‘Tip of the negative equity iceberg’: A record number of Americans are grappling...

source link: https://finance.yahoo.com/news/tip-negative-equity-iceberg-record-173000474.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

A record number of Americans are grappling with $1,000 car payments and many drivers can't keep pace — stay ahead by dodging these 2 loan mistakes

With a record 16% of American consumers paying at least $1,000 a month for their cars, it's no surprise that drivers are starting to fall behind on their bills.

The percentage of borrowers at least 60 days late on their car payments is higher today than it was during the peak of the Great Recession in 2009.

Don't miss

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

'Hold onto your money': Jeff Bezos issued a financial warning, says you might want to rethink buying a 'new automobile, refrigerator, or whatever' — here are 3 better recession-proof buys

Here's the average salary each generation says they need to feel 'financially healthy.' Gen Z requires a whopping $171K/year — but how do your own expectations compare?

There are multiple factors driving this trend. Car financing costs are climbing as the Federal Reserve continues its aggressive campaign of interest rate hikes to combat persistent inflation.

At the same time, used car values are dropping, leaving debtors at risk of owing more money than their cars are actually worth.

As your monthly car costs increase, you can dodge a debt default by avoiding two common auto loan mistakes.

Late payments, repossessions are on the rise

Used car prices surged during the pandemic due to supply chain challenges, which forced buyers to take out bigger loans — with higher APRs — for their vehicles.

Despite the fact that car prices started to cool off by the end of 2022, a concerning trend of auto loan defaults and car repossessions has started to surface.

The percentage of subprime auto borrowers who were at least 60 days late on their bills hit 5.67% in December, trumping 5.04% in January 2009 at the peak of the Great Recession, according to the credit rating agency Fitch Ratings.

Ally Financial (NYSE:ALLY), one of the largest providers of car financing in the U.S., said its percentage of car loans that were more than 60 days overdue rose to 0.89% in Q4 2022, up from 0.48% a year earlier.

MoneyWise

MoneyWiseSuper rich New Yorkers — including billionaire Carl Icahn — are fleeing the Big Apple in droves. Here are the top 3 states they're quickly escaping to

These snowbirds are heading south for the winter. And staying put.

7h ago Yahoo Finance

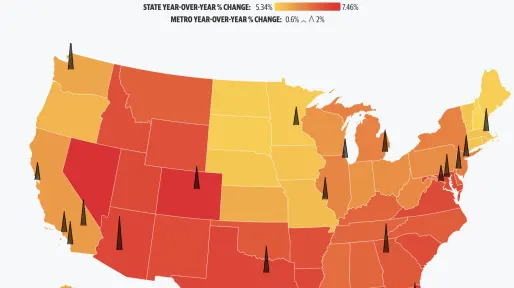

Yahoo FinanceInflation is still hitting certain states particularly hard

Some parts of the U.S. are particularly feeling the impact of sky-high prices from inflation.

5h ago AP Finance

AP FinanceFed Minutes: Almost all officials backed quarter-point hike

Nearly all Federal Reserve policymakers agreed earlier this month to slow the pace of their rate increases to a quarter-point, with only “a few” supporting a larger half-point hike. The minutes from the Fed’s Jan. 31-Feb.1 meeting said most of the officials supported the quarter-point increase because a slower pace “would better allow them to assess the economy’s progress” toward reducing inflation to their 2% target. The increase raised the Fed’s benchmark rate to a range of 4.5% to 4.75%, the highest level in 15 years.

1h ago MoneyWise

MoneyWiseSaudi Arabia says it's now 'open' to the idea of trading in currencies besides the US dollar — does this spell doom for the greenback? 3 reasons not to worry

Can't get rid of U.S. that easily.

9h ago MoneyWise

MoneyWiseDid Harry and Meghan blow up their brand? The prince's popularity is at a record low after the release of 'Spare' — but the Duke and Duchess aren't done telling their story yet

This is just the beginning of the couple's media empire.

6h ago Benzinga

Benzinga'We Are Entering The Best Real Estate Market Opportunity Since 2008': Why This Billionaire Investor Is Aggressively Buying Income-Producing Properties

If you own a home or have been interested in buying one, you are aware of the sizeable U.S. residential real estate downturn. Sales numbers are dropping to their lowest rates since 2020, but interest rates continue to rise to around 6.5%. This scenario doesn’t mean investors should look to another option viewed as less volatile. Take real estate investment trusts (REITs), for example. REITs are not just a platform for investing in residential real estate, offering properties such as retail space

9h ago MoneyWise

MoneyWiseLaid-off Silicon Valley workers are panic-selling their start-up shares as valuations tumble — here are 3 top tech stocks for 2023 that actually make money

It's a tech-astrophe out there. But you have options.

23h ago MoneyWise

MoneyWiseWarren Buffett's new 13F is out — and he's leaning on these 4 big holdings to fight white-hot inflation

The Oracle of Omaha knows how to beat inflation. So ride his coattails.

1d ago MarketWatch

MarketWatchFed minutes show some officials thought easing of financial conditions could necessitate tighter monetary policy

Some Federal Reserve officials at their meeting in early February thought that easier financial conditions could mean tighter monetary policy.

47m ago TipRanks

TipRanksBillionaire David Einhorn Loads Up on These 2 Stocks — Here’s Why They Could Bounce

Only a relatively small number of investors enjoyed 2022’s treacherous bear conditions, and one of those was David Einhorn. In contrast to the S&P 500’s 19% loss, Einhorn’s hedge fund Greenlight Capital notched returns of 36.6%, in what amounted to the fund’s finest year in a decade. The value investor’s strategy obviously worked wonders in a year when more risk-flavored stocks got hammered and in a recent note to investors, the fund stated they believe their game plan “has and will continue to

4h ago Barrons.com

Barrons.comTesla Is Moving Battery Manufacturing to the U.S. Biden’s Incentives Are Working: Report

The electric-vehicles company will shift some manufacturing to the U.S. from Germany, apparently won over by American tax breaks.

10h ago Yahoo Finance

Yahoo FinanceConsumers are still spending at restaurants despite inflation

In the latest data from the U.S. Census Bureau, consumers spent more than $86.6 billion on dining out in the month of January — up 24% year over year.

1d ago MarketWatch

MarketWatchBernie Sanders and Elizabeth Warren’s bold tax hike to shore up Social Security

We are entering into what could be a prolonged battle over the future of Social Security and Medicare.

1d ago Yahoo Finance

Yahoo FinanceDoubleLine’s Jeffrey Sherman cautions Fed shouldn't push rates above 6%

The Federal Reserve is likely to take its federal funds rate beyond 5% but must assess the impact of such a level before pressing higher, according to DoubleLine Capital’s deputy chief investment officer Jeffrey Sherman.

2h ago Benzinga

BenzingaWhich Billionaire Owns The Most Land In The U.S.? Hint, It's Not Bill Gates

Earlier this year, in May, claims were made that Microsoft Corp co-founder Bill Gates owned the majority of America’s farmland. While that is false, with the billionaire amassing nearly 270,000 acres of farmland across the country, compared to 900 million total farm acres, a different billionaire privately owns 2.2 million acres, making him the largest landowner in the U.S. John Malone, the former CEO of Tele-Communications Inc., which AT&T Inc. purchased for more than $50 billion in 1999, has a

9h ago Zacks

ZacksNikola (NKLA) to Report Q4 Earnings: Here's What to Expect

The Zacks Consensus Estimate for Nikola's (NKLA) loss per share and revenues is pegged at 46 cents and $34.12 million, respectively, for the fourth quarter of 2022.

3h ago Investopedia

InvestopediaHow the Superrich Use 401(k)s

Higher earners may have an advantage when funding 401(k) plans. Learn how to make the most of your 401(k) like the superrich do.

4h ago MarketWatch

MarketWatchHome values fell the most in these 3 housing markets since last year, says Zillow

The mortgage rate meltdown from the end of 2022 is showing up in home prices. Among the 50 largest metro areas, San Francisco, Sacramento and San Jose saw the biggest drops in home values year-over-year, followed by Austin and Seattle. San Francisco saw home value appreciation fall by 4.9% as compared to the previous year.

1d ago Zacks

ZacksTilray Brands, Inc. (TLRY) is Attracting Investor Attention: Here is What You Should Know

Tilray Brands, Inc. (TLRY) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

6h ago Yahoo Finance

Yahoo FinanceIntel dividend cut a result of 'very specific issues': DoubleLine's Monica Erickson

Intel brings out the hatchet to its dividend.

2h ago TipRanks

TipRanks‘Big Short’ Michael Burry Pours Money Into These 2 Stocks — Here’s Why They May Be Worth Buying

Michael Burry’s fame spread far and wide after his exploits were documented in the Big Short – the book - and later the movie - that told the story of Burry’s success in betting against the housing market during the financial crisis of 2008. That was a move that turned out to be a hugely profitable one. Burry went short then and hasn’t been shy in issuing repeated warnings on the current state of the market, either. In addition to some recent enigmatic tweets that hint at looming disaster, Burry

1d ago Bloomberg

BloombergDomino’s Plunges Most on Record as Customers Shun Price Hikes

(Bloomberg) -- Shares of Domino’s Pizza Enterprises Ltd. plummeted the most on record in Sydney after the pizza chain operator said its first-half earnings fell as customers spurned price increases meant to offset inflationary pressures.Most Read from BloombergMcKinsey Plans to Eliminate About 2,000 Jobs in One of Its Biggest Rounds of CutsHow Much Do Investors Say They Need to Retire? At Least $3 MillionChina Urges State Firms to Drop Big Four Auditors on Data RiskRussia’s War on Ukraine, China

14h ago Barrons.com

Barrons.comLuminar Broadens Deal With Mercedes but Lidar Technology Is Still Growing Slowly

The companies have been collaborating on lidar, essentially laser-based radar, for the past couple of years, but broader adoption is still slow.

1h ago TipRanks

TipRanksSeeking at Least 7% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

Inflation, interest rates, and recession – these are the bogeymen of investing, and they’ve been watching over our shoulders for the past year. We all know the story by now, the rate of inflation, at 6.4%, is still high, the Federal Reserve is hiking rates in an attempt to push back against high prices, and that could tip the economy into recession. At a time like this, investors are showing a growing interest in finding strong defensive portfolio moves. It’s a mindset that naturally turns us to

18h ago Reuters

ReutersFed minutes show officials mulled financial stability risk amid aggressive hikes

At their last monetary policy meeting, Federal Reserve officials took stock of how the financial system was faring in the face of very aggressive rate rises. Officials flagged what they saw as potential vulnerabilities in things like commercial real estate and non-bank financial companies, as well as the orderly functioning of the Treasury bond market, which is the backbone of the global credit system. Some Fed officials were also worried about overseas shocks hitting the U.S. financial system, while others "noted the importance of orderly functioning of the market for U.S. Treasury securities and stressed the importance of the appropriate authorities continuing to address issues related to the resilience of the market."

45m ago Zacks

ZacksWhat's in Store for American Tower (AMT) in Q4 Earnings?

The high demand for American Tower's (AMT) assets due to rising carrier network spending is likely to have benefited its Q4 earnings. However, rising interest expenses may have been a deterrent.

1d ago Yahoo Finance

Yahoo FinanceLucid earnings preview: Production, ownership structure in focus

When California-based EV-maker Lucid announces Q4 financial results after the bell on Wednesday, the production guidance, and questions of its future ownership structure, may dominate the headlines.

3h ago Investor's Business Daily

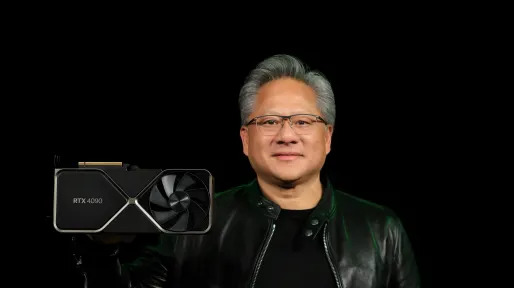

Investor's Business DailyDow Jones Reverses Ahead Of Fed Minutes; Baidu Surges On Earnings; Nvidia Earnings On Deck

The Dow Jones reversed lower Wednesday ahead of minutes from the Federal Reserve's latest policy meeting. Nvidia earnings are due out late.

5h ago Bloomberg

BloombergBill Gates Buys Stake in Heineken for $902 Million

(Bloomberg) -- Bill Gates has acquired a minority stake in Heineken Holding NV, the controlling shareholder of the world’s second-largest brewer, for about $902 million.Most Read from BloombergMcKinsey Plans to Eliminate About 2,000 Jobs in One of Its Biggest Rounds of CutsChina Urges State Firms to Drop Big Four Auditors on Data RiskHow Much Do Investors Say They Need to Retire? At Least $3 MillionApple Makes Major Progress on No-Prick Blood Glucose Tracking for Its WatchPutin Has Decided to No

4h ago Yahoo Finance

Yahoo FinanceNvidia earnings: Gaming revenue expected to plummet as data center profit rises

Nvidia will report its Q4 earnings after the bell on Wednesday with analysts expecting gaming revenue to sink.

7h ago TheStreet.com

TheStreet.comMorningstar Lists Three Undervalued, 'Superior' Dividend Stocks

Morningstar says two factors can indicate stocks with safe dividends: economic moats and distance-to-default scores.

1d ago Zacks

ZacksZIM Integrated Shipping Services (ZIM) Stock Moves -1.26%: What You Should Know

ZIM Integrated Shipping Services (ZIM) closed the most recent trading day at $21.88, moving -1.26% from the previous trading session.

21h ago Zacks

ZacksCleveland-Cliffs Inc. (CLF) is Attracting Investor Attention: Here is What You Should Know

Cleveland-Cliffs (CLF) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

6h ago Zacks

ZacksMatador Resources (MTDR) Tops Q4 Earnings and Revenue Estimates

Matador (MTDR) delivered earnings and revenue surprises of 6.67% and 8.66%, respectively, for the quarter ended December 2022. Do the numbers hold clues to what lies ahead for the stock?

20h ago Benzinga

BenzingaWhy Fiverr International Shares Are Trading Higher Today

Fiverr International Ltd (NYSE: FVRR) reported fourth-quarter FY22 sales growth of 4.2% year-on-year to $83.1 million, marginally missing the consensus of $83.5 million. Active buyers increased 1% Y/Y to 4.3 million, and Spend per buyer rose 8% Y/Y to $262. The take rate expanded by 100 bps to 30.2%. Non-GAAP gross margin contracted 30 bps to 83.1%, while the adjusted EBITDA margin expanded 20 bps to 11.3%. Non-GAAP EPS of $0.26 beat the consensus of $0.20. Fiverr generated $9.6 million in opera

4h ago TheStreet.com

TheStreet.comIntel Slashes Dividend Following Grim Profit Outlook; Stock Slides

"We are setting the foundation for significant operating leverage and free cash flow growth," said CFO David Zinsner.

3h ago Zacks

ZacksTaiwan Semiconductor Manufacturing Company Ltd. (TSM) Is a Trending Stock: Facts to Know Before Betting on It

TSMC (TSM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

6h ago Barrons.com

Barrons.comIntel Cuts Dividend by 66% and Reiterates Forecast

Intel announced Wednesday it will be cutting its quarterly dividend by 66%, saying the move “reflects the board’s deliberate approach to capital allocation.” Intel (ticker: INTC) announced in a news release that it will be cutting its quarterly dividend to 12.5 cents a share , down 66% from its previous dividend of 36.5 cents.

4h ago Zacks

ZacksAMC Entertainment (AMC) Expected to Beat Earnings Estimates: What to Know Ahead of Q4 Release

AMC Entertainment (AMC) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

1d ago MarketWatch

MarketWatchNorfolk Southern’s stock extends selloff, but one analyst turns bullish — here’s why

Norfolk Southern's stock has fallen enough since the Feb. 3 Ohio train derailment that Wolfe Research analyst Scott Group has turned bullish.

6h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK