Why Paradigm Was Wrong: How rETH Will Flip stETH(2)

source link: https://www.tuoniaox.com/news/p-553853.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

摘要:

When that day comes, the decentralization and security of rETH will push it into the bedrock of DeFi.

5 - A New Challenger Arrives

The history between Lido and Rocket Pool is well established by this point. However, the LSD ecosystem is rapidly expanding and a new generation of participants is hot on the heels of stETH and rETH. In this section, I will break down the other major LSD tokens that I think will fight for large chunks of the total stake. These tokens (cbETH, frxETH, and osETH) all exemplify different approaches to staking and have their own faults. I conclude by pointing the critical eye inwards and discussing areas Rocket Pool could improve in.

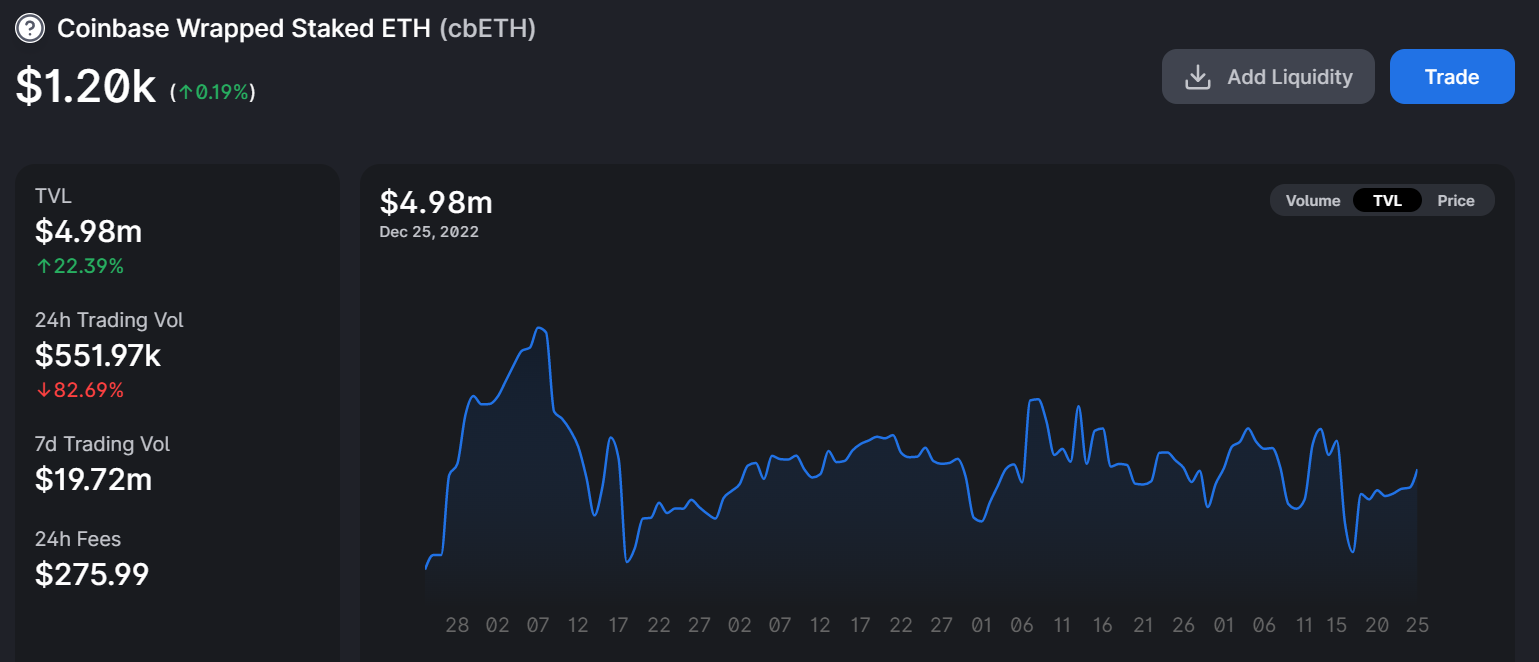

The Drain of cbETH

Hasu and Georgios argue that the domination of centralized exchanges (CEXs) in the Ethereum staking market can only be avoided if a competitor focuses on rapid scaling. Lido has interpreted this to mean prioritizing growth over decentralization. But curiously, the release of Coinbase’s cbETH LSD has actually provided a helpful demonstration of how, in the absence of incentives, market participants will gravitate to the most decentralized option. Currently, cbETH is used primarily on Uniswap. Approximately $6 million is locked in the cbETH/ETH 0.3% and 0.05% pools, a reflection of the low daily volumes since cbETH has a total value many orders of magnitude greater than this TVL. Uniswap is staunchly permissionless and easy to use so it is logical that this is where most cbETH has ended up. Outside of Uniswap, adoption has been poor. Curve, the dApp where stETH is most dominant, used to only have a few hundred cbETH in its cbETH/ETH pool. It has since grown to a still meager 2000 ETH TVL with the help of some incentives from the Curve protocol. This shows that without a strong liquidity incentivization campaign or a supportive public ethos, tokens do not naturally gain deep liquidity.

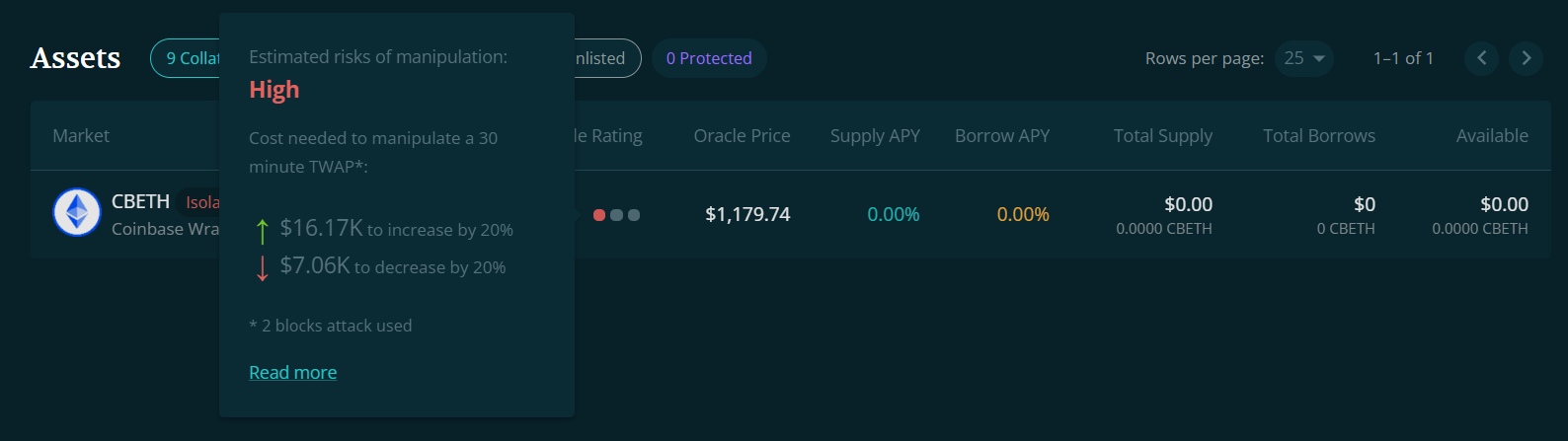

The general illiquidity of cbETH has a myriad of effects. It has made impossible the safe use of cbETH in lending platforms like Euler, Maker, or Aave. The image below is taken from Euler’s frontend. It shows that cbETH would depend on a very insecure Uniswap v3 TWAP oracle. This oracle is easily attacked and any debt positions built around cbETH could be liquidated by malicious actors. A robust oracle, like one provided by Chainlink, requires high volume across multiple CEXs or DEXs. Further, lending platforms that want to be able to safely liquidate positions require tokens that have a large amount of inactive liquidity. The Curve stETH/ETH pool is the best example of this. The pool has several billions USD worth of liquidity but only sees some 10s of millions USD in trade daily. The excess buffer is useful in blackswan events when large amounts have to be sold, like during the 3AC capitulation.

As mentioned previously, illiquidity and the depressed prices that result, can trap holders and prevent them from selling. Those that do sell are likely selling to arbitrageurs as there are no productive uses for cbETH and competitors are higher earning. Currently, 1inch, a popular DEX aggregator, shows that only 2000 cbETH can be sold for ETH before incurring 1% slippage. The same transaction would only have 0.4% slippage for rETH. With limited yield opportunities and liquidity, most cbETH buyers on uniswap are likely holding the token for the arbitrage that will be available post-withdrawals. Thus, a pipeline is being constructed.

Over time, existing or new Coinbase users will at some point want to exit their positions to cbETH. This could be due to ETH price collapse or a desire to explore DeFi. Both of these users will quickly realize that their best bet is to sell their cbETH to an arbitrageur. More and more cbETH will end up purchased with the explicit purpose of being burned. This huge cohort of buyers has no need for DeFi integrations and so are happy to sit on their illiquid cbETH that they bought at a discount and accumulate until withdrawals create a pathway for any LSD to be converted into ETH on peg. There will not be a reshuffling between small holders and big whales like the ecosystem saw with stETH during the 3AC crisis. There will be a unidirectional current pulling cbETH rapidly towards the burn address.

Consider the wallet 0x7f507739b6242B048Be9185cf462BE816b8eFf1f, which has accumulated 1% of all circulating cbETH. This wallet has slowly migrated from wstETH to cbETH to buoy the token and consolidate for withdrawals. The owner is taking a risk, of course. There is a possibility that Coinbase will see the writing on the wallet and try to stop the damage. Instead of allowing these sleuthy cbETH whales from mass exiting, which would greatly hurt Coinbase’s cash flow, Coinbase may limit or even block cbETH redemptions. Such a move, exceedingly unlikely as it may it be, would have devastating effects on the cbETH/ETH peg as all confidence is lost. A bank run scenario may become possible. This is the gamble of engaging in the opaque world of CeDeFi.

In conclusion, though it may seem scary to see how quickly cbETH supply has grown, it does not represent an existential threat to DeFi. In fact, DeFi has roundly rejected cbETH and, if what I believe is correct, DeFi is playing Coinbase into a long con – slowly accumulating cbETH to drain away Coinbase’s stake after withdrawals. The course of this grand arbitrage has sucked away liquidity, crippling any hope cbETH had of gaining DeFi adoption. Unless Coinbase makes an active stance to promote the DeFi usage of cbETH, it appears that DeFi will remain the battlegrounds of Lido and Rocket Pool.

frxETH - Liquidity vs Design

One of the most recent entrants to the LSD landscape is frxETH from the FRAX ecosystem. FRAX, a stablecoin, came to prominence through the FRAX DAO’s aggressive acquisition and use of liquidity-directing tokens (veCRV/vlCVX). The DAO attracts users to mint their stablecoin by creating profitable liquidity provision strategies for FRAX holders through the voting power of their DAO tokens. This model has clear merits. Pre-withdrawals, all major LSD tokens have to create liquidity and usually pay to rent it. By owning these liquidity-directing tokens, FRAX sets itself up to avoid the capital expenses incurred by competitors such as Lido. Since FRAX has had such great success with this model for stablecoins, the DAO has decided to venture into a new kind of stable, an LSD pegged to ETH.

The frxETH tokenomics are unique in the world of LSDs. Most tokens either rebase for rewards (stETH) or passively increase in value (rETH). FRAX went a different route. The frxETH token itself does not accrue any staking rewards. In order for token holders to access the APR earned by the ETH locked in validators, users must deposit the frxETH token into a staking vault. All the rewards earned by the protocol’s staked ETH, minus fees, are then distributed to whatever users staked in that vault. Any users holding frxETH, not staking in the vault, will receive no rewards. Users are forced with a choice - either pursue yields in DeFi with frxETH or earn staking rewards in the vault.

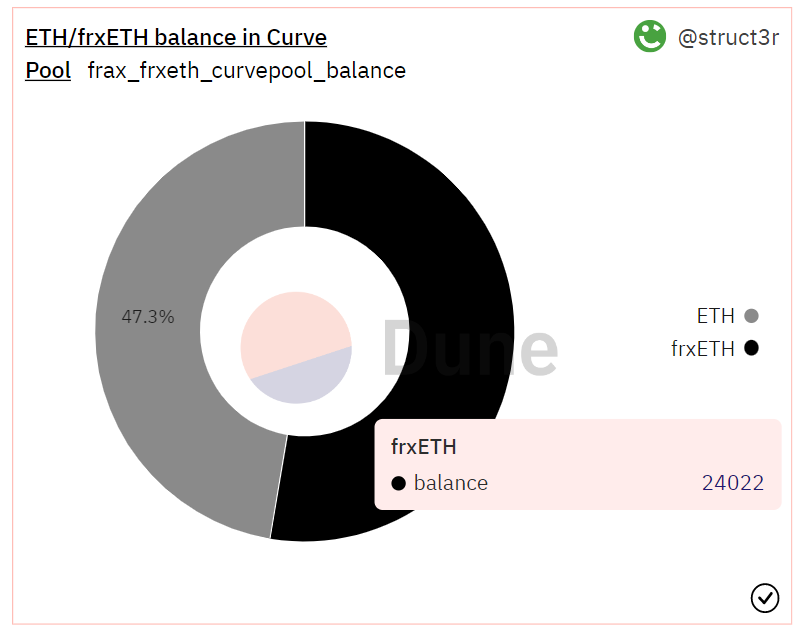

The goal here is valiant. This binary option will force the staked frxETH APR to be higher than any other LSD token simply because the DAO is pitting its own LPs against its own stakers. If the APR to LP in the Curve pool, the current main DeFi integration, was a hypothetical 20% while the staking vault reflected a 7% APR then users are likely to naturally migrate out of the vault and into the Curve pool. At equilibrium, the APR of the leading DeFi frxETH integration should come close to parity with the staked frxETH return, potentially over 10%. In theory, holders of other LSD tokens would see this yield and convert.

Now the catch. First off, this model is counterintuitive to some core DeFi principles, namely those of capital efficiency and composability. This model is purposefully not capital efficient. FRAX could have incentivized a yield-bearing token such that the liquidity providers earn LP rewards along with the staking rewards. By forcing users to choose one or the other, the cost ends up being higher. Take for example a long-term hypothetical where the staked frxETH token is yielding 9% while the frxETH token in Curve earns 11%. The Curve liquidity providers would not provide liquidity unless the incentives beat out the staking rate, otherwise, they would migrate to the staking pool. This has to be paid for - either in incentives or by directing liquidity. The cost of paying LPs in this example to maintain the same level of liquidity would likely be dropped by ~30% since the Curve pool could have been 14% APR (assuming an 6% ETH rewards rate) had those ETH rewards not been redirected. As the TVL in the ecosystem builds, the cost savings become more and more important.

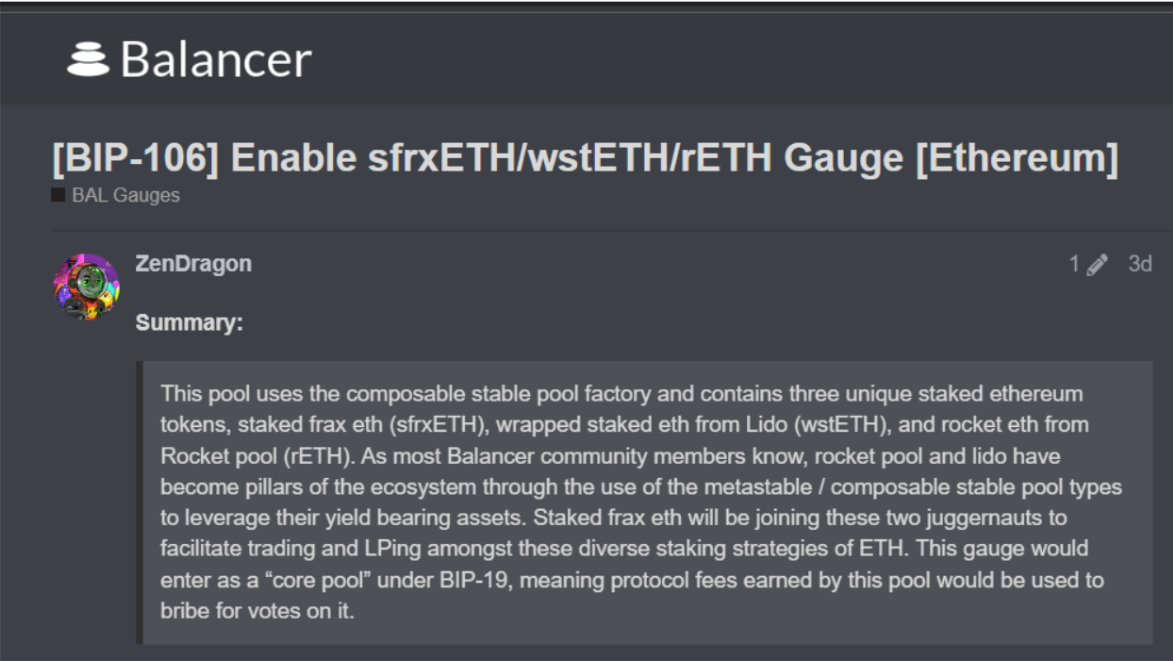

Another confusing element to frxETH is that the staking vault is a liquid token, sfrxETH. The FRAX DAO is currently choosing only to incentivize the frxETH pool. Ostensibly, savvy DeFi buildoors will want to integrate sfrxETH as the actual ETH reward-bearing token. This will put FRAX in a similar situation to the one Lido faces in trying to migrate liquidity from the stETH token to the wstETH token. Having to support an ecosystem of two tokens is going to be more expensive than just one. As discussed earlier, financing liquidity for a top tier LSD can cost millions of USD/month. As such, even though FRAX is starting with a large capacity to incentivize liquidity, it is doing so on an inherently less capital-efficient system. For a stablecoin provider, this is worrying for a second reason.

The costs of incentivizing frxETH are twofold. First, it is capital inefficient compared to other LSD tokens in order to create a facade of higher APRs (LSD APRs when including their DeFi strategies ought to be even with or higher than staked frxETH). Second, and more importantly for FRAX, liquidity tokens used to incentivize frxETH cannot be used to incentivize the FRAX stablecoin that underpins the whole FRAX ecosystem. By shifting incentives from FRAX base pairs towards frxETH pairings, the strength of FRAX is weakened. Liquidity is a zero-sum game and FRAX are using the liquidity power they have on an inefficient schema.

In the post-withdrawal world, the liquidity-directing tokens that FRAX has accumulated suddenly will become much less valuable for LSD tokens. The exit queue will enable large orders to navigate outside the open market without damaging the LSD peg. Thus, FRAX will have lost its major edge in the LSD token wars. At this point, FRAX’s position as a very centralized staking provider will come into focus. Currently, the FRAX team runs all of the validators and there are no concrete plans to decentralize.

Shadowy Super Stakewisers

The most difficult LSD to analyze is one that currently does not exist – osETH. Stakewise is a staking service that currently operates with a permissioned set of nodes and a two token model. This is being completely redone for Stakewise v3, slated to launch sometime in 2023. In this release, Stakewise is challenging Rocket Pool’s dominant position over solo node operators by becoming permissionless. Users will be able to spin up validators and mint osETH against said validators in a fashion reminiscent of loan-to-value calculations. Many of the fine details about osETH have not been released and so this section should largely be taken as conjecture.

The Stakewise v3 platform will allow individualized debt markets. The benefit of this structure is that risk can be managed on a case by case basis and so the previously lacking insurance cover provided by Stakewise may improve. Further, depending on the ratio for LTV that Stakewise allows, it may be possible to start running a validator with as little as 4-8 ETH. However, many difficulties lie ahead for the Stakewise team.

The elephant in the room is that the SWISE team will have to migrate all their liquidity from sETH2 and rETH2 into a single token – osETH. A complete rebrand and tokenomic redesign is a costly venture that will force them to start over on integrations. DeFi governance is slow and this can be a time-consuming process. Another issue is that Stakewise is going to hope for a strong migration of solo stakers. This cohort, however, is notoriously risk-averse. Rocket Pool node operator registration is a good proxy of this, as the period following launch did not see a surge in registrations. Many solo ETH stakers will likely want to see mainnet resilience without any hacks before trusting funds to the protocol. It may be the case that most of the osETH supply is minted by Staking as a Service providers using Stakewise. However, it is not clear how these StaaS groups will draw demand.

Concerns also remain around the reward schema. MEV stealing is a problem that has driven much of Rocket Pool’s insurance discussions. It is unclear how Stakewise will account for this issue in extreme LTV vaults. If they do solve this issue, they will provide a compelling alternative to Rocket Pool in the permissionless staking ecosystem.

Reflections of a Rocketeer

The Ethereum ecosystem participants will ultimately be the ones to decide which LSD deserves to scale. In the pursuit of intellectual honesty, I will now explore some legitimate criticisms of the Rocket Pool protocol in the hopes of spurring even better iterations.

One of the earliest criticisms of the protocol was that Rocket Pool is an attack vector on Ethereum consensus. Any agent that wanted to attack Ethereum’s consensus broadly could double their attacking power by launching Rocket Pool mini pools instead of solo validators. With LEB8s this vector is further amplified. One limitation of this issue is that minipools can only be launched if there is ETH in the deposit pool. For this attack to play out, two difficult conditions must be met. Primarily, this attack would require a long period of time to execute as the deposit pool would have to be repeatedly filled. It would additionally require that Rocket Pool scale well past the previously-discussed caps. As such, this criticism, while true, is unlikely to be relevant.

A criticism that I’ve dealt with in detail now is that Rocket Pool is capital inefficient, cannot scale, and has distasteful tokenomics that require exposure to RPL. As discussed in section 4, rETH has a clear pathway to scaling up into the millions of ETH staked with planned, iterative upgrades. These will include a design overhaul that would allow users to enter with only ETH or only RPL exposure.

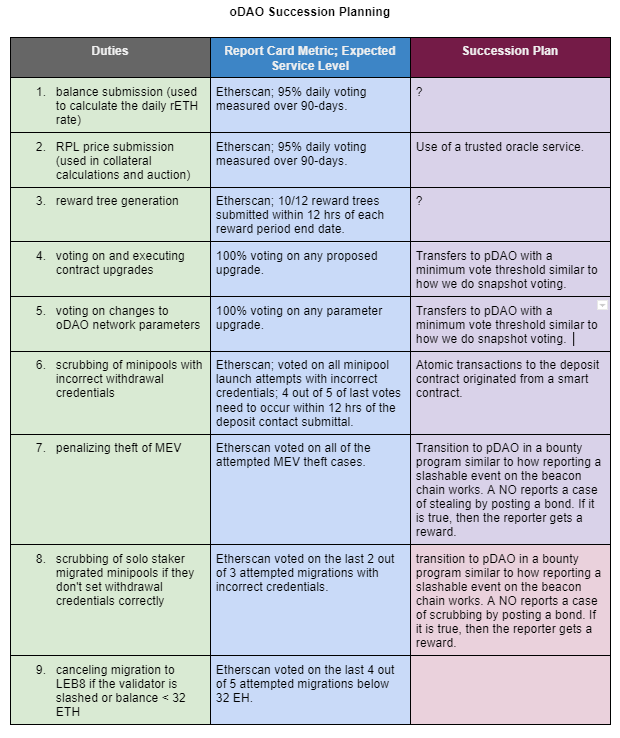

There is significant discourse about reducing reliance on the core developer team and the oDAO. Currently, the majority of the team lives in Australia. Further, a majority of the oDAO resides in the US or EU. Both the core team and the oDAO have the power to wreak havoc on the protocol if corrupted and so the transition away from them is of paramount concern. The oDAO cannot be dissolved until certain changes are made in the core Ethereum spec such as better communication between the execution and consensus layers. The community is already brainstorming ways to migrate all of the oDAO duties to the decentralized protocol DAO, as shown in the table below.

Another criticism of Rocket Pool’s governance is that node registrations are not sybil resistant, meaning one person could register multiple nodes. Currently, voting is done based on the quadratic root of effective RPL staked per node. A malicious agent could spin up many nodes and launch one mini pool on each in order to maximize their voting power in future votes. Such an attack has not yet been discovered, however, it may be hard to notice until after a vote has been compromised. As such, discussions have been ongoing about moving towards a linear scaling method until a more robust sybil mechanism is introduced.

https://dao.rocketpool.net/t/proposal-switch-to-linear-voting-power-to-resist-attackers/1213

Additionally, rETH holders lack a say in Rocket Pool governance. It is possible to become a delegate without being a node operator and champion rETH, however, the tables are stacked against this type of behavior. While the best governance is no governance, until that is possible, rETH interests should be represented more.

A pessimistic view of Rocket Pool is that it is introducing a huge swath of people to node operations who have no business being node operators. Champions of professional staking sometimes see hobbyists as irrational. By lowering the barrier to entry, some would argue that we increase the risk to Ethereum by increasing the number of node operators who do not know what to do when things go wrong. The Rocket Pool Smart Node makes set-up incredibly straightforward. This ease of entry can be worrying to staking professionals because it allows people who have never run servers to now protect Ethereum.

Keeping the network resilient despite the ease of access desired is a challenge that Rocket Pool is happily taking on. Even a complete novice can set up and effectively run a full node with the support of the Rocket Pool guides and community. The Rocket Pool Discord server is one of the most active in the ecosystem as a bastion of full-time node support and Ethereum knowledge. Additionally, the Rescue Node will reduce the impact of user error so the network does not suffer. DVT in time will only accelerate this process.

Further, I find this criticism resoundingly anti-Ethereum. The long-term vision of Ethereum idealizes a world in which millions of light client nodes running on personal devices all contribute to the network. In this world, the barrier to entry must be incredibly low. Do not listen to the staking professionals – Ethereum staking will (and should!) only get easier while maintaining utmost security.

Extreme security aficionados may have reservations about Rocket Pool. Currently, a limitation of the smart node is that it cannot be used on an air-gapped device for key generation. Further, there is always inherently more risk to Rocket Pool as an additional set of smart contracts over and above the Ethereum deposit contract – however, this same risk exists for all LSDs.

Lastly, there is the attack that Rocket Pool is fighting a pointless fight. This cohort might argue that the hard work Rocket Pool has put into creating a highly tail-risk resilient LSD is moot because stakers only care about chasing yield. I believe this criticism paints the multi-billion dollar LSD ecosystem in an uncharitable light. For this thesis to be true, either the value of risk must approach zero or investors are in for a rude awakening. The former case is hard to imagine in the near future – there are too many avenues of risk to solve in any LSD. If the latter is true, that investors are casting a blind eye towards the ever-growing risks presented by more centralized LSDs, then it will likely be by their own painful realizations that risk gains value once more. As long as there are traders over-leveraging insecure products, there will be events that punish the yield seekers and reward the cautious. If the LSD ecosystem is to mature into the next-generation bond market, risk must be incredibly relevant to value.

6 - The Underappreciated Art of Counterparty Tokenomics

Lastly, I want to touch on the broader tokenomics around LSDs. There is an important tension that exists between the protocol utility/governance token (LDO, RPL, SWISE) and the LSD token itself (stETH, rETH, sETH2). This tension is ignored by most protocols, but is fundamental to a sustainable staking protocol. All staking protocols are two-sided ventures; most simply opt to centralize one of the sides. I will discuss LDO’s fee switch and RPL’s collateral system.

As a means of deriving sustainable value, the fee switch is insignificant and will perpetuate the dangerous elements of LDO governance. Practically, the fee switch is soft capped at 5% of staking returns, since the other 5% has been guaranteed towards the elite node operator set. This already hints at the problem as a small core group of operators is due the same rewards as the entire DAO. There is an inefficient alignment as the node operators seem to be extracting too much value. For that 5% to be worthwhile, LDO will have to be at a maximum of one-twentieth (1/20) of the market cap of stETH, and not deviate. If LDO/ETH drops, your existing LDO stake will be worth less. If LDO/ETH increases, your stake will be worth more, but the rewards will be a smaller percent gain. In the vast majority of cases, it appears that holding stETH would be more rational for token holders because of this hard cap on potential fee earning. There is no unique value added, other than freely accessible governance, to LDO.

In the fee switch design, the protocol token acts as a pure rent extraction mechanism and does not serve to align incentives. This has already become problematic as greed pushes DAO governances to distribute fees irrationally. This perhaps is already taking place as LDO has capped its insurance pool and opted to redirect those funds toward the treasury. This is not a diversion for direct rent extraction, however, it is emblematic of the type of behavior that simple structure DAOs tend towards.

The Rocket Pool design does respect the tension between the protocol token holders and LSD token holders. Node operators are required to post RPL bonds in order to service the rETH demand and spin up minipools. This enables both a permissionless node operator set and ties the growth of rETH to RPL. There is no protocol treasury nor protocol commission so there is no impulse towards rent extraction broadly. Further, Rocket Pool recognizes that governance ought not to be open, as the desires of rETH holders require protocol alignment to be maintained. Thus, only RPL that is staked as a bond can be used in governance. This RPL does have a unique value add as both a license to collect commission and as collateral in case of a severe loss. This protocol alignment and lack of an extraction mechanism on top of a more capital-efficient system make the RPL system far more conducive to long-term survival.

7 - Conclusion:

The team behind Lido served an important role. The research Paradigm presented suggested that whatever entity was able to quickly and efficiently capitalize on liquid ETH staking would become wildly dominant. If the choice was either Lido exists or all Lido's ETH was split between Coinbase, Kraken, and Binance then clearly Lido's existence was net good. However, it is no longer the early days of the Beacon chain. The utility that Lido's stETH has offered to the ecosystem has peaked and now it is time to transition towards Rocket Pool and competitors. The actions that Lido took to maximize growth were all one-time affairs and will soon be rendered obsolete.

In this paper, I began with an overview of the liquid staking ecosystem. In it, I described the near monopoly Lido has on the LSD market and how it extended beyond just a power law dynamic. The natural balance of power had been manipulated by Lido’s liquidity incentive campaign, one of the largest in all of DeFi. However, the golden age of Lido is over now as both the power of these incentives and the gap in DeFi are diminishing. I make the bold claim that rETH will flip stETH's market share and begin to outline the social and economic reasons for believing so.

In the social world, stETH has already hit critical mass and attracted the ire of core ETH developers. I present 4 major arguments; the system is governance attackable, the fee distributions are volatile, the DAO and its operators are multichain, and the validator registry remains a powerful and centralized carrot/stick. In terms of economics, I detailed the rETH and stETH peg histories as a means of understanding the market implied risk. This risk I then break down into execution risk, centralization risk, and tail risk. The major point of this section is that rETH is engineered to be resistant in extreme scenarios which is the ideal trait for a base layer asset.

After presenting these stETH headwinds / rETH tailwinds, I give my projection for how the shift in power will proceed. Major accelerants will be full rETH DeFi integration, a major CEX/Lido slashing event, enabling of withdrawals, and reducing collateral requirements. The post-withdrawal era will see Lido’s greatest asset, its powerful liquidity mining campaign, become nerfed as the exit queue reduces the costs that protocols will have to pay to maintain liquidity.

With the case against stETH established, I shift focus toward the newest challengers in the LSD space. Starting with cbETH, which has quickly raced to the second most dominant LSD, I point out that there is no DeFi adoption and that cbETH may end up as a stepping stone for users to migrate towards rETH. Next, frxETH, by FRAX, is built on a capital inefficient system wherein the staking rewards are kept separate from the liquidity providers. I provide some conjecture on a future rival, osETH of Stakewise v3. This token aims to challenge Rocket Pool on permissionless node operators, however, the product is not yet live and will require a complete protocol reboot – no cheap, quick, or easy task. I conclude the section by taking a step back and looking at Rocket Pool itself through a critical lens.

Lastly, I provide a short description of why the fundamental models behind RPL and LDO are different. I suggest that LDO's endgame is just a stETH wrapper giving users no unique value, not even governance, whereas RPL adds value to the system by functioning as collateral. These divergent models give LDO a clear value ceiling, but not for RPL.

Why does this matter? LSDs are going to be an intrinsic part of Ethereum. Staked ETH will be the future bond market. If an LSD becomes too dominant, it can become an attack on the host chain. The asset that propagates and survives will be the one that is resilient in extreme cases just as Ethereum is. Rocket Pool has been building towards that future since 2017. It will not be the one that starts with a manipulated early head start or the one designed to maximize yield at all costs. The invisible hand of decentralization will test market participants. Today, people are free to run validators in any country. This may be a luxury of the moment as nation-states have not set their target on Ethereum yet. When that day comes, LSDs will not be the reason Ethereum fails. rETH is the path forward. You can choose to ignore it or bet against it, but rest assured, the Orange Cascade is coming.

8 - Postscript: FTX Fallout

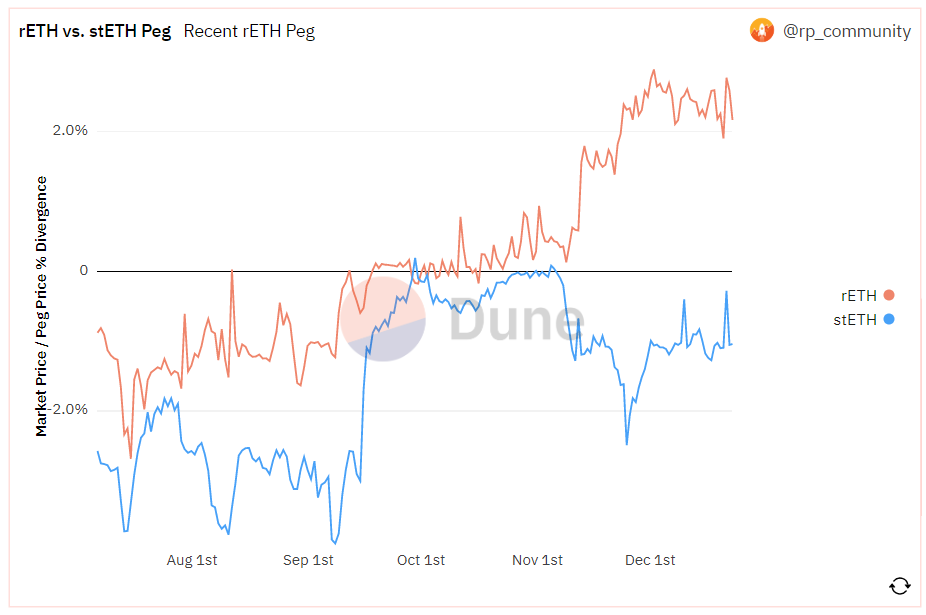

Following the merge, LSD pegs all quickly converged back towards parity. rETH held consistently at a premium during this process. Suddenly, the stETH/ETH ratio was where it was prior to the 3AC capitulation. Is this deserved? Has the risk left the ecosystem or has the rush of new stake post-merge combined with a dearth of yield opportunities obfuscated the risk Lido poses once more?

FTX is dead. Volatility and calamity are crypto’s best friends. Thus, it should come as no surprise that the markets have been rocked yet again with cascading liquidations hitting most DeFi markets. The value of the SOL token has been cut in half in days. Many lenders, institutional and unsuspecting retail, are now bereft of their assets. For an asset aiming to be the base layer of DeFi, the market capitulation we experienced should be like a passing breeze. This recent fiasco has proved just the opposite for Lido. I will briefly discuss how the stETH peg held up, what is happening with stSOL, and why contagion is a real threat.

Once again, when the broader market hits a downturn, the stETH peg collapses. This time the losses extended to ~1.5%. It is likely that many leveraged stETH/ETH positions were liquidated in this process as this was the largest single day peg hit since the 3AC cascade. Had this event occurred after withdrawals, Lido would have seen a max exodus of stake while Rocket Pool would have gained stake. While stETH dropped 1.5%, rETH increased its premium against its NAV, signaling how resilient rETH is in the eyes of the market.

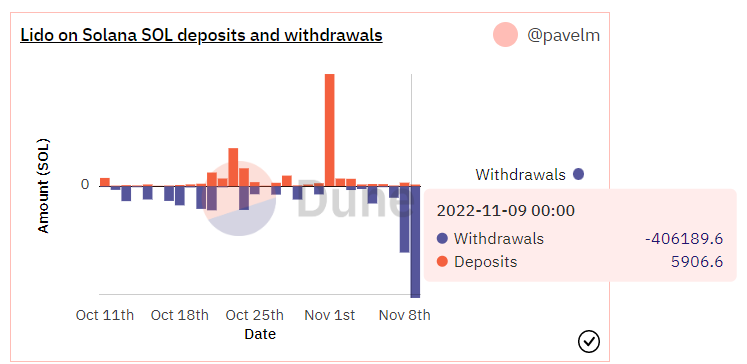

More concerning for the Lido DAO is the performance of stSOL, Lido’s liquid staking derivative for Solana. The entire Solana network has been struggling since the FTX news. Large swatches of SOL have exited or are waiting to exit, degrading the network’s security. At points, stSOL was reported to be trading at -10% on open markets compared to SOL. Volatility for the LSD is not an issue at face value, but this arbitrage opportunity has pushed large sums of SOL into their withdrawal queue. As such, the network is being stress tested and the Lido node operators that run Solana nodes have exceptional duties to attend to.

The node operators are shared between all chains Lido operates on. The Solana Lido validators also run Ethereum validators. Perhaps not on the same hardware, but the same teams must manage both chains. The complexities of properly running one validator for one blockchain can be profound. Having to constantly monitor Telegram for updates about the Solana reboot is directly inhibitory to a team’s ability to service other networks. Imagine if the events of the FTX collapse had triggered severe fallout in the Ethereum ecosystem. Would the Lido operators who run both blockchains be forced to dedicate resources one way or the other? Further, Solana may have represented a cash cow for some validators. By abruptly losing a huge income stream, a professional validator may be forced to adjust staffing. As long as Lido continues to diversify across chains, their dedication towards Ethereum will fall and the risk for stETH holders will multiply. Further, it is unclear if the Lido insurance pool extends across every chain. If so, then the security model of stETH is even worse than I have described.

There is only one LSD that has a value set identical to Ethereum itself - rETH. In the endgame, the social layer rules above all else. When that day comes, the decentralization and security of rETH will push it into the bedrock of DeFi.

作者:jasperthefriendlyghost.eth

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK