Housing confidence craters once more as mortgage rates spike

source link: https://finance.yahoo.com/news/housing-confidence-craters-once-more-as-mortgage-rates-spike-212535171.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Housing confidence craters once more as mortgage rates spike

weathered the storm,

Americans are feeling worse about the housing market again.

Fannie Mae’s gauge of housing sentiment dropped 3.8 points in February to 58.0, falling close to its record low set last year and reversing three months of consecutive gains. Overall, 44% of consumers reported that it’s a bad time to sell, up from 39% last month. At the same time, 24% of respondents expressed concern about losing their job in the next 12 months, up 18% last month.

Both buyers and sellers were pessimistic about the market, Doug Duncan, chief economist and senior vice president at Fannie Mae, said. He noted the decline in sentiment coincided with a run-up in mortgage rates in February after they had softened some since November.

“With home-selling sentiment now lower than it was pre-pandemic – and home-buying sentiment remaining near its all-time low – consumers on both sides of the transaction appear to be feeling cautious about the housing market,” Duncan said in a statement. “We believe these results corroborate our expectation for subdued home sales in the coming quarters, particularly now that mortgage rates have begun rising again.”

The results underscore how heavily affordability conditions have dampened the housing market ahead of the spring.

In the last month, the rate on the 30-year fixed mortgage surged over a half-point to 6.65%. As a result, homebuyers pulled back on their purchasing plans, the Mortgage Bankers Association found, with purchase activity plunging to a 28-year low by the last week of February.

Buyers still in the market also face higher home prices.

The median listing price on a home sold in February rose to $415,000, Realtor.com data showed, up from $406,000 the previous month. At last week’s rate, that translates to a typical monthly mortgage payment of $2,132, or 49% more than a year ago.

That financial blow was reflected in buyers' cratering confidence levels. At least 79% of respondents said that buying conditions were bad last month, Fannie Mae found, while only 20% said it was a good time to buy. While confidence in buying conditions increased 5 points, they remained 21 points lower than a year ago.

Yahoo Finance

Yahoo FinanceWalgreens internal memo says it is following the law on abortion pill distribution

Walgreens faces backlash over misperception of its intent to sell abortion pill in some states.

5h ago Yahoo Finance

Yahoo FinanceBuy-now-pay-later borrowers struggle more financially, study finds

This could potentially make them more vulnerable to potential late payments and fees.

4h ago Bloomberg

BloombergWeWork Is in Talks to Raise Hundreds of Millions in Cash

(Bloomberg) -- WeWork Inc., the long-struggling workspace rental company, is in talks to raise hundreds of millions in capital to support the business, said a person familiar with the negotiations.Most Read from BloombergMeta Plans Thousands More Layoffs as Soon as This WeekPowell Sees Higher Peak for Interest Rates, Says Fed Prepared to Speed Up If NeededBiden Eyes Tax Hike on Income Over $400,000 to Fund MedicareUS Banks Are Finally Being Forced to Raise Rates on DepositsChina Warns US Risks C

2h ago Reuters

ReutersCitadel's Griffin says the Fed needs more consistency to tame inflation

Billionaire investor Ken Griffin, the founder of Citadel and Citadel Securities, said on Tuesday the Federal Reserve needs more consistency of communication in order to tame inflation and that the setup for a recession is unfolding. Earlier on Tuesday, Fed chair Jerome Powell said the Fed will likely need to raise interest rates more than expected to control inflation. Previously, some market participants have at some points read Fed official's speeches as less hawkish.

3h ago Yahoo Finance

Yahoo FinanceOlder mortgage applicants are more likely to be rejected, study finds

Insufficient collateral and mortality risk are the main reasons for rejection.

1d ago Reuters

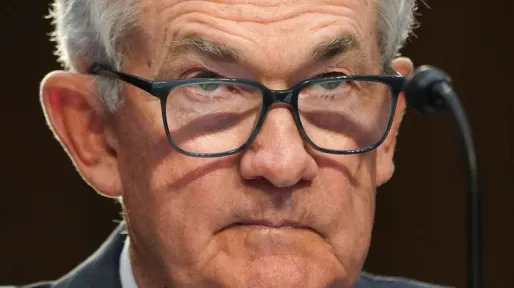

ReutersHawkish Powell puts 50 bp Fed rate hikes back on table

The Federal Reserve will likely need to raise interest rates more than expected in response to recent strong data and is prepared to move in larger steps if the "totality" of incoming information suggests tougher measures are needed to control inflation, Fed Chair Jerome Powell told U.S. lawmakers on Tuesday. "The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated," Powell said in prepared remarks for a hearing before the Senate Banking Committee. U.S. stocks sold off, Treasury yields rose and the dollar extended a gain after Powell's comments, his first since inflation unexpectedly jumped in January and the U.S. government reported an unusually large increase in payroll jobs for that month.

10h ago Yahoo Finance

Yahoo FinanceTikTok ban: Senators to introduce legislation to shut down social app

Sens. Mark Warner (D-VA) and John Thune (R-SD) are set to introduce a bill that would ban TikTok.

9h ago TipRanks

TipRanksThis 11.8%-Yielding ETF Pays Large Monthly Dividends

There are few things investors enjoy more than receiving a dividend payment each quarter. However, a popular ETF from JPMorgan, the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI), takes this approach and does it one better by paying investors a dividend on a monthly basis. Not only that, but JEPI’s dividend yield is a massive 11.8% on a trailing basis, which is more than seven times the average yield for the S&P 500 of 1.65% and nearly three times the yield that investors can get from 10-yea

21h ago Reuters

ReutersUS FTC asked Twitter for details on Musk's internal communications -House report

WASHINGTON (Reuters) -The U.S. Federal Trade Commission asked Twitter to turn over some internal communications related to owner Elon Musk and other detailed information about business decisions as part of an investigation into the social media company, according to a report put out by two House of Representatives committees. The FTC has sent more than a dozen letters to Twitter and its lawyers since Musk's takeover in October. Among the requests were the company "identify all journalists" who were granted access to company records and to provide information about the launch of the revamped Twitter Blue subscription service, the report said.

3h ago Yahoo Finance

Yahoo FinanceStock market news today: Stocks sink after Powell tells Congress rates could go 'higher'

Stocks fell on Tuesday as testimony from Federal Reserve Chair Jerome Powell set the stage for additional rate hikes from the central bank as inflation remains stubbornly high.

5h ago SmartAsset

SmartAssetI'm 50. How Much Should I Have in My 401(k)?

Most Americans have less in their retirement accounts than they'd like, and much less than the rules say they should have. So, obviously, if that describes you then you're not alone. Now, most financial advisors recommend that you have between five … Continue reading → The post How Much Should I Have in My 401(k) at 50? appeared first on SmartAsset Blog.

1d ago Yahoo Finance

Yahoo FinanceLuxury housing market sees 'steep' deceleration: charts

Even the wealthy are feeling the squeeze.

2d ago Reuters

ReutersAmazon worker loses bid for California class action over remote work expenses

Amazon.com Inc on Tuesday defeated a proposed class action lawsuit on behalf of nearly 7,000 workers in California that claimed the company should have reimbursed employees who worked remotely during the COVID-19 pandemic for home office expenses. U.S. District Judge Vincent Chhabria in San Francisco said the named plaintiff, David Williams, failed to show that Amazon had a company-wide policy of not reimbursing employees for internet, cell phone and other costs, and the judge denied his motion to certify the workers as a class. Williams' motion for class certification was denied without prejudice, meaning he can file a renewed motion later on.

6h ago MoneyWise

MoneyWiseBiden’s one-size-fits-all plan to protect renters comes 'at the expense' of mom-and-pop landlords — what to do if you still want a slice of the real estate pie

Rule changes living rent-free in your mind? Perhaps it's time for a more passive approach.

10h ago MoneyWise

MoneyWiseMillennials are sinking under the weight of their debts, adding a record $3.8 trillion to the pile last quarter. Here’s what’s driving that — plus 3 tips to get your head above water

There's room for everyone on this raft.

13h ago Fortune

FortuneMissing $96,000 is your problem, Coinbase allegedly told account holder who had life savings cleaned out

The crypto exchange’s response to the alleged theft “disclaimed any responsibility for the hacking of its customers’ accounts.”

12h ago MarketWatch

MarketWatchThe 6% CD has arrived. Should you bite?

Thanks to rapidly rising interest rates, many reputable banks and credit unions are now offering certificates of deposit with impressive rates above 4%. Security Plus Federal Credit Union offers an 11-month, 6% APY CD with a minimum $1,000 deposit and maximum $50,000 deposit to Baltimore City residents. Meanwhile, Frontwave Credit Union offers 6% on an 18-month CD for residents of Riverside, San Bernardino and San Diego Counties, California who can pony up a minimum deposit of $1,000.

2d ago Benzinga

BenzingaBillionaire Charlie Munger's Investment Advice Could Make Gen Z Rich — With A Little Patience

Charlie Munger is the billionaire extraordinaire who wears many hats, including being the director of Daily Journal Corp. and the longtime vice chairman of the legendary Warren Buffett's holding firm Berkshire Hathaway Inc. His decades-long experience in investing and finance makes him a force to be reckoned with. Munger has some advice for young investors who are looking to make their mark in the world of finance. He's warning the latest batch of college grads that getting rich and staying that

2h ago MarketWatch

MarketWatch‘I finally woke up to reality.’ I’ve been paying a percentage of my investments to a financial adviser for years now, but I don’t think it’s worth it. Is a 1% fee really fair?

“After too many years of paying for oversight, I finally woke up to the reality that it cannot be in the investor’s best interest as long as the manager is rewarded for assets under management.” Well, firstly the AUM model — which stands for assets under management and is often a flat 1% of one’s assets — isn’t without controversy.

14h ago Zacks

Zacks3 Value Stocks on Sale Now

Growth stocks have clearly led the market thus far in 2023, but will that continue?

6h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK