Putting the Fun in Finance?

source link: https://austinstartups.com/putting-the-fun-in-finance-565836ef8ac

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Putting the Fun in Finance?

Trust me. I get it. The finance industry is not known for many fun things over the past twenty years. That said Venture Capital, which traces its roots back to 1946, can be an exhilarating and exciting world. As someone who just changed careers into this buy side of finance, and is actually enjoying it, I wanted to share my thoughts on my first 30 days.

As most of you reading this might know, I switched careers this year. Leaving behind being a startup founder (x2) and consultant/agency person who focuses on products, to take a new job in Venture Capital.

What DALL-E AI thinks our office looks like. This is incorrect.

As a new VC partner here in Austin my first 30 days have been full of the following:

Fundraising — We are in the late stages of raising a $100m dollar fund that concentrates on capital P problems in Security, Health, Material Science, and Climate Change. Coming from the nonprofit world and the startup world I know that fundraising is hard, frustrating work. You hear a lot more “No” or “not right now” than you would imagine. As a startup VC firm, we aren’t showing up with huge wins in the portfolio yet. I’ve been working every single day to think about potential investors from my network who want to invest in Venture Capital as an asset class. And educating others who are interested but new to this world.

Deal Flow Evaluation — Thanks to the hard work of all the great folks who came before me we have a great pipeline of startups to look at and evaluate. We take a qualitative and quantitative look at the startups through their pitch deck, materials and their websites, and rate them using 17 individual performance metrics. Some interesting stats here on our deal flow over the last 30 days that I’ve been here.

72% identify as seed stage

40% software

20% healthcare

16% materials science

Avg ask is $2,063,000

Launching an Intern Program — I’m on the Moody College of Communications advisory board so I get to spend some time thinking about how we graduate students into the workforce. Besides our own internship program at Ecliptic, I know that most startups in our portfolio don’t have time to do on-campus recruiting or spend time with professors. And I know most students never get exposure to startups while on campus. So I raised my hand to help our portcos find, recruit and hire interns when they are ready. We even offer development and editing of job descriptions and navigating the University of Texas system for our startups. Through some really nice word of mouth, we will be doing this with McCombs students and the Bridging Disciplines Program at UT as well. Have a connection with another school? Drop me an email.

Listening — I’ve also spent my first-month listening. Scheduling time with every GP, MP, Partner, Managing Director, Investor Relations person and intern on our staff. I’ve been reaching out to folks at Live Oak, Clutch, and other VCs here in Austin and beyond. I’ve also started to join a lot of great calls with folks from our portfolio like pluralytics. This has led me to have some pretty solid hypotheses around what our companies might want and need help with including ideal customer profile building, sales automation, early org design, and problem-solution mapping.

All that said I wake up every day excited to go to work and am starting to actively build products and programs inside our VC firm. Once a builder always a builder.

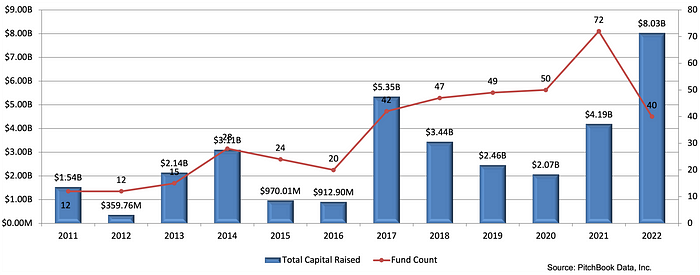

And as you can see from the graphics below it’s a great time to be in this industry in Texas with that amount of capital walking around.

Texas VC Fund Activity

So what’s next?

I want to build and concentrate on an investment thesis that resonates not only with myself, but our firm and startups out in our ecosystem. Thank to the climate fellowship I did at Terra.do, it’s definitely going to be focused on climate change, but that’s a huge beast to tackle. With many details and verticals within it. In the meantime send me your best wishes and your most interesting startups. I’d love to see them and meet them.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK