JPM lawsuits against ex-banker over Epstein ties make legal and PR sense: expert...

source link: https://finance.yahoo.com/news/jpm-lawsuits-against-ex-banker-over-epstein-ties-make-legal-and-pr-sense-experts-140217523.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

JPM lawsuits against ex-banker over Epstein ties make legal and PR sense: experts

JPMorgan should have identified

JPMorgan’s (JPM) offensive this week against two lawsuits tying the bank to late financier Jeffrey Epstein are savvy legal and public relations moves, legal experts say.

On Wednesday, the banking giant filed third-party complaints against its former investment banking chief, James “Jes” Staley, in response to the suits that claim the bank knew Epstein was trafficking and abusing girls and financially benefited from its relationship with Epstein – allegations that JPMorgan denies.

“It looks so much better for them to be throwing [Staley] under the bus,” University of Iowa corporate law professor Robert Miller said about JPMorgan’s new filings. “And this is a much more aggressive way of throwing him under the bus.”

One of the suits that now includes Staley as a third-party defendant was brought against the bank by a woman who says she was abused in Epstein’s decades-long trafficking scheme. The other was filed against the bank by the U.S. Virgin Islands’ attorney general.

Jane Doe claims that after befriending Epstein, Staley “observed victims personally,” and promised to “use his clout within JPMorgan to make Epstein untouchable.”

In detailing the rationale behind the third-party complaints, a JPMorgan spokesperson said: “The plaintiffs have made troubling allegations concerning the conduct of our former employee Jes Staley, and if true, he should be held responsible for his actions.”

Kathleen Harris, an attorney for Staley from Arnold & Palmer, declined to comment on JPMorgan’s claims.

In JPMorgan’s complaint the company says the former executive breached his fiduciary duty as a company employee by engaging in inappropriate conduct in his personal dealings with Epstein. The actions, the bank says, were concealed from JPMorgan and outside the scope of Staley’s employment, making him liable to reimburse the company if any damages result from the pair of underlying cases.

“At the time, we could not have imagined any of our employees would engage in the type of conduct alleged,” JPMorgan said in response to a request for more detail concerning the actions against Staley. “If these allegations against Staley are true, he violated this duty by putting his own personal interests ahead of the company’s.”

Bloomberg

BloombergSingapore’s Central Bank Boosted Gold Reserves 30% in January

(Bloomberg) -- Singapore boosted its gold reserves by about 30% in January, joining central banks from China to Turkey in building up holdings of the precious metal.Most Read from BloombergOne Bank Folds, Another Wobbles and Wall Street Asks If It’s a CrisisPeter Thiel’s Founders Fund Advises Companies to Withdraw Money From SVBCompanies Are Telling Us the Real Reason They're Still Raising PricesSVB Races to Prevent Bank Run as Funds Advise Pulling CashIn Biden’s Tax-the-Rich Budget, Capital-Gai

2d ago Reuters

ReutersUPDATE 2-Stablecoin USDC breaks dollar peg after revealing $3.3 bln Silicon Valley Bank exposure

Stablecoin USD Coin (USDC) lost its dollar peg and slumped to an all-time low on Saturday after Circle, the U.S. firm behind the coin, revealed that some of the reserves backing it were held at Silicon Valley Bank. Circle has $3.3 billion of its $40 billion of USDC reserves at collapsed lender Silicon Valley Bank, the company said in a tweet on Friday. The coin broke its 1:1 dollar peg and fell as low as $0.88 shortly after 0800 GMT on Saturday according to market tracker CoinGecko.

3h ago Reuters

ReutersSilicon Valley Bank's demise began with downgrade threat

In the middle of last week, Moody's Investors Service Inc delivered alarming news to SVB Financial Group, the parent of Silicon Valley Bank: the ratings firm was preparing to downgrade the bank's credit.That phone call, described by two people familiar with the situation, began the process toward Friday's spectacular collapse of the startup-focused lender, the biggest bank failure since the 2008 financial crisis. Details of SVB's failed response to the prospect of the downgrade, reported by Reuters for the first time, show how quickly confidence in financial institutions can erode. The Moody's call came after the value of the bonds where SVB had parked its money fell due to the higher interest rates.

5h ago The Fiscal Times

The Fiscal TimesHouse Freedom Caucus Issues Demands in Debt Limit Fight

Members of the far-right House Freedom Caucus on Friday demanded steep spending cuts and a rollback of major portions of President Joe Biden’s agenda and insisted that their conditions be met before they will consider voting to raise the debt limit. At a press conference at the U.S. Capitol, Freedom Caucus leaders said that they want to shrink Washington, D.C., and grow America. They railed against the federal government and what they called a “wasteful, woke and weaponized federal bureaucracy”

17h ago Reuters

ReutersUPDATE 2-Treasury, White House: Confident in regulators response on Silicon Valley Bank collapse

U.S. Treasury Secretary Janet Yellen met with banking regulators on Friday on the collapse of SVB Financial Group as she and the White House expressed confidence in their abilities to respond to the largest bank failure since the 2008 financial crisis. Yellen met with officials from the Federal Reserve, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency on Friday to discuss developments with SVB, which does business as Silicon Valley Bank, Treasury said in a statement.

20h ago Zacks

ZacksUnder Armour (UAA) Down 15.6% Since Last Earnings Report: Can It Rebound?

Under Armour (UAA) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues.

1d ago Yahoo Finance

Yahoo FinanceJobs report: Economists split on Fed's next move after strong February jobs report

Wall Street economists saw February's jobs report as a sign the labor market is cooling a bit, but remains far stronger than the Federal Reserve needs to bring inflation down to 2%.

21h ago Reuters

ReutersYellen warns U.S. House members of 'economic collapse' from default

WASHINGTON (Reuters) -U.S. Treasury Secretary Janet Yellen urged members of the U.S. House of Representatives on Friday to raise the federal debt ceiling without conditions, warning that a default on U.S. debt would cause "economic and financial collapse." Yellen, in budget testimony before the Republican-controlled House Ways and Means Committee, said that failure to increase the $31.4 trillion borrowing cap would threaten the economic progress that the U.S. has made since the COVID-19 pandemic. "In my assessment - and that of economists across the board - a default on our debt would trigger an economic and financial catastrophe," Yellen said.

1d ago Reuters

ReutersU.S. House Republican hardliners unveil spending demands for raising debt ceiling

The caucus of at least 37 members, which can stymie legislation in the narrowly divided House of Representatives, issued a position paper that would keep defense spending flat and reset nondefense discretionary spending at pre-COVID-19 pandemic levels while holding annual spending growth to 1%. Biden's proposal and the hardline response are just early salvos in a budget negotiation that has higher-than-usual stakes because House Republicans have said they will not vote to lift the nation's $31.4 trillion debt ceiling unless Biden agrees to spending cuts.

20h ago Bloomberg

BloombergShort Sellers Make $500 Million on SVB’s Demise. Collecting Won’t Be Easy

(Bloomberg) -- SVB Financial Group’s record plunge on Thursday minted short sellers roughly half a billion dollars in paper profits. But they now face a challenge: how to close their positions.Most Read from BloombergSVB’s 44-Hour Collapse Was Rooted in Treasury Bets During PandemicSilicon Valley Bank Swiftly Collapses After Tech Startups FleeWhy Is Everyone Talking About SVB? Everything We Know About the Bank’s Collapse Right NowStartup Bank Had a Startup Bank RunSVB’s Auction Block Includes VC

20h ago TipRanks

TipRanks‘Too Cheap to Ignore’: Cathie Wood Snaps Up These 2 Stocks Under $10

Sentiment shifts periodically on Wall Street, and you could argue Cathie Wood might be the prime example of fortune reversal. Once an investor favorite and hailed as a pioneer with a portfolio jam-packed with the novel and cutting-edge, Wood’s reputation has been tarnished over the past year and a half as her growth-oriented investing style went out of fashion in the post-pandemic climate. Does that mean Wood is ready to desert her strategy of backing innovative yet risky and often unprofitable

1d ago Investor's Business Daily

Investor's Business DailyTesla Price Cuts Trigger Desperate Fight For Survival In China's EV Market

Tesla price cuts have ignited a China EV price war, as market leaders, startups and foreign automakers fight for sales. Here's what's ahead.

18h ago The Wall Street Journal

The Wall Street JournalA Supermarket Megamerger Will Redefine What You Buy at the Grocery Store

Kroger and Albertsons want to merge in a $20 billion deal. If antitrust regulators approve, the definition of a grocery store grows further.

11h ago Fortune

FortuneGoogle over-hired talent to do ‘fake work’ and stop them working for rivals, claims former PayPal boss, Keith Rabois

The PayPal Mafia veteran claimed new hires were given "fake work", adding that mass layoffs seen in the sector are overdue.

1d ago Fortune

FortuneElon Musk is reportedly building his own town in Texas

Dubbed “Snailbrook,” the 3,500-acre community will house workers from SpaceX, Tesla and Boring.

2d ago Quartz

QuartzGM seeks to cut jobs by offering thousands of workers the chance to get paid to quit

General Motors is doing layoffs a little differently: It’s letting people choose to leave.

1d ago Footwear News

Footwear NewsInside the Great Athletic Leadership Shakeup: The C-Suite Hiring Trends to Know Now

Women from outside the industry are edging their way in — and nabbing top jobs.

22h ago Barrons.com

Barrons.comSol Gindi: Getting Wells Fargo Advisors Growing Again

The head of Wells Fargo Advisors explains how a redesigned core platform and a growing independent channel could help the firm rebuild an advisor corps that’s much diminished from a few years ago.

1d ago Reuters

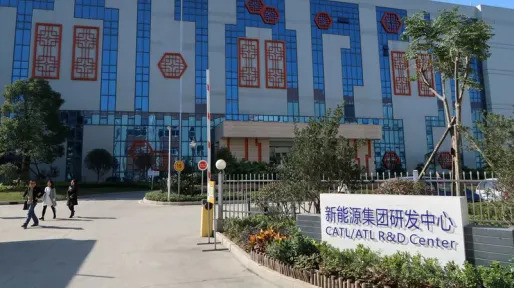

ReutersXi adds oversight risk to China EV battery growth plans

The world's largest battery maker CATL and its rivals in China were put on notice this week with a message from the top. When Chinese President Xi Jinping said he was “both pleased and concerned” about CATL’s electric vehicle (EV) battery dominance, industry executives and regulators heard a caution to be ready to throttle back expansion to keep the current boom from collapsing in a bust of overcapacity. Xi’s remarks, made in response to a presentation by CATL's chairman Robin Zeng on the sidelines of China's annual parliament on Monday, showed CATL has drawn the attention of top Chinese officials.

1d ago MarketWatch

MarketWatchChatGPT is about to make the business of retirement planning and financial advice profoundly human

ChatGPT and other AIs are set to transform the business of financial and retirement advice, and not just because of what the technology does.

23h ago

Recommend

-

6

6

Crypto Crime Cartel: The many lawsuits against BitMEX Business 8 hours ago ...

-

6

6

7 steps to protect against ransomware-related lawsuitsInternational ransomware gangs aren't the only people after your enterprise's money. Long after a ransomware attack fades into gloomy history, your organization could face another potentia...

-

7

7

Elon Musk: ‘Bezos retired in order to pursue a full-time job filing lawsuits against SpaceX’ Amazon is now protesting SpaceX plans for more internet satellites...

-

6

6

As lawsuits pile up, Activision Blizzard loses its chief legal officer Claire Hunt said her time at the company was ‘full of unexpected twists and turns’ ...

-

5

5

Local Google’s local rebrand prompts SMB support amid antitrust lawsuits, says local SEO expert If you work with SMBs and they...

-

3

3

The outcome of a Supreme Court case could have significant implications for how internet companies operate, content curation and free speech.

-

13

13

Tesla, the electric vehicle maker, is no stranger to legal disputes, with its CEO Elon Musk often at the center of the controversies. However, the latest lawsuit against the company centers on a growing concern among Tesla owners regarding parts a...

-

3

3

Copyright — Stable Diffusion copyright lawsuits could be a legal earthquake for AI Experts say generative AI is in uncharted legal waters.

-

7

7

TechU.S. Virgin Islands issued subpoena to Elon Musk in Jeffrey Epstein lawsuit...

-

6

6

AdvertisementCloseMusk subpoenaed in government’s Jeffrey Epstein lawsuit against JPMor...

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK