Jobs report: Economists split on Fed's next move after strong February jobs repo...

source link: https://finance.yahoo.com/news/jobs-report-economists-split-on-feds-next-move-after-strong-february-jobs-report-192035548.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Jobs report: Economists split on Fed's next move after strong February jobs report

different surveys here, 3.6%.

On Friday morning, the Bureau of Labor Statistics announced 311,000 non-farm payroll jobs were added to the U.S. economy in February, beating expectations and suggesting continued strength in the U.S. labor market.

The unemployment rate also rose more than expected last month, increasing from 3.4% in January to 3.6% in February as labor force participation picked up.

Meanwhile, February's report also showed wage growth moderating, rising 0.2% last month compared to 0.3% in January.

Analysts flooded our inboxes with their takes on the report, with some arguing February's numbers indicate the economy is in for a soft-landing while others contend current job growth increases the odds the Federal Reserve will continue their hawkish campaign.

"The labor market cools from blistering to just plain hot. The moderation in job growth in February confirms that job gains in January were inflated by unusually warm weather and seasonal adjustment quirks." said Ryan Sweet and Nancy Vanden Houten, economists at Oxford Economics.

"However, the pace of job growth is surely still too rapid for the Fed's liking and won't stand in the way of the Fed continuing to push interest rates higher."

Here’s what other Wall Street strategists are telling clients following the report:

Mike Loewengart, Head of Model Portfolio Construction, Morgan Stanley Global Investment Office

"While payrolls remained hot, unemployment ticked up and wage growth was the slowest it has been since before the Fed started hiking rates. The market’s initial positive, although tepid, reaction may be a sign many investors believe the data was not enough to push the Fed to a 50-basis point hike."

Neil Dutta, Head of Economic Research, Renaissance Macro Research

"The labor markets are undeniably strong...Given the participation rate increase and slowing in wage growth (mostly a composition story) I can see why the soft-landing bulls are running with today's report, especially given the set up going in, but let's state the obvious, the Fed's work is not done. Terminal rates are still going up."

Reuters

ReutersUK plans 11 billion stg business tax break in budget - Bloomberg News

Hunt will limit the relief to three years and propose a permanent replacement in the ruling Conservative Party's manifesto before the next election, the report said. A previously announced increase in the headline rate of corporation tax, to 25% from 19%, is due to come into force in April. "For the manufacturing industry... those capital allowances work, so I would say, we do want to bring down our effective corporation tax, the total amount people pay," Hunt said earlier today in a GB News interview, referring to measures which allow companies to offset capital expenditure against their tax bill.

1h ago Reuters

ReutersWho is Greg Becker, the head of failed Silicon Valley Bank?

(Reuters) -Greg Becker, the chief executive officer who presided over the collapsed Silicon Valley Bank, joined the company three decades ago as a loan officer. The executive cut his teeth during the dotcom bubble and later steered the startup-focused lender in the wake of the 2008 global financial crisis. The executive sent a video message to employees on Friday acknowledging the "incredibly difficult" 48 hours leading up to the bank's collapse.

17h ago Yahoo Finance

Yahoo FinanceJobs report: US economy adds 311,000 jobs in February as labor market stays strong

The February jobs report showed the U.S. economy remains stronger than expected, even in the face of stubborn inflation and aggressive rate hikes from the Federal Reserve.

1d ago Bloomberg

BloombergBank of Canada Seeks More Evidence Rates Are Now High Enough

(Bloomberg) -- The Bank of Canada’s No. 2 official said policymakers need time to assess whether they’ve raised borrowing costs enough to curb inflation, reiterating that their path on rates can differ from peers.Most Read from BloombergCompanies Are Telling Us the Real Reason They're Still Raising PricesPeter Thiel’s Founders Fund Advises Companies to Withdraw Money From SVBOne Bank Folds, Another Wobbles and Wall Street Asks If It’s a CrisisIn Biden’s Tax-the-Rich Budget, Capital-Gains Rates N

2d ago Reuters

ReutersSilicon Valley Bank's demise began with downgrade threat

In the middle of last week, Moody's Investors Service Inc delivered alarming news to SVB Financial Group, the parent of Silicon Valley Bank: the ratings firm was preparing to downgrade the bank's credit.That phone call, described by two people familiar with the situation, began the process toward Friday's spectacular collapse of the startup-focused lender, the biggest bank failure since the 2008 financial crisis. Details of SVB's failed response to the prospect of the downgrade, reported by Reuters for the first time, show how quickly confidence in financial institutions can erode. The Moody's call came after the value of the bonds where SVB had parked its money fell due to the higher interest rates.

6h ago Yahoo Finance

Yahoo Finance5 things you may have missed in investing this week

More happening in markets than the SVB bank blowup.

6h ago Yahoo Finance

Yahoo FinanceYellen says Treasury Department 'carefully' watching crisis at 'a few banks'

Treasury Secretary Janet Yellen said the department is "carefully" monitoring the situation at Silicon Valley Bank and others as fears ripple through the financial system.

1d ago Yahoo Finance

Yahoo FinanceNewbie investors shy away from 'own research' after 2022 stock swoon, study finds

New investors relied less on "other personal research" — down nearly 10 percentage points versus 2020 — and more on financial professionals — up 9.3 percentage points versus 2020.

1h ago Yahoo Finance

Yahoo FinanceSVB failure doesn't threaten 'safety and soundness' of banking system: Analyst

The failure of Silicon Valley Bank shook the financial world on Friday, but one analyst doesn't see this rapid collapse as a threat to the safety of the banking system.

20h ago Benzinga

BenzingaUS-India Ink Semiconductor Deal To Counter China's Growing Tech Dominance Under Xi Jinping

The U.S. and India signed an agreement regarding semiconductors, with the aim of enhancing coordination in their chip-industry incentive plans. What Happened: U.S. Commerce Secretary Gina Raimondo told the media that the memorandum of understanding focuses on information-sharing and policy dialogue to avoid over-subsidization. The U.S. companies are optimistic about the future of ties with the South Asian nation as New Delhi looks to boost its role in the global technology supply chain, Raimondo

22h ago Bloomberg

BloombergSchwab Has Worst Drop in Years After SVB, Block Trade

(Bloomberg) -- The worst two-day stretch since 2016 for Charles Schwab Corp. looks like a case of bad timing for the buyers behind a large block trade in the brokerage.Most Read from BloombergSVB’s 44-Hour Collapse Was Rooted in Treasury Bets During PandemicSilicon Valley Bank Swiftly Collapses After Tech Startups FleeWhy Is Everyone Talking About SVB? Everything We Know About the Bank’s Collapse Right NowStartup Bank Had a Startup Bank RunSVB’s Auction Block Includes VC-Focused Lender, Wealth U

23h ago Fortune

FortuneA Silicon Valley Bank short seller explains how he knew the bank was in trouble months ago

“I've never seen a balance sheet crumble this quickly,” says Dale Wettlaufer, a partner at Bleecker Street Research who shorted the stock in January.

19h ago TipRanks

TipRanks‘Too Cheap to Ignore’: Cathie Wood Snaps Up These 2 Stocks Under $10

Sentiment shifts periodically on Wall Street, and you could argue Cathie Wood might be the prime example of fortune reversal. Once an investor favorite and hailed as a pioneer with a portfolio jam-packed with the novel and cutting-edge, Wood’s reputation has been tarnished over the past year and a half as her growth-oriented investing style went out of fashion in the post-pandemic climate. Does that mean Wood is ready to desert her strategy of backing innovative yet risky and often unprofitable

1d ago MarketWatch

MarketWatch10 banks that may face trouble in the wake of the SVB Financial Group debacle

Silicon Valley Bank wasn't well positioned for rising interest rates, leading to losses and a dilutive capital raise. Other banks show similar red flags.

2d ago Investor's Business Daily

Investor's Business DailySilicon Valley Bank Panic Crashes 10 Bank Stocks — Is Yours OK?

The halt of trading shares of Silicon Valley Bank is setting off a cascade of selling throughout the financial sector.

19h ago TheStreet.com

TheStreet.comTwo U.S. Banks Collapse in 48 Hours. Which One's Next?

Silvergate served the cryptocurrency industry, while SVB was the bank for Silicon Valley tech startups.

22h ago MoneyWise

MoneyWiseBill Gates is using these dividend stocks right now to generate a fat inflation-fighting income stream — you might want to do the same for the rest of 2023

Bill Gates looks for income, too. This is how he gets it.

6h ago Fortune

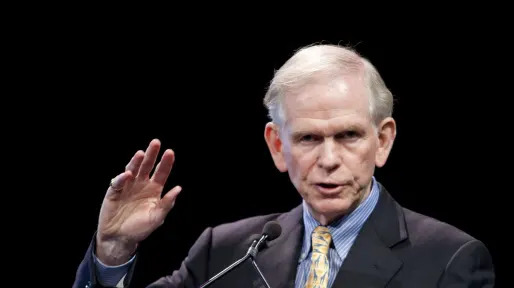

FortuneA major Bay Area bank just failed. ‘Spectacular overpriced bubbles’ are going to keep popping, warns legendary investor Jeremy Grantham

Grantham blamed a “horror show” of Fed policies for a bear market he says likely won’t bottom out until late next year.

20h ago TipRanks

TipRanksThis Growth ETF Has a Massive 11.4% Dividend Yield, and It Pays Monthly

The JPMorgan Equity Premium Income Fund (NYSEARCA:JEPI) has become a hit in the ETF world thanks to its 12.2% dividend yield and its monthly payout. While many investors are likely familiar with JEPI thanks to the considerable level of fanfare it has garnered as it has grown to $21.8 billion in assets under management (AUM), they may not be as familiar with JEPI’s newer and somewhat less heralded cousin — the JPMorgan Nasdaq Premium Income ETF (NASDAQ:JEPQ). There are some notable differences be

17h ago MarketWatch

MarketWatchSoFi CEO Noto makes ‘opportunistic’ million-dollar stock purchase as SVB crisis fuels selloff

As SoFi shares fell Friday amid the fallout over Silicon Valley Bank's collapse, the financial-technology company's chief executive bought up stock.

15h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK