The stock market is plunging and could fall a lot further with the U.S. at the c...

source link: https://finance.yahoo.com/news/stock-market-plunging-could-fall-203259943.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

The stock market is plunging and could fall a lot further with the U.S. at the center of a huge global bubble, says chief investment officer of world’s largest hedge fund

S&P Futures

3,945.00+13.75(+0.35%)Dow Futures

31,181.00+78.00(+0.25%)Nasdaq Futures

12,079.75+43.25(+0.36%)Russell 2000 Futures

1,841.70+4.20(+0.23%)Crude Oil

87.84+0.53(+0.61%)- 1,714.20-3.20(-0.19%)

Silver

19.50+0.00(+0.02%)EUR/USD

1.0012+0.0042(+0.42%)10-Yr Bond

3.42200.0000(0.00%)- 26.74+2.87(+12.02%)

GBP/USD

1.1564+0.0072(+0.63%)USD/JPY

143.2610-1.3840(-0.96%)BTC-USD

20,361.37-2,166.58(-9.62%)CMC Crypto 200

483.48-39.22(-7.50%)FTSE 100

7,316.75-69.11(-0.94%)Nikkei 225

27,818.62-796.01(-2.78%)

A hotter-than-expected monthly inflation report threw the stock market for a loop on Tuesday, and a top executive at the world’s largest hedge fund argues that it’s just the beginning of the pain for investors.

In an interview at the SALT hedge fund conference in New York on Monday, Greg Jensen, co–chief investment officer of Bridgewater Associates, said that the stock market hasn’t fully priced in a recession, and that the U.S. is at the center of a global bubble that has yet to burst.

The co-CIO, a three-time honoree on Fortune’s 40 Under 40 list of rising business stars, made the case that investors are overestimating the Federal Reserve’s ability to tame inflation and that ultimately asset prices will continue to fall as a result.

“I think the biggest mistake right now is the belief we’re going to return to, essentially, prices similar to the pre-COVID,” Jensen said, per Reuters.

Bridgewater Associates declined Fortune’s request for comment.

Monday’s bearish prediction wasn’t the first time Jensen has spoken out about his fears for the U.S. economy and stock market. In August, the co-CIO told Bloomberg that markets are in the midst of a “de-globalization” trend and forecast that stocks would fall another 20% to 25% as the Fed continues raising interest rates.

Jensen’s comments echoed previous statements from his fellow chief investment officer, Bob Prince, who told Bloomberg in May at the World Economic Forum in Davos that the U.S. is on the cusp of stagflation—a toxic economic combination of low growth and high inflation—and that investors weren’t properly accounting for the impact of the Fed’s monetary tightening.

However, on Monday, Jensen noted that Bridgewater can create profits for its clients amid the market downturn by shorting—or betting against—the stocks of select companies.

The leading hedge fund shorted some 28 European companies for a total position valued at up to $10.5 billion in June, according to data compiled by Bloomberg. But it cut its disclosed short positions on European firms to just $845 million in August.

MarketWatch

MarketWatchThe biggest Fed rate hike in 40 years? It could be coming next week.

Desperate times call for desperate measures, and this might be just such a time: Persistently high inflation might force the Federal Reserve to resort to the biggest increase in a key U.S. interest rate in more than 40 years.

14h ago MoneyWise

MoneyWiseMorgan Stanley expects the S&P 500 to plunge another 17%-27% within the next four months — use these 3 top recession-resistant stocks for protection

It's time to be extra picky.

22h ago Fortune

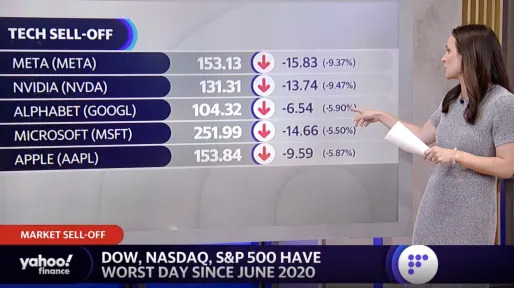

FortuneThe stock market’s worst day since June 2020 shows ‘the Fed has the worst problem in the world’ with inflation—and recession is the only solution

Chris Zaccarelli of Independent Advisor Alliance knows what Tuesday's inflation print means for the Fed: “Not only are they going to end up causing a recession, but it is going to be a bad one."

18h ago MarketWatch

MarketWatchA second leg down for the bear market in stocks would expose 3 ‘naked swimmers.’ That won’t be pretty.

Miller Tabak + Co.'s chief market strategist Matt Maley has his eye on three troubled areas of financial markets right now. He thinks investors need to be looking at them too.

2d ago MoneyWise

MoneyWise‘Get out of these distorted markets’: Mohamed El-Erian just issued a dire warning to stock and bond investors — but also offered 1 shockproof asset for safety

Is this the ultimate safe haven?

2d ago MarketWatch

MarketWatchAny doubt Fed will raise rates by 75 basis points next week is gone after hot U.S. inflation data

Any doubt that the Federal Reserve will hike interest rates by 75 basis points next week is gone given the hot inflation data, economists said.

21h ago Investor's Business Daily

Investor's Business DailyDow Jones Futures: Stocks Dive On Call For Biggest Fed Rate Hike In 40 Years; Apple, Tesla Tumble

The stock market sold off Tuesday as a hot inflation report spurred calls for the biggest Fed rate hike since the early 1980s. Apple, Tesla, Nvidia skidded.

17m ago Fox News

Fox NewsKarine Jean-Pierre stumbles when pressed on so-called Inflation Reduction Act: 'Is it fair?'

Karine Jean-Pierre floundered when pressed to defend President Joe Biden's Inflation Reduction Act on Tuesday. Reporters suggested she was misrepresenting the bill.

16h ago Bloomberg

BloombergIf You Want to Know Where US Inflation Is Heading, Look at Rents

(Bloomberg) -- The Federal Reserve’s attempt to get a clean read on post-pandemic inflation has focused attention on gauges that elevate housing costs, which is why what happens to rental inflation will factor heavily into the future of monetary policy.Most Read from BloombergThe World’s Hottest Housing Markets Are Facing a Painful ResetRussian Defenses Crumble as Ukraine Retakes Key TerritoryStocks on CPI Eve Close Out Best 4 Days Since June: Markets WrapRussia Strikes Power Plants, Vowing to C

2d ago MarketWatch

MarketWatchAmericans are feeling poorer for good reason: Household wealth was shredded by inflation and soaring interest rates

Net worth falls by a record $8.7 trillion as high inflation and the stock-market crash offset gains in house prices.

2d ago Yahoo Finance

Yahoo Finance'More heavy lifting ahead': Wall Street reacts to August's shock inflation data

Inflation rose more than expected in August, signaling to investors that Fed officials will remain aggressive in their rate-hiking campaign. Here's how Wall Street strategists reacted to the report.

16h ago Motley Fool

Motley FoolDown 85% From Its High, This Top Growth Stock Is a Screaming Buy

To that end, BMO Capital Markets estimates CTV ad spend in the U.S. will reach $100 billion by 2030, up from $21 billion in 2021. Few companies are better positioned to capitalize on that opportunity than Roku (NASDAQ: ROKU). Roku connects consumers with content publishers, allowing users to manage all of their streaming channels from a single platform.

1d ago National Review

National ReviewDow Plummets Nearly 1,300 Points on August Inflation News in Worst Day Since June 2020

The major stock market indexes tumbled on Tuesday after a key measure of inflation came in worse than expected.

13h ago TipRanks

TipRanksHow Can I Protect My Portfolio? Here Are 2 ‘Strong Buy’ Dividend Stocks Yielding at Least 8%

According to the latest CPI (consumer-price index) report, U.S. inflation cooled down slightly from July but not enough to appease the markets. Overall prices rose by 8.3% from the same period a year ago, slowing down from July’s 8.5% uptick and further down from June’s 40-year high showing of 9.1%. On a monthly basis, after plateauing in July, consumer prices rose by 0.1%. As the expectation was for a rise of 8.1% over last year and a drop of 0.1% compared to last month, the markets did what th

13h ago Bloomberg

BloombergBiden May Buy Oil Just Below $80; Democrats Stymied Trump at $24

(Bloomberg) -- The Biden administration is considering replenishing the Strategic Petroleum Reserve when oil dips below $80 a barrel, just two years after Democrats blocked former President Donald Trump from filling the reserve at a fraction of that price.Most Read from BloombergUS Inflation Tops Forecasts, Cementing Odds of Big Fed HikeUgly Selloff Pushes Stocks Down Most Since 2020: Markets WrapXi Returns to World Stage With Putin to Counter US DominanceThese Cities Have the Most Millionaires

14h ago MarketWatch

MarketWatchThe Meta meltdown: This chart shows Facebook’s fall from grace among the most valuable U.S. companies

Dogged by competitive and macroeconomic threats, Meta Platforms Inc. is sinking down the ranks of the largest U.S. companies.

12h ago Yahoo Finance

Yahoo FinanceWhy tech stocks may continue to get pummeled

Goldman Sachs managing director Eric Sheridan perfectly explains why the short-term outlook for tech stocks is cloudy, at best.

16h ago Yahoo Finance Video

Yahoo Finance VideoStocks moving in after hours: Meta, Nvidia, Apple, Toll Brothers, Lennar, KB Home, Paramount

Yahoo Finance Live anchor Seana Smith breaks down the after-hours trading action for trending tech and homebuilder stocks.

14h ago Reuters

ReutersAnalysis-This might hurt: tectonic plates of global economy shift

When the Shannon family announced the closure of their garden centre just off London's busy South Circular road after 33 years of trading this month, their message to customers sought to explain their difficult decision. While south Londoners will have to go elsewhere for their plants, the greater worry is that the local difficulties cited by the Shannons are just the sharp end of bigger moves in the global economy that go far beyond today's cost of living crisis. Labour market shifts as baby boomers retire; disruption caused by extreme weather; the cost of climate action; more volatile geopolitics and an uncertain future for world trade: these are the larger trends some policy-makers believe could make for a durably more expensive world.

2d ago Reuters

ReutersMarketmind: Great expectations

If reining in inflation expectations is the U.S. Federal Reserve's main task, it can count the latest surveys as a tactical victory at least. Stock markets around the world edged higher and U.S. equity futures were set for further gains at the open. While consensus forecasts see headline annual inflation slip back further to 8.1% - a full percentage point below June's peak - 'core' rates, excluding food and energy, are expected to tick higher again to 6.1% from 5.9%.

1d ago- Bloomberg

Stock Rout Eases as Traders Assess Policy Outlook: Markets Wrap

(Bloomberg) -- A semblance of calm returned to markets on Wednesday after the carnage sparked by hotter-than-expected American inflation that prompted investors to reassess the outlook for interest rates and economic growth.Most Read from BloombergUS Inflation Tops Forecasts, Cementing Odds of Big Fed HikeUgly Selloff Pushes Stocks Down Most Since 2020: Markets WrapXi Returns to World Stage With Putin to Counter US DominanceThese Cities Have the Most Millionaires in New RankingTerra Co-Founder D

38m ago - Yahoo Finance

Why State Farm and Google have invested big-time in ADT

ADT CEO Jim Devries chats with Yahoo Finance Live at the annual Goldman Sachs tech conference about the outlook for the business.

14h ago - Yahoo Finance

What’s coming next in Putin’s energy war

The war in Ukraine has turned against Russia. But Russian President Vladimir Putin still has some potent weapons he can deploy, and an energy war with the West is erupting in parallel with the military war in Ukraine.

15h ago President Biden pledges to cut cancer deaths by 50% in 25 years

President Joe Biden challenged the nation on Monday to cut cancer deaths in half in the next 25 years. Biden marked the 60th anniversary of President Kennedy's pledge to get a man on the moon with his own parallel promise.

1d ago- MarketWatch

Soybean futures mark highest finish since June as USDA cuts output and yield forecasts

Soybean futures on Monday mark their highest settlement since June after the U.S. Department of Agriculture reduces its 2022/2023 forecasts on the commodity's domestic production and yield per acre.

2d ago - Bloomberg

Gundlach Urges Fed to Slow Rate Hikes as Summers Prefers 1% Jump

(Bloomberg) -- Jeffrey Gundlach of DoubleLine Capital is worried the Fed will choke off economic growth by raising interest rates too fast. Former Treasury Secretary Larry Summers is among those saying the central bank needs to hike even faster to restore its credibility.Most Read from BloombergUS Inflation Tops Forecasts, Cementing Odds of Big Fed HikeUgly Selloff Pushes Stocks Down Most Since 2020: Markets WrapXi Returns to World Stage With Putin to Counter US DominanceThese Cities Have the Mo

6h ago - Barrons.com

IBM, CVS and 10 Other Stocks That Are Too Cheap Now

Most stocks are having a lousy year in 2022. Here are a dozen that don't deserve being this deep in the red.

15h ago - Fortune

Trevor Milton founded buzzy EV company Nikola and positioned himself as the next Elon Musk—then his $34 billion house of cards came crashing down

Brought down by Hindenburg Research, Milton is widely seen as the biggest con man the markets have seen since Elizabeth Holmes's Theranos.

19h ago - Motley Fool

Cathie Wood Goes Bargain Hunting: 3 Stocks She Just Bought

The last year and change has been rough for the growth investing style that Cathie Wood has championed, but it doesn't mean that her head-turning run in 2020 was a fluke. The co-founder, CEO, and stock shopper of the Ark Invest exchange-traded funds (ETFs) keeps buying disruptors on the cheap. Wood kicked off the new trading week by adding to her existing stakes in Velo3D (NYSE: VLD), DraftKings (NASDAQ: DKNG), and Nvidia (NASDAQ: NVDA) on Monday.

19h ago - Motley Fool

If You Like Dividends, You Should Love These 3 Stocks

The S&P 500 index's downturn in 2022 has pushed its dividend yield up to 1.6%. British American Tobacco's (NYSE: BTI) $91 billion market capitalization makes it the second-largest tobacco company on the planet, trailing just Philip Morris International (NYSE: PM). British American Tobacco's success is in large part due to the variety of well-known brands that it offers to consumers.

21h ago - SmartAsset

This is How Much Money You Should Have at Your Age

Net worth is a financial metric that can help you keep your individual picture of your finances in perspective. The average net worth by age, in this case, refers to the net worth of the households in the U.S. divided … Continue reading → The post Average Net Worth by Age appeared first on SmartAsset Blog.

22h ago - Motley Fool

As Markets Plunged, These 2 Stocks Hit All-Time Highs

All 30 Dow stocks were down, and just five stocks out of the S&P 500 managed to eke out gains on the day. Below, you'll learn more about why Albemarle (NYSE: ALB) and Catalyst Pharmaceuticals (NASDAQ: CPRX) bucked the big downward move on Wall Street and moved further into record territory. Albemarle ended the day up just a fraction of a percent after having climbed as much as 3.5% above its closing level on Monday.

13h ago - TipRanks

‘Investors Should Consider Defensive Equities,’ Says JPMorgan; Here Are 2 High-Yield Dividend Names to Consider

Markets are up in recent sessions, and year-to-date losses have moderated somewhat. The NASDAQ, which has taken the hardest hits this year, is back above 12,200, although still down 22% this year. The S&P 500 has managed to climb back out of the bear market, is above 4,100 now, and its year-to-date loss stands at 14%. Neither index has really tested its June low again in the last two months, and recent trends are upwards. Writing for JPMorgan, global investment strategist Elyse Ausenbaugh gives

1d ago - Motley Fool

The Best Stock Today in Cathie Wood's Ark Innovation ETF

Popular investor Cathie Wood has taken a lot of heat lately in connection to her well-known Ark Innovation ETF (NYSEMKT: ARKK), which has toppled 54% since the start of 2022. As long-term investors, however, we shouldn't be overly absorbed in short-term stock price movements. After all, if you look at Wood's portfolio, you'll notice that many promising businesses are down significantly from their highs.

21h ago - TheStreet.com

It's Time for Me to Jump Into Intel. Yes, Intel

The Biden Administration had sent letters to Nvidia requiring a license to sell its A100 and H100 chips that are designed to speed machine learning and artificial intelligence to those three regions. Nvidia stated at the time that the restriction likely jeopardized... for the firm, up to $400M in annual revenue. Advanced Micro Devices was similarly informed that a similar restriction would be placed on that firm's MI250 chips.

2d ago - Motley Fool

Why Intel, Microsoft, and HP Stocks Flopped Today

Bad news for investors in the personal computing (PC) industry: In morning trading Tuesday, shares up and down the supply chain -- from chipmaker Intel (NASDAQ: INTC) to software giant Microsoft (NASDAQ: MSFT) to hardware manufacturer HP (NYSE: HPQ) -- are all sliding. As of 10:40 a.m. ET today, Intel stock was down a big 4.6%, with both Microsoft and HP following with 3.9% losses. Although analysts had predicted that inflation would decline with the falling price of oil, August's inflation rate inched up another 10 basis points, resulting in an 8.3% year-over-year inflation rate for the month.

19h ago - Motley Fool

Why Plug Power, Bloom Energy, and Hyzon Motors Stocks Sold Off Today

At their lowest points through 1 p.m. ET on Tuesday, Plug Power (NASDAQ: PLUG) had shed 6.7%, Bloom Energy (NYSE: BE) 7.5%, and Hyzon Motors (NASDAQ: HYZN) 4.9%. Investors dumped these stocks after the latest economic data refueled fears of an economic slowdown that could force these companies to cut back on their plans. Although economists expected inflation in the U.S. to drop by 10 basis points in August versus July in what would have been the first signs of inflation cooling down, the latest data from the Bureau of Labor Statistics poured cold water on their hopes.

15h ago - American City Business Journals

Here's why Mark Zuckerberg is a bad boss, according to a leadership expert

To understand why Meta Platforms Inc. has been struggling of late and likely won't rebound anytime soon, one doesn't have to look much beyond founder and CEO Mark Zuckerberg, according to one leadership expert. Bad bosses can be placed into five different categories, Bill George, a senior fellow at Harvard Business School, told CNBC. Zuckerberg, who has headed Facebook's parent company since he founded it while a student at Harvard, fits into three of those, George said.

13h ago - Motley Fool

2 of the Best Stock-Split Stocks You'll Wish You'd Bought on the Dip

Stock splits are all the rage in 2022, but it's important to stay focused on the businesses attached to them.

1d ago - Motley Fool

Why Unity Software Stock Was Falling This Afternoon

Year to date, Unity is down 74%. This raises the likelihood of further interest-rate hikes by the Federal Reserve in the near term. Higher interest rates are bad for stocks that trade at high valuations since it means a lower present value for future profits when estimating the long-term value of a business.

16h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK