The VC dream machine pumped out one dumb startup after another. 2023 should put...

source link: https://finance.yahoo.com/news/vc-dream-machine-pumped-one-140632149.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

The VC dream machine pumped out one dumb startup after another. 2023 should put an end to that.

2023 should curtail the current flow of bad startup ideas.

Easy money and tech solutionism saw investors juicing everything from NFTs to dog-walking startups.

The collapse of FTX and other startups, plus higher interest rates, should push them to be more disciplined.

Lately, few ideas have proven to be too dumb for venture capital money.

VCs are in the business of betting on speculative ideas. The way it roughly works is to bet millions across lots of startups in the hope one of them blows up and returns that cash.

But a blitz in capital and a perhaps misguided faith in technology have seen VCs juice up everything from robot pizza makers to NFTs to dog-walking apps over the past few years.

VC silliness peaked this year in the public consciousness. Elizabeth Holmes, the fraudulent founder of venture-backed Theranos, was sentenced to more than 11 years in prison. Her downfall was portrayed in ABC News series "The Dropout." VC-fueled founder hubris also hit the entertainment mainstream through "WeCrashed", the dramatization of the WeWork saga, and "SuperPumped", which centers on Uber's enfant terrible Travis Kalanick. None of this is a good look for an industry that prides itself on funding innovation.

Still, a combination of reputational damage and a tightening monetary environment should mean VCs pull back from startups that clearly have no chance in hell.

Why bad businesses got so much money

Some gory details around recent startup collapses might make even the most financially unsavvy spectator ask how on earth so many investment professionals were happy to overlook obvious problems.

Take FTX, the crypto exchange led by disgraced founder Sam Bankman-Fried that collapsed with an $8 billion hole. Bankman-Fried was arrested in the Bahamas and awaits possible extradition to the US. At its peak, the exchange won investment from blue-chip names such as SoftBank, Lightspeed, and Sequoia — the latter once crowing about being won over by Bankman-Fried as he played 'League of Legends' during a pitch meeting.

The Hill

The HillFTX founder Bankman-Fried agrees to extradition

Former FTX CEO Sam Bankman-Fried said in a Bahamian court on Wednesday that he has agreed to be extradited to the U.S., according to The Associated Press. Bankman-Fried was arrested last week in the Bahamas after a U.S. federal court in Manhattan indicted him on eight counts, including wire fraud, conspiracy to commit securities fraud…

9h ago

US home sales dip for 10th straight month in 'frozen' market

Sales of existing homes in the United States slid for a 10th consecutive month in November, extending a record streak with mortgage rates high and inventory tight, according to industry data released Wednesday.

14h ago Defense News

Defense NewsCongress forgoes $2 billion Taiwan security grants in favor of loans

Taiwan loses out on a behind-the-scenes Capitol Hill clash that ended with the omnibus using loans instead of grants to fund U.S. military aid.

21h ago The State Journal-Register

The State Journal-RegisterThe cold, snow headed to Springfield and central Illinois is 'straight out of the Arctic'

While the National Weather Service has not narrowed down the amount of snow that will dump on the area, blizzard-like conditions are expected

15h ago Sacramento Bee

Sacramento BeeSacramento Sheriff’s Office faces wrongful death claim in man’s struggle with deputies

The filed claim is a likely precursor to the family filing a federal civil rights lawsuit.

5h ago 12h ago

12h ago Zacks

ZacksIs American Funds Growth Fund of America C (GFACX) a Strong Mutual Fund Pick Right Now?

Mutual Fund Report for GFACX

17h ago WSB Cox articles

WSB Cox articlesLaw enforcement warn of woman posing as IRS agent in North Georgia

Barrow County Sheriff's Office is issuing a warning after a woman was believed to be impersonating a field agent for the IRS.

5h ago CNW Group

CNW GroupKLIMAT X DEVELOPMENTS INC. PROVIDES END OF YEAR COMPANY UPDATE AND PARTICIPATES IN EXPERT PANEL AT TRAYPORT'S CARBON CREDIT WEBINAR

Klimat X Developments Inc. ("Klimat X" or the "Corporation") (TSXV: KLX) a company in the business of developing validated and verified carbon credits from its own nature based solutions for sale into international voluntary carbon markets, is very pleased to provide a company update and to provide access to the recording of a webinar hosted by Trayport (a TMX company) entitled, The Future of the Carbon Credit Economy. "Klimat X enjoyed an extremely positive trajectory from our listing in July,

17h ago TipRanks

TipRanksDown More Than 60%: Analysts Say Buy These 3 Beaten-Down Stocks — They Are Too Cheap to Ignore

2022 is almost over and although 2023 brings with it plenty of uncertainty, most investors will no doubt be happy that a tumultuous year for the stock market is finally coming to an end. The selling pressure has at times been so severe that it didn't really matter whether a stock has strong fundamentals or not, the reflex has been to throw the baby out with the bathwater. The upshot to the relentless selling is that now investors get a chance to load up on their favorite names at a big discount.

4h ago MoneyWise

MoneyWiseHere are the 3 big bets Warren Buffett is taking into 2023 — if you're worried about the new year, it might be time to follow along

Bonus: this trio provides diversification.

13h ago MarketWatch

MarketWatchTesla’s stock drop has been bad. But this company has wiped out more investor wealth in 2022.

Despite all the pain from Elon Musk's Twitter distractions, Tesla ranks fourth on a list of the worst S&P 500 stocks of 2022 by market-value decline.

9h ago Motley Fool

Motley FoolWhy CrowdStrike, Palo Alto Networks, and Fortinet Fell Today

Shares of cybersecurity software stocks CrowdStrike (NASDAQ: CRWD), Palo Alto Networks (NASDAQ: PANW), and Fortinet (NASDAQ: FTNT) were falling today, down 2.1%, 1.1%, and 1.3% as of 1:49 p.m. ET, even though the broader Nasdaq Composite was up by about 1.5% at that time. Yesterday, Palo Alto announced the closing of its acquisition of Cider Security, a leader in software application protection. On Tuesday night, cybersecurity peer BlackBerry had its fiscal third-quarter earnings report, in which management noted some caution in closing large cybersecurity deals in the near term, as sales cycles have become "elongated," which is a fancy term for customers being slower to sign off on purchases.

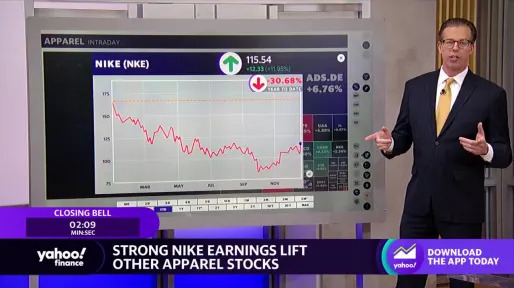

9h ago Yahoo Finance Video

Yahoo Finance VideoBiggest market movers at the close: Chinese stocks, Carnival Cruise Line, Nike, Crocs

Yahoo Finance's Jared Blikre highlights key tickers moving markets at the close of the trading session.

8h ago Motley Fool

Motley FoolBefore You Buy Annaly Capital Management: Here's an Ultra-High-Yield Stock I'd Buy First

Annaly Capital Management (NYSE: NLY) pays one whopper of a dividend. As tempting as that big-time payout might be, investors seeking a monster yield should first consider Medical Properties Trust (NYSE: MPW). Annaly's business model plays a big role in its outsized dividend yield.

17h ago TheStreet.com

TheStreet.comInvestor Daniel Loeb Unleashes Criticism of Ark's Cathie Wood

Wood's flagship Ark Innovation ETF has dropped 66% year to date, and is down 80% from its February 2021 peak.

6h ago MoneyWise

MoneyWise'They will come to a bad ending': Just over a year since its $69K peak, Bitcoin has plummeted more than 70% — here's why Warren Buffett has hated cryptocurrency all along

The Oracle of Omaha never saw a future in cryptocurrency.

17h ago Bloomberg

BloombergElon Musk Lashes Out at Unhappy Investor as Tesla Shares Retreat

(Bloomberg) -- Elon Musk pushed back on criticism from one of Tesla Inc.’s most vocal supporters amid growing concern about the chief executive officer’s ability to manage Twitter Inc. and his other businesses.Most Read from BloombergMusk Will Resign as Twitter CEO and Focus on EngineeringMusk Lashes Out at Unhappy Investor as Tesla Shares RetreatMessi Evacuated by Helicopter After Crowds Swarm World Cup WinnersAmazon Ring Cameras Used in Nationwide ‘Swatting’ Spree, US SaysTrump’s Tax Records t

1d ago Insider Monkey

Insider MonkeyLithium Stocks List: 15 Biggest Lithium Stocks

In this article, we will discuss the 15 biggest lithium battery stocks. If you want to explore similar stocks within the lithium industry, you can also take a look at Lithium Stocks List: 5 Biggest Lithium Stocks. At a time when the world is at a crossroads with regard to climate change, lithium has risen […]

6h ago MoneyWise

MoneyWiseSuper rich New Yorkers — including billionaire Carl Icahn — are fleeing the Big Apple in droves. Here are the top 3 states they're escaping to

These snowbirds are heading south for the winter. And staying put.

14h ago TipRanks

TipRanksGoldman Sachs Sees Over 70% Gains in These 2 Stocks — Here’s Why They Could Jump

There’s been no hiding place for most investors seeking shelter from 2022’s stormy market conditions. Most corners of the market have been subjected to a torrid time, pushed under by a combination of soaring inflation, the aggressive interest rate hikes taken in order to tame it, and a global macro environment rocked by Russia’s invasion of Ukraine and China’s zero-Covid policies. The fear now is that a recession in 2023 is all but inevitable – either of the mild variety or a lengthy and painful

14h ago CNW Group

CNW GroupTrulieve Announces Closing of $71.5 Million Financing

Trulieve Cannabis Corp. (CSE: TRUL) (OTCQX: TCNNF) ("Trulieve" or "the Company"), a leading and top-performing cannabis company in the U.S., today announced the closing of a commercial loan secured by a cultivation and manufacturing site in Florida for aggregate gross proceeds of $71.5 million. Trulieve will pay interest at a fixed rate of 7.53% for the duration of the five-year loan. Lenders were comprised of three banks, with Valley National Bank serving as lead agent. The Company intends to u

8h ago Barrons.com

Barrons.comGE HealthCare Stock Is Trading. We Were Wrong.

GE HealthCare stock, which will trade under the stock symbol "GEHC," has started to trade on a "when issued" basis. The price looks low.

8h ago Insider Monkey

Insider Monkey11 Best Penny Stocks to Buy Now

In this article, we discuss the 11 best penny stocks to buy now. If you want to read about some more penny stocks, go directly to 5 Best Penny Stocks to Buy Now. The majority of penny stocks, which are defined as securities that trade for less than $5 per share, have had a terrible […]

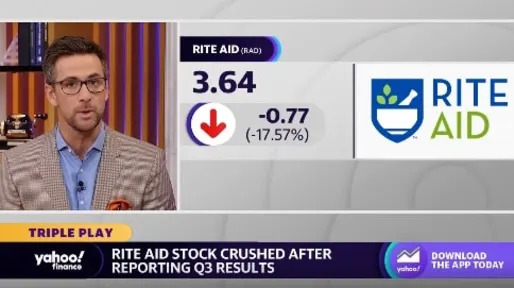

11h ago Yahoo Finance Video

Yahoo Finance VideoRite Aid stock plummets after disappointing third-quarter results

Yahoo Finance Live anchors discuss why Rite Aid stock is tanking on Wednesday afternoon.

8h ago Yahoo Finance

Yahoo FinanceStock movers after hours: Micron, Under Armour, MillerKnoll

Stocks moving after hours: Micron, Under Armour, MillerKnoll

7h ago Zacks

ZacksHere's Why You Should Retain Abbott (ABT) Stock for Now

Investors continue to be optimistic about Abbott (ABT) owing to the strength in its Diabetes business and product launches.

2d ago MarketWatch

MarketWatchMicron sales could dive more than 50%, and more belt-tightening is expected before outlook improves

Micron Technology Inc.'s revenue declines could worsen to more than 50% before inventory-saturated customers work though that product and boost sales in the second half of next year, but before then the memory-chip maker is implementing some austerity measures.

6h ago Investor's Business Daily

Investor's Business DailyWith Bear Market Scars, These 26 Stocks Expect Up To 1,220% Growth

Oil stocks dominate this list of today's fastest-growing stocks, all eyeing 100%-1,220% EPS gains this year.

11h ago Motley Fool

Motley FoolWhy Shares of AGNC Investment Corp Are Rising Today

Shares of the mortgage real estate investment trust (mREIT) AGNC Investment (NASDAQ: AGNC) are trading nearly 3% higher as of 10:04 a.m. ET today after getting an endorsement from Bill Gross, also known as the Bond King. As an mREIT, AGNC uses debt and leverage to invest largely in agency mortgage-backed securities, which carry a guarantee from the U.S. government. Bond values have an inverse relationship with bond yields, so as yields have risen, bond values have been crushed.

12h ago Motley Fool

Motley FoolWhy Walgreens Boots Alliance Stock Caught a Cold Today

Walgreens Boots Alliance (NASDAQ: WBA) had a lousy day on an generally prosperous Wednesday for stocks. The rival in question is Rite Aid, which unveiled its third quarter of fiscal 2023 results before market open. While the company notched modest beats on both the top and bottom lines, it lowered its non-GAAP (adjusted) earnings before taxes, depreciation, and amortization (EBITDA) guidance for the entirety of the fiscal year.

7h ago MarketWatch

MarketWatchIs a 2023 stock-market rebound in store after 2022 selloff? What history says about back-to-back losing years.

History shows back-to-back losing years for the stocks are rare --- but a rebound might not be a sure thing. Here's what investors need to know.

9h ago Simply Wall St.

Simply Wall St.In the wake of Ford Motor Company's (NYSE:F) latest US$8.1b market cap drop, institutional owners may be forced to take severe actions

Every investor in Ford Motor Company ( NYSE:F ) should be aware of the most powerful shareholder groups. With 49...

18h ago Motley Fool

Motley Fool1 Unique Stock-Split Stock I'm Buying Hand Over Fist Right Now

This unique stock split provided investors with an entity that offers an attractive and fast-growing dividend.

13h ago Motley Fool

Motley FoolA Bull Market Is Coming. 3 Stocks to Buy Like There's No Tomorrow

Investors holding out for a Santa Claus rally may have gotten their hopes dashed by the Federal Reserve last week, which raised interest rates another 50 basis points and also lifted its forecast for interest rate hikes next year, calling for rates to rise another 75 basis points, which added to fears that the economy will fall into a recession next year. No one knows what 2023 holds for the stock market, but we do know one thing. A bull market will come eventually, just as it has after every bear market in the history of the U.S. stock market, including the Great Depression, the financial crisis of 2008 and 2009, and the coronavirus pandemic crash.

2d ago Zacks

Zacks3 Stocks Seeing Insider Activity in 2022

If an insider buys, it delivers a positive message to shareholders, indicating that they're confident in the current state of business.

10h ago Bloomberg

BloombergCathie Wood Loads Up Tesla Amid Growing Criticism of Elon Musk

(Bloomberg) -- Cathie Wood ramped up purchases of Tesla Inc. shares in the fourth quarter even as concerns over Chief Executive Officer Elon Musk’s ability to manage businesses rise, potentially signifying her faith in the billionaire and electric vehicles. Most Read from BloombergMusk Will Resign as Twitter CEO and Focus on EngineeringMusk Lashes Out at Unhappy Investor as Tesla Shares RetreatI’ve Seen Trump’s Tax Returns and Now You Can, TooMessi Evacuated by Helicopter After Crowds Swarm Worl

20h ago Simply Wall St.

Simply Wall St.ConocoPhillips' (NYSE:COP) Dividend Will Be Increased To $0.70

ConocoPhillips' ( NYSE:COP ) dividend will be increasing from last year's payment of the same period to $0.70 on 13th...

14h ago Benzinga

Benzinga3 REITS That Just Increased Their Dividends

Most everyone loves an early holiday present. And for some real estate investment trust (REIT) investors, that early gift came in the form of a dividend increase over the past two weeks. Of course, a dividend increase is great because it puts more income into the pockets of investors and increases the yield on their purchase price, but more importantly, a dividend increase also signals to the markets that the company expects to perform well, perhaps generating increases in revenue and funds from

2d ago SmartAsset

SmartAssetVanguard vs. Fidelity vs. Schwab

SmartAsset compares three of the largest investment companies based on usability, trade experience, offerings and cost. Learn more here.

2d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK