Wander: Owning Happy Places

source link: https://www.notboring.co/p/wander-owning-happy-places

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Wander: Owning Happy Places

Wander Atlas & Natively Integrated Luxury Vacation Rentals

Welcome to the 868 newly Not Boring people who have joined us since last Tuesday! If you haven’t subscribed, join 184,121 smart, curious folks by subscribing here:

Hi friends 👋,

Happy Tuesday!

It’s a great week over here at Not Boring HQ. The Eagles are back in the Super Bowl and I get to write about one of my favorite companies: Wander.

Wander has a chance to build one of those iconic brands that becomes both noun and verb. As they grow their portfolio of incredible vacation rental properties throughout the US and beyond, I suspect that “Let’s Wander” will become synonymous with “Let’s get away for the week.”

Building that kind of brand, especially when Airbnb and established hotel chains exist, is really hard. It takes a relentless attention to detail, a rare willingness to do everything in-house, and an uncommon ability to fit all of the pieces together just so. It also takes the capital to achieve ubiquity, which is why Wander recently launched Atlas, the first vacation rental REIT.

So this is a piece about Wander, but it’s also a case study on how to build a Natively Integrated Company from the ground up. We’ve written that the most important companies of the next decade will be built at the intersection of Bits & Atoms — Wander provides a playbook for those willing and able to do the hard work.

This essay is a Sponsored Deep Dive on a Not Boring Capital portfolio company. You can read more about how I choose which companies to do deep dives on, and how I write them here. Nothing in this essay is investment advice - check the footnote

.

Let’s get to it.

Wander: Owning Happy Places

Not all those who wander are lost.

Look, I didn’t want to use that quote, but bear with me.

Since J.R.R. Tolkien first wrote those words in The Riddle of Strider, they’ve been splashed across so many inspirational posters and Instagram bios that they’ve become meaningless.

Worse than meaningless, in fact. Tolkien meant the exact opposite. The original is a reference to Aragorn, who wanders around his kingdom not because he is lost, but because he has a very specific goal: to learn to become a great ruler. Those who wander with a purpose, according to Tolkien, are not lost. Those who wander aimlessly are.

Admittedly, I only looked into the history of that quote because this is a piece about a company called Wander. But as I read this explanation, it struck me that the dueling interpretations of that same quote are a perfect metaphor for Wander and Airbnb.

Wander is vertically integrated and purposeful; Airbnb is a more meandering marketplace.

You’ve heard of Airbnb, probably stayed in a few, and maybe even listed your home. I have, and I’ve had good, if varied, experiences. I’ve stayed in some Airbnbs that were more wonderful than the pictures and descriptions could have conveyed, and some that were more appalling than the Host would have wanted us to believe. Airbnb is a marketplace, and navigating a marketplace can feel like aimlessly wandering.

For a long time, Airbnb had that special startup sheen on it that glossed over the inconsistencies. Sometimes, you’d show up to an Airbnb and the door was locked and the host didn’t answer the phone and you’d be stuck outside in a foreign country for hours. Sometimes the beds were barely made. Often, the pictures looked just a little bit better than the real thing.

When people booked Airbnbs, all of the little hiccups became part of the adventure. “Remember when we were stranded outside our Airbnb in the rain in Porto for three hours and we found that amazing little bar next door?!” That was part of the fun! Not all those who wander are lost, and we were ~wAnDeRiNg~!

Now, however, Airbnb is a public and well-known company, and the little inconsistencies aren’t as much fun as they used to be. The beds aren’t as comfortable as hotel beds. There’s no food in the fridge. The Host charged me a $300 cleaning fee and made me take out the trash? Tweets and videos like this one are more and more common:

Wander, on the other hand, feels purposeful in every detail.

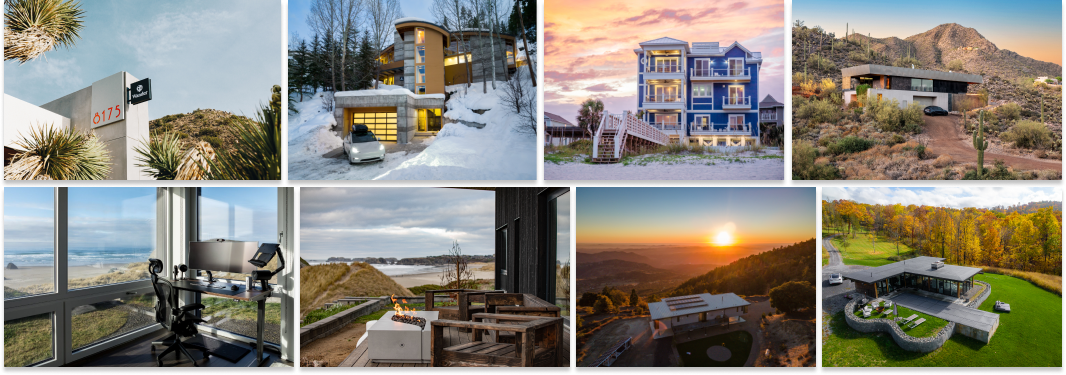

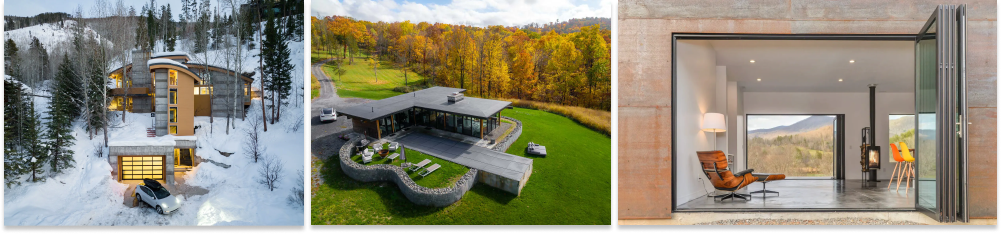

If you haven’t heard of Wander, the best way to think of it is as a vertically-integrated Airbnb. If you haven’t seen Wander, the properties are ridiculous. Here’s a little eye candy:

You should go check out the properties and the video tours for each on its site. After I mentioned to Puja that I was writing this piece, she watched all of them back-to-back. Wander properties are architectural gems in stunning locations – some have warnings not to bring kids because they’re perched on the edges of cliffs. They’re the kind of properties that can cost over $1,000 per night – don’t worry, you can split with friends or teammates in the app – and still reach occupancy rates in the 80-90% range and higher.

In order to craft a perfect experience, the company handles everything itself:

Acquisitions. Its team scours the country for architecturally stunning vacation properties in unique locations and purchases them.

Design. Wander renovates homes and outfits them with products and furniture from top brands (every rental comes with a Tesla, for example).

Booking. All properties are listed on the Wander website and app, where guests can book them for themselves, family and friends, or Teams. Bookers are able to invite guests and even split costs from within the app.

Property Management: Wander’s team operates each property in-house to keep the experience bar high for each guest.

The benefit of that approach is that it translates into a consistently high-quality experience. Wander’s Customer Satisfaction Score is consistently in the 90s. The drawback is that, unlike Airbnb which is able to acquire its supply for free and scale at near-internet speed, Wander is more expensive and slower to scale. Acquiring, renovating, and furnishing properties is neither cheap nor easy.

Or rather, it was capital intensive until very recently, when it launched Atlas.

In my Fund III announcement, I highlighted Wander specifically:

We’ve backed a number of companies in traditionally capital-intensive categories with the ability to scale in a capital efficient manner. As one example from our Fund II portfolio, Wander, which is a vertically integrated vacation rental home company, just launched Atlas, the “world’s first vacation rental REIT,” to scale its portfolio without dilutive venture funding.

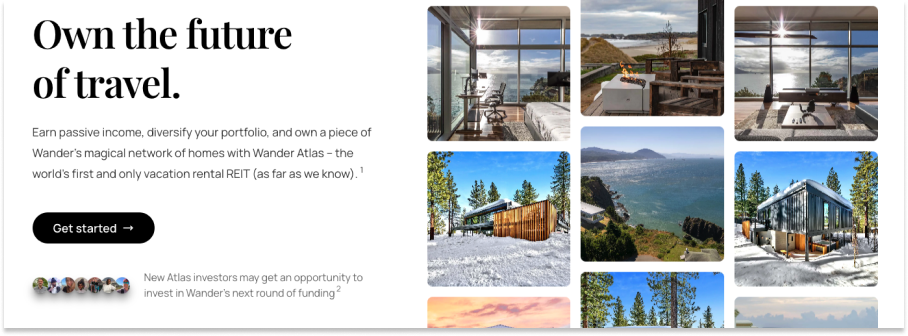

With Atlas, Wander is able to move the costs of acquiring, renovating, and furnishing its real estate portfolio off of its balance sheet by selling shares in its portfolio of homes to institutional and accredited investors. And investors get access to a new asset class – “the first and only vacation rental REIT (as far as we know)” – with a targeted 8% annual dividend

. Importantly, Wander retains full control of the experience as it manages all properties in the Atlas portfolio.

What Wander is doing with Atlas is catnip to me. It’s a marriage of my professional experience (better executed) with ideas I’ve been thinking through for a long time:

While I believe that the natively-integrated approach is the only way to attack a category dominated by large marketplaces, which we’ll discuss, the company’s strategy really comes into focus with Atlas.

During my first meeting with Wander CEO John Andrew Entwistle, a Thiel Fellow and second-time founder, it all clicked. It was the pitch I was born to swing at, and I immediately invested one of Not Boring Capital’s larger Fund II checks. My only regret one year later is that I didn’t invest more.

Over the past year, I’ve seen Wander execute at every level, from the obvious product-related things to all the little details. Its investor updates are among my favorites to receive because each team leader writes his or her team’s section. I’m writing this wearing my Wander sweatshirt, the most comfortable I own. When I asked JAE where he got them, he told me they designed them in-house, down to the fabric selection, because the quality of the others they looked at didn’t meet their standards.

Now, they’re bringing that same attention to detail to bear on Atlas. With Atlas, Wander is creating a new asset class – short-term rental REITs (Real Estate Investment Trust). The company spent roughly $1 million to bring the product to market, working with firms like Latham & Watkins, Ernst & Young, and Citrin Cooperman. They structured the product as a Reg D REIT instead of a Reg A offering. They poured months of effort internally – led by JAE, VP Finance & Head of Acquisitions David Molotsky (ex-Goldman Real Estate), and Head of Capital Markets Jake Kelley (ex-Morgan Stanley Real Estate Structured Finance) – into getting it right. The Private Placement Memorandum – which you’ll have the pleasure of reading during the subscription process – is 160 pages long and chock full of detail. It doesn’t feel like a two-year-old startup led by a 25-year-old founder did this.

It’s all part of the master plan – a purposeful wander – that JAE laid out the first time we spoke.

Prove that Wander can acquire and manage the top short-term rentals on its own balance sheet.

Build a brand and an integrated machine to do it repeatedly and predictably.

Build an investment product that gives people the opportunity to invest in the properties they love while letting Wander scale in a capital-efficient manner.

Today, we’ll analyze that strategy, tour Wander’s portfolio, dive into the details on Atlas, and discuss where the company might go from here:

Zillbnb and the Short-Term Arbitrage

Natively Integrated Vacation Rentals

Wander Atlas

Wandering Into the Future

To understand Wander’s potential, you need to understand the theory behind building a portfolio of STR properties. To do that, we’ll start by imagining that Airbnb and Zillow had a baby.

Zillbnb and the Short-Term Arbitrage

In June 2020, I wrote a Fantasy M&A piece proposing that Zillow and Airbnb should merge. I gave five reasons I thought a combined “Zillbnb” could make sense, the most relevant of which for this piece is that combining Zillow’s Offers iBuyer product and Airbnb’s short-term rental expertise would create a more robust business. I wrote:

Plugging in Airbnb would lower Zillow’s risk and improve its yields. Instead of a binary outcome - buy the house for $x and only profit if Zillow can sell the house for $x+y - Zillow could turn on short-term rentals to generate income while looking for a buyer at the right price.

Zillow may even choose to continue to operate the homes it buys as short-term rentals on Airbnb instead of selling, based on predictive calculations of which offering will produce higher yields. Short-term rentals can generate 30% higher rates than long-term rentals. Airbnb has even shown a desire to own and manage its own supply with Backyard.

Zillbnb has the opportunity to build something more potent than Blackstone’s Invitation Homes, on which the private equity firm netted about $7 billion by buying up a portfolio of single-family homes in the US and managing them as rental properties. By using Zillbnb’s combined data, the company can make sharper offers based on both short-term and rental cashflow predictions. By offering Zillow Offers homes for one night, one month, one year, or forever, Zillbnb would be able to optimize yields based on where each duration prices in each market.

Joining forces with Airbnb might even increase the buyer pool for Zillow’s homes. Selling homes with Airbnb up and running turns a home into a turnkey small business, making it attractive to financial buyers looking for yield in a low interest rate environment.

That’s a longer block quote than Dan normally lets me get away with, but it’s important context for thinking about Wander’s portfolio. Essentially, acquiring properties that the company expects to appreciate, financing them, and offering them as short-term rentals increases optionality, potentially lowering risk and improving yields compared to a standard iBuyer model and compared to a portfolio of single-family rentals (SFRs).

In the iBuyer model, like Zillow’s now-defunct Offers or Opendoor, companies acquire properties, do improvements, and attempt to sell them quickly, taking a small spread on very large numbers. If the market turns, or a home takes longer than expected to sell, however, the company is stuck holding the bag. By introducing short-term rentals into the mix, they could generate revenue and buy themselves time to wait for the right sale price.

The first time John Andrew told me the plan for Wander, I immediately saw the Zillbnb dream, but on a longer timescale. Instead of buying to flip, Wander would acquire properties that it expects to appreciate over a decade or so. It mainly buys residential homes, not those that are already operating as short-term rentals, which means that it can often acquire homes for less than they’re worth to the company. By building a diversified portfolio of high-quality STRs in different locations, it can reduce risk and improve yields across the portfolio.

In real estate terms, Wander is buying residential homes and converting them into their “highest and best use”: short-term rentals. By converting them to STRs and improving them cost-effectively, they can then be valued based on a “cap rate” applied to the cash flow they generate, rather than appraised as a residential home. The cap rate is the Net Operating Income (NOI) the property generates each year divided by the Purchase Price of the home, and a lower cap rate is generally a sign that the property is a lower risk investment.

So for illustrative purposes, if Wander buys ten $1 million homes that the market believes it could rent annually for $100k above its costs, it would be buying at a 10% cap rate – $100k/$1 million – for a total of $10 million. If it’s able to increase its NOI to $150k on each of the properties and sell the portfolio at the same cap rate – 10% – it could sell the portfolio for $15 million, or a 50% profit. If, by lowering risk through diversification and professionalization, it can lower the cap rate the purchaser is willing to pay to 8%, it can sell the portfolio for $18.75 million, or an 87.5% profit.

If Wander is able to accelerate the institutionalization of the STR market, time may bring lower cap rates as the market matures. The larger and more sophisticated an industry becomes, the more likely it is to attract large pools of investors that generally seek low-risk, lower-yielding investments. As a very relevant comp, institutionalization of the SFR market over the past decade or so, and the billions of dollars invested in the space, have driven cap rates down from 10% to ~6%.

Wander’s returns may be further enhanced if you factor in annual revenue growth and the fact that Wander finances its properties, meaning that it might take out a mortgage for 60-75% of the purchase price and only put down 25-40% in cash. If it can cover its mortgage payments and operating costs, it can produce higher levered returns than it could by paying the whole purchase price in cash.

Up to this point, there’s not a huge difference between the STR model and the SFR model aside from the fact that SFR has been institutionalized, lowering cap rates. The STR market today is where the SFR market was roughly a decade ago. A professional SFR operator like Invitation Homes can purchase a diverse portfolio of residential properties, standardize them, rent them on an annual basis to cover its costs and generate NOI, and sell the lower-risk portfolio at a lower cap rate. Like Wander, an SFR operator can choose to rent out properties when the numbers favor renting, and sell them when the numbers favor selling.

Here, though, Wander’s ability to rent properties short-term, for as little as three nights, gives them more optionality, and the opportunity to further increase NOI versus SFRs.

As short-term rentals are the highest and best use, optionality provides downside protection. STRs typically generate more income than SFRs, but STRs can also be rented long-term (like SFR’s) if a particular home doesn’t perform well as an STR. The opposite is not true. Further, as a backup to the backup, a Wander STR could be converted back into a regular residential home if it isn’t performing as an STR or didn’t convert well into an STR. That backup backup market – the US single-family home market – is the largest, and one of the most liquid, marketplaces in the world.

For now, though, Wander is able to generate a higher NOI by renting its properties to guests for a few nights at a time. Its focus is on increasing RevPAR – a hospitality industry metric based on Average Daily Rate (ADR) and occupancy – by continuing to improve the quality of the guest experience and making sure its properties are booked as many nights as possible. It’s able to do both of those things better than a pure marketplace could because it’s a Natively Integrated Company.

Natively Integrated Vacation Rentals

Back in June 2019, a couple months into writing online and still working at Breather, I wrote my first series on a type of company I thought was set to thrive: Natively Integrated Companies.

The idea was that the most successful pre-Internet consumer companies controlled supply, the most successful Internet consumer companies (the Aggregators) controlled demand, and that the next generation of successful companies would control both. In the introduction to the series, I wrote:

Tomorrow’s best companies will be like a child who exhibits each of their parents’ and grandparents’ best attributes. They will be born with a focus on building products and experiences for customers whose problems they were born to solve. They will grow up in close contact with those customers, and their reputations will be built by how dirty they were willing to get their hands to serve them. They will have a digital native’s fluency with technology, and will wield it to smoothly connect the disparate functions necessary to deliver an excellent and personalized experience. In short, tomorrow’s best companies will be Natively Integrated Companies.

All of the low-hanging Aggregator opportunities had been taken, “Uber for X” companies were failing left and right, and many of the biggest Aggregators were backwards integrating into supply. Netflix was making its own content, Zillow got into iBuying, Uber was pouring billions into self-driving, and Airbnb launched Backyard. When you own distribution, the logic went, owning supply means a better, more consistent product and higher margins.

Natively Integrated Companies, I predicted, would take the lessons from that generation of companies and do it all themselves from the beginning. That meant three things:

Leverage technology to integrate supply, demand and operations from day 1

Build relationships with customers to build products that resonate

Take principal risk to achieve 1) and 2) and capture larger share of profits

Even though Wander wouldn’t be born for another two years, I was describing Wander.

1. Leverage technology to integrate supply, demand and operations from day 1

Wander is vertically integrated from top to bottom. It acquires the homes on its platform, lightly renovates them, furnishes them in partnership with brands like Herman Miller, and manages them in-house. Each home comes with at least one WFH setup with a widescreen monitor and speakers, many come with in-home gyms including Pelotons, rowers, and saunas (where they don’t, Wander partners with local gyms for free access), all have super-fast WiFi, and most have pools, hot tubs, or both. Because it controls all of the details, it can promise those attributes, giving guests a sense of cohesion across the entire portfolio.

Guests search for and book Wanders exclusively through Wander’s app or website, giving it the ability to adjust prices based on demand and create a cohesive user journey.

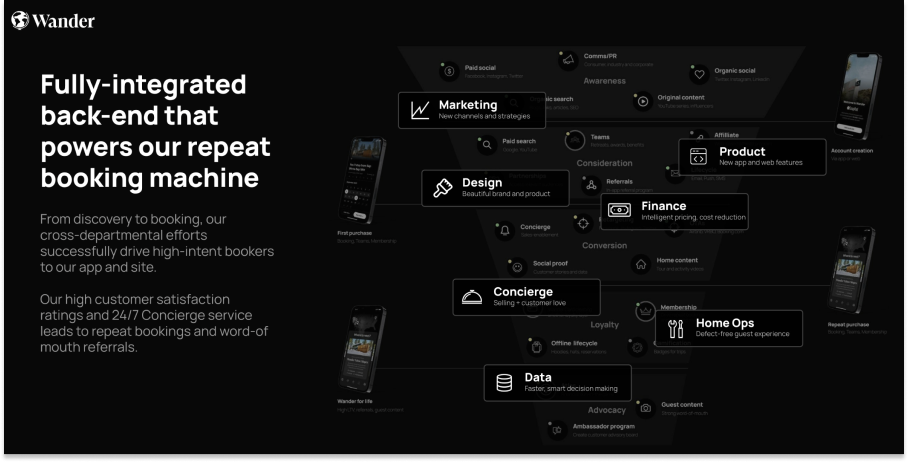

The whole process is coordinated through Wander’s back-end system, which handles everything from marketing to booking to operations, and feeds back data that informs future acquisitions and property designs.

For example, if the company sees unmet demand for a property in a certain location from enough potential bookers, it can acquire a property in that location with higher confidence in its underwriting. Airbnb has similar data on unmet demand, and more of it, but in order to put locations on the map, it needs to incentivize homeowners in those locations to list their properties.

The benefits of integration get more pronounced the deeper you go.

If guests give feedback that certain couches are uncomfortable, or if the property management team finds that a certain chair is hard to clean, they can feed that information back to the design team, who can replace furniture at the existing property or adjust inventory for future properties. It’s harder to convince an Airbnb host to buy a new couch.

In slow seasons, Wander can adjust prices on homes to stimulate demand and drive up occupancy. This, too, is much harder when you don’t control supply – some Hosts would rather just not host than not get their rate. When Puja and I hosted an Airbnb upstate, that was certainly the case. Airbnb’s recommended pricing seemed to prioritize filled nights over maximizing our revenue, so we ignored the recommendations and priced higher. This isn’t theoretical – in December, a typically slow month for short-term rentals, Wander filled 84% of available nights whereas, according to data from AirDNA, Airbnb and VRBO homes in the same markets filled ~40% of nights.

Simply put, controlling every detail creates a better experience. Airbnb famously strives to achieve an “11-star experience” for its guests, and went so far as to hire Disney illustrators to storyboard what that might look like. The challenge is, from there, it’s like handing those professionally illustrated storyboards to thousands of inexperienced filmmakers and expecting each of them to create The Lion King. As a result, the Airbnb experience has left enough gaping holes that Wander is able to counter position easily thanks to its vertical integration.

The “Wander Difference” section on its website reads like a list of answers to the most common complaints about Airbnb – homes not matching photos, Hosts not responding to messages, shoddy WiFi, lack of transparent pricing, and the dreaded cleaning checklists (plus fees).

I’m a fan of Airbnb. I’ve stayed in some incredible Airbnbs and covered our mortgage as a Host. Their team is excellent and genuinely cares about guest experience. It’s a $75 billion public company, and it’s been able to scale in a capital-light way through its marketplace. It has advantages over Wander.

But when you’re the new entrant, counter positioning is often the best strategy (and my favorite of the 7 Powers). It means doing something that your competitor cannot without dramatically altering their business model. It’s why I predicted that the next wave of winners in the categories that Aggregators like Airbnb currently dominate would be Natively Integrated Companies. And Wander is executing counter positioning to perfection through vertical integration.

2. Build relationships with customers to build products that resonate

Vertical integration connected by software gives all of the advantages described above, and it gives another equally important one: the ability to build direct relationships with customers, and to iterate on the product more quickly based on feedback.

For Wander, this comes through in two main ways: Concierge and WanderOS.

Concierge

Even before booking a Wander, all guests and potential guests have access to Wander’s Concierge team 24/7. Pre-booking, that means being able to ask questions about the properties, travel options, and the surrounding neighborhoods. Once booked, that might mean anything from arranging for cribs, strollers, and car seats for kids to planning unique outings, offsites, and “Experiences” for guests.

Vertical integration makes the team more effective because each of the Concierges can easily access all of the information about the property and surrounding areas, and even remotely unlock doors, turn on lights, and reboot WiFi. That kind of integration isn’t possible in a marketplace full of independent operators, and the difference comes through in higher customer satisfaction.

Importantly, the Concierge team acts as a conduit between guests and the rest of the company. Because they build a direct relationship with customers, and get their feedback firsthand through conversations, they can quickly figure out what improvements need to be made. In Wander’s last monthly investor update, Guest Experience Lead Matt Kowalewski shared how that feedback was put into action:

Done right, the Concierge team both creates a more seamless experience for guests in real-time and feeds information back to the rest of the team so that they can continually improve the portfolio. And a continually improving portfolio should lead to a higher RevPAR.

WanderOS

In addition to human Concierges, Wander guests are able to control all of the home’s smart features through WanderOS inside the Wander app. They can lock and unlock doors, adjust the temperature and lighting in each of the rooms, turn on the fireplace, connect to speakers, and even access the Tesla that comes with each home in one place.

WanderOS is a triple-threat.

On the consumer-facing side, it’s magical to be able to walk into a new place and control everything right from your app. It’s the kind of thing that people tell their friends about.

On the ops side, making it easy for guests to control everything from an app – made possible because Wander installs all of the equipment itself – means fewer panicked support messages. I can’t tell you how many times we had to get on the phone with our Airbnb guests when they couldn’t figure out how to turn on the fireplace in our home. It also means proactive fixes when the ops team sees that the WiFi is down or the thermostat is offline.

Less obviously, on the acquisitions and design side, it means understanding exactly how guests are using the home and its features and using that information to inform future decisions. Through the app, Wander can see how many other guests each booker invited, which rooms they used and when, and which smart amenities are more or less popular. All of this information feeds back into the underwriting and design of future homes.

All of these translate into higher NOI through lower customer acquisition costs, lower ops costs, better underwriting, and higher RevPAR.

Taken together, Concierge and WanderOS create a more magical user experience during each guest’s booking and drive Wander’s ability to continue to improve its product. That’s important, because unlike Airbnb, it can’t shake off underperformers. It takes principal risk on each property.

3. Take principal risk to achieve 1) and 2) and capture larger share of profits

What makes all of the above possible is that Wander acquires, renovates, outfits, and manages all of its properties itself. For an early stage, venture-backed startup, that’s a risky model that requires putting early stage venture dollars – which typically look for 100x returns or more – to work in residential real estate, a category whose returns are often measured in the single-digit percentage points.

Taking principal risk meant that Wander has been able to build a differentiated and superior offering, and the beginnings of a powerful brand, in a competitive and often commoditized market. It has proven out, at least on a small scale, that vertical integration can lead to higher NPS scores and RevPAR.

But it’s not the most capital efficient way to scale the business. The company currently has 13 properties on the map, and it plans to 10x that number over the next two years. That will present all sorts of operational challenges, and put Wander’s integrated teams and systems to the test, but those are solvable challenges.

What’s less obviously solvable is Wander’s ability to adjust and scale its capital base to finance the rapidly growing portfolio without diluting equity holders into oblivion. Taking capital risk is hard even for the biggest, most well-funded tech companies.

When I wrote about Natively Integrated Companies, one of the signals that pointed me towards believing that startups would need to take more principal risk was the fact that incumbents like Netflix, Zillow, Airbnb, and Uber were all beginning to do the same. Nearly four years later, in a more challenged market, they’re pulling back on those ambitions. Zillow shut down its Offers program. Airbnb spun off its Backyard project. Uber sold its self-driving unit. Netflix is still producing its own content in-house, but the company is facing its first real bumps in a decade.

So what’s a Natively Integrated Company to do?

Wander’s special sauce is in all of the details made possible by vertical integration, but even Zillow, Airbnb, and Uber can’t stomach the capital risk required to scale a vertically integrated offering.

This is where Wander exceeds my expectations for a Natively Integrated Company. Finance is as key a piece of the vertically integrated product as the homes or property management teams.

Last year, the company secured a $100 million warehouse facility with a large investment bank to fund acquisitions, renovations, and furnishings. That was an important step towards better matching the capital base with the product, and gave Wander confidence that it could continue to grow in any market condition.

But the masterstroke is the product it launched last October: Wander Atlas.

Wander Atlas

Every time I travel somewhere I love, I wish there were a way that I could invest in that city’s real estate without going through the headache of actually buying, maintaining, and renting out a home. I can’t find the texts, but I swear that while Puja and I were in Mexico City in 2019, I texted my friends Ben and Dror that I wanted to buy an index of vacation rental properties in CDMX. That trade would be doing well right now…

In that Zillbnb piece, I expanded on the idea a little bit:

Instead of owning just one home, Zillbnb customers might be able to buy a portfolio of homes in different locations, representing a financial tie to the places they’ve traveled and the experiences they’ve loved, and diversifying their risk. It sounds like a crazy idea, but I think that in twenty-five years, we will look back and think that the way we do it today was insane.

I didn’t have to wait twenty-five years. That’s pretty much Wander Atlas.

After a year of legwork and nearly $1 million in spend, Wander created the first vacation property REIT (that it knows about), seeding Atlas with five properties from the Wander portfolio.

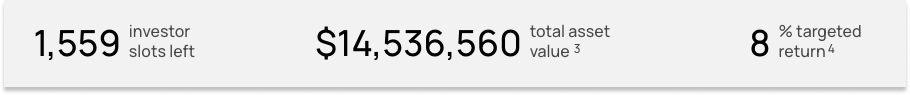

Atlas is a private REIT available to accredited and institutional investors under the SEC’s Reg D. Currently, according to its website, Atlas has $14.5 million in Total Asset Value – the value of the homes in the portfolio – and is targeting an 8% annual dividend.

When Atlas launched, I had JAE on Not Boring Founders to discuss it:

I’ll explain how it works, why I like it as an investor in Wander itself, and as a soon-to-be investor in Atlas.

Note: I plan to invest every dollar Wander is paying for the Sponsored Deep Dive into Atlas – I only write SDDs on companies and products I’d invest in myself – but you should know better than to blindly follow me by now. This is not investment advice, and you should do your own research, including reading the full Private Placement Memorandum and considering how Atlas fits into your overall portfolio before investing.

How Atlas Works

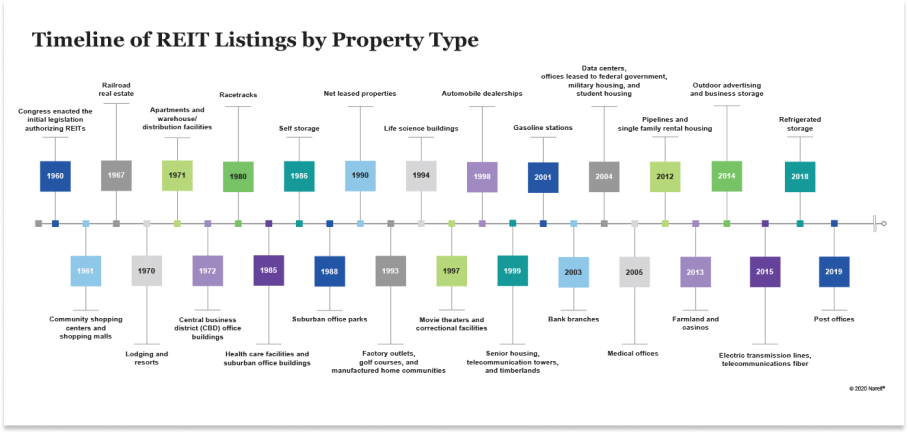

Real Estate Investment Trusts, or REITs, have been around since President Dwight D. Eisenhower signed legislation allowing them in 1960. The first REITs involved shopping malls, but by 1970 and 1971, the first hospitality and residential REITs, respectively, hit the market.

The purpose of a REIT is to give average investors the exposure to real estate without buying and operating properties themselves. Typically, investors buy shares in a REIT, the REIT uses the cash to purchase properties, and it contracts with an (often related) management company to operate the properties, sometimes through a Master Lease Agreement.

In order to qualify as a REIT, a company needs to meet a bunch of criteria, including:

Investing at least 75% of assets in real estate, cash, or Treasuries

Generating at least 75% of gross income from rents, interest on mortgages, or real estate sales

Paying at least 90% of taxable income in the form of shareholder dividends

According to Nareit, as of 2020, there were 223 REITs in the US with a combined market cap of $1.25 trillion, up 3.2x since 2010. REITs are increasingly popular with investors because they offer the potential for:

Diversification: Real estate can help diversify a portfolio, which may improve risk-adjusted returns, and REITs make that diversification more accessible. Private REITs, like Atlas, don’t trade on public markets and therefore are less prone to violent swings when equities experience them.

Income: Because REITs have to pay out at least 90% of taxable income as dividends, they can provide monthly or quarterly payments even before properties appreciate.

Inflation Protection: Home prices and rents – particularly short-term rents – can move with inflation. Real estate tends to appreciate during periods of inflation.

Tax Benefits: REITs are only taxed once at an individual level, not double-taxed at the corporate and individual levels, and there may be opportunities for individuals to write off a portion of their REIT income under current US tax laws.

REITs come in as many flavors as real estate does: commercial, residential, industrial, hospitality, communications, gas stations, and more. The largest REITs – like Prologis (industrial) and American Tower (communications) can manage more than $100 billion in assets.

To date, however, no one has built a REIT focused on short-term rentals, despite the fact that STRs are the fastest-growing segment in hospitality. According to Grand View Research, STRs generated $110 billion in 2022 revenue and the category is expected to grow at an 11.1% CAGR through 2030 to $255 billion. And the category, done right, is ideal for REITs.

As JAE explained it to me, “You’re left with a product that has the underlying value of a single-family home with hospitality-level returns.” That’s what Wander is building with Atlas.

Wander Atlas REIT, Inc. (“Wander Atlas REIT”) is a private REIT that gives investors ownership in a portfolio of homes operated by Wander. Here’s how it works:

Raise Money to Acquire Properties. Wander Atlas REIT raises money from investors and acquires properties.

Lease Properties to Wander. The REIT leases its properties to Wander under a Master Lease Agreement, and pays Wander a 0.65% management fee as well as 20% performance fees over an 8% hurdle.

Wander Manages Properties. Wander does all of the things described throughout this piece in order to generate revenue and NOI on the properties in the portfolio.

Wander Pays the REIT Rent. Wander pays the REIT monthly rent based on a combination of a fixed payment and a percentage of revenue from the properties.

The REIT Pays Investors Quarterly Dividends. The REIT pays investors quarterly dividends from those payments – at least 90% of the income it receives from Wander. It’s targeting an 8% annual dividend, although returns cannot be guaranteed.

Portfolio NAV Valued Monthly. Meanwhile, the REIT works with outside parties to value its properties in order to update its Net Asset Value on a monthly basis. The NAV determines the price of Atlas shares.

REIT Sells Properties. At its discretion, Wander and Wander Atlas REIT may sell properties and return proceeds to investors in the form of dividends or reinvest in new properties.

There are many, many more details, including dozens of pages worth of risks, in the Private Placement Memorandum, but the high-level takeaway is that Wander Atlas REIT hopes to generate hospitality-level yields through Wander rentals while building up a diversified portfolio of high-quality residential properties, which it hopes will appreciate over time.

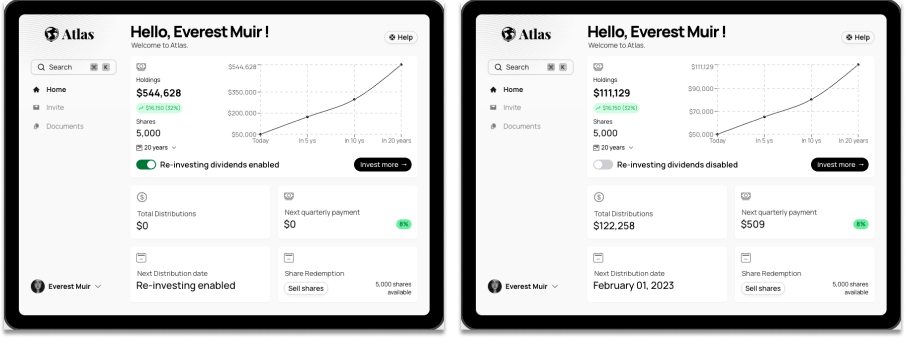

Investors can benefit from both dividend payments – which they can choose to reinvest or take out – and through appreciation in the value of the underlying properties. The below dashboards show how a $50k investment today would perform at 8% annual dividends, paid quarterly, over the next twenty years with dividends reinvested (left) and paid out (right).

It’s important to note that, currently, Wander Atlas is not required to provide liquidity to investors – if you purchase shares, you may not be able to sell them to Wander Atlas (it can repurchase up to 5% of shares annually at its discretion) or to other investors. As always, don’t invest any money that you can’t afford to lose or that you’ll need to access in the near future.

Why Atlas Makes Sense for Wander

Simply put, Atlas gives Wander a vehicle through which to scale its portfolio in a capital efficient manner while retaining the full control of the experience it believes is required to generate hospitality yields.

Atlas also represents an opportunity to institutionalize the STR market. Currently, the STR market is tremendously fragmented, with less than 5% of the market managed by institutional operators. The vast majority of STR properties are owned and managed by mom & pops. As it stands:

No institutional STR owner/operators exist today

No diversified STR investment vehicles exist today

No STR-backed public securities (debt or equity) exist today

Wander has the rare opportunity to define a new asset class and set the standard in a $100 billion+ market, extending its high-quality brand from customers to investors. The single-family rental market was similarly fragmented in the early 2010s. A decade later, it’s dominated by professional investment managers, and the three largest NYSE-listed SFR REITs have a combined market cap of $35 billion. As discussed, STRs may represent an even more attractive product than SFRs given their duration optionality.

From a business perspective, Wander is giving up some of the upside in its portfolio to Wander Atlas investors in exchange for the ability to scale faster while maintaining vertical integration. Speed is important because there’s a bit of a first-mover advantage here: if institutionalization occurs, the downward pressure on cap rates could increase the value of the portfolio that Wander is able to build up while STR cap rates are still higher than SFR cap rates.

In the meantime, Wander can make money in four ways:

It collects Acquisition and Financing Fees for identifying and financing suitable STR investments.

It collects a monthly Asset Management Fee for the work it does to manage the REIT.

It collects a monthly Property Management Fee for all of the work it does to manage the properties.

To the extent that it’s able to cover its Master Lease Payments and produce dividends in excess of 8% per year, it can also earn 20% Incentive Fees.

If it can reach the ~$10B in NAV of the largest SFR REITs over the next decade, that would represent tens of millions in annual revenue from asset management fees. If its bet on vertical integration to improve RevPAR and yields is correct, and it’s able to return more than 8% to investors, it could make tens or hundreds of millions of dollars in incentive fees.

The bet that Wander is making is that it will be able to take a smaller slice of a much larger pie through Atlas, while enabling members to become owners of its portfolio and creating even more brand affinity in the process.

Why I’m Investing in Atlas

I’ll state the obvious here: if I weren’t investing in Atlas, there would be a problem.

It feels like Atlas was created for me. It’s an investment product I’ve wanted for a long time, and I believe that Wander is the right company to offer it. Beyond what I’ve written so far, though, Atlas is compelling to me for a few additional reasons.

First, I want exposure to real estate but don’t necessarily want to buy a house. Home ownership is great, it’s part of the American Dream, and done responsibly, it can be a good investment. But I also think that home ownership is financially overrated when you consider how much of the average homeowner’s net worth goes into the home, and how much debt they take on for the purchase. As I wrote in Ownership and the American Dream, “You would be hard pressed to find a professional investor with a portfolio that consisted of one asset and a bunch of debt to finance it.”

I’m not sentimentally attached to the idea of buying a home – the only home Puja and I have purchased was a second home in upstate New York that we listed on Airbnb – and I’d rather buy equity in a diversified portfolio of beautiful, professionally managed homes than take out a ton of debt to buy one of my own.

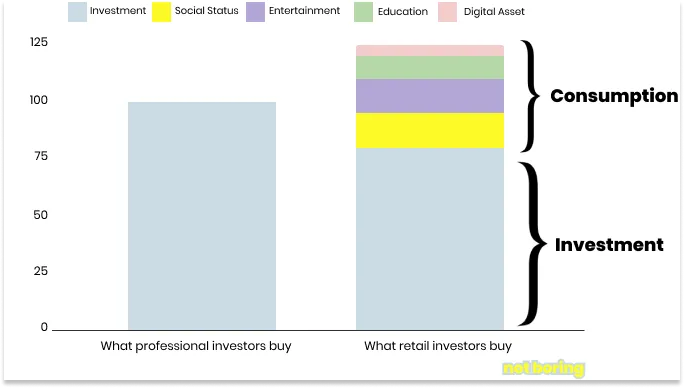

Second, I love the idea of being able to stay in the portfolio I own when I travel. This isn’t really a financial consideration; there’s just something cool about being a partial owner in the homes I stay in on vacation. In Software is Eating the Markets, I described the idea that retail investors are often buying more than returns when they invest, and personally, I view Atlas as both an investment and an experience.

Third, the homes in the Wander portfolio are magnificent. Its Vail Valley property was featured in Architectural Digest. Hudson Woods was profiled in The New York Times. Asheville Meadows was featured in Architectural Digest, GQ, and Conde Nast Traveller. Wander’s is a portfolio of homes I’d be proud to show off and take family and friends to, and the quality and uniqueness of the properties should mean that they should generate high RevPARs and appreciate better than cookie-cutter homes in traditional iBuyer markets.

Fourth, the investment profile is a compelling fit for my portfolio. Through Not Boring Capital and personally, I’m probably a little longer tech and crypto and lighter on income-generating investments than a financial advisor might recommend. While there’s no guarantee that Wander will be able to hit its 8% target dividends, I’m confident in the team’s ability given everything I’ve seen so far, am comfortable with the risk/reward given the fact that the portfolio is supported by the underlying homes, and could use the diversification. This isn’t a fixed income product – Wander Atlas is not contractually obligated to pay 8% dividends any more than a public company is obligated to pay dividends – but Atlas will play a similar role in my portfolio.

Finally, I believe in the team and the approach it’s taking. Building a Natively Integrated Company is easy to write about, and I think it’s the right strategy given the STR market and Wander’s goals, but difficult to execute. It requires an insane attention to detail, an ability to sync hundreds of moving parts, and a relentless pursuit of the type of high-quality product that NICs are uniquely able to create. I’ve spoken with and invested in hundreds of companies over the past few years, and very few execute on the level that JAE and the Wander team do. If anyone can pull this off, it’s them.

Once again, this is not investment advice. My reasons for investing are part financial and part emotional, and you should fully explore Wander Atlas for yourself before deciding to invest. You can find more information at its website.

Wandering Into the Future

As may have become clear over the course of this piece, there are few companies I’m more excited about than Wander. I think that they have the potential to create the trusted brand in luxury short-term rentals, a multi-billion dollar business at the parent company level, and the leading REIT in the STR space.

It’s why Not Boring Capital invested in the first place, and they’ve exceeded my initial expectations on every front.

We always ask three questions about every company we invest in:

How hard is it?

How much of the value it creates can it capture?

So What?

I’ve spent most of this piece explaining the answers to the first two questions. Vertical integration is really hard, but the prize for success is that vertical integrators should be able to capture most of the value they create. It’s the high risk, high reward approach and the only one that I think makes sense for a new entrant in short-term rentals. With Atlas, the company is aligned with investors – it will capture the most value for itself only if it’s able to clear its 8% hurdle and acquire homes that appreciate over time thanks to sharp underwriting and the company’s own efforts in managing properties.

The answer to “So What?” is less obvious but equally important.

At the simplest level, Wander is tackling one of the biggest, slowest-moving markets in the world, and one that each of us interacts with every day. Residential real estate is a $1.6 trillion market annually, and while STRs are only a fraction of that total, there’s a good argument to be made that luxury STRs are the right starting point from which to shake up the industry. It’s the most responsive part of the market – improvements in a home or changes in demand can be reflected in RevPAR within days, and starting at the high-end, a la Tesla, means that there’s more margin available for innovation.

Wander and Atlas are attempts to make real estate more liquid, both in terms of how we invest in it and how we interact with it in the physical world. It’s early days. Wander only has thirteen properties. But you can imagine a world in which Wanders dot the globe, Concierges powered by WanderOS understand your preferences, property management teams and smart technology create experiences that make you feel at home wherever you are, and exploring the world is as simple as booking through an app and showing up. You might even own a piece of the places you stay.

More deeply, Wander exists to help people find their happy place. They even trademarked “Find your happy place™️” last year. It’s a tagline, but it’s also an important mission.

I have a baby thesis forming that we’re going to see a lot of companies pop up that focus on making people happier. The logic is that life is improving across a number of key metrics, technology is giving people more and more superpowers, and yet, people don’t seem to be happier. What’s the point of living forever or using AI to make our jobs easier if we spend the extra time getting mad at each other on the internet? As technology continues to improve and permeate more of our lives, it creates an equal and opposite need for experiences that let us connect with friends and family in real life. As remote work settles in, it creates a need to connect with our teams in person. Wander exists to make those connections happen.

As people have gotten frustrated with Airbnb, there’s been a push to go back to hotels:

Hotels are more consistent and convenient. They don’t ask you to take out the trash. There are people there to help you out and to bring you drinks.

But there’s nothing quite like the experience of waking up in a house with a bunch of friends, slowly padding out to the living room, cooking up some breakfast, and recounting the previous day’s adventures in your own space. Those are the magic times.

Creating a network of homes that capture that magic while retaining the consistency and convenience of hotels is really hard. It requires acquisitions, design, technology, property management, and a Concierge to help coordinate it all. It requires smart financing to create ubiquity, and tailored marketing to drive occupancy in a growing portfolio. Wander is proving that it can be done.

In the coming years, Wander will expand to thousands of properties. JAE hinted that they’ll look abroad soon. They’ll continue to improve the guest experience by listening to feedback. They’ll build out a loyalty program. They might even create a new multi-billion dollar asset class, turning guests into owners. And that’s just the start. Check out the replies to JAE’s tweet for a sneak peek at the roadmap (and add your wish list):

Don’t take my word for it. Go Wander. Dig into Atlas. Make a booking and give feedback.

When you wander with a purpose, you can wander far without getting lost.

Thanks to Dan for editing, and to JAE, Jake, Kyle, David, and Dom for your input!

That’s all for today! We’ll be back in your podcast feed on Thursday and back in your inbox on Friday for the Weekly Dose.

Thanks for reading,

Packy

For the avoidance of any doubt, the Private Placement Memorandum (“PPM”) is the sole controlling document for all information concerning investment in Atlas. Neither Wander nor Atlas can guarantee future performance or any return on investment. Like any investment, an investment in Atlas entails the risk of loss of some or all of one’s invested capital. The PPM explains in detail the risks associated with an investment in Atlas and the related terms and conditions of the investment and it should be read carefully and in detail before investing. The PPM is the sole and exclusive source of information concerning investment in Atlas.

Neither Wander nor Atlas, nor certainly not Not Boring, can guarantee future performance or any return on investment. Like any investment, an investment in Atlas entails the risk of loss of some or all of one’s invested capital.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK