Helping to make an ATM for children — inclusive of accessibility and usability w...

source link: https://uxplanet.org/helping-to-make-an-atm-for-children-inclusive-of-accessibility-and-usability-with-a-research-5181cc1aa5cd

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Helping to make an ATM for children — inclusive of accessibility and usability with a Research Plan for Concept Testing a New Product.

In terms of traditional banking, markets have always been for adults. Parents managing their children’s accounts on their behalf using traditional banking are the competition.

Parents want to start teaching their children about money management and saving at an early age. They’re also concerned that they’ll forget to give their kids an allowance from time to time, and they’d like an automatic system to help them with this. The ATM also provides a chance for children to create savings goals for items they desire.

The ATM helps create habits around positive independent money management for the child and helps the parent keep track of their children’s spending and saving habits. Include money as well. The choice to innovate new-to-the-world products must be made while considering the bank’s value-added methods and analyzing consumer attitudes as well as industry economic developments.

This was an interesting environment; here’s how I planned my next steps:

Empathize, Define, Ideate, Design

Part 1: Empathize

An automated teller machine (ATM) is a type of electronic banking terminal that allows users to conduct basic transactions without the assistance of a teller.

In a nutshell, what does an ATM do for its user?

Fundamentally: Get money while on the go.

Metaphorically: it gives you access to things and experiences.

‘Why have an ATM for a child?’

Parents want to start teaching their children about money management and saving at an early age. They’re also concerned that they’ll forget to give their kids an allowance from time to time, and they’d like an automatic system to help them with this. The ATM also provides a chance for children to create savings goals for items they desire.

‘What makes a child use an ATM?’

- Withdraw or deposit funds

- Begin your journey toward financial literacy.

- Consider it a piggy bank for goal-based savings.

- Make positive, independent money management a habit.

- For the novelty of feeling ‘grown up’

- To have a central location to save/deposit their money from chores, birthdays, and so on.

- To save money for anything, from candy to dance lessons, and so on.

- To withdraw cash for snacks, special occasions, and so on.

- Parents can keep track of their spending and saving habits, as well as add funds.

‘How may a child use an ATM?’

- Scan of the face

- Touch ID

- If transaction-based authentication is used, a four-digit pin could be used.

- Deposit and withdraw tray

- Audio and voice commands

Part 2: Define

‘What issue are we attempting to resolve?’

Making an ATM simple enough for children to understand how it works.

Attempting to educate the child with as few interactions as possible for financial reasons, such as:

1. Learn basic math skills

2. Understand how saving works

3. Establish financial responsibility

4. Saving with a purpose

How can we give children easy and engaging access to their money while also ensuring their safety?

‘How are we measuring success?’

- How frequently is a task completed successfully?

- How long did it take to complete a task?

- How frequently did you require assistance to complete a task?

- How many errors were there?

- How often did they give up in the middle of a task?

- How engaged or frustrated did they feel while performing a task?

Here are a few things I considered before moving forward to ideating..

Part 3: Ideate

The mood at the ATM:

What will the ATM for kids look like?

- Making an ATM simple enough for children to understand its functions, for use cases such as securely withdrawing money, depositing money, and creating and saving up for a goal.

- An immersive UX+UI+Voice interaction that allows children to access their money in a simple and engaging way while ensuring their safety.

- Use AI integration to create an avatar of the child and a mascot for the child to interact with.

- Allow parents to set a monthly/weekly/daily allowance for their child’s account using a banking app, as well as track their transactions.

- This ATM is shorter in height and has a touch display, a touch ID pane, a face scanner, a child-friendly user interface with multiple language options, a coin deposit, and withdrawal slot, and a cash withdrawal and deposit slot, as well as Fancy ATM Cards. It also has a microphone and a camera for voice recognition and remote assistance.

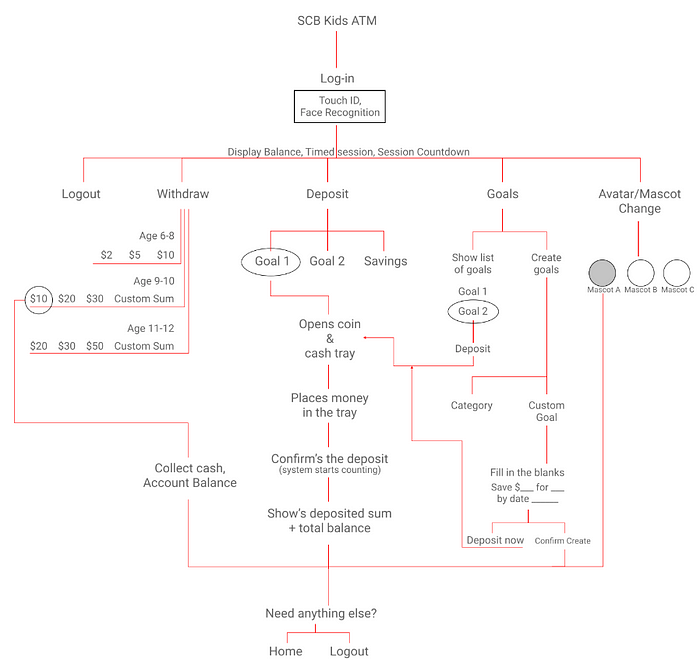

Information Architecture

Strategy: Different features/versions for different age groups

There will be three different feature bundles for children of various ages:

- ‘Basic’ version UI for children aged 6–8 who have little to no financial understanding or math skills.

- ‘Intermediate’ version UI for children aged 9–10, who have better financial understanding and math skills than the previous group.

- ‘Advanced’ version UI for children aged 11 to 12, who have greater financial understanding and math skills.

So, what changes for these age groups:

Financial terminology for various age groups, beginning with simple/easy terms for ages 6 to 8, progressing to full disclosure as the age increases.

There are zero to a handful (maybe) of ATMs for children today, no money management for children, and no emergency money access for children. Parents are unable to manage and track their children’s allowance.

This ATM for Kids aims to provide financial support and financial knowledge to children while keeping it engaging through gamification, gifting, and reward systems, which in turn motivates the child to save with a goal in mind.

Avatar/Mascot illustration (one of 1000 possibilities)

The avatar used here is a cat. For kids, poems, rhymes, and cartoons are common. And one of the most common animals they usually come across is a cat! So, yeah, something a child using an ATM would recognize!

Trying to materialize the idea by...

Questionnaire to parents: It could be circulated at schools, malls, play homes, popular QSR restaurants, tuition, via email, telephone, and via links.

Element 1 — Intent: How interested/willing are you to expose your children to the above-mentioned product, which aims to provide children with financial literacy and a parent with pocket-money management?

Possible Answers: Definitely yes; Probably yes; Maybe, maybe not. Unlikely; Definitely not

Element 2 — Frequency: How frequently do you want your child (whose money management will be controlled by their parent) to use the ATM?

I do not want my child to use the ATM for Kids.

Options: Daily, weekly, bimonthly, and monthly

Element 3 — Believability: Do you believe the product will provide your children with good financial literacy?

Options: Strongly agree, Agree, Neutral, Disagree, and Strongly disagree are the available options.

Research synthesis!

If the responses to "Intent of purchase’ is near or more than 40% on ‘Option 1 — Definitely yes’ and/or maximum on ‘Option 2 — Probably yes’:

This would help me understand that there is traction for the needs presented in the value proposition, which will propagate a motive to develop a hardware prototype and narrow down on features.

If the "frequency of purchase" responses are near or greater than 40% for "Option 3—weekly" or/and maximum for "Option 4—twice a month,"

This would help me understand where the ‘ATM for Kids’ should be located at. Probably places like schools, malls, popular restaurants, and hostels.

If the responses to the ‘Believability’ is near or more than 40% to ‘Option 1- Strongly agree’ or/and maximum to ‘Option 2 — agree’:

this would make me confident of introducing not just the educational aspect but also re-imagine the interaction with the ATM Kiosk with ideas like AI Avatars of children and ATM Bank Mascot which will help in brand building of the bank, and go beyond depositing or withdrawing money.

Part 4: Design

The ATM Hardware. ATM silos are to be height-adjustable.

Flow 1: ATM Log-in

Children may log in with their ATM cards, Touch IDs, or even via face scan.

Home screen 1

Home screen 2

Home screen 3

End of flow 1, children have logged in.

Flow #2: Withdraw Money

Joey, 6 year old is at his school and needs cash to buy lunch.

He finds the SCB ATM at his school.

End of Flow 2!

Flow 2, extras!

Flow #3: Deposit Money

Kirby is a 9-year-old girl, she has been gifted some cash on her

birthday by her grandparents.

Kirby wants to deposit money to save for her bicycle.

Kirby has logged in using face recognition.

End of Flow 3!

Flow #4: Create a Goal

George is a 12-year-old kid, he wants to create a new goal.

He wants to buy the new iPad mini.

Goerge has logged in using Touch ID and now is at his home screen.

End of Flow 4!

I believe the ATM helps children develop positive money management habits and helps parents keep track of their children’s spending and saving habits. Include monetary value as well. I hope you liked my exploration of having an ATM for children. This is something that I did in my free time, and it was an interesting experience.

Thoughts, suggestions, feedback: feel free to write to me: @[email protected]

Let’s get in touch: https://www.linkedin.com/in/radhakrishnaaekbote/

Thank you!

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK