A salary below this amount is a dating deal-breaker for many Americans, survey s...

source link: https://finance.yahoo.com/news/survey-shows-1-3-americans-161500220.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

A salary below this amount is a dating deal-breaker for many Americans, survey shows — why you should talk money on your very first date

Thinking about getting down on one knee this Valentine’s Day? Don’t make the big move without first being bold about your financial needs and goals.

Financial services company Western & Southern Financial Group surveyed over 1,000 married Americans about their financial triggers and found that 1-in-3 couples waited until after marriage to talk about important financial topics, with salary being the biggest topic they wished they’d talked about sooner.

Don't miss

On average, Americans said they want their partner to be making at least $29,878. Some of the most common financial deal-breakers include having outstanding personal loans and credit card debt.

Financial activist Dasha Kennedy — also known as The Broke Black Girl — says couples should be having conversations about money as early as the very first date.

Here’s why it’s important to figure out if you’re a financial match before things get serious.

Why it’s important to have the money talk

Kennedy, who has worked as an accountant and loan default counselor, divorced her husband after realizing they weren’t financially compatible. The divorce left her $25,000 in debt and took her five years to financially recover from.

“Had we initiated more financial conversations in the beginning, we probably would have either decided early on that we were just not financially compatible to be in a relationship, let alone to be married.”

A 2022 survey from The Knot found that being secretive about finances or dishonest about how you’re spending your money is one of the biggest deal-breakers in a relationship.

“When we look at the data, we see that not talking about money or money-related issues is one of the leading causes for divorce,” says Kennedy. “Initiating those conversations as early as possible and trying to get ahead of that curve is very important.”

MarketWatch

MarketWatchI will leave my daughter my house, but she doesn’t want to take over my $250,000 mortgage. Should she rent the house, or just sell it?

My house is worth $450,000, with a loan balance of $248,000, which I had recently refinanced to a 3.35% mortgage rate. It is kind of you to give your daughter a financial leg-up by willing your home to her.

1d ago MoneyWise

MoneyWisePhoenix Airbnb, Vrbo managers were shocked that 50% of their homes stayed empty over Super Bowl weekend — here are 3 ways you can still earn steady passive income from real estate

Are short-term rentals the next big bubble?

14h ago MoneyWise

MoneyWiseBoomer's remorse: These are the top 5 ‘big money’ purchases you will (probably) really regret in retirement

Do it your way — but it's simpler just to avoid these financial blows.

2d ago MarketWatch

MarketWatchThis restaurant chain offers the worst bang for your buck, customers say — and it’s not even the most expensive

A new study looked at the prices at several fast-casual and fast-food chains, and at how diners feel about the value offered relative to cost.

1d ago MarketWatch

MarketWatchI’ll inherit $40,000 from my grandmother. Should my husband and I boost our kids’ college savings accounts, or pay off credit cards and student loans?

Should we put more into the college accounts or try to pay off the student loans instead? With variable credit-card rates hitting 19.9%, anyone who is not paying off their credit card in full every month is bleeding money. After paying off your credit cards, $30,000 is a gift, and a large amount of money for millions of Americans.

1d ago Quartz

QuartzA tech founder who didn’t pay employees for months but bought a $16 million private jet has been arrested

The co-founder of Texas-based software firm Slync has been accused of misleading investors and shortchanging employees.

16h ago Benzinga

BenzingaDon't Call Them Mobile — Manufactured Housing Might Be The Answer To U.S. Housing Crisis

In the first half of last year, more than 50,000 manufactured homes were shipped across the country — a 31% year-over-year increase, according to the latest numbers from the U.S. Census Bureau. The average sale price was $124,900, and while that number represents a two-year increase of nearly $40,000, manufactured homes remain an affordable option for an inventory-depleted U.S. housing market. While 22 million Americans live in manufactured homes, according to the Manufactured Housing Institute,

1d ago Decrypt Media

Decrypt MediaAndrew Tate Reveals How Much Bitcoin He’s Had Seized by Authorities

The controversial influencer boasted about his shrewd Bitcoin investments—but Romanian authorities have nabbed at least some of it.

1d ago MarketWatch

MarketWatchHere come the 5% CDs

If you’re looking for certificates of deposit, the interest rates on offer should be—here’s hoping—heading higher following the latest inflation numbers out Tuesday morning. You can already get 5% on a one-year CD if you shop around, and there should be more—and maybe better—on offer soon following the latest economic news, which has sent the money markets jumping around. January’s inflation data came in higher than expected, and the markets were surprised by the news, even though Federal Reserve Chairman Jay Powell had basically told them this was going to happen at his press conference a couple of weeks ago.

1d ago TheStreet.com

TheStreet.comWarren Buffett's Company Boosted Its Stake In Only Three Major Companies in Q4

Berkshire Hathaway, for the first time in years, neither added a brand new position nor fully liquidated an existing holding in the fourth quarter.

1d ago Barrons.com

Barrons.com‘Big Short’ Investor Michael Burry Bets on Alibaba and JD. This Time, Wall Street Agrees.

Michael Burry, the investor whose bet on the U.S. mortgage market before 2008-09 was immortalized in "The Big Short" initiated large positions in Alibaba and JD.com.

13h ago Bankrate

BankrateBest 18-month CD rates – February 2023

An 18-month CD may provide the right balance for your needs.

1d ago Bloomberg

BloombergJPMorgan’s Kolanovic Warns of ‘Volmageddon 2.0’ Risk in Options

(Bloomberg) -- The explosive rise of short-dated options is creating event risk on the scale of the stock market’s early-2018 volatility implosion, according to JPMorgan Chase & Co.’s Marko Kolanovic. Most Read from BloombergUS Says 3 Mystery Objects Likely Private, With No China LinkChina Warns of Retaliation Against US Entities in Balloon SagaAmerica's Priciest Neighborhoods Are Changing as the Ultra-Rich Move to FloridaUS Scrambles Jets for ‘Routine’ Intercept of Russian WarplanesNew Cars Are

7h ago Investor's Business Daily

Investor's Business DailyCisco Beats Profit, Sales Estimates And Gives Investors This Bonus

Cisco once again announced a dividend hike as it posted December-quarter earnings that topped views.

6h ago News Direct

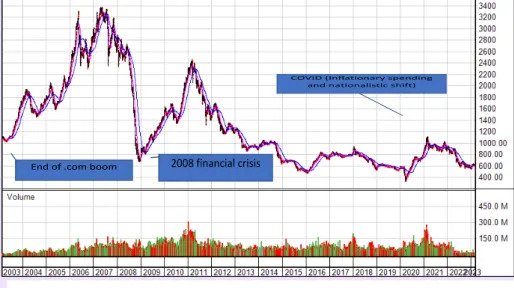

News DirectA Once in a Lifetime Bull Market Opportunity in Metals and Mining: US Critical Metals

The market is poised for the next metals and mining bull market to commence. The theme for the last bull market was centered on globalization and the emergence of a new middle class in what we defi...

23h ago TheStreet.com

TheStreet.comThe Average New Car Payment Sounds Like A Sick Joke

Along with regular inflation, a global semiconductor shortage has severely limited the availability of new cars (one estimate found that global carmakers produced 8 million fewer cars than planned in 2022) while also hiking up the prices of many used models. A year of sometimes double-digit increases started to wane somewhat by 2023 -- in January, the Bureau of Labor Statistics reported a 0.2% increase in new car prices and a 1.9% drop in used car prices. Average interest rates also rose by an average 53 basis points although there's hope that now that prices are evening out, this number will also start to stabilize.

1d ago Investor's Business Daily

Investor's Business DailyShopify Stock Rally Snuffed Out On Weak 2023 Revenue Outlook

Shopify reported fourth-quarter earnings and revenue that topped analyst estimates but 2023 revenue guidance fell short of expectations.

5h ago MarketWatch

MarketWatchShopify stock falls nearly 7% as forecast disappoints amid escalating Amazon rivalry, price increases

Shopify produced a better holiday quarter than expected, but a forecast for slowing revenue growth hit the stock in late trading.

1h ago Yahoo Finance

Yahoo FinanceStock market news today: Stocks rise after strong retail sales data

U.S. stocks capped a choppy session higher Wednesday as investors pondered the outlook for interest rates after economic data showed strong consumer spending and an uptick in inflation across January.

6h ago SmartAsset

SmartAssetThis Is What Really Happens to Your Mortgage When You Die

If you die owing money on a mortgage, the mortgage remains in force. If you have a co-signer, the co-signer may still be obligated to pay back the loan. A spouse or other family member who inherits a house generally … Continue reading → The post What Happens to Your Mortgage When You Die? appeared first on SmartAsset Blog.

2d ago

Recommend

-

81

81

Not what you’re worth, dear reader: we know your worth cannot possibly be calculated in base-10 numbering systems because you’re just so awesome, but what you make. A few things to know: It’s totally anonymous (we’re not getting your email, IP a...

-

15

15

NewsApril 16, 2020From Android to iPhone, survey finds most Americans want right to repair

-

6

6

IT Pro Salary Survey: What You Earned in 2020Did you get a raise in 2020? The InformationWeek 2020 IT Salary Survey lets you know how you stacked up against your peers during a year that was like no other. Credit: setthaphat...

-

6

6

2021 Data/AI Salary Survey By Mike Loukides

-

2

2

InformationWeek Salary Survey: What IT Pros EarnHow does your salary stack up to what other IT pros are earning? How does what you are paying your top talent compare to the offers they are likely to get out there in the job ma...

-

6

6

Salary Survey: IT Gender Pay Gap Keeps GrowingThe InformationWeek Salary Survey 2022 found that the gender pay gap for IT professionals grew to the widest seen since we started tracking the question.

-

3

3

-

5

5

Report: 2022 IT Salary Survey (a $499 value) — Free Download...

-

3

3

Home ...

-

6

6

ITPro Today's 2023 Salary Survey Report — Free Report...

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK