Bitcoin Barrels Toward Historic January as Crypto Market Jumps by $280 Billion

source link: https://finance.yahoo.com/news/bitcoin-barrels-toward-historic-january-025852293.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Bitcoin Barrels Toward Historic January as Crypto Market Jumps by $280 Billion

Bitcoin Barrels Toward Historic January as Crypto Market Jumps by $280 Billion

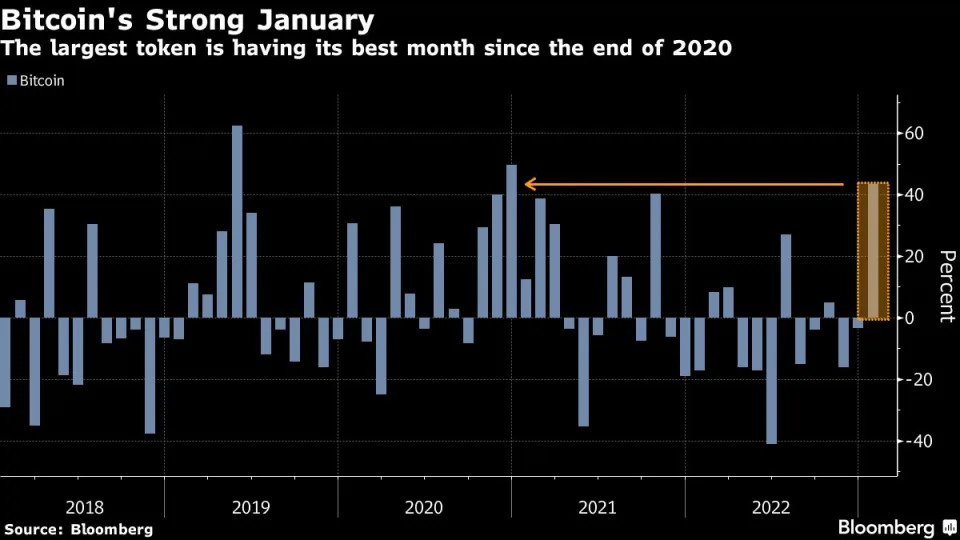

(Bloomberg) -- Bitcoin is set for its best January since 2013 on bets that monetary tightening and the crypto-sector crisis are both ebbing.

Most Read from Bloomberg

The largest token is up 39% since the turn of the year, a first-month gain bettered only twice before when crypto was in its infancy. Smaller coins like Solana, Axie Infinity and Decentraland have doubled in value, part of a $280 billion January climb in digital assets overall, CoinGecko figures show. Bitcoin retreated 2.9% to $23,111 as of 10:44 a.m. in New York on Monday amid broad declines in risk assets.

The rebound from last year’s deep rout is part of a wider revival in risk appetite on expectations that central banks will slow interest-rate hikes and perhaps even cut borrowing costs later this year as high inflation moderates.

The rally in virtual coins has weathered ongoing fallout from the collapse of Sam Bankman-Fried’s FTX exchange — such as the bankruptcy of crypto lender Genesis Global Holdco LLC and a spate of layoffs across the industry.

January “feels like a month of new beginnings, with emerging clarity as to bankruptcy proceedings, corporate restructurings and market fundamentals pointing to the bottom being behind us,” wrote Noelle Acheson, author of the “Crypto Is Macro Now” newsletter.

Still, there are plenty of skeptics who doubt if the rebound in the likes of crypto and tech stocks will last. One risk is that the soft economic landing markets are hoping for is fanciful because rates must stay higher for longer.

The comeback of speculative assets like Bitcoin and the Ark Innovation ETF “will likely reverse” if oil, wages and consumer-price increases shift the “soft landing” narrative temporarily in coming weeks into a “no landing” view, Bank of America Corp. strategists led by Michael Hartnett said last week.

TODAY

TODAYLisa Loring, who played Wednesday in the original 'Addams Family,' dies at 64

Lisa Loring, the actor who originated the role of Wednesday Addams on the 1960s TV series “The Addams Family,” has died, her agent confirmed to NBC News.

6h ago American City Business Journals

American City Business JournalsJPMorgan Chase retrofitting Delaware space, looking to fill over 700 jobs

Of the 725 job openings, Chase said about 200 will be technology roles at a time when giants such as Google and Microsoft are laying off tens of thousands of employees.

5h ago Zacks

ZacksHas Exact Sciences (EXAS) Outpaced Other Medical Stocks This Year?

Here is how Exact Sciences (EXAS) and Lantheus Holdings (LNTH) have performed compared to their sector so far this year.

6h ago Yahoo Finance Video

Yahoo Finance VideoLucid stock rises amid rumor of potential Saudi buyout

Yahoo Finance Live anchors discuss the rise in stock for Lucid amid reports of a potential Saudi buyout.

5h ago Yahoo Finance Video

Yahoo Finance VideoAlibaba stock under pressure amid HQ move reports

Yahoo Finance Live’s Rachelle Akuffo discusses the decline in stock for Alibaba following rumors that the e-commerce company is moving its headquarters to Singapore, despite the company denying reports.

4h ago CoinDesk

CoinDeskMoney Supply ‘Falling Like a Stone’: Economist

Johns Hopkins University professor of applied economics Steve Hanke shares his outlook on the upcoming Federal Open Market Committee decision on interest rates and the current state of the money supply.

6h ago TheStreet.com

TheStreet.comCostco Gets Ready to Raise its Membership Prices

Costco has a tremendously loyal customer base with an over 90% membership renewal rate worldwide and an even higher rate in the United States (92.5%) in its most recent quarter. Currently, Costco charges $60 for a Gold Star membership and $120 for an Executive membership. Executive members have been rising in importance for the company.

6h ago Motley Fool

Motley FoolWhy Carvana Stock Was Skyrocketing Today

Shares of Carvana (NYSE: CVNA) were moving higher again today as an ongoing short squeeze seemed to lift shares of the beaten-down online used car dealer for the second day in a row. As of 10:22 a.m. ET, Carvana stock was up 26.8% on high-volume trading, following a 19.5% gain last Friday. What was also notable about today's jump is that, unlike Friday's, it came as tech stocks pulled back, meaning the squeeze wasn't correlated with any specific market news or optimism about slowing interest rates or something similar.

5h ago TheStreet.com

TheStreet.comBillionaire Gautam Adani Calls on India for Help to Save His Empire

Adani and his companies are facing accusations of fraud from a New York short-seller, threatening the group's shares and his fortune.

4h ago MoneyWise

MoneyWise‘Back to the meat grinder’: Jeremy Grantham warns that stocks could plunge a ‘stomach-churning 50%’ from here — he's using these 3 shockproof stocks for protection

The legendary investor remains highly bearish. And for good reason.

5h ago Zacks

ZacksFisker Inc. (FSR) Soars 15.0%: Is Further Upside Left in the Stock?

Fisker Inc. (FSR) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

7h ago Insider Monkey

Insider Monkey12 Cheap Energy Stocks To Buy

In this article, we will be taking a look at 12 cheap energy stocks to buy. To skip our detailed analysis of the energy sector, you can go directly to see the 5 Cheap Energy Stocks To Buy. Energy stocks such as Exxon Mobil Corporation (NYSE:XOM), Chevron Corporation (NYSE:CVX), and ConocoPhillips (NYSE:COP), among more, managed to […]

6h ago Zacks

ZacksIs Medical Properties (MPW) a Buy as Wall Street Analysts Look Optimistic?

According to the average brokerage recommendation (ABR), one should invest in Medical Properties (MPW). It is debatable whether this highly sought-after metric is effective because Wall Street analysts' recommendations tend to be overly optimistic. Would it be worth investing in the stock?

7h ago Insider Monkey

Insider Monkey15 Undervalued Defensive Stocks For 2023

In this article, we will take a look at the 15 undervalued defensive stocks for 2023. You can skip this part and go to 5 Undervalued Defensive Stocks For 2023. Investors flocked to defensive stocks in 2022 amid recession fears and massive losses in the growth stocks space. Defensive stocks are favored by investors during […]

1h ago Motley Fool

Motley FoolWhy CrowdStrike, Zscaler, and Fortinet Stocks Dropped Today

Another hike to the benchmark federal funds interest rate is coming -- and growth investors are nervous. According to experts polled by CNBC, chances are good that when Federal Reserve officials announce their decision on interest rates Wednesday, the hike will be a relatively benign 25 basis points (0.25 percentage points). Investors in growth stocks -- and cybersecurity stocks CrowdStrike Holdings (NASDAQ: CRWD), Fortinet (NASDAQ: FTNT), and Zscaler (NASDAQ: ZS) in particular -- aren't 100% certain they like the sound of that.

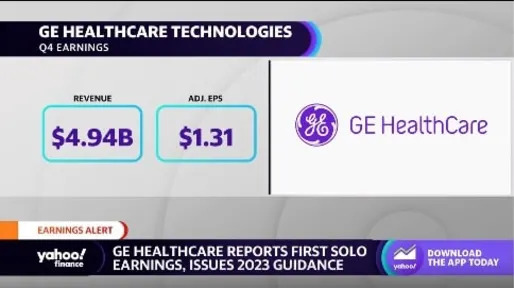

3h ago Yahoo Finance Video

Yahoo Finance VideoGE HealthCare delivers strong revenue growth in first earnings report after spinoff

Yahoo Finance Live anchors break down quarterly earnings for GE HealthCare.

6h ago Motley Fool

Motley FoolVerizon Is Growing Again, But There's a Problem

Verizon Communications (NYSE: VZ) reported a return to customer growth in the fourth quarter of 2022, and the company's 5G fixed broadband product continues to grow like crazy. Given the stock's valuation, is this a value stock or a value trap? Motley Fool contributors Travis Hoium and Jason Hall discuss both sides in this video.

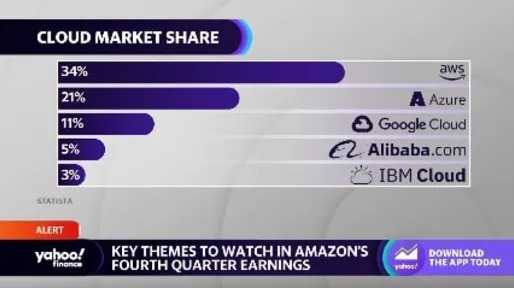

5h ago Yahoo Finance Video

Yahoo Finance VideoAmazon earnings preview: Investors eye cloud business, revenue, prime subscriptions

Yahoo Finance Live anchors discuss what to expect from Amazon Q4 earnings.

6h ago TipRanks

TipRanksCarvana Stock: More Fuel for the Bulls

Just a month into 2023 and shares of Carvana (NYSE:CVNA) are up by a hefty 108%. Those are indeed some impressive returns, but only tell a small part of the story. Zoom out, and even after those recent gains, you are looking at a stock that over the past year has still shaved off 94% of its value. The used car dealer’s troubles have been well-documented. A massive debt load, declining vehicle sales with the losses piling up against a backdrop of a softening economy have brought about talks of po

4h ago Investor's Business Daily

Investor's Business DailyE-Commerce Giants Alibaba, JD.com Tumble On News Of Strategic Moves

Alibaba stock and JD stock tumbled on reports that the two China e-commerce companies were planning strategic moves.

2h ago Zacks

ZacksBeat the Market the Zacks Way: NVIDIA, Bilibili, Novo Nordisk in Focus

Our time-tested methodologies were at work to help investors navigate the market well last week. Here are some of our key performance data from the past three months.

11h ago MoneyWise

MoneyWiseIf you want to be really rich, use these 3 Warren Buffett investing techniques that no one talks about

Buy and hold forever? Not always.

9h ago Insider Monkey

Insider Monkey15 Most Undervalued Value Stocks To Buy According To Hedge Funds

In this article, we will take a look at the 15 most undervalued value stocks to buy according to hedge funds. To see more such companies, go directly to 5 Most Undervalued Value Stocks To Buy According To Hedge Funds. Investors began to pile into value stocks in 2022 as financial markets wavered amid rising […]

25m ago Investor's Business Daily

Investor's Business DailyThink Chevron's Profit Was Obscene? 5 Companies Will Blow It Away

Chevron's giant $36.5 billion 2022 profit turned heads — including at the White House. But plenty of S&P 500 companies will make even more than the oil giant.

8h ago Motley Fool

Motley FoolThese 2 Warren Buffett and Cathie Wood Stocks Are Lapping the Market so Far in 2023

Cathie Wood and Warren Buffett are two of the most well-known investors in the world, albeit for very different reasons. Buffett runs the large conglomerate Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) and has historically been a value investor, although he dabbles in a variety of investing strategies and in almost every industry. Wood, on the other hand, runs ARK Invest, which manages several exchange-traded funds (ETF) focused on growth stocks and is known for being a big-tech investor and a believer in crypto, as well.

1d ago Yahoo Finance Video

Yahoo Finance VideoBitcoin: Investors digest crypto volatility ahead of Fed meeting

Yahoo Finance Live’s Jared Blikre breaks down how bitcoin is trading ahead of Wednesday’s Fed meeting.

5h ago Zacks

ZacksBrokers Suggest Investing in Datadog (DDOG): Read This Before Placing a Bet

Based on the average brokerage recommendation (ABR), Datadog (DDOG) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

7h ago Zacks

ZacksWhy Caterpillar (CAT) Might Surprise This Earnings Season

Caterpillar (CAT) is seeing favorable earnings estimate revision activity and has a positive Zacks Earnings ESP heading into earnings season.

7h ago Yahoo Finance Video

Yahoo Finance VideoEarnings this week: Meta, Peloton, Starbucks, Apple among companies reporting results

Yahoo Finance Live’s Rachelle Akuffo discusses the earnings to watch for this week.

4h ago Zacks

ZacksWant Better Returns? Don't Ignore These 2 Computer and Technology Stocks Set to Beat Earnings

The Zacks Earnings ESP is a great way to find potential earnings surprises. Why investors should take advantage now.

7h ago TheStreet.com

TheStreet.comCarvana Stock Soars

The stock of beleaugured car seller Carvana surged on Monday by as much as 33%. Some traders speculated that the rise was from a short squeeze. "Carvana is on an epic short squeeze today," Genevieve Roch-Decter, CFA, a former small cap money manger, tweeted.

9m ago TheStreet.com

TheStreet.com3 High-Yield Dividend Tech Stocks for Income Investors

Now could be a very good time to capitalize on sustainable income streams from a sector where dividend income is scarce.

1h ago Investor's Business Daily

Investor's Business DailyStocks To Buy And Watch: Warren Buffett-Led Berkshire, 3 Others In Or Near Buy Zones

Among the best stocks to buy and watch, Warren Buffett-led Berkshire Hathaway is approaching a new buy point in the ongoing market rally.

1h ago Motley Fool

Motley FoolHow Much Income Can You Make Investing $10,000 in Warren Buffett's Top 5 Dividend Stocks?

If you're Warren Buffett, you won't have to use your imagination. Here's how much income you could make investing $10,000 in each of Buffett's top five dividend stocks. Let me first define how I identified Buffett's top five dividend stocks.

1d ago Simply Wall St.

Simply Wall St.We Wouldn't Be Too Quick To Buy New York Community Bancorp, Inc. (NYSE:NYCB) Before It Goes Ex-Dividend

It looks like New York Community Bancorp, Inc. ( NYSE:NYCB ) is about to go ex-dividend in the next four days...

1d ago MarketWatch

MarketWatchMorgan Stanley’s Mike Wilson warns the stock market’s January rally could end this week

A surprisingly good start for the U.S. stock market in 2023 is likely to fade this week as the Federal Reserve is set to announce its eighth consecutive rate hike, according to Morgan Stanley’s Michael Wilson.

1h ago Barrons.com

Barrons.comBed Bath & Beyond Is Closing Over 140 Additional Stores. The Stock Soars.

The retailer will be shutting 87 of its banner stores, five buybuy Baby stores, and all 50 of its Harmon locations.

4h ago Yahoo Finance Video

Yahoo Finance VideoJPMorgan reiterates Underweight rating on Tesla stock

Yahoo Finance Live’s Brian Sozzi breaks down a JPMorgan analyst’s Underweight rating and $120 price target on Tesla stock.

6h ago SmartAsset

SmartAssetHow Much Will I Make on a $1 Million Annuity?

The amount you collect from an annuity depends on when you invest, the return your specific annuity offers and the details of your particular contract. As a result, it's difficult to provide a specific answer to what any single person … Continue reading → The post How Much Would a $1 Million Annuity Pay? appeared first on SmartAsset Blog.

7h ago Motley Fool

Motley Fool4 Splendid Dividend Stocks Yielding 4% (or More) to Buy While They're Still on Sale

There is a silver lining to last year's sell-off: Dividend yields are much higher. Several high-quality dividend stocks now offer yields above 4%, including Crown Castle (NYSE: CCI), Community Healthcare Trust (NYSE: CHCT), Digital Realty (NYSE: DLR), and Realty Income (NYSE: O).

1d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK