Illegal for 79 Years, This Loophole Lets Regular Americans Invest Alongside Sili...

source link: https://finance.yahoo.com/news/illegal-79-years-loophole-lets-143801832.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Illegal for 79 Years, This Loophole Lets Regular Americans Invest Alongside Silicon Valley Insiders

For 79 years, if you wanted the right to invest in early-stage companies like Apple in the 1970s, Facebook in 2004, or Airbnb in 2009, you had to be an “accredited investor.”

The concept came from a 1933 law that created the U.S. Securities & Exchange Commission (SEC) to guard against some of the excesses on Wall Street that had led to the 1929 crash and the ensuing Great Depression.

The Securities Act also held a provision barring any non-founders or other company insiders from investing in a pre-IPO company unless they had either a consistent income of at least $200,000 a year or a net worth of $1 million.

Read About Investing In this AI Startup: This Startup Built the World's First AI Marketing Platform That Can Understand Emotion and Some of the Biggest Companies on the Planet Are Already Using It

In theory, the law was to protect financially unsophisticated people from being goaded into investing in flashy but ultimately doomed companies. Unfortunately, there’s no denying that the law slammed the door shut on millions of people’s hopes of striking gold on pre-IPO opportunities – while Silicon Valley insiders made out like bandits.

Consider Peter Thiel. The co-founder of PayPal wasn’t a billionaire in 2004 – but he was rich and well-connected enough in Silicon Valley to be offered a chance to invest in Facebook back in the company’s early days. Thiel was able to turn the $500,000 he invested into $1.1 billion.

Or take Uber. In 2011, Amazon’s Jeff Bezos was part of a coterie of tech titans investing $37 million into Uber’s Series B funding. Just a few years later, Uber became the most valuable startup in the world.

Read about startup investing ideas: A New Supply Chain: 3D Printing Allows For The Creation Of A Global, Decentralized Supply Network

In May 2019, Uber finally went public almost a decade after billionaires, Wall Street funds and tech moguls had gotten the first bite of the apple. This meant that regular Americans were at the very end of the line – even behind Saudi Arabia’s government, which was allowed to invest $3.5 billion in 2015.

Benzinga

BenzingaThe Real Estate Market Is In The Freezer, But Billionaire Grant Cardone Says Investors Will 'Save The Day'

Economists have been calling for a housing crash for several months. Some even predicted that home prices would fall by as much as 30% in 2023. While these claims are understandable considering that rising mortgage rates have priced many would-be buyers out of the market, it appears that a different scenario is beginning to play out. Best-selling author and real estate fund manager Grant Cardone agrees that the housing market is in trouble, but points out that investors will create enough demand

15h ago TheStreet.com

TheStreet.comElon Musk, Others Call For Microsoft to Shut Down ChatGPT in Bing: 'Clearly Not Safe Yet'

After the new AI-powered Microsoft search engine rolled out last week, users testing it are finding some unexpected results.

6h ago MoneyWise

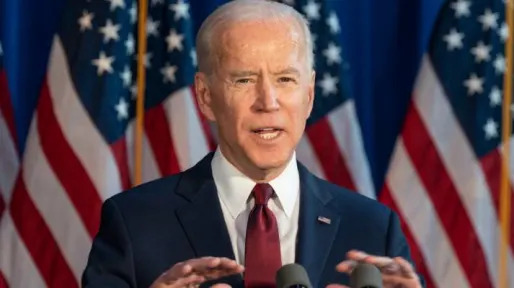

MoneyWiseThe US is about to sell another 26M barrels of oil reserves — depleting the 'oil piggy bank' even further. But here's President Biden's 3-part plan to replenish it

The SPR is already at its lowest level in 40 years.

14h ago MarketWatch

MarketWatchAnother ‘Volmageddon’? JPMorgan becomes the latest to warn about an increasingly popular short-term options strategy.

"While history doesn’t repeat, it often rhymes, and current selling of 0DTE (zero day to expiry), daily and weekly options is having a similar impact on markets," says JPM's Marko Kolanovic.

18h ago Reuters

ReutersJudge on Bankman-Fried: 'Why am I being asked to turn him loose?'

NEW YORK (Reuters) -A U.S. judge intimated on Thursday that Sam Bankman-Fried might deserve to be jailed pending trial after prosecutors suggested that the indicted FTX co-founder might have tampered with witnesses while out on bail. At a hearing in Manhattan federal court, U.S. District Judge Lewis Kaplan challenged prosecutors on their willingness to let Bankman-Fried remain under house arrest with his parents, despite signs the former billionaire might have broken the law while out on $250 million bail. The judge questioned whether prosecutors' proposal to largely ban Bankman-Fried's internet use went far enough, citing the risk he could use his parents' unmonitored devices.

14h ago MoneyWise

MoneyWise'Think of the unthinkable': IMF chief warns that we're living in a 'shock-prone' world struck by the pandemic, war, and natural disasters — these are 3 shockproof assets for protection

Protect your downside at all times — especially now.

18h ago Benzinga

BenzingaGoogle, Apple, Lyft And Ring: Shaquille O'Neal's Track Record Of Phenomenal Startup Investments

Shaquille O’Neal may be best known as one of the greatest basketball players of all time, but since his retirement from the NBA, he’s become increasingly respected for his business acumen. You might know of O’Neal’s impressive portfolio of franchises from his regular appearances in various commercials. O’Neal has owned as many as 40 24 Hour Fitness gyms, 150 car washes, 155 Five Guys Burger & Fries, nine Papa John’s, 17 Auntie Anne’s pretzels and a few Krispy Kreme restaurants. He has sold some

15h ago Benzinga

BenzingaFord Identifies Source Of F-150 Lightning's Problem, Production And Delivery To Resume In One Week

U.S. automaker Ford Motor Co (NYSE: F) has reportedly identified the issue that forced it to halt production for the F-150 Lightning electric pickup. The carmaker stopped production in response to one vehicle catching fire during a pre-delivery quality inspection in a company holding lot in Dearborn, Michigan, on February 4. Ford said that it believes engineers have found the root cause of the fire. The investigation into the problem is expected to be completed by the end of next week, followed

17h ago Benzinga

BenzingaPennsylvania Farmer Behind $5 Trillion Trend Speaks Out: I Created A Monster

Add up the market valuation of Apple Inc. (NASDAQ: AAPL), all the cryptos in the world and entrepreneur Jeff Bezos’s fortune, and you get to over $3 trillion. But one 80-year-old man has created something bigger than all three of these combined. These days, he shuns the spotlight and lives on a modest farm in rural Pennsylvania. You would never guess the farm’s owner set in motion a $5 trillion force that grows each fortnight. It’s a comfortable enough retirement, but Ted Benna has some regrets.

16h ago Barrons.com

Barrons.comBiden’s IRS Nominee Says Agency Will Increase Audits of Wealthy Taxpayers

The Internal Revenue Service has $80 billion in new funding. What taxpayers should know about how that money will be used.

1d ago MarketWatch

MarketWatchWhy traders suddenly see significant chance of a June interest rate hike by the Fed

The likelihood that the fed-funds rate target could reach 5.25% to 5.5%, or possibly higher, by June is seen at 58% as of Thursday.

9h ago Benzinga

BenzingaA New Era of Auto Repair: How Electric Cars Will Be Fixed in the Future and What It Means for Consumers

Electric vehicles (EVs) are rapidly becoming more popular, with more and more models hitting the market every year. While electric cars offer many benefits over traditional gas-powered vehicles, they also require a different approach to repair and maintenance. In this article, we'll take a look at how electric cars will be fixed in the future and what it means for consumers. One of the most significant differences between electric cars and traditional vehicles is the drivetrain. EVs use an elect

15h ago MarketWatch

MarketWatchElon Musk is close to becoming the world’s top billionaire again, as his wealth pile climbs $54 billion in 2023 so far

As of Thursday, Elon Musk was worth $191 billion, according to the Bloomberg Billionaires Index. That's just behind the No. 1 billionaire.

16h ago Yahoo Finance

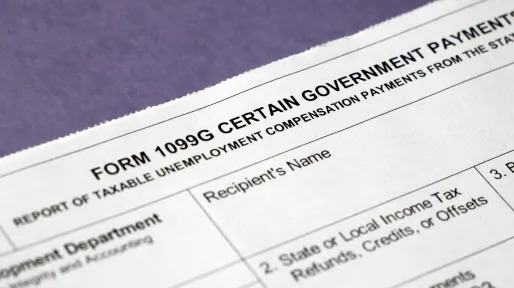

Yahoo FinanceIRS singles out tax payments 4 states sent last year as taxable

Most residents in states that distributed some kind of stimulus payments last year don’t have to report them on their federal returns. But some residents in four states do — largely because of how their states designed these payments.

1d ago MarketWatch

MarketWatchA potential stock-market catastrophe in the making: The popularity of these risky option bets has Wall Street on edge

Professional and amateur traders are flocking to risky equity options that some have likened to lottery tickets, dawn by the opportunity to reap massive returns in the span of just a few hours.

10h ago Reuters

ReutersExclusive-Crypto giant Binance moved $400 million from U.S. partner to firm managed by CEO Zhao

Global cryptocurrency exchange Binance had secret access to a bank account belonging to its purportedly independent U.S. partner and transferred large sums of money from the account to a trading firm managed by Binance CEO Changpeng Zhao, banking records and company messages show. Over the first three months of 2021, more than $400 million flowed from the Binance.US account at California-based Silvergate Bank to this trading firm, Merit Peak Ltd, according to records for the quarter, which were reviewed by Reuters. Company messages show the transfers to Merit Peak began in late 2020.

11h ago TipRanks

TipRanks‘Long-term investors will be rewarded’: Goldman Sachs explains why you should ‘buy’ these 2 cybersecurity stocks

Our digital world runs on computer tech, and that tech is only going to become more autonomous and more ubiquitous. And that, in turn, only underscores the ongoing importance of online security. With digital automation growing, it’s more important than ever, right now, to start firming up the digital protections. Against this backdrop, Goldman Sachs' Gabriela Borges has turned her eye on the cybersecurity sector. The analyst sees several industry dynamics that are favorable for long-term investo

4h ago Benzinga

BenzingaMPW Soars 8% In One Day: What In The World Happened?

Stocks can fly up or down very quickly for many reasons, including rumors, analyst upgrades or downgrades, dividend increases or solid earnings reports that beat the Street. But when a stock that has been sinking — both short and long term — suddenly soars 8% in one day on heavier than usual volume, it bears a closer look. Here is one real estate investment trust (REIT) that soared 8% on Feb. 16. What in the world happened? Medical Properties Trust Inc. (NYSE: MPW) is a Birmingham, Alabama-based

10h ago Investor's Business Daily

Investor's Business DailyThe Ultimate Warren Buffett Stock Is Near A Buy Point, But Should You Buy It?

Berkshire Hathaway is the ultimate Warren Buffett stock. It is near an entry but is it a good buy? Here's what earnings and charts show for Berkshire stock.

1d ago Yahoo Finance

Yahoo FinanceStock market news today: Stocks sell off after hot inflation report, hawkish Fedspeak

U.S. stocks sold off on Thursday as investors parsed through more hotter-than-expected economic data and hawkish Fedspeak.

9h ago Bloomberg

BloombergStocks Sink as Fed Officials Embrace Bigger Hikes: Markets Wrap

(Bloomberg) -- US equity indexes closed firmly in the red Thursday after two Federal Reserve officials said they were considering 50 basis-point interest rate hikes to battle persistently high inflation. Most Read from BloombergChina Hits Back at US with Sanctions on Lockheed, RaytheonStocks Sink as Fed Officials Embrace Bigger Hikes: Markets WrapChina Warns of Retaliation Against US Over Balloon SagaTesla Recalls More Than 362,000 Cars Due to Self-Driving Crash RiskTesla Fires Dozens After Work

9h ago Barrons.com

Barrons.comThe Stock Market Is Playing a ‘Game of Chicken’ With Bonds. It Won’t End Well.

Wall Street is making some assumptions that will derail the S&P 500's rally if they turn out to be wrong.

11h ago Bloomberg

BloombergChina’s Top Tech Banker Goes Missing, Unnerving Finance Industry

(Bloomberg) -- The disappearance of high-profile banker Bao Fan is fueling speculation of a renewed clampdown on China’s finance industry. Most Read from BloombergChina Hits Back at US with Sanctions on Lockheed, RaytheonStocks Sink as Fed Officials Embrace Bigger Hikes: Markets WrapChina Warns of Retaliation Against US Over Balloon SagaTesla Recalls More Than 362,000 Cars Due to Self-Driving Crash RiskAdderall’s Disappearing Act Has Left Millions Without TreatmentBao’s company China Renaissance

4h ago MarketWatch

MarketWatchShopify stock suffers one of its worst days yet as Wall Street wonders what is to come

Shopify Inc. shares suffered one of their worst days on record Thursday, after financial results failed to provide much clarity about the road ahead in 2023.

8h ago Zacks

ZacksHow Much Upside is Left in Energy Transfer LP (ET)? Wall Street Analysts Think 25.57%

The consensus price target hints at a 25.6% upside potential for Energy Transfer LP (ET). While empirical research shows that this sought-after metric is hardly effective, an upward trend in earnings estimate revisions could mean that the stock will witness an upside in the near term.

16h ago Reuters

ReutersHedge funds' short-covering of tech bets is 2nd biggest in a decade - banks

Hedge funds betting against stocks in the technology sector rushed to unwind those trades in the first half of February as markets rallied, data from Goldman Sachs and JPMorgan & Chase prime brokerage units showed on Thursday. "The short covering in U.S. tech stocks from Jan 31st to Feb 15th is the second largest in magnitude over any 12-day period in the past decade," Goldman Sachs wrote in a note reviewed by Reuters. JPMorgan also said in a daily note to clients that communication services and information technology stocks had led the short covering in its books on Thursday.

6h ago Yahoo Finance

Yahoo FinanceTravelCenters stock pops 70% after BP announces $1.3 billion deal to buy company

TravelCenters of America (TA) shares are surging today as BP’s (BP) North America subsidiary announced it is buying the fuel and service centers in a $1.3 billion all-cash deal.

15h ago American City Business Journals

American City Business JournalsMarathon Oil makes $3.6B profit in 2022, plans Eagle Ford activity this year

After raking in big profits in 2022, Marathon Oil Corp. (NYSE: MRO) is bullish on growth in 2023 and 2024. Houston-based Marathon Oil made $3.61 billion in net income in 2022, up from $946 million a year prior, the company reported in fourth-quarter earnings after markets closed Feb.

11h ago SmartAsset

SmartAssetGood News: Biden's News Retirement Saver's Match Could Help You Save More For Retirement

The SECURE 2.0 Act was recently signed into law by President Biden. Coming just a few years after the first SECURE Act, this legislation makes a bevy of changes designed to make it easier for Americans to save for retirement … Continue reading → The post Retirement Saver's Credit Goes Further in Conversion to Saver's Match appeared first on SmartAsset Blog.

2d ago MarketWatch

MarketWatchHere’s where the 60/40 could really fail you. But a better option may be under your nose.

Only in 1974 — the year of Watergate, OPEC embargoes, gas lines and recession — did the standard, benchmark, middle-of-the-road investment portfolio lose more value than it did in 2022. The so-called “balanced” or “60/40” portfolio, consisting of 60% U.S. large-company stocks and 40% U.S. bonds, lost a staggering 23% of its value last year in real money (meaning when adjusted for inflation). The point about 60/40—the point at least sold to savers by Wall Street — is that the 40% invested in “safe” bonds is supposed to balance out the risks of the 60% invested in stocks.

16h ago Reuters

ReutersU.S. household debt jumps to $16.90 trillion

Household debt, which rose by $394 billion last quarter, is now $2.75 trillion higher than just before the COVID-19 pandemic began while the increase in credit card balances last December from one year prior was the largest since records began in 1999, the New York Fed's quarterly household debt report also said. Mortgage debt increased by $254 billion to $11.92 trillion at the end of December, according to the report, while mortgage originations fell to $498 billion, representing a return to levels last seen in 2019.

15h ago MoneyWise

MoneyWise'Act of God': The price of eggs is soaring due to an 'unprecedented' crisis, warns a trade strategist — here are 2 surging food stocks to help buck the slumping market

Don’t just consume food, invest in it.

2d ago MarketWatch

MarketWatchBed Bath & Beyond falls toward 8th-straight loss, the longest such streak in 3 months

Shares of Bed Bath & Beyond Inc. (BBBY) sank 6.5% in afternoon trading Thursday, to put them on track for an eighth straight decline. The losing streak comes after the stock rocketed 92.1% on Feb. 6, even amid growing concerns the home goods retailer was nearing bankruptcy. The stock then sold off after the Feb. 6 close, after the company announced plans to sell convertible preferred shares and warrants to buy common stock in an effort to stave off bankruptcy.

11h ago Barrons.com

Barrons.comDeere Earnings Are Coming. The Stock Needs a Beat.

Wall Street is looking for earnings of $5.57 a share from $11.3 billion in equipment sales for the latest quarter.

9h ago Reuters

ReutersEtsy shares fall after research firm says platform showcases fake goods

The percentage of counterfeit goods on Etsy has become too large and the company could no longer defend it as a small percentage of revenue, said Citron, which cemented its reputation in the research industry by calling out poor performers and betting against their stocks. "Counterfeit items, fraud and other illicit practices are explicitly prohibited on Etsy," an Etsy spokesperson said in an email, adding that the company had expanded the team dedicated to fighting counterfeits and violations of its policy for handmade goods. Citron alleged that Etsy had allowed sellers on the platform to buy "ad words" of brands and then labeled many of them as trusted websites.

12h ago Zacks

ZacksAlbemarle's (ALB) Q4 Earnings Surpass Estimates, Sales Lag

Higher lithium prices and increased volumes drive Albemarle's (ALB) performance in the fourth quarter.

14h ago Zacks

ZacksWatsco (WSO) Tops Q4 Earnings Estimates

Watsco (WSO) delivered earnings and revenue surprises of 10.85% and 1.39%, respectively, for the quarter ended December 2022. Do the numbers hold clues to what lies ahead for the stock?

17h ago Zacks

ZacksForget Bargain Hunting: Buy These 5 Stocks With Rising P/E

Tap five stocks with increasing P/E ratios to try out a different approach.

17h ago SmartAsset

SmartAssetWhy Does My Bank Have Savings Account Transfer Limits? It's My Money!

Some banks limit how often you can transfer money out of a savings account. Exceeding the allowed quota of transfers via ATM, electronic bill payment or other methods could result in being charged a fee, having your savings account changed … Continue reading → The post Savings Account Transfer Limit appeared first on SmartAsset Blog.

17h ago Investor's Business Daily

Investor's Business DailyDatadog Earnings Top Views, Software Stock Falls On Weak Guidance

Datadog's fourth-quarter earnings topped estimates but the company's outlook came in below expectations. Datadog stock fell.

9h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK