Hesai Climbs in Biggest US Debut by Chinese Firm Since Didi

source link: https://finance.yahoo.com/news/hesai-raises-190-million-biggest-020637054.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Hesai Climbs in Biggest US Debut by Chinese Firm Since Didi

(Bloomberg) -- Hesai Group, a developer of sensor technologies used in self-driving cars, rose 11% in its US trading debut after expanding its initial public offering to raise $190 million.

Most Read from Bloomberg

The listing is the largest by a Chinese issuer in the US market since the crash of Didi Global Inc. in 2021. Shanghai-based Hesai sold 10 million American depositary shares for $19 each, after marketing 9 million for $17 to $19.

Hesai opted to pursue a US listing over other venues because it wanted more exposure on the global stage, co-founder and Chief Executive Officer Yifan Li said in an interview.

“We wanted to be able to directly compare against with peers and make ourselves transparent to the greater part of the market,” he said.

He added that Hesai is talking to several global car players for potential business opportunities. “For them to make those decisions, being able to know we are publicly traded, well-funded with healthy growth margin and cashflow is tremendously important,” he said.

The company’s shares, which opened trading Thursday at $23.75, closed at $21.05 in New York trading, giving the company a market value of about $2.6 billion.

Hesai’s listing marks a potential comeback of Chinese companies seeking to raise capital in the US, joining two other firms that have already launched IPOs this year. Delisting risk for this group has eased significantly after Washington and Beijing made progress resolving an audit dispute, with market sentiment turning more bullish amid China’s reopening bets.

The US IPO market was nearly shut for China firms since Beijing forced Didi to delist shortly after its $4.4 billion New York debut. Only 10 Chinese issuers went public in New York last year, raising a total of $376 million, the smallest amount in a decade, according to data compiled by Bloomberg.

MarketWatch

MarketWatchCrypto staking: what it means, why it matters, and how a crackdown will change investing

On Thursday evening, the U.S. Securities and Exchange Commission charged Kraken, a large crypto exchange, for failing to register the offer and sale of their crypto asset staking-as-a-service program. There had already been rumors about the possible ban of crypto staking prior to the announcement of Kraken’s $30 million settlement with the SEC, with Coinbase chief executive Brian Armstrong calling the regulation of crypto staking a “terrible path” for retail traders. What is crypto staking?

2d ago MoneyWise

MoneyWiseWant to be Uncle Sam's landlord? Earn up to a 13.7% yield with these REITs that rent to the US government

We all pay taxes, so why not get some money back?

23h ago SmartAsset

SmartAssetHow You Can Make $1,000 in Dividends Every Month

Dividends are the bread and butter of income investors. You don't need to sell your assets or spend hours every day managing your accounts. Instead, dividend stocks simply generate income on their own. Putting together a portfolio that generates at least … Continue reading → The post How to Make $1,000 a Month in Dividends appeared first on SmartAsset Blog.

21h ago Investor's Business Daily

Investor's Business DailyCheap Stocks To Buy: Should You Watch These 5 Growth Stocks?

Regardless of what stage of the market cycle we're in, some folks never tire of searching for cheap stocks to buy. Imagine a large-cap mutual fund trying to buy a meaningful stake in a stock that trades at 30 cents a share. If it has thin trading volume, the fund manager will have an awfully tough time accumulating shares — without making a big impact on the stock price.

1d ago Barrons.com

Barrons.comBuy Hertz Stock. It’s Cheap, Well-Run, and Renting Teslas.

The rental car company remains highly profitable, leads peers in adding electric vehicles to its fleet, and has bought back over 30% of its stock since it emerged from bankruptcy in mid-2021.

2d ago TheStreet.com

TheStreet.comThis Ultra-Luxury Brand Is Quietly Building an Empire Around Us

A cold-weather clothing company founded more than half a century ago is beginning to make a global move. While launched in the 1950s by Polish-Jewish immigrants to Canada, winter clothing company Canada Goose truly started exploding as a business in the mid-2000s. After taking over from his father-in-law in 2001 at 27 years old, current president and chief executive Dani Reiss started opening factories and sewing schools all over Canada and pitching the goose down winter coats workers produced to luxury boutiques in Europe.

2d ago TheStreet.com

TheStreet.com3 High-Yielding Monthly Dividend Stocks

Monthly dividend payers provide a variety of advantages over quarterly payouts. Let's check out three REITs.

22h ago Fortune

FortuneMeta employees are reportedly bracing for more layoffs amid delays to finalized budgets: ‘It’s still a mess’

“The year of efficiency is kicking off with a bunch of people getting paid to do nothing," one Meta employee told the FT.

12h ago Barrons.com

Barrons.comMoney Markets Pay 4.5%. If You’re Getting Less on a Sweep Account, It’s Time for ‘Cash Sorting.’

A lot has changed in two years, when rates were hugging zero and the banks’ 1% looked like a screaming bargain. Plus, why Charles Schwab looks like a longer-term buy.

1d ago Investor's Business Daily

Investor's Business DailyMarket Rally Pullback Continues, Here's What To Do Now; How Strong Is Tesla Demand?

The stock market rally's pullback still looks normal, but the CPI inflation report and Tesla data are ahead. Get your game plan ready.

1h ago Bloomberg

BloombergClock Is Ticking Louder on a Stock Rally the Pros Never Believed In

(Bloomberg) -- The buying binge that has propelled US equities almost without interruption for four months is nearing a point where past rebounds caved in.Most Read from BloombergObject Shot Down Over Canada in Escalating Aerial DramaBlackRock, Pimco Push Back Against Bets Inflation Cooling FastUS Downs Unknown Object Over Alaska as China Tension GrowsUS Recovery of Object Downed Over Alaska Faces Arctic ConditionsClock Is Ticking Louder on a Stock Rally the Pros Never Believed InIt’s in the cha

2d ago TheStreet.com

TheStreet.comCathie Wood Watch: Ark Continues to Shed a Big Holding

Wood's flagship Ark Innovation ETF has dropped 47% over the past year and 75% from its February 2021 peak.

2d ago TipRanks

TipRanksTipRanks ‘Perfect 10’ List: There’s More Upside Ahead for These 2 Top Score Stocks

The markets might have kicked off the year in a generally upbeat mood, but they have been zigzagging recently, making it even harder to know what direction stocks are heading in next. That makes stock picking even more difficult than usual but there’s a tool that could come in handy here. The TipRanks Smart Score algorithm collects all the data required for stock picking purposes and sorts it out according to 8 factors - all known to correspond with future outperformance. Then those elements get

1h ago Yahoo Finance

Yahoo FinanceBig Oil raked in record profits last year, but check out Big Tech

If you think oil and gas giants made boatloads of money last year, check out Big Tech

18h ago SmartAsset

SmartAssetHow to Create a Set-It-And-Forget-It Portfolio

Investing can be a complex and stressful endeavor. The idea of constant monitoring, rebalancing and stock picking can be overwhelming (not to mention costly, if done incorrectly), especially for those new to investing. But what if there were a way … Continue reading → The post How to Create a Set-It-And-Forget-It Portfolio appeared first on SmartAsset Blog.

2d ago SmartAsset

SmartAssetYou Should Have a Financial Advisor If You Have This Much Money

Money can't buy you happiness, but what about working with a financial advisor?

21h ago MarketWatch

MarketWatchWhy the stock market’s ‘FOMO’ rally stalled out and what will decide its fate

It took a while, but investors seem to be listening to the Federal Reserve. Will that kill a 2023 rally built partly on the “fear of missing out?”

21h ago Yahoo Finance

Yahoo FinanceMap: Here's where home prices are dropping the most

Some metros have posted home price declines of more than 10% from their 2022 peaks.

18h ago Barrons.com

Barrons.comChatGPT Sparked an AI Craze. Investors Need a Long-Term Plan.

Artificial intelligence has sparked new competition in internet search—for the first time in decades. Here's how to build an AI portfolio.

1d ago Benzinga

Benzinga5 REITs Hitting Higher Highs In February

Five real estate investment trusts (REITs) are successfully kicking off the year 2023, with each reaching higher four- and six-month highs. While there are no guarantees that the bullish vibe will continue, it’s a sweet start for the year for people who invested in the REITs. Apollo Commercial Real Estate Finance Inc. (NYSE: ARI) is a mortgage REIT (mREIT) now trading with a price-earnings ratio of 6 and at just 71% of its book value. Apollo pays a dividend of 11.6%. The mREIT is selling off fro

2d ago TheStreet.com

TheStreet.comBuying the Dips in Microsoft Stock as AI Plans Come to Life

Microsoft stock has been in focus amid tech-stock momentum and as the software giant continues with its AI advancements.

2d ago The Wall Street Journal

The Wall Street JournalRussia's 'Voluntary' Oil Production Cut Might Not Be So Voluntary

Is there such a thing as a voluntary cut in oil production? That's how Russian Deputy Prime Minister Alexander Novak described the Kremlin's 500,000-barrel-a-day pullback from global oil markets, which [pushed crude prices higher](https://www.wsj.com/livecoverage/stock-market-news-today-02-10-2023/card/oil-prices-rise-as-russia-plans-output-cuts-in-response-to-sanctions-x3KY7MRWUG8vnNRmIJ4v) in Friday morning trading. But energy analysts say such moves by oil exporters are typically driven by co

2d ago MoneyWise

MoneyWise'It's outrageous': Biden blasts Big Oil's record profits amid the 'energy crisis' — proposes quadrupling the tax on buybacks. Here's how much the 3 giant US-based producers made in 2022

It’s a dirty business. Somebody’s gotta tax it.

22h ago Investopedia

Investopedia10 Biggest Telecommunications (Telecom) Companies

With AT&T leading the pack, these are the 10 biggest telecommunications companies by 12-month trailing revenue.

14h ago Bloomberg

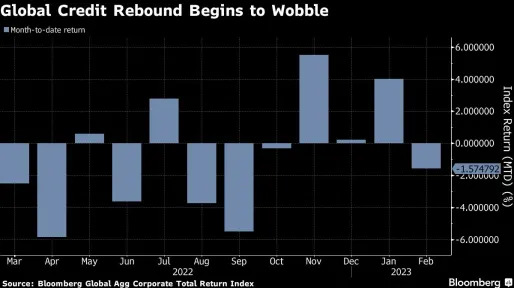

BloombergCredit Markets Are Poised for a Gut Check After 10% Rally

(Bloomberg) -- After rallying for the past three months, the mood is starting to shift in global credit markets.Most Read from BloombergObject Shot Down Over Canada in Escalating Aerial DramaBlackRock, Pimco Push Back Against Bets Inflation Cooling FastUS Downs Unknown Object Over Alaska as China Tension GrowsUS Recovery of Object Downed Over Alaska Faces Arctic ConditionsClock Is Ticking Louder on a Stock Rally the Pros Never Believed InDespite a selloff during the past week, a Bloomberg index

14h ago The Wall Street Journal

The Wall Street JournalZoom, Disney, Lyft: Stocks That Defined the Week: Stocks That Defined the Week

Zoom is cutting its connection to some workers. Zoom shares rose 9.9% Tuesday. Alphabet’s Google unit and Microsoft on Tuesday unveiled rival AI-powered search features as companies capitalize on a wave of renewed excitement about the technology’s potential among businesses and consumers.

1d ago Zacks

ZacksQuantumScape (QS) Q4 Earnings to Suffer From Cost Pressure

The Zacks Consensus Estimate for QuantumScape's (QS) Q4 bottom line is pegged at a loss of 26 cents per share, implying a year-over-year deterioration of 62.5%.

2d ago Bloomberg

BloombergStock Rally Is a Bear-Market Trap, Top-Ranked Fund Managers Say

(Bloomberg) -- Despite enduring a brutal start to the year for their portfolios thanks to a surprise market rally, two top-ranked fund managers are sticking to the bearish views that made them winners in the 2022 stock crash. Most Read from BloombergRussia Blames US for Nord Stream Blasts, Threatens ConsequencesUS Downs Unknown Object Over Alaska as China Tension GrowsThe Rise of the Millionaire RentersUS Shoots Down Object Over Alaska Waters, Citing Aviation RiskClusters of Eye Drop-Linked Infe

2d ago Zacks

ZacksIs Ping An Insurance Co. of China (PNGAY) Stock Undervalued Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

2d ago SmartAsset

SmartAssetShould I Really Use Fidelity's 45% Rule?

Financial services giant Fidelity has a rule for retirement savings you may have heard of: Have 10 times your annual salary saved for retirement by age 67. This oft-cited guideline can help you identify a retirement savings goal, but it … Continue reading → The post Should the 45% Rule Guide Your Retirement Strategy? appeared first on SmartAsset Blog.

21h ago SmartAsset

SmartAssetHow Do I Deduct Stock Losses From My Taxes?

Capital gains and capital losses both have tax implications. When you sell stocks for a profit, you owe taxes on those gains. These taxes are calculated based on capital gains rates. However, when it comes to investments, the IRS taxes … Continue reading → The post How to Deduct Stock Losses on Your Taxes appeared first on SmartAsset Blog.

21h ago USA TODAY

USA TODAYIRS warns taxpayers to hold off filing returns in 20 states as it checks if it can tax special refunds

Taxpayers in more than 20 states are asked to wait to file 2022 returns until the IRS issues guidance, according to the National Taxpayer Advocate.

2d ago Investor's Business Daily

Investor's Business DailyTech Strikes Back — And This Cloud Stock Ascends Toward Buy Point

As fellow tech stocks like Nvidia and Mobileye power higher, Arista Networks sets up to launch new breakout move.

2d ago Zacks

ZacksDo Options Traders Know Something About Dynavax Technologies (DVAX) Stock We Don't?

Investors need to pay close attention to Dynavax Technologies (DVAX) stock based on the movements in the options market lately.

2d ago Zacks

ZacksDoes Editas (EDIT) Have the Potential to Rally 51.55% as Wall Street Analysts Expect?

The average of price targets set by Wall Street analysts indicates a potential upside of 51.6% in Editas (EDIT). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.

2d ago Barrons.com

Barrons.comElon Musk Is on Track to Be the World’s Richest Person Again—if Tesla Stock Cooperates

An acceleration in gains for Tesla shares, and losses for Bernard Arnault's LVMH stock, mean the top of the world's richest list may be due for a shakeup.

2d ago TheStreet.com

TheStreet.comBed Bath & Beyond Struggles to Find Footing

The retailer got a last minute lifeline from Hudson Bay Capital, but the future of Bed Bath & Beyond remains challenging.

21h ago Barrons.com

Barrons.comAI Arms Race Will Lift Chip Stocks Nvidia, Broadcom, and Marvell, Says J.P. Morgan

J.P. Morgan analyst Harlan Sur worte that chip stocks Nvidia, Broadcom, and Marvell are best positioned to sell chips to tech giants building artificial-intelligence products.

2d ago Zacks

ZacksTime to Buy These "Unique" Top-Rated Stocks as Earnings Approach

Here is a look at these two 'unique' companies that investors may want to consider buying with their quarterly reports approaching.

1d ago The Wall Street Journal

The Wall Street JournalLyft Shares Fall After Unexpected Loss, Weak Outlook

More than a dozen Wall Street analysts cut their price target for the stock, while six downgraded the stock’s rating, after Lyft reported underwhelming revenue growth and an adjusted quarterly loss.

2d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK