FTX on brink of collapse after Binance abandons rescue

source link: https://arstechnica.com/tech-policy/2022/11/ftx-on-brink-of-collapse-after-binance-abandons-rescue/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Insolvency risk —

FTX on brink of collapse after Binance abandons rescue

Crypto exchange dashes to fill $8 billion hole as investors write down equity.

Joshua Oliver, Richard Waters, Ortenca Aliaj, James Fontanella-Khan, William Langley, and Chan Ho-him, FT - 11/10/2022, 2:27 PM

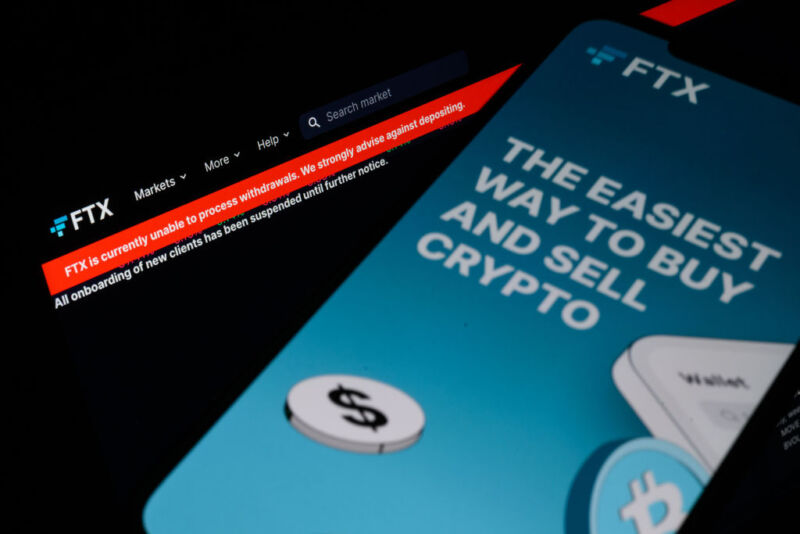

FTX is on the brink of collapse as chief Sam Bankman-Fried races to secure billions of dollars to salvage his empire after Binance ditched an 11th-hour rescue of one of the world’s biggest crypto exchanges.

Venture capital firm Sequoia Capital said it would mark down its $214 million investment in FTX to zero after a run on the exchange in recent days blew a massive hole in its balance sheet and cast serious doubts over its survival.

“In recent days, a liquidity crunch has created solvency risk for FTX,” Sequoia said in a note on Wednesday to investors in its fund.

The abrupt change in fortune for FTX and its sister trading firm Alameda Research marks a spectacular fall for Bankman-Fried, a 30-year-old trader and entrepreneur who is one of the industry’s most prominent figures. Bankman-Fried was one of the world’s richest people just months ago, but large swaths of his $24 billion fortune will evaporate if FTX and Alameda Research go bust.

A collapse would also deal a blow to FTX’s blue-chip backers, which include BlackRock, Canada’s Ontario Teachers’ Pension Plan, SoftBank, and hedge fund billionaires Paul Tudor Jones and Izzy Englander.

In recent days, Bankman-Fried has appealed to investors for support to prop up the exchange as customers fearful of its financial health demanded their money back. FTX needs $8 billion to steady the ship, according to people with knowledge of the matter.

Bankman-Fried also turned to rival crypto exchanges including OKX and Binance for a bailout, which led to a short-lived plan by Binance chief executive Changpeng Zhao to buy FTX and backstop customers’ funds.

AdvertisementZhao walked away from the table after less than 48 hours of due diligence, having concluded the scale of the financial problems and potential wrongdoing at FTX made the deal impossible.

“As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com,” Binance said.

The US Securities and Exchange Commission has expanded an investigation into FTX, which includes examining the platform’s cryptocurrency lending products and the management of customer funds, according to a person familiar with the matter.

Wall Street’s regulator launched the probe months ago but sought additional information after Binance’s acquisition plans were announced on Tuesday, the person added. The agency is also examining FTX’s relationship with a US entity, FTX US.

Bitcoin, the largest cryptocurrency and a barometer of confidence in the sector, tumbled as low as $15,700 before steadying at $16,600, down 10 percent from Wednesday morning. Investors and traders fear the collapse of FTX and Alameda will trigger another wave of market panic and losses for those exposed to the firms via lending and trading relationships.

“Given the size and interlinkages of both FTX and Alameda Research with other entities of the crypto ecosystem… it looks likely that a new cascade of margin calls, deleveraging and crypto company [and] platform failures is starting similar to what we saw last May [and] June following the collapse of Terra,” JPMorgan analysts wrote.

Analysts at Moody’s said the spillover from turmoil in the crypto sector to the traditional financial world was likely to be limited.

Fadi Massih, vice president at Moody’s Investors Service, said: “The lack of regulatory oversight and the sector’s overall opacity facilitate risky financial strategies, exposing firms to an environment in which rumors of illiquidity can become self-fulfilling prophecies.”

© 2022 The Financial Times Ltd. All rights reserved. Not to be redistributed, copied, or modified in any way.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK