley Bank exec was Lehman Brothers CFO prior to 2008 collapse

Prior to the Lehman Brothers collapse, Joseph Gentile was its CFO until 2007 when he left and became Silicon Valley Bank's Chief Administrative Officer.

6h ago TechCrunch

TechCrunchTC+ roundup: Silicon Valley Bank fails, fintech VC survey, B2B growth tools

To protect SVB’s former customers, who have around $175 billion in deposits, the Federal Deposit Insurance Corporation (FDIC) transferred assets to a new entity: the Deposit Insurance National Bank of Santa Clara. Insured customers who deposited $250,000 or less will have access to their money on Monday morning, according to the FDIC.

1d ago Yahoo Finance

Yahoo FinanceWorkers worried about a 'looming recession' pick up more side hustles

One driver of this trend — beyond the ongoing inflationary pressures — is fear.

12h ago Investopedia

InvestopediaShareholders Side With Apple on Contentious Votes, Analyst Eyes $230 Per Share

Apple's annual shareholders' meeting was held on Friday and despite some controversy and disagreements, the company won support for each of its voting proposals.

1d ago AP Finance

AP FinanceFavoring continuity, China reappoints central bank governor

China on Sunday reappointed Yi Gang as head of the central bank in an effort to reassure entrepreneurs and financial markets by showing continuity at the top while other economic officials change during a period of uncertainty in the world's second-largest economy. Yi, whose official title is governor of the People’s Bank of China, plays no role in making monetary policy, unlike his counterparts in other major economies.

2h ago Zacks

ZacksKeep these 3 Stocks on Your Buy List After the Market Selloff

The broader selloff in markets this week is creating opportunities and here are three stocks that investors should keep an eye on.

1d ago MarketWatch

MarketWatch20 banks that are sitting on huge potential securities losses—as was SVB

SVB Financial faced a perfect storm, but there are plenty of other banks that would face big losses if they were forced to dump securities to raise cash.

1d ago MoneyWise

MoneyWise‘Things were way tougher’: Warren Buffet’s right-hand man has a blunt message for whiners worried about 'hardship.' 3 stocks that keep Charlie Munger happy in tough times

The 99-year-old investing legend has spoken.

17h ago Investor's Business Daily

Investor's Business DailyWhat To Do As S&P 500 Breaks Final Support; Watch JPMorgan, These Stocks

The S&P 500 broke decisively below key levels. Here's what to do now. It's a big weekend for SVB Financial. Watch JPMorgan and these bank stocks.

4h ago TheStreet.com

TheStreet.comTwo U.S. Banks Collapse in 48 Hours. Which One's Next?

Silvergate served the cryptocurrency industry, while SVB was the bank for Silicon Valley tech startups.

1d ago MarketWatch

MarketWatchAs Silicon Valley Bank collapses, these are the banks contrarians are buying

Good-quality banks are getting painted with the same brush stroke as those that appear to be vulnerable to collapse

1d ago TheStreet.com

TheStreet.comCathie Wood Makes a Big Prediction on the Future of Banks

The crisis at two California banks sparked a CNBC discussion on cryptocurrency and technology in banking trends.

1d ago The Wall Street Journal

The Wall Street JournalSilicon Valley Bank’s Meltdown Visualized

Silicon Valley Bank’s collapse was the second-biggest bank failure in U.S. history in terms of assets. Deposits at the tech-focused lender’s parent, SVB Financial Group had declined in three consecutive quarters and the situation worsened on March 9 when clients tried to withdraw $42 billion. SVB was flooded with cash during the pandemic tech boom—startups and their investors were taking in huge sums, which swelled SVB’s coffers.

4h ago TheStreet.com

TheStreet.com3 High Dividend Healthcare Stocks for Passive Income

The global economy has slowed down remarkably lately, primarily due to the aggressive interest-rate hikes implemented by central banks in an effort to restore inflation to normal levels. Here we will discuss the prospects of three healthcare stocks that offer above-average dividend yields and have decent growth prospects. GSK plc , formerly GlaxoSmithKline, headquartered in the United Kingdom, develops, manufactures and markets healthcare products in the areas of pharmaceuticals, vaccines and consumer products.

18h ago MarketWatch

MarketWatchHedge funds and banks offer to buy deposits trapped at Silicon Valley Bank

Some hedge funds and banks are offering to buy deposits trapped at the failed Silicon Valley Bank, according to reports on Saturday.

6h ago MarketWatch

MarketWatchSilicon Valley Bank CEO Greg Becker cashed out $2 million just before the collapse

The chief executive of Silicon Valley Bank cashed out stock and options for a $2.27 million net gain in the weeks before Friday's collapse, public filings show.

1d ago Reuters

ReutersSilicon Valley Bank staff offered 45 days of work at 1.5 times pay

Employees of Silicon Valley Bank were offered 45 days of employment at one and a half times their salary by the Federal Deposit Insurance Corp, the U.S. regulator that took control of the collapsed lender on Friday, according to an email to staff seen by Reuters. Workers will be enrolled and given information about benefits over the weekend by the FDIC, and healthcare details will be provided by the former parent company SVB Financial Group, the FDIC wrote in an email entitled "Employee Retention" late on Friday. SVB had a workforce of 8,528 at the end of last year.

15h ago Reuters

ReutersFirst Republic, Western Alliance calm contagion worries from SVB meltdown

The disclosures come after banking regulators shut California-based SVB after a failed share sale that triggered worries of a liquidity crisis, hammered bank stocks and rippled through global markets. Western Alliance reported total deposits of $61.5 billion and warned of a moderate decline from these levels by the end of the quarter due to seasonal and monthly activity, but affirmed its full-year deposit growth forecast of 13% to 17%. Its investment portfolio is less than 15% of total bank assets and only less than 2% of total bank assets is categorized as available for sale.

1d ago Reuters

ReutersUS weighs new fund to backstop deposits if more banks fail, Bloomberg News says

Regulators discussed the new special vehicle in conversations with banking executives and hope such a measure would reassure depositors and help contain any panic, the report said, citing people familiar with the matter. The new vehicle is part of the agency's contingency planning as panic spreads about the health of banks focused on the venture capital and startup communities, the report added. The U.S. Federal Reserve declined to comment on the report, while FDIC did not immediately respond to a Reuters request for comment.

4h ago Reuters

ReutersHedge funds offering to buy startup deposits stuck at Silicon Valley Bank -Semafor

Bids range from 60 to 80 cents on the dollar, the report said adding that the range reflects expectations for how much of the uninsured deposits will be eventually recovered once the bank's assets are sold or wound down. Firms like Oaktree which are known for investing in distressed debt are reaching out to startups after SVB's seizure by the Federal Deposit Insurance Corp (FDIC), the report said. Traders from investment firm Jefferies are also contacting startup founders with money stuck at the bank, offering to buy their deposit claims at a discount, The Information reported separately.

9h ago Zacks

ZacksIs Most-Watched Stock Bank of America Corporation (BAC) Worth Betting on Now?

Zacks.com users have recently been watching Bank of America (BAC) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

2d ago Yahoo Finance

Yahoo FinanceWhy Silicon Valley Bank's crisis is rattling America's biggest banks

The struggles of SVB Financial are spooking investors across the banking world, highlighting the new risks posed by rising interest rates.

2d ago Bloomberg

BloombergSVB’s Balance-Sheet Time Bomb Was ‘Sitting in Plain Sight,’ Short Seller Says

(Bloomberg) -- The problems that triggered SVB Financial Group Inc.’s death spiral were hiding in plain sight in the firm’s earnings reports.Most Read from BloombergUS Discusses Fund to Backstop Deposits If More Banks FailSVB Fallout Spreads Around World From London to SingaporeStartup Bank Had a Startup Bank RunSVB’s 44-Hour Collapse Was Rooted in Treasury Bets During PandemicSVB’s Auction Block Includes VC-Focused Lender, Wealth UnitThat’s according to short seller William C. Martin, who warne

1d ago MoneyWise

MoneyWiseChad ‘Ochocinco’ saved 83% of his NFL salary by buying fake jewelry and sleeping in the stadium — here are 5 simple ways to preserve your wealth at an all-star level

Tackle your way to financial success.

16h ago MarketWatch

MarketWatchWhat happened to Silvergate Capital? And why does it matter?

The crypto industry banker was hard hit by the bankruptcy of FTX, and on Wednesday announced that it will close operations and liquidate its bank

16h ago MarketWatch

MarketWatchSilicon Valley Bank failed for one simple reason: its key startup clients lost faith.

Silicon Valley Bank was forced to shutter after its core depositors — startup companies — took their money out in a shocking bank run, leaving many unanswered questions in the tech world.

14h ago Barrons.com

Barrons.comAmerican Express and 4 More Companies That Raised Their Stock Dividends This Week

American Express Oracle and Johnson Controls were among the large U.S. companies that declared dividend increases this week. It was a fairly light week for such announcements, with earnings season having slowed down. Credit card and travel company American Express (ticker: AXP) said it will pay a quarterly disbursement of 60 cents a share, a 15% increase from 52 cents a share.

22h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK