Canalys: Q3 worldwide smartphone shipments declined by 9%

source link: https://www.gsmarena.com/canalys_q3_worldwide_smartphone_shipments_declined_by_9_-news-56320.php

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Canalys: Q3 worldwide smartphone shipments declined by 9%

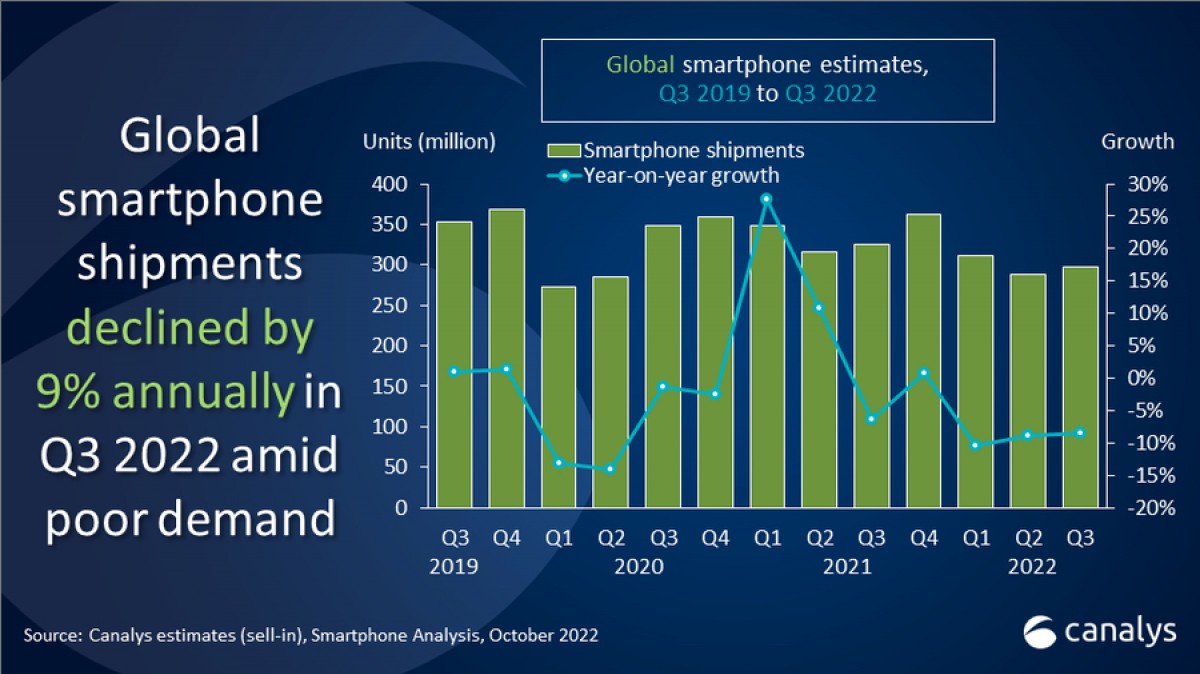

Global smartphone shipments for the July – September period totaled 297.8 million units according to the latest Canalys Smartphone Analysis report. The figure represents a 9% decline compared to Q3 2021 (325.6 million shipments) and is the third consecutive quarter of declining smartphone shipments.

Q3 Smartphone shipments in Europe and Asia Pacific outperformed other regions with improved demand seen in India, Indonesia and the Philippines. Despite the market trends, the premium segment saw strong demand for Apple and Samsung flagships while demand for mid and entry-level devices was yet again weak.

Samsung retained its leading spot with 64.1 million shipments and a 22% market share with big trade-in promotions for its Galaxy S series and the introduction of its new line of foldable smartphones. Apple came in second place with 53 million shipments and an 18% share of the global market.

| Worldwide smartphone shipments and annual growth | Canalys Smartphone Market Pulse: Q3 2022 | |||||

| Vendor | Q3 2022 shipments (million) | Q3 2022 market share | Q3 2021 shipments (million) | Q3 2021 market share | Annual growth |

| Samsung | 64.1 | 22% | 69.4 | 22% | -8% |

| Apple | 53.0 | 18% | 49.2 | 16% | +8% |

| Xiaomi | 40.5 | 14% | 44.0 | 14% | -8% |

| Oppo | 28.5 | 10% | 36.7 | 12% | -22% |

| vivo | 27.4 | 9% | 34.2 | 11% | -20% |

| Others | 84.3 | 27% | 92.1 | 25% | -6% |

| Total | 297.8 | 100% | 325.6 | 100% | -9% |

| Notes: Figures in tables rounded to the first decimal point Source: Canalys Smartphone Analysis (sell-in shipments), October 2022 |

Cupertino saw strong demand for its new iPhone 14 series and is the only company in the top-five list to experience positive yearly growth. Xiaomi saw 40.5 million shipments and a 14% market share followed by Oppo (28.5 million) and vivo (27.4 million).

Looking ahead to Q4, Canalys analysts predict lower OEM order targets and slow inventory turnover. The outlook is gloom and the vendors with the best strategies to handle the current economic downturn will be the ones that are well-positioned for the long run.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK