CIOs are in a holding pattern - but ready to strike at data monetization

source link: https://siliconangle.com/2023/01/07/cios-holding-pattern-ready-strike-data-monetization/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

but ready to strike at data monetization

Recent conversations with information technology decision-makers show a stark contrast between the period exiting 2021 and the mindset leaving 2022.

Chief information officers are generally funding new initiatives by pushing off or cutting lower-priority items. While security efforts are still being funded, those that enable business initiatives that generate revenue take priority over cleaning up legacy technical debt.

The bottom line is, for the moment at least, the mindset is not to cut everything, rather it’s to put a pause on cleaning up legacy hairballs and continue to fund initiatives to drive monetization. Cloud has become fundamental and getting data “right” is a consistent theme that appears to be an underpinning of initiatives getting funded today.

In this Breaking Analysis, we tap recent discussions from two primary sources: year-end Enterprise Technology Research roundtables with IT decision makers and conversations on theCUBE with data, cloud and IT architecture practitioners.

Direct input from key IT decision-makers

The sources of data for this Breaking Analysis come from the following areas:

Erik Bradley’s recent ETR year-end panel featured a DevOps and Site Reliability Engeineering manager in financial services, a chief information security officer in a large hospitality firm, a director of IT for a big tech company, the head of IT infrastructure for a financial firm and a chief technology officer for a global travel enterprise.

For our upcoming Supercloud2 conference on Jan. 17, we’ve had CUBE Conversations with data and cloud practitioners — specifically, heads of data in retail and financial services, a cloud architect at a biotech firm, the director of cloud and data at a large media firm and the director of engineering at a financial services company.

We’ve curated commentary from these sources and share them with you today as anecdotal evidence supporting what we’ve been reporting in the market these past couple of quarters.

An unpredictable market breeds caution

On Breaking Analysis, we’ve previously likened the economy to the slingshot effect when you’re driving.

You’re cruising along at full speed on the highway and suddenly you see red taillights up ahead, so you tap the brakes. Then you speed up again, traffic is moving along at full speed, so you think nothing of it. And all of a sudden the same thing happens – you slow down to a crawl. And you start wondering what the heck is happening. So you become a lot more cautious about the rate of acceleration going forward.

Well, that’s the trend in IT spend right now. Back in June we reported that despite the macro headwinds, CIOs were still expecting 6% to 7% spending growth for 2022, down from 8% at the beginning of the year, but given Ukraine and Fed tightening, that still seemed pretty robust.

However, throughout the fall we reported consistently declining expectations where CIOs are now saying Q4 will come in at around 3% growth and they’re expecting – or should we say hoping – that it pops back up in 2023 to 4% to 5%.

The recent ETR panelists are saying based on their businesses and discussions with peers they could even see low single-digit growth for 2023 of 1% to 3%.

So this slingshot or seesaw economy has been underestimated by most everyone. Amazon.com Inc. is a good example of this – there are others – but Amazon entered the pandemic year with around 800,000 employees. It doubled that workforce during the pandemic. Right before Thanksgiving 2022, Amazon announced it was laying off 10,000 employees and Andy Jassy, Amazon’s chief executive, just announced this past week that number will now grow to about 18,000. In reality, this is a rounding error and Amazon’s headcount remains far above 2019 levels. But its stock price does not, as its valuation is now under $1 trillion.

The point is that visibility is very poor right now, but the cloud changes the dynamic and potentially enables a faster snapback.

Revenue initiatives still getting funded

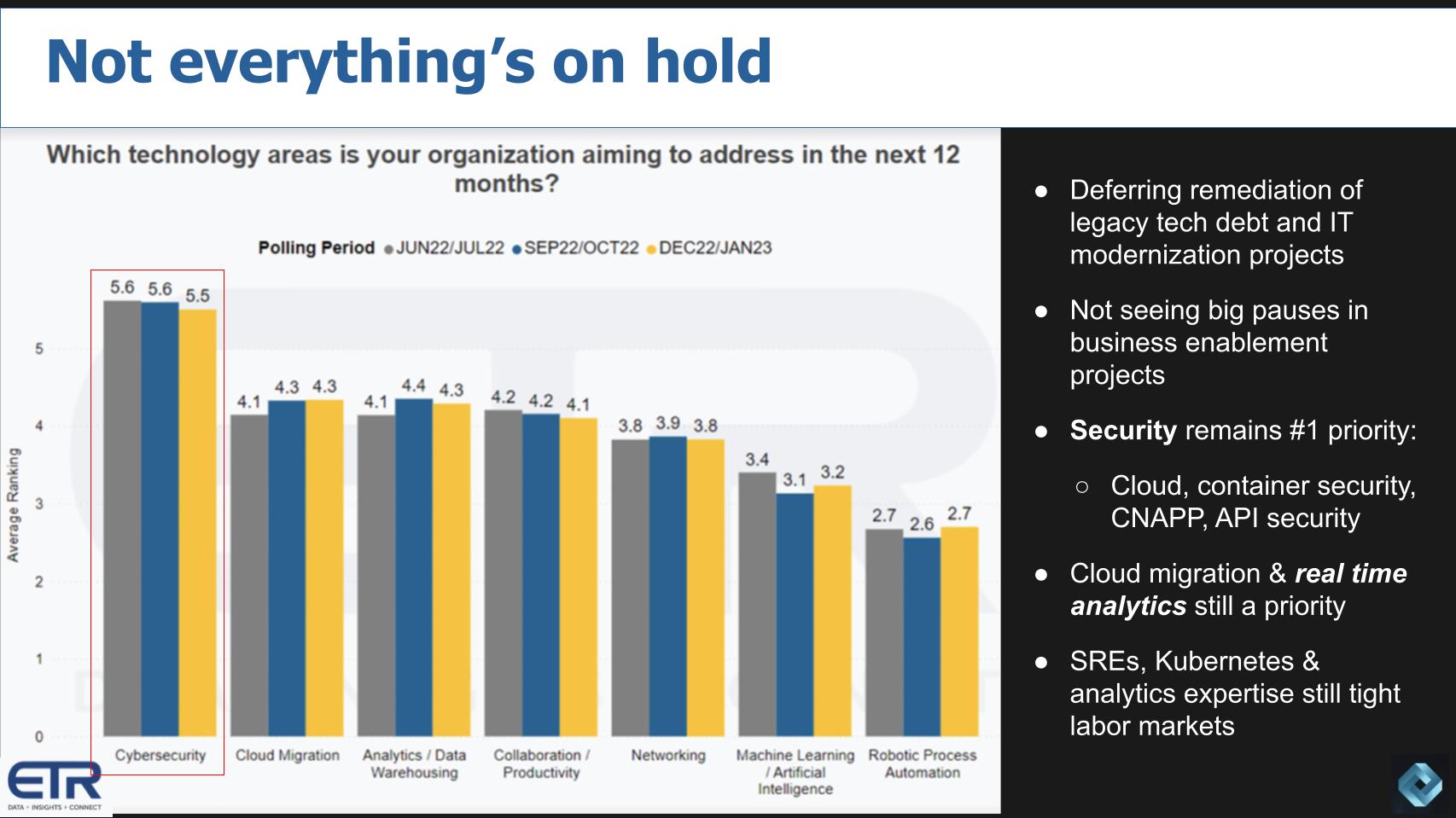

Importantly, not everything is on hold. This downturn is different from previous tech pullbacks in that the speed at which new initiatives can be rolled out is much greater, thanks to the cloud, and if you can show fast return, you’ll get funded.

Organizations are pausing the cleanup of technical debt. Unless it’s driving fast business value, they’re holding off on modernization projects. However, business enablement initiatives are still getting funded. The two primary strategies CIOs are using to save money are: 1) consolidating redundant vendors; and 2) optimizing cloud spend. Initiatives are being funded by stealing from other pockets of budget.

Cybersecurity remains the No. 1 priority

As shown in the chart above, it’s not surprising that cybersecurity remains the No. 1 technology priority in 2023. Specifically cloud, cloud native, container and application programming interface security are the main areas of focus. CISOs report there are still holes to plug from the “forced march to digital” during COVID.

Cloud migration still near the top

Cloud migration is still a high priority. Although optimizing cloud spend is definitely a strategy organizations use to cut costs, there’s very little evidence that cloud repatriation – moving workloads back on-premises – is a major cost-cutting trend.

Real-time analytics to hyper-target customers

A trend that is getting more real is real-time analytics so faster and more accurate customer targeting can take place. “Real-time” we sometimes define as “before you lose the customer.”

Despite layoffs, certain roles still hard to fill

On the hiring front, customers tell us they’re still having a hard time finding qualified site reliability engineers, Kubernetes experts and deep analytics pros. These job markets remain tight.

CISOs are making zero trust a thing

We’ve said many times that prior to COVID zero trust was this fuzzy buzzword. Even today, the joke is if you ask three people what is zero trust, you’ll get three different answers. But that’s changing. Ask ChatGPT and you’ll get the following answer, which is generally acceptable:

Zero trust is a security model that assumes that every network entity, whether inside or outside the network perimeter, is untrusted and must be authenticated and authorized before being granted access to network resources.

The truth is that virtually every security company that was resisting taking a position on zero trust – in an attempt to avoid getting caught up in the buzzword vortex – is being forced to go there by CISOs.

Above are some relevant pull quotes on cyber that have come out of the recent conversations we cited upfront.

Zero trust is the highest ROI because it enables business transformation.

ZTA is more than securing the perimeter. It encompasses strong authentication and multiple identity layers. It requires taking a software approach to security instead of a hardware focus.

I’d love to have a security data lake that I could apply to asset management, vulnerability management, incident management, incident response… all aspects of my security team. I see huge promise in that space.

I see natural language processing as the foundation for email security. Instead of searching for IP addresses, you can read emails at light speed and identify phishing threats.

This is a small snapshot of the mindset amongst most CISOs right now. And when you talk to CrowdStrike Holdings Inc., Zscaler Inc., Okta Inc., Palo Alto Networks Inc. and many other security firms, including Amazon Web Services Inc., they’re listening to these narratives and working hard on skating to this vision of a zero-trust architecture.

Data is at the heart of a digital business – but it’s still too complicated

A digital business is a data business. And data is at the core of such a firm. So it’s no surprise that this topic gets a lot of mindshare amongst practitioners. But getting enough value from data is still a challenge for most organizations.

Most companies still put data at the periphery of their business. Or data lives in silos within different business units, different clouds, on-prem and now increasingly at the edge. It seems the problem will get worse before it gets better.

But the acceleration of digital transformation has made monetization initiatives a priority and specifically using data to better target customers and building data products or services that can be monetized. Although it’s early days for most customers, many practitioners with whom we spoke see this as a strategic imperative.

Above and below we cite some instructive comments from our recent conversations:

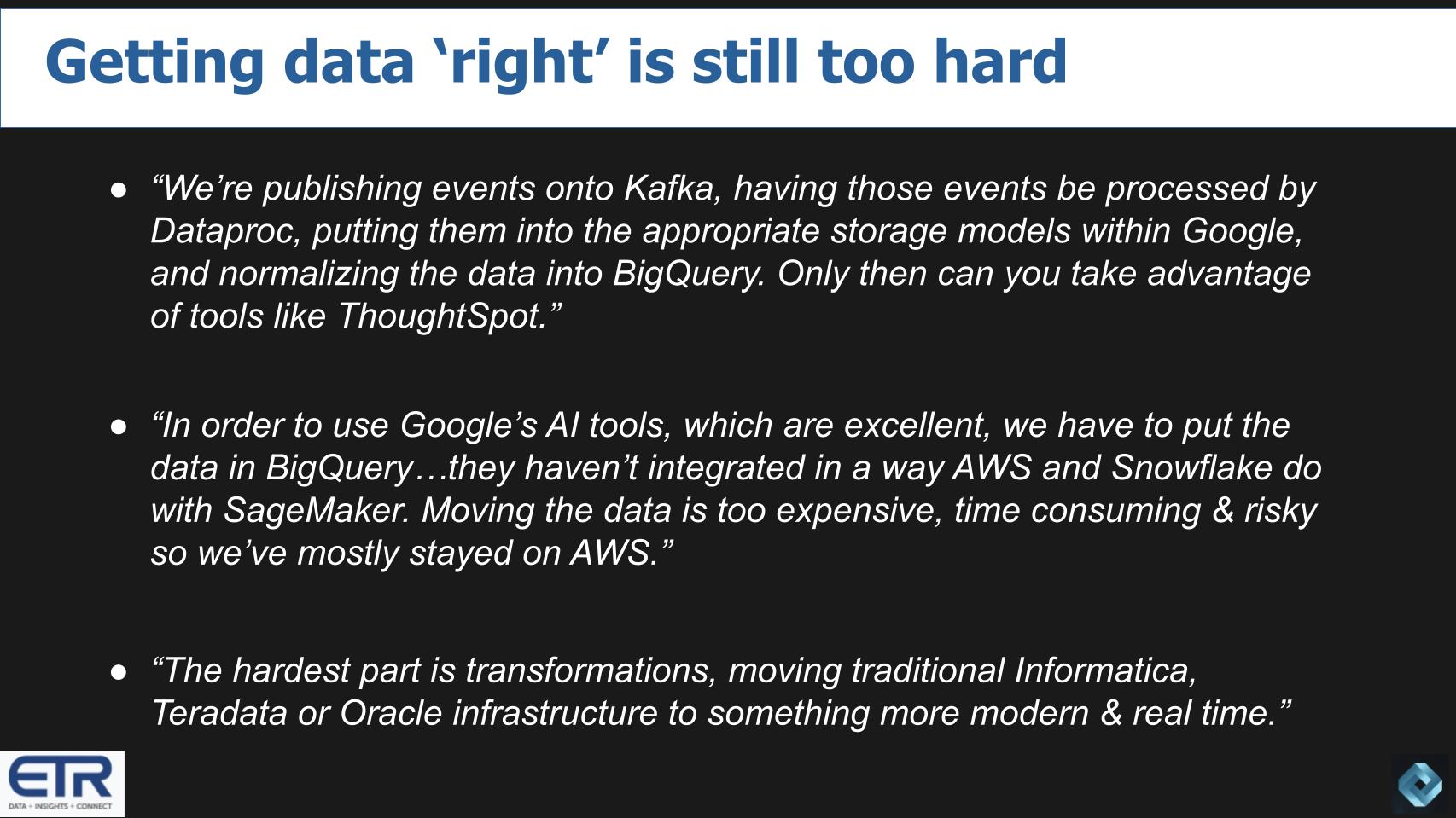

The data pipeline remains complex

We’re publishing events onto Kafka, having those events be processed by Dataproc — putting them into the appropriate storage models within Google, and normalizing the data into BigQuery. Only then can you take advantage of tools like ThoughtSpot.

So here you have a company such as ThoughtSpot Inc., which is all about simplifying and democratizing data, but to get there, you have to go through some pretty complex processes to achieve an outcome.

Google prioritizing BigQuery adoption ahead of ecosystem partnerships

In order to use Google’s AI tools, which are excellent, we have to put the data in BigQuery. They haven’t integrated in a way AWS and Snowflake do with SageMaker. Moving the data is too expensive, time-consuming and risky, so we’ve mostly stayed on AWS.

Data sharing is a supercloud killer app – data monetization is the future

Sharing data is a killer supercloud use case and firms such as Snowflake Inc. appear to be on top of the game. As well, Databricks Inc., while taking a different path, understands the powerful nature of this trend and the importance of ecosystem integrations to make it a reality. But it’s still not pretty across clouds. And Google LLC’s posture seems to be “we’re going to let our database product competitiveness drive the strategy first and the ecosystem integration take a back seat.”

There’s logic behind this posture. Owning the database is critical and Google doesn’t want to capitulate on that front. BigQuery is high quality and competitive. And strategies that prioritize integration work. Apple and Oracle are two examples. However as we’ve said many times, strong ecosystems are the hallmark of a public cloud company.

AWS has figured this out. They’re killing it in database. Take Redshift, for example. It continues to grow, as does Aurora and other data stores. But AWS realizes it can make more money in the long term partnering with the Snowflakes, the Databricks, the MongoDBs, the Couchbases and others of the data platform world versus sub-optimizing their relationships with partners and customers in order to sell more homegrown tools.

Data monetization is the future

Going forward, we believe a big opportunity beyond data sharing is data monetization, data apps that use AI to create outcomes without human involvement. The fundamental fact is that data will remain distributed. Moving data is expensive and hard. Standards to share and join data across clouds will require new standards but will open up new revenue generating opportunities that many firms have on their strategic planning radar.

Is history repeating?

It’s understandable. It’s hard not to feature your own product. IBM Corp. chose OS/2 over Windows and for years attempted to win in PC operating systems. Lotus Development Corp. refused to run on Windows when it first came out and instead supported Digital Equipment Corp.’s VAX/VMS operating system. IBM initially wanted to run its best software only in its cloud. Same with Oracle Corp. VMware Inc. tried to build its own cloud. But eventually, when the market speaks and reveals what seems to be obvious to many years ahead of time, a vendor faces reality and stops wasting money to fight a losing battle.

The trend is your friend, as the saying goes.

Getting rid of stuff: a rare occurrence in IT

The pull quote on data…

The hardest part is transformations – moving traditional Informatica, Teradata or Oracle infrastructure to something more modern and real time.

And that’s why people still run COBOL. In IT we rarely get rid of stuff. Rather, we add on another coat of paint until the wood rots out and roof is going to cave in.

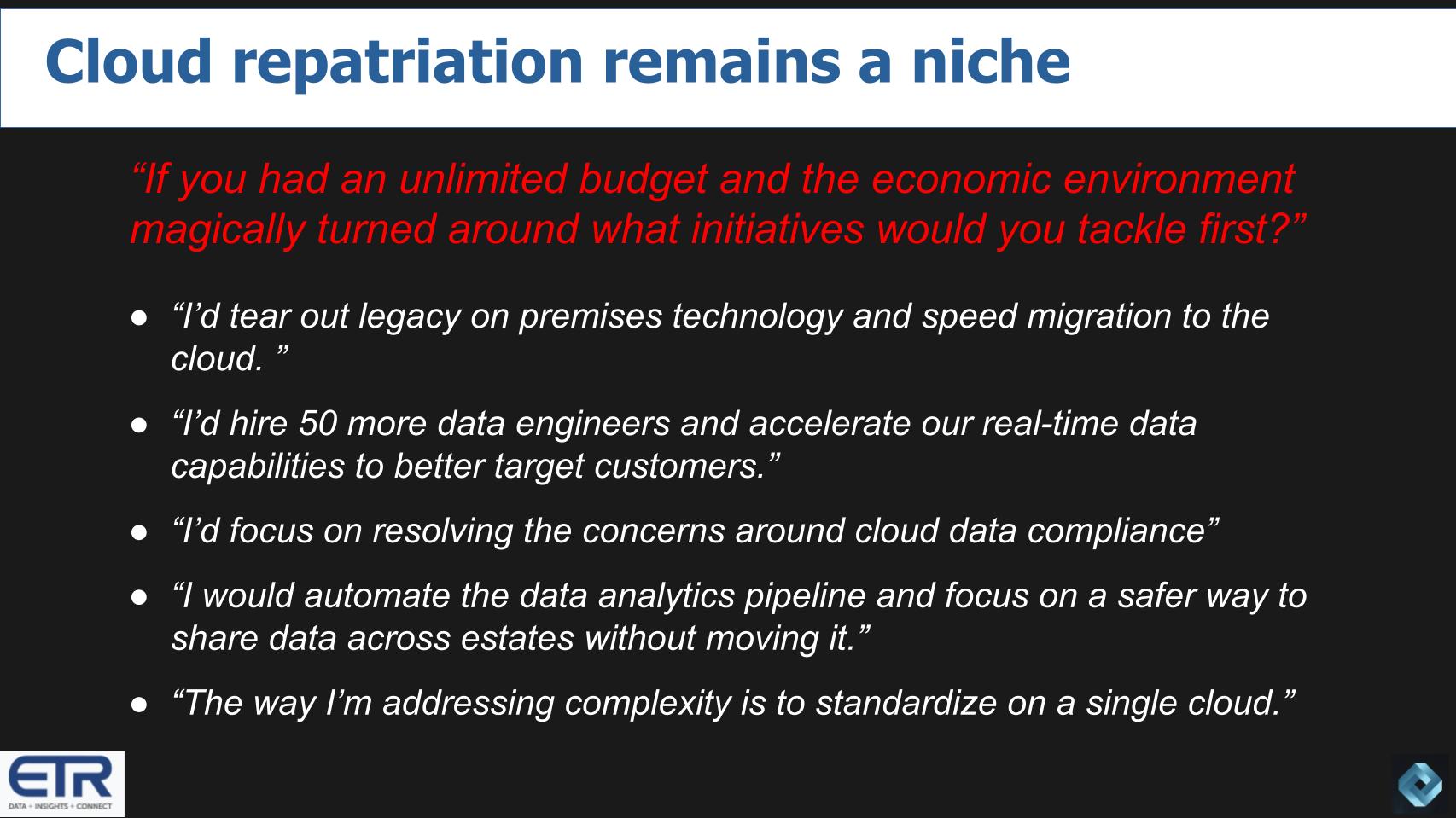

Cloud repatriation still doesn’t show up in the data

The last key findings we want to highlight brings us back to the cloud repatriation myth.

Followers of this program know it’s a real sore spot with us. We’ve heard the stories about repatriation, we’ve read the thoughtful articles from venture capitalists on the subject, we’ve been whispered to by vendors that we should investigate this trend. But the data doesn’t support it.

Here’s the question that was posed to practitioners:

If you had unlimited budget and the economy miraculously flipped, what initiatives would you tackle first?

First answer:

I’d rip out legacy on-prem and move to the cloud even faster.

The thing here is maybe renting infrastructure is more expensive than owning. Maybe. But if I can optimize my rental with better utilization, turn off compute, use things like serverless, get on a steeper silicon curve with Graviton, tap best-of-breed tools that make my business more competitive, move faster, fail faster, experiment more quickly and cheaply — what’s that worth? Even the most “hardo” chief financial officers understand the business benefits far outweigh the possible added cost per gigabyte.

Other interesting comments from practitioners:

I’d hire 50 more data engineers and accelerate our real-time data capabilities to better target customers.

Real-time is becoming a thing. AI being injected into data and apps to make faster decisions – perhaps with less or no human involvement – is on the rise.

Next comment:

I’d focus on resolving the concerns around cloud data compliance.

So again, despite the risks of data being spread out in different clouds, and all the on-prem vendor FUD, organizations realize cloud is a given and they want to find ways to make it work better, not move away from it.

Same thing on the next comment:

I would automate the data analytics pipeline and focus on a safer way to share data across estates without moving it.

And finally…

The way I’m addressing complexity is to standardize on a single cloud.

Monocloud is a viable strategy. We’re hearing this more and more: “Yes, my company has multiple clouds, but in my group we’ve standardized on a single cloud to simplify things.”

We see this as somewhat dangerous because it’s creating more silos and is an opportunity that needs to be addressed. And that’s why we’ve been talking so much about supercloud as a cross-cloud unifying architectural framework. Or perhaps it’s a platform.

Is supercloud an architecture or a platform?

In fact, that’s a question we’ll be exploring later this month at Supercloud2, live from our Palo Alto studios. Is supercloud an architecture or a platform? We’re featuring technologists, analysts and practitioners to explore the intersection between data and cloud and the future of cloud computing.

You don’t want to miss this opportunity so go to supercloud.world and register for free to participate in the event directly.

Keep in touch

Many thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email [email protected], DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at [email protected].

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Image: Worawut

A message from John Furrier, co-founder of SiliconANGLE:

Show your support for our mission by joining our Cube Club and Cube Event Community of experts. Join the community that includes Amazon Web Services and Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger and many more luminaries and experts.

Join Our Community

Click here to join the free and open Startup Showcase event.

We really want to hear from you, and we’re looking forward to seeing you at the event and in theCUBE Club.

Click here to join the free and open Startup Showcase event.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK