Leaked documents show Amazon's seller lending business is booming. But the compa...

source link: https://finance.yahoo.com/news/leaked-documents-show-amazons-seller-183000765.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Leaked documents show Amazon's seller lending business is booming. But the company's economists are worried about defaulters.

Amazon economists expect its seller lending volume to roughly double this year.

Amazon's lending business has rebounded in recent years after scaling back during COVID.

It still expects to tighten the underwriting process as repayment rates are expected to drop.

Amazon is expecting to roughly double its loans to sellers in 2023, though its underwriting process could get more stringent, Insider has learned.

Amazon's lending program is part of a broader business to business payments and lending team, known internally as ABPL. The group also offers other services, like invoice financing to sellers and co-branded credit cards.

The company's economists are forecasting that third-party sellers will owe it over $2 billion over the next year, according to internal document obtained by Insider. That's an over 80% increase from the first quarter of last year's $1.1 billion in outstanding loans. And it's more than double the balance Amazon reported at the end of 2021, when it reached $1.0 billion in total outstanding loans for the first time.

But Amazon plans to tighten its underwriting and credit management policies as it anticipates further macroeconomic headwinds into 2023, the document said. Of the $2 billion-plus outstanding loans projected for this year, Amazon expects a 1.34% loss rate.

"The increased uncertainty of business repayment ability" by sellers "necessitates higher inspection of our on-balance sheet credit/lending products," according to the document.

The potential growth in loans signals a continued rebound of Amazon's lending business. Amazon's invite-only lending program to sellers, which launched in 2011, significantly scaled back during COVID, reducing the total outstanding loan balance to under $400 million at the end of 2020, company filings show.

The lending activity reaccelerated over the past two years, however, and closed the most recent quarter with $1.4 billion on the balance sheet. The documents also said Amazon's lending arm served over 1 million customers and sellers in 2022, reaching a total transaction volume of $50 billion that generated more than $1 billion in "economic profit," the document said. It's unclear how it defines economic profit.

Motley Fool

Motley FoolWhy Amazon Stock Had Trouble Gaining Ground on Wednesday

The e-commerce giant was dubbed a top internet pick by one analyst, while another saw the glass as half empty.

15h ago

Scheme to help young people dig at Vindolanda Roman site opens

Historic England is providing £10,000 to fund 10 places on digs for budding archaeologists.

1d ago Reuters

ReutersAmazon secures $8 billion term loan

The term loan will mature in 364 days, with an option to extend for another 364 days and the proceeds would be used for general corporate purposes. "Given the uncertain macroeconomic environment, over the last few months we have used different financing options to support capital expenditures, debt repayments, acquisitions, and working capital needs," an Amazon spokesperson told Reuters in a statement. Amazon had about $35 billion in cash and cash equivalents and long-term debt of about $59 billion at the end of the third quarter ended Sept. 30.

2d ago Bloomberg

BloombergMicrosoft Sinks as Downgrade Highlights Cloud-Growth Concerns

(Bloomberg) -- Microsoft Corp. shares closed at their lowest level since November after UBS Group AG downgraded the stock, amplifying concern about the company’s cloud-computing business, for years a key driver of revenue.Most Read from BloombergIf You Have Student Loans, Mark These Dates on Your CalendarWhy Conservatives Are Blocking McCarthy as Speaker — and Throwing Congress Into ChaosFed Affirms Inflation Resolve, Pushes Back Against Rate-Cut BetsShopify Tells Employees to Just Say No to Mee

14h ago Yahoo Finance Video

Yahoo Finance VideoConstellation Brands set to report Q3 earnings before Thursday’s opening bell

Yahoo Finance Live’s David Briggs discusses the rise in stock for Constellation Brands ahead of third-quarter earnings.

14h ago American City Business Journals

American City Business JournalsWhat Nvidia announced at CES: Foxconn EV partnership, cloud gaming in cars, graphics cards

Nvidia Corp. on Tuesday announced that Foxconn Technology Group — the Tawain-based company best known for its work with Apple Inc. — will be manufacturing electric vehicles that are based on Nvidia's technology.

20h ago Deadline

DeadlineAmazon CEO Confirms Layoffs Will Surpass 18,000 After Number Leaked By “One Of Our Teammates”

Amazon CEO Andy Jaffy said Wednesday that the company’s recent review will result in the elimination of more than 18,000 jobs, a confirmation came soon after a report earlier in the day in the Wall Street Journal cited the total number of employees impacted by staff reductions that began back in November. “We typically wait […]

9h ago MarketWatch

MarketWatchIt’s time to buy I-bonds again. Here are 3 ways to maximize your $10,000 inflation-fighting investment.

The current rate is good, but if you hold off until just before the next change, it could be even better.

23h ago Yahoo Finance

Yahoo FinanceWhy investors should stop fixating on Apple and Tesla stock in 2023: Morning Brief

What to watch in markets on Thursday, January 5, 2023.

2h ago Motley Fool

Motley Fool2 FAANG Stocks to Buy Hand Over Fist in 2023 and 1 to Avoid Like the Plague

Among Meta Platforms (formerly Facebook), Amazon, Apple, Netflix, and Alphabet (formerly Google), there are two rock-solid buys and one well-known industry leader to avoid.

2h ago Bloomberg

BloombergWall Street’s Top Bear Sees Another Big Down Year for S&P 500

(Bloomberg) -- Equity investors hoping for a reprieve in the new year after a brutal 2022 are likely to be disappointed, according to Michael Kantrowitz at Piper Sandler & Co.Most Read from BloombergIf You Have Student Loans, Mark These Dates on Your CalendarWhy Conservatives Are Blocking McCarthy as Speaker — and Throwing Congress Into ChaosFed Affirms Inflation Resolve, Pushes Back Against Rate-Cut BetsShopify Tells Employees to Just Say No to MeetingsThe strategist, ranked No. 3 in the last y

15h ago Motley Fool

Motley FoolWhy Verizon Rose Today

Shares of telecom giant Verizon (NYSE: VZ) were rising today, up as much as 3.3% before settling into a 2.5% gain on the day. While the markets were broadly positive, Verizon's outsized gains were likely due to its CEO's appearance at a Citigroup telecom and technology conference today, during which CEO Hans Vestberg had positive things to say about the recently concluded fourth quarter. Without giving too many details, Vestberg stated that the company saw positive net additions in the fourth quarter, and that store traffic had increased compared with prior periods.

13h ago TipRanks

TipRanksSeeking at Least 10% Dividend Yield? These 2 ‘Strong Buy’ Dividend Stocks Do the Job

The big market headline last year has been the steady fall in stocks. The S&P 500 tumbled 19% for 2022, and the NASDAQ has fallen a disastrous 33%. And while recent data shows that there may be some hope on the inflation front, there may still be storm clouds massing for this year’s stock market. In times like these, it’s natural to turn to the high-yield dividend payers. These stocks offer the twin advantages of a steady income stream through regular, reliable dividend payments – and dividend y

1d ago Yahoo Finance

Yahoo FinanceFed minutes: No rate cuts in 2023, inflation risk remains in focus

No Fed officials thought it’d be appropriate to begin cutting rates in 2023, as members thought that that price pressures could prove to be more persistent than anticipated with the job market remaining so strong for longer than anticipated, according to internal discussions of Fed officials at their policy meeting three weeks ago.

16h ago TheStreet.com

TheStreet.comMicrosoft Stock: Here's When to Buy the Dip

Microsoft stock is down more than 5% following a downgrade from UBS. Is it a buying opportunity or are still lower prices in store?

19h ago Yahoo Finance Video

Yahoo Finance VideoMicrosoft stock downgraded by UBS amid concerns on Azure cloud unit growth

Yahoo Finance Live breaks down analyst concerns in Microsoft's Azure cloud unit, also commenting on the tech company's partnership with ChatGPT.

15h ago The Wall Street Journal

The Wall Street JournalAmazon Layoffs to Hit Over 18,000 Workers, the Most in Recent Tech Wave

The cuts focused on the company’s corporate staff exceed an earlier projection and represent about 5% of the company’s corporate workforce.

8h ago Barrons.com

Barrons.comBonds Are Back. Here Are the Income-Generating Funds to Buy Now.

After a tough 2022, this could be the year that fixed income is a better bet than stocks. Here’s what some of the experts recommend buying now.

3h ago Bloomberg

BloombergBofA’s Subramanian Echoes Yogi Berra’s Advice of Avoiding Crowds

(Bloomberg) -- Yogi Berra once said of a restaurant that “no one goes there anymore. It’s too crowded.” Bank of America Corp. strategist Savita Subramanian has a similar warning for stock investors.Most Read from BloombergIf You Have Student Loans, Mark These Dates on Your CalendarWhy Conservatives Are Blocking McCarthy as Speaker — and Throwing Congress Into ChaosNew Hedge Fund Soars 163% Betting It’s All Going DownFed Affirms Inflation Resolve, Pushes Back Against Rate-Cut BetsShopify Tells Em

17h ago MarketWatch

MarketWatchEarn $3,500 cash by opening a savings account? The offer is real for the next week — but there are hurdles

For Citi customers with a sizable sum on hand, opening a new savings account can deliver just that — but, of course, not without significant hurdles. Like many bank accounts these days, the Citi® Savings Account comes with the promise of a hefty sign-up bonus — up to $3,500 — for simply opening a new account and “completing required activities.” Chanelle Bessette, banking specialist at NerdWallet, says offerings like these, albeit eye-catching at first glance, show just why it’s critical to read the fine print.

1d ago MoneyWise

MoneyWise'You have to increase your income. It’s a must': A TikToker went viral for explaining why Americans making less than $25/hour 'should be terrified'. Here's how to prove him wrong

You know it's time to be scared when a TikToker says so.

2d ago MarketWatch

MarketWatch‘Am I crazy?’ I’ve paid my fiancée rent for 9 years and spent $10,000 improving her home. She’s also listed on my health insurance. What should I do?

THE MONEYIST Dear Quentin, I have a situation that is causing a lot of issues in my relationship. We have been dating for 17 years, have lived together for close to nine years and have been engaged for six.

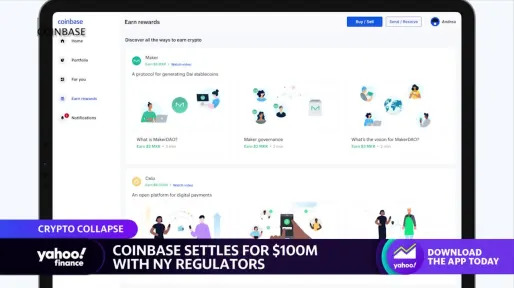

5h ago Yahoo Finance Video

Yahoo Finance VideoCoinbase pays $100 million settlement, FTX’s Robinhood shares under investigation

Yahoo Finance’s David Hollerith joins the Live show to report that Coinbase has reached a $100 million settlement with New York regulators.

14h ago MarketWatch

MarketWatchJeff Bezos may return to helm Amazon, says forecaster of double-digit stock market losses last year

The Dow Jones Industrial Average (DJIA) had a 537-point trading range, even though the blue chip index lost only 11 points by the close. “The S&P 500 will have its worst year since 2008,” said Michael Batnick, managing partner at Ritholtz Wealth Management. Of course, not all his predictions came true — for instance, he said the Fed would end up cutting rates by the end of the year — but still that’s a better track record than many.

15h ago Barrons.com

Barrons.comThese Stocks Are Moving the Most Today: Amazon, Western Digital, Tesla, Walgreens, and More

Amazon is slashing more than 18,000 jobs as it looks to cut costs amid economic uncertainty. Walgreens reports quarterly earnings Thursday.

1h ago Yahoo Finance Video

Yahoo Finance VideoMarkets have been ‘detached from reality for a very long time’ amid Fed rate hikes: Strategist

TheoTrade Chief Market Technician Jeff Bierman joins Yahoo Finance Live to discuss the impact of the Fed's 2023 rate hike outlook on markets

14h ago Motley Fool

Motley FoolMy Top Beaten-Down Growth Stock to Buy in 2023

In my view, one of the most exciting is none other than e-commerce giant Amazon (NASDAQ: AMZN). Amazon lost about half its value in the trailing 12-month period as economic issues affected its operations. AWS usually accounts for the bulk of Amazon's operating and net income, and it boasts much stronger margins than its e-commerce units.

2h ago Motley Fool

Motley FoolCathie Wood Is Buying These Top Growth Stocks -- and Both Could Make You Rich Over Time

In December, shopping was on the agenda for a lot of us, including superstar investor Cathie Wood. Speaking of other programs, CRISPR recently reported positive data from a phase 1 trial of an immuno-oncology candidate.

1d ago Benzinga

BenzingaChinese Startup Nezha Delivered More EVs Than Nio In 2022: Report

Chinese electric car startup Nezha has been grabbing eyeballs after claiming it made 152,000 vehicle deliveries in 2022, surpassing 122,486 deliveries by Nio Inc (NYSE: NIO). Nezha, a brand under startup Hozon Auto, asserted its car deliveries more than doubled in 2022, CNBC reported. The company's best-seller, Nezha V, is priced at 83,900 yuan ($12,000). Whereas Nio's larger SUV's start from the price range of 400,000 yuan. As of July 2022, Nezha had raised nearly 10 billion yuan for its Series

23h ago MarketWatch

MarketWatchAfter Democrats release Trump’s tax returns, CPAs have questions: ‘In order to generate these kinds of losses, you need to be super rich. It’s not a poor man’s game.’

Democrats released six years of Donald Trump’s income-tax returns on Friday, providing further insight into the former president’s tax situation. Trump and his wife, Melania, paid $0 in income taxes for 2020, according to a report released late Tuesday by the congressional Joint Committee on Taxation. The nonpartisan committee’s findings also raised several red flags related to the filings, namely Trump’s carryover losses, loans to his children that may or may not also be considered taxable gifts, and deduction-related tax write-offs.

2d ago MarketWatch

MarketWatchMy husband and I rent our second home to our son and his wife. Now we want him to own this house, but keep our 2.5% mortgage rate. How can we do that?

'Because of the 2.5% rate, none of us are interested in selling the house and getting our rates jacked up to 7%.'

22h ago Motley Fool

Motley FoolA Bull Market Is Coming: 2 Magnificent Growth Stocks Down 79% and 80% to Buy Now

Red-hot inflation threw a wrench into the gears of the global economy last year, causing the S&P 500 to nosedive into a bear market. For instance, Shopify (NYSE: SHOP) and Cloudflare (NYSE: NET) saw their share prices plunge 79% and 80%, respectively, from all-time highs and both stocks currently trade at sizable discounts to their historical valuations. Shopify makes omnichannel commerce easy.

1h ago Motley Fool

Motley Fool3 Reasons to Sell Carnival Stock in 2023

2022 is finally over, closing the chapter on a financially brutal year that sent Carnival (NYSE: CCL) stock down over 60%. The COVID-19 pandemic battered the cruise industry through movement restrictions and a no-sail order that grounded operations for much of 2020 and 2021. Now that the worst of the crisis is over, Carnival benefits from easy comparisons against these prior periods.

20h ago Yahoo Finance

Yahoo FinanceAmazon, Salesforce: When one veteran portfolio manager will feel good about buying battered tech stocks

A longtime equity analyst provides some perspective.

22m ago MarketWatch

MarketWatchInvestors who did this one thing survived the markets in 2022

BRETT ARENDS'S ROI Forget inflation. Forget oil prices. Forget Vladimir Putin’s invasion of Ukraine. Forget layoffs in the tech sector. Forget the yield curve. When I sat down to write about what worked for investors in 2022 and what didn’t, I came to a simple conclusion.

20h ago Yahoo Finance Video

Yahoo Finance VideoSalesforce restructuring sees layoffs in 10% of its staff, reductions in office space

Yahoo Finance Live anchors discuss Salesforce's restructuring initiatives as layoffs continue into the new year for the tech sector.

15h ago TipRanks

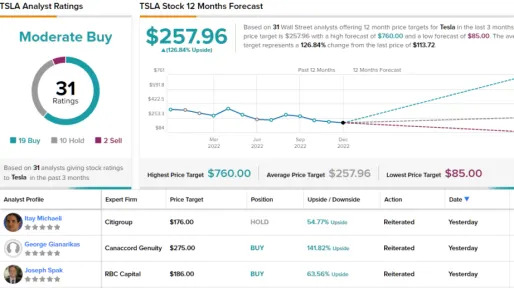

TipRanksThere’s an Opportunity Brewing in Tesla Shares, Says Morgan Stanley

Tesla (TSLA) shares have been on the end of a severe beating in recent times, with the latest meltdown taking place after the EV leader missed delivery estimates for Q4. That has only exacerbated a stock that already badly impacted by CEO Elon Musk’s ongoing Twitter shenanigans. However, according to Morgan Stanley’s Adam Jonas, the stock’s awful showing – down by 42% over the past month – is “driven by EV supply > EV demand for the first time since Covid, exacerbated by technical factors.” Jona

13h ago Motley Fool

Motley Fool5 Top Growth Stocks I'm Buying to Kick Off 2023

After more than a decade of incredible outperformance, growth stocks badly underperformed a falling market in 2022. Many companies that can generate strong sales and profitability look like compelling buys as we kick off 2023, and the five I'm most excited about are Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), ASML Holding (NASDAQ: ASML), Crocs (NASDAQ: CROX), Fortinet (NASDAQ: FTNT), and Lululemon Athletica (NASDAQ: LULU).

23h ago Investor's Business Daily

Investor's Business DailyDow Jones Futures: Stocks Rise, Microsoft Tumbles; Beware Doing This

Futures fell overnight. Stocks rose Wednesday despite a Microsoft sell-off. Be wary of buying stocks on the first "blip" of strength.

8m ago TheStreet.com

TheStreet.comCathie Wood Watch: Ark Dives Further Into Tesla

Production issues, delivery problems and signs of slowing demand have weighed on the electric car giant.

17h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK