Millennials are sinking under the weight of their debts, adding a record $3.8 tr...

source link: https://finance.yahoo.com/news/millennials-sinking-under-weight-debts-130000850.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

In news that will come as no surprise to their boomer parents, millennials in their 30s are digging themselves deeper and deeper into debt.

Don't miss

A record number of Americans are grappling with $1,000 car payments and many drivers can't keep pace. Here are 4 ways to stay ahead

UBS says 61% of millionaire collectors allocate up to 30% of their overall portfolio to this exclusive asset class

'Hold onto your money': Jeff Bezos issued a financial warning, says you might want to rethink buying a 'new automobile, refrigerator, or whatever' — here are 3 better recession-proof buys

And it’s not just due to their long-abiding love for avocado toast and bougie coffee — although both of these things have certainly become more expensive lately, thanks to inflation.

Their demographic alone amassed nearly $4 trillion in debt in the fourth quarter of 2022, according to the Wall Street Journal's analysis of Federal Reserve Bank of New York data. This marks a 27% rise from late 2019 — the biggest jump of any age group — and it’s the fastest they’ve ever accumulated debt since the 2008 financial crisis.

The generational wealth gap is widening for these 30-somethings, and here’s why the occasional splurge at Starbucks isn’t to blame.

Debt rising for millennials in their 30s at a record pace

Household debt hit $16.90 trillion last quarter, as consumers grappled with rising inflation and interest rates.

Millennials in their 30s have added over $3.8 trillion in debt to their accounts — and are missing their credit card and auto loan payments at startling rates as well, according to the New York Fed.

And when you factor in the fact that housing affordability is at its lowest level in history, these young(ish) adults face an additional hurdle to building wealth.

“We are seeing a ‘credit gap’ emerge in the sense that younger, less-affluent borrowers are coming under financial pressure from higher living costs and inflation outpacing their income gains,” Silvio Tavares, chief executive of VantageScore, told The Wall Street Journal.

MarketWatch

MarketWatch‘I finally woke up to reality.’ I’ve been paying a percentage of my investments to a financial adviser for years now, but I don’t think it’s worth it. Is a 1% fee really fair?

“After too many years of paying for oversight, I finally woke up to the reality that it cannot be in the investor’s best interest as long as the manager is rewarded for assets under management.” Well, firstly the AUM model — which stands for assets under management and is often a flat 1% of one’s assets — isn’t without controversy.

14h ago MoneyWise

MoneyWiseBiden’s one-size-fits-all plan to protect renters comes 'at the expense' of mom-and-pop landlords — what to do if you still want a slice of the real estate pie

Rule changes living rent-free in your mind? Perhaps it's time for a more passive approach.

10h ago Fortune

FortuneGoogle boss Sundar Pichai says staff are bemoaning office ghost towns—‘It’s just not a nice experience’

The search engine giant is facing what is likely its greatest competitive threat since it was founded in 1998, forcing Pichai to make tough choices on costs.

13h ago 11h ago

11h ago CoinDesk

CoinDeskWhite House Is 'Aware of' Silvergate Situation, Spokeswoman Says

White House Press Secretary Karine Jean-Pierre said the presidential administration is monitoring Silvergate Bank's situation, and said Congress must act.

1d ago Fortune

FortuneLayoffs, burnout, return-to-office wars: There’s never been a worse time to be a middle manager

For the first time since O.C. Tanner began measuring engagement and cultural sentiment, managers are reporting lower morale than their reports.

13h ago Yahoo Finance

Yahoo FinanceRivian stock tanks as it announces $1.3B 'green bond' offering

Rivian shares are sliding today as the EV-maker announces plans for a “green” debt offering. Rivian says it intends to sell $1.3 billion worth of “green” convertible senior notes due in 2029, with the option to grant an additional $200 million worth of convertible notes to the original purchasers.

9h ago TipRanks

TipRanksThis 11.8%-Yielding ETF Pays Large Monthly Dividends

There are few things investors enjoy more than receiving a dividend payment each quarter. However, a popular ETF from JPMorgan, the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI), takes this approach and does it one better by paying investors a dividend on a monthly basis. Not only that, but JEPI’s dividend yield is a massive 11.8% on a trailing basis, which is more than seven times the average yield for the S&P 500 of 1.65% and nearly three times the yield that investors can get from 10-yea

21h ago Benzinga

BenzingaBillionaire Charlie Munger's Investment Advice Could Make Gen Z Rich — With A Little Patience

Charlie Munger is the billionaire extraordinaire who wears many hats, including being the director of Daily Journal Corp. and the longtime vice chairman of the legendary Warren Buffett's holding firm Berkshire Hathaway Inc. His decades-long experience in investing and finance makes him a force to be reckoned with. Munger has some advice for young investors who are looking to make their mark in the world of finance. He's warning the latest batch of college grads that getting rich and staying that

2h ago TheStreet.com

TheStreet.comThree Dividend Stocks to Consider Now: Morningstar

The firm's analysts give them all wide moats, meaning they will have competitive advantages for at least 20 years.

4h ago Bloomberg

BloombergA Nation's Heavily Indebted Consumers Face a Painful Margin Call

(Bloomberg) -- At the height of the Covid-19 pandemic, with his job as a delivery driver bringing plenty of overtime and the cost to borrow at record lows, James Kebe went on a spending spree. He leased a boat and an all-terrain vehicle, and when his bank offered him a bigger line of credit, he maxed it out.Then interest rates started rising at their fastest pace in generations. And because Kebe’s line of credit had a floating rate, his monthly payments soared, too. The cost of his debt has now

1d ago Investor's Business Daily

Investor's Business DailyDow Jones Tumbles Over 500 Points On 'Faster' Fed Chief Powell; Tesla Falls Below Key Level

Fed chief Jerome Powell signaled rate hikes will go higher and faster than previously expected. The major indexes fell sharply.

6m ago Zacks

ZacksAT&T Inc. (T) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to AT&T (T). This makes it worthwhile to examine what the stock has in store.

12h ago Benzinga

Benzinga4 Technologies That Aren't That Big Today but Will Likely Be Massive in 20 Years

The concept of smartphones and electric cars seemed like a pipe dream 20 years ago, but today, nearly 6.92 billion people, or 86.4% of the global population, have personal smartphones. Governments worldwide are moving toward a green future by encouraging the use of electric cars instead of vehicles with combustible engines. Investing in burgeoning technologies could increase your wealth within the next two decades. Take look at some of the most promising technologies poised to catch on. Generati

1d ago Bloomberg

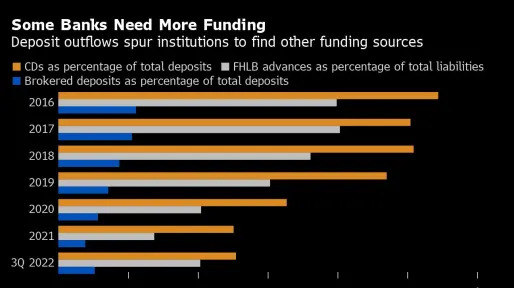

BloombergUS Banks Are Finally Being Forced to Raise Rates on Deposits

(Bloomberg) -- US banks are being forced to do something they haven’t done for 15 years: fight for deposits.Most Read from BloombergHolding Cash Will Be a Winning Strategy in 2023, Investors SayTrump’s Threat of a Third-Party Run Is Undercut by ‘Sore Loser’ LawsUS Banks Are Finally Being Forced to Raise Rates on DepositsTesla Slashes Model S and X Prices for the Second Time This YearTesla’s China Price War Sparks $18 Billion BYD Rout: Tech WatchAfter years of earning next to nothing, depositors

1d ago TipRanks

TipRanksHigh Rates’ Pain Is Others’ Gain: Here Are 2 Stocks That Could Benefit From the Fed’s Tightening Policy

Inflation remains high, and that was on the mind of Jerome Powell as the Federal Reserve chair gave testimony to the Senate Banking committee today. Powell made it clear that the central bank is likely to lift interest rates higher than previously anticipated. Currently, the Fed’s key funds rate is set in the range of 4.5% to 4.75%. “Although inflation has been moderating in recent months, the process of getting inflation back to 2% has a long way to go, and is likely to be bumpy… The latest eco

53m ago Zacks

ZacksRigel Pharmaceuticals (RIGL) Q4 Earnings and Revenues Surpass Estimates

Rigel (RIGL) delivered earnings and revenue surprises of 114.29% and 36.56%, respectively, for the quarter ended December 2022. Do the numbers hold clues to what lies ahead for the stock?

3h ago Investor's Business Daily

Investor's Business DailyCrowdStrike Earnings Top Estimates, Revenue Outlook Well Above Views

CrowdStrike reported Q4 profit and sales that topped estimates while revenue guidance came in well above Wall Street targets.

3h ago Fortune

FortuneGoogle middle managers hoping for a big promotion better think again

CEO Sundar Pichai is cutting back on large pay rises, as investors demand management take more forceful action to reduce its bloated cost base.

10h ago Zacks

ZacksIs NIO Inc. (NIO) a Buy as Wall Street Analysts Look Optimistic?

The average brokerage recommendation (ABR) for NIO Inc. (NIO) is equivalent to a Buy. The overly optimistic recommendations of Wall Street analysts make the effectiveness of this highly sought-after metric questionable. So, is it worth buying the stock?

1d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK