SVB Races to Prevent Bank Run as Funds Advise Pulling Cash

source link: https://finance.yahoo.com/news/svb-financial-ceo-asks-silicon-221638593.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

SVB Races to Prevent Bank Run as Funds Advise Pulling Cash

To put it really simply, this is one of

(Bloomberg) -- Unease is spreading across the financial world as concerns about the stability of Silicon Valley Bank prompt prominent venture capitalists including Peter Thiel’s Founders Fund to advise startups to withdraw their money.

Most Read from Bloomberg

The turmoil followed a surprise announcement from Santa Clara, California-based SVB that it was issuing $2.25 billion of shares to bolster its capital position after a significant loss on its investment portfolio. The stock plunged 63% in premarket trading in New York on Friday before trading in the bank’s parent was halted with news pending. They declined 60% the day before. Its bonds posted record declines, igniting a broad selloff in bank shares around the world.

In the US, Thursday was the worst day for the KBW Bank Index since June 2020, as its members shed more than $90 billion of value. The biggest banks in Europe lost more than $40 billion from their market capitalizations on Friday.

Read More: SVB Share Rout Deepens as Worries Grow Over Lender’s Finances

Founders Fund asked its portfolio companies to move their money out of SVB, according to a person familiar with the matter who asked not to be identified discussing private information. Coatue Management, Union Square Ventures and Founder Collective also advised startups to pull cash, people with knowledge of the matter said. Canaan, another major VC firm, told firms it invested in to remove funds on an as-needed basis, according to another person.

SVB Financial Group Chief Executive Officer Greg Becker held a conference call on Thursday advising clients of SVB-owned Silicon Valley Bank to “stay calm” amid concern about the bank’s financial position, according to a person familiar with the matter.

Reuters

ReutersTreasury, White House: Confident in regulators response on Silicon Valley Bank collapse

WASHINGTON (Reuters) -U.S. Treasury Secretary Janet Yellen met with banking regulators on Friday on the collapse of SVB Financial Group as she and the White House expressed confidence in their abilities to respond to the largest bank failure since the 2008 financial crisis. Yellen met with officials from the Federal Reserve, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency on Friday to discuss developments with SVB, which does business as Silicon Valley Bank, Treasury said in a statement.

1d ago CoinDesk

CoinDeskU.S. Lawmakers Met With Fed, FDIC to Discuss Collapse of Silicon Valley Bank: Source

Rep. Maxine Waters convened meetings with federal bank regulators in the wake of the bank's collapse.

17h ago Reuters

ReutersSVB shutdown sends shockwaves through Silicon Valley as CEOs race to make payroll

The sudden collapse of Silicon Valley Bank on Friday sent shockwaves through the startup community, which has come to view the lender as a source of reliable capital and deposit partner, particularly for some of tech’s biggest moonshots. On Friday, tech CEOs scrambled to make payroll after SVB Financial Group was shuttered by California banking regulators in a bid to protect depositors following a dive in the value of its investment holdings and a rush of withdrawal requests starting just two days ago. Startups with money held at Silicon Valley Bank raced to come up with plans to pay workers after hearing their funds would be locked up over the weekend, said Jai Das, president at Sapphire Ventures, whose investments have included Box and LinkedIn.

1d ago MarketWatch

MarketWatch20 banks that are sitting on huge potential securities losses—as was SVB

SVB Financial faced a perfect storm, but there are plenty of other banks that would face big losses if they were forced to dump securities to raise cash.

1d ago MarketWatch

MarketWatch‘The government has about 48 hours to fix a soon-to-be-irreversible mistake’: Hedge-fund titan Bill Ackman warns some businesses may not be able to meet payroll in wake of SVB’s failure

Silicon Valley Bank had boasted of having relationships with more than half of the venture-backed companies in the U.S.

3h ago TheStreet.com

TheStreet.comElon Musk May Buy Failed Silicon Valley Bank

Tesla's CEO says he's open to the idea of Twitter acquiring the Californian bank that was shut down on March 10 by regulators.

4h ago TipRanks

TipRanks‘Too Cheap to Ignore’: Cathie Wood Snaps Up These 2 Stocks Under $10

Sentiment shifts periodically on Wall Street, and you could argue Cathie Wood might be the prime example of fortune reversal. Once an investor favorite and hailed as a pioneer with a portfolio jam-packed with the novel and cutting-edge, Wood’s reputation has been tarnished over the past year and a half as her growth-oriented investing style went out of fashion in the post-pandemic climate. Does that mean Wood is ready to desert her strategy of backing innovative yet risky and often unprofitable

1d ago Investor's Business Daily

Investor's Business DailySilicon Valley Bank Panic Crashes 10 Bank Stocks — Is Yours OK?

The halt of trading shares of Silicon Valley Bank is setting off a cascade of selling throughout the financial sector.

1d ago The Telegraph

The TelegraphSilicon Valley Bank collapse could spark the next financial crash – but we cannot bail out failed bankers again

Depositors can't get their money out. Payrolls might not be met next weekend. And small companies, especially in the fast growing technology industries, might soon face closure as their assets are frozen. There will be a lot of nervousness when the financial markets open on Monday morning following the collapse of the Silicon Valley Bank in the United States and the decision by the Bank of England to take control of its London arm.

7h ago Bloomberg

BloombergShort Sellers Make $500 Million on SVB’s Demise. Collecting Won’t Be Easy

(Bloomberg) -- SVB Financial Group’s record plunge on Thursday minted short sellers roughly half a billion dollars in paper profits. But they now face a challenge: how to close their positions.Most Read from BloombergStartup Bank Had a Startup Bank RunSVB’s 44-Hour Collapse Was Rooted in Treasury Bets During PandemicFrom Santa Clara to Shoreditch, SVB Fallout Spreads Around WorldSVB’s Auction Block Includes VC-Focused Lender, Wealth UnitSilicon Valley Bank Swiftly Collapses After Tech Startups F

1d ago Fortune

FortuneA major Bay Area bank just failed. ‘Spectacular overpriced bubbles’ are going to keep popping, warns legendary investor Jeremy Grantham

Grantham blamed a “horror show” of Fed policies for a bear market he says likely won’t bottom out until late next year.

1d ago TipRanks

TipRanksThis Growth ETF Has a Massive 11.4% Dividend Yield, and It Pays Monthly

The JPMorgan Equity Premium Income Fund (NYSEARCA:JEPI) has become a hit in the ETF world thanks to its 12.2% dividend yield and its monthly payout. While many investors are likely familiar with JEPI thanks to the considerable level of fanfare it has garnered as it has grown to $21.8 billion in assets under management (AUM), they may not be as familiar with JEPI’s newer and somewhat less heralded cousin — the JPMorgan Nasdaq Premium Income ETF (NASDAQ:JEPQ). There are some notable differences be

1d ago Bloomberg

BloombergSVB’s 44-Hour Collapse Was Rooted in Treasury Bets During Pandemic

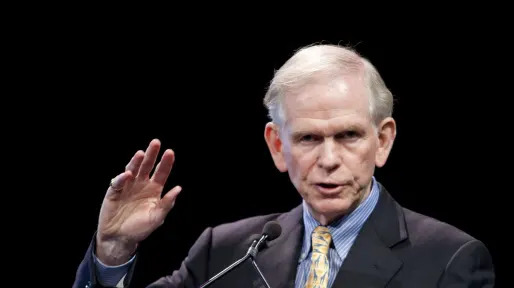

(Bloomberg) -- Greg Becker sat in a red armchair at an invite-only conference in Los Angeles last week, legs crossed, one hand cutting through air. Most Read from BloombergStartup Bank Had a Startup Bank RunSVB’s 44-Hour Collapse Was Rooted in Treasury Bets During PandemicFrom Santa Clara to Shoreditch, SVB Fallout Spreads Around WorldSVB’s Auction Block Includes VC-Focused Lender, Wealth UnitSilicon Valley Bank Swiftly Collapses After Tech Startups Flee“We pride ourselves on being the best fina

12h ago TheStreet.com

TheStreet.comCathie Wood Makes a Big Prediction on the Future of Banks

The crisis at two California banks sparked a CNBC discussion on cryptocurrency and technology in banking trends.

1d ago MarketWatch

MarketWatchAs Silicon Valley Bank collapses, these are the banks contrarians are buying

Good-quality banks are getting painted with the same brush stroke as those that appear to be vulnerable to collapse

1d ago Reuters

ReutersHedge funds offering to buy startup deposits stuck at Silicon Valley Bank -Semafor

Bids range from 60 to 80 cents on the dollar, the report said adding that the range reflects expectations for how much of the uninsured deposits will be eventually recovered once the bank's assets are sold or wound down. Firms like Oaktree which are known for investing in distressed debt are reaching out to startups after SVB's seizure by the Federal Deposit Insurance Corp (FDIC), the report said. Traders from investment firm Jefferies are also contacting startup founders with money stuck at the bank, offering to buy their deposit claims at a discount, The Information reported separately.

2h ago Zacks

ZacksAlibaba Group Holding Limited (BABA) Is a Trending Stock: Facts to Know Before Betting on It

Alibaba (BABA) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

1d ago Reuters

ReutersFirst Republic, Western Alliance calm contagion worries from SVB meltdown

The disclosures come after banking regulators shut California-based SVB after a failed share sale that triggered worries of a liquidity crisis, hammered bank stocks and rippled through global markets. Western Alliance reported total deposits of $61.5 billion and warned of a moderate decline from these levels by the end of the quarter due to seasonal and monthly activity, but affirmed its full-year deposit growth forecast of 13% to 17%. Its investment portfolio is less than 15% of total bank assets and only less than 2% of total bank assets is categorized as available for sale.

1d ago AP Finance

AP FinanceFrom wine country to London, bank's failure shakes worldwide

It was called Silicon Valley Bank, but its collapse is causing shockwaves around the world. From winemakers in California to startups across the Atlantic Ocean, companies are scrambling to figure out how to manage their finances after their bank suddenly shut down Friday. California Gov. Gavin Newsom said Saturday that he's talking with the White House to help "stabilize the situation as quickly as possible, to protect jobs, people's livelihoods, and the entire innovation ecosystem that has served as a tent pole for our economy.”

2h ago Zacks

ZacksShould Investors Buy Bristol Myers or CVS Stock Near 52-week Lows?

Investors are often on the lookout for strong companies that may be undervalued and present lucrative long-term opportunities.

21h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK