How do rich people avoid taxes? Wealthy Americans skirt $160 billion a year in t...

source link: https://finance.yahoo.com/news/rich-people-avoid-taxes-wealthy-192633039.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

How do rich people avoid taxes? Wealthy Americans skirt $160 billion a year in tax payment

More than $160 billion in tax revenue is lost every year because the top 1% finds ways to avoid paying “their fair share,” according to academic research cited by the Treasury Department.

What tactics, though, do uber-wealthy people use to avoid the taxes?

It turns out that not only can they afford tax attorneys, accountants, and estate planners, but there are also some tax benefits that require lots of money to even access. We’ll shed light on some of those strategies available only to the extremely rich.

“As long as it’s done legitimately and there’s no fraud, I’m okay with it,” said Ed Smith, senior tax and estate planner at Janney Montgomery Scott.

Tips from rich people on how to save: These are the tax strategies used by uber rich Americans

Important info: Are you ready to file your taxes? Here's everything you need to know to file taxes in 2023.

How much do rich people avoid in taxes?

According to U.S. Treasury estimates, the top 1% of wealthy people underpay their taxes by $163 billion annually.

How the super-rich avoid paying taxes

Foundations

Gifting

Family offices

Investments

Moving residency

1. Foundations: Some begin with as little as $250,000, but a more feasible amount begins in the millions.

Immediate income tax deduction of up to 30% of adjusted gross income (AGI) for your contribution but only distribute about 5% each year for charitable purposes. Because that 5% is calculated off the previous year’s assets, the first year requires no distribution.

Avoid high capital gains tax and grow money tax efficiently. You can deduct the full fair-market value of the stock you contribute and not pay capital gains tax. If the foundation sells, it only pays 1.39% excise tax on the capital gains.

Example: By investing $250,000 in a private foundation each year for five years, earning 8% annually, yields about $1.43 million after excise taxes and minimum annual distributions of 5% to charitable activities. Contrast this with $1.38 million had the money been invested in a taxable account and paid capital gains taxes along the way.

MoneyWise

MoneyWiseWarren Buffett's new 13F is out — and he's leaning on these 4 big holdings to fight white-hot inflation

The Oracle of Omaha knows how to beat inflation. So ride his coattails.

7h ago MarketWatch

MarketWatchBernie Sanders and Elizabeth Warren’s bold tax hike to shore up Social Security

We are entering into what could be a prolonged battle over the future of Social Security and Medicare.

4h ago SmartAsset

SmartAssetMy Portfolio in Approaching $1 Million. Will I Be Able to Live Off The Interest It Produces?

Once you have $1 million in assets, you can look seriously at living entirely off the returns of a portfolio. After all, the S&P 500 alone averages 10% returns per year. Setting aside taxes and down-year investment portfolio management, a … Continue reading → The post How Much Interest Can You Earn on $1 million? appeared first on SmartAsset Blog.

8h ago TipRanks

TipRanks‘Big Short’ Michael Burry Pours Money Into These 2 Stocks — Here’s Why They May Be Worth Buying

Michael Burry’s fame spread far and wide after his exploits were documented in the Big Short – the book - and later the movie - that told the story of Burry’s success in betting against the housing market during the financial crisis of 2008. That was a move that turned out to be a hugely profitable one. Burry went short then and hasn’t been shy in issuing repeated warnings on the current state of the market, either. In addition to some recent enigmatic tweets that hint at looming disaster, Burry

7h ago Yahoo Finance

Yahoo Finance'The biggest reason' why people won't switch banks

A Frost Bank survey found that only 11% of people felt a sense of financial belonging with their banks.

7h ago TipRanks

TipRanksDown More Than 50%: Analysts Say Buy These 2 Beaten-Down Stocks Before They Rebound

Old school investors will tell you that ‘buying low and selling high’ is the key to market success. The advice may be cliché, but it’s based on mathematical truth. The hard part, however, is understanding when prices are low, because that’s not always an absolute number. In recognizing that lower price range, investors can turn to Wall Street’s pros for help. Using TipRanks’ platform, we pinpointed two beaten-down stocks the analysts believe are gearing up for a rebound. In fact, despite their h

21h ago MarketWatch

MarketWatchHome values fell the most in these 3 housing markets since last year, says Zillow

The mortgage rate meltdown from the end of 2022 is showing up in home prices. Among the 50 largest metro areas, San Francisco, Sacramento and San Jose saw the biggest drops in home values year-over-year, followed by Austin and Seattle. San Francisco saw home value appreciation fall by 4.9% as compared to the previous year.

3h ago SmartAsset

SmartAssetVanguard Says This Is the Ideal Tipping Point For Your Roth Conversion

Deciding between a traditional individual retirement account (IRA) and a Roth IRA can be difficult. Choosing when or if you should convert your IRA funds to a Roth account can be even more daunting. Experts commonly recommend that investors compare … Continue reading → The post When Should You Consider a Roth Conversion? Vanguard Has an Answer appeared first on SmartAsset Blog.

8h ago Yahoo Finance

Yahoo FinanceWalmart keeps gaining high-income shoppers amid 'stubborn inflation' in the grocery aisle

Walmart reported its fiscal 2023 fourth-quarter results that topped Wall Street estimates, but updated its outlook as inflation remains.

7h ago TheStreet.com

TheStreet.comMorningstar Lists Three Undervalued, 'Superior' Dividend Stocks

Morningstar says two factors can indicate stocks with safe dividends: economic moats and distance-to-default scores.

2h ago Yahoo Finance

Yahoo FinanceWalmart CFO: 'There is considerable pressure on the consumer'

Walmart’s quarterly results show consumers increasingly squeezed by inflation and forced to choose between buying necessities or splurging on discretionary items.

2h ago Yahoo Finance

Yahoo FinanceSupreme Court hears arguments in a case that could reform the internet

Google (GOOG) (GOOGL) presented arguments before the U.S. Supreme Court Tuesday in a case that could reform the internet by further defining how much risk comes with hosting third party content.

2h ago MarketWatch

MarketWatch‘Not a time to buy’: S&P 500 exiting ‘best era’ in decades for earnings growth amid ‘dried up’ liquidity

The U.S. stock market, as measured by the S&P 500, appears to be exiting the 'best era' for earnings growth in decades, according to Bank of America.

3h ago Yahoo Finance

Yahoo FinanceQ&A: How to find a career you are passionate about

Q&A: Author and career coach Maggie Mistal tells Yahoo Finance's Kerry Hannon how to take your old job, shove it and find new work you're passionate about.

9h ago Bloomberg

BloombergLithium's Plunge Is Pitting Cathie Wood Against Sector Veterans

(Bloomberg) -- Lithium’s recent price collapse and the prospect that supply from new mines could accelerate the slump are stoking fierce debate in the electric-car battery industry.Most Read from BloombergHow Much Do Investors Say They Need to Retire? At Least $3 MillionPutin Halts Nuke Pact With US, Vows to Push War in UkraineRussia’s War on Ukraine, China’s Rise Expose US Military FailingsWorld’s Largest Four-Day Work Week Trial Finds Few Are Going BackPutin Says Russia to Suspend New START Nu

11h ago Yahoo Finance

Yahoo FinanceShark Tank's Barbara Corcoran on housing market: ‘The worst is behind us’

Real estate may be seeing signs of life as one expert said 'the worst is behind us.' Still, the market will only take off if the interest rates drop, said Barbara Corcoran

1h ago TheStreet.com

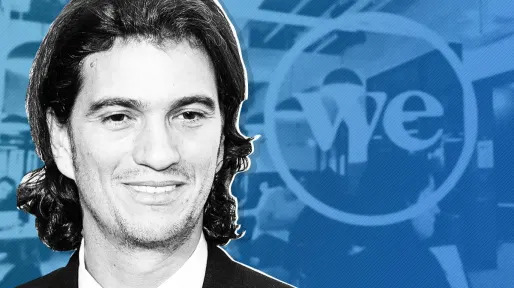

TheStreet.comElon Musk Suggests WeWork Founder's New Company Is Nonsense

Tesla's CEO doesn't hide what he thinks of Flow, Adam Neumann's new company. It could be summed up in one word: bull.

9h ago TheStreet.com

TheStreet.comT-Mobile Follows Verizon by Adopting Unpopular Pricing Policy

The self-dubbed "Un-carrier" used to make fun of its rivals. Now it's following Verizon's lead.

1d ago Bloomberg

BloombergUS Stocks in Thrall of Fed Have Further to Fall, History Shows

(Bloomberg) -- The US stock market hasn’t found a bottom yet, if history is any indication.Most Read from BloombergHow Much Do Investors Say They Need to Retire? At Least $3 MillionPutin Halts Nuke Pact With US, Vows to Push War in UkraineRussia’s War on Ukraine, China’s Rise Expose US Military FailingsWorld’s Largest Four-Day Work Week Trial Finds Few Are Going BackPutin Says Russia to Suspend New START Nuke Pact ParticipationThe S&P 500 Index hit a low only after the Federal Reserve stopped ra

11h ago Yahoo Finance

Yahoo FinanceConsumers are still spending at restaurants despite inflation

In the latest data from the U.S. Census Bureau, consumers spent more than $86.6 billion on dining out in the month of January — up 24% year over year.

3h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK