Go Fork Yourself

source link: https://www.notboring.co/p/go-fork-yourself

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Go Fork Yourself

Internet-Native Evolutionary Governance with David Phelps & Luca Prosperi

Welcome to the 1,169 newly Not Boring people who have joined us since last Monday! If you haven’t subscribed, join 142,501 smart, curious folks by subscribing here:

🎧 I’m going to try to record the audio version later today, we wrote down to the wire!

Programming Note: We’re due with our second kid any day now. Whenever she comes, I’m taking off for a month. We’ll still have some great guest posts and the Weekly Dose of Optimism, but this Thursday, if we make it there, will be the last essay I write until September!

Today’s Not Boring is brought to you by… Masterworks

During my paternity leave, I’m trying to stay as far away from a keyboard, and the markets, as possible. So I wanted to make sure to leave you with at least one idea that should be helpful for whatever's ahead.

Despite not knowing Donatello from Dogecoin, Masterworks has always been a resilient, top-appreciating segment of my portfolio. Right now it's more important than ever. Nobody is panic selling Picassos.

On the Masterworks platform, anyone can easily invest in blue-chip contemporary art. Why art? It's a $2 trillion asset class that has:

Outpaced equities by 3x in the last 25 years,

Remained relatively insulated from macro shifts,

Performed even better during inflationary periods.

Masterworks’ team of experts scours the blue-chip art market, gives members the opportunity to invest in shares of appreciating pieces, and decides when to sell.

Since inception in September 2019, their art investments have generated 15.3% net annualized appreciation1. I don’t need to look at my portfolio except when I want to admire the art.

The only problem? I’ve wanted to complement my Basquiat and Warhol with a Banksy for months. So of course when I finally had a chance 2 days ago, the shares sold out in 14 minutes and I missed it. Don’t be like me. Skip the waitlist with the Not Boring link2:

Hi friends 👋 ,

Happy Monday!

If you read “governance” and thought about skipping today because that sounds boring, I implore you to read on. Flipping DAO governance models is one of the most fascinating rabbit holes I’ve gone down recently. Incentivizing dissent over consensus creates both an internet-native model for organizing humans and directing resources, and a source of real differentiation versus incumbents.

But like Tokenomics, for which we needed to borrow Tina He’s brilliance to explain, DAO governance is a topic so complex and fast-evolving that we needed to tap not one, but two, people who live and breathe the topic.

Today, I’m teaming up with two of my favorite people / writers in web3:

Luca Prosperi, the author of the truly excellent Dirt Roads, mathematician, ex-MakerDAO, and advisor to Cherry Ventures.

David Phelps, the author of Three Quarks, co-creator of ecodao and jokedao, investor at cowfund, advisor to TCG Crypto, Gitcoin steward, and more.

Luca and David are two of my favorites because they’re simultaneously optimistic about web3, vocal about its shortcomings, and actively engaged in building solutions. If you don’t already, follow them on Twitter and subscribe to their newsletters to get a sense of what I mean.

Bringing old models online isn’t the goal. Creating new ones that weren’t possible offline is.

Let’s get to it.

Go Fork Yourself

In video games, “speedrunning” means completing a video game as fast as possible.

The world record speedrun for Super Mario 64, for example, belongs to the inimitable cheesecheese, who beat the entire game in 1:37:50 while singing and responding to Twitch commenters.

Crypto has borrowed the term. It’s speedrunning the history of financial markets. It’s speedrunning the history of governance.

Speedrunning is a catchy analogy, but it’s not quite perfect. For one, the best speedrunners play games that they’ve played thousands of times nearly flawlessly. For another, a speedrun video game ends at the same place that a game played at regular speed does.

What’s happening in crypto is different. No one is playing flawlessly. DeFi protocols (and CeFi entities) are doing many of the things that have been done in the financial markets, making many of the same mistakes, and learning many of the same lessons. DAOs are experimenting with the same governance models – from direct democracy to representative democracy, from direct shareholder vote to boards and management – that local and national governments and corporations have tried. They’re just doing it really fast, compressing thousands of years of experiments into less than a decade. In a piece by the same name for a16z, Andy Hall and Porter Smith call it Lightspeed Democracy. That gets closer.

But the game shouldn’t end there. Just like online advertising started out as a copy-paste of print ads in the form of banner ads and evolved a richer and more sophisticated toolkit than would ever be possible offline, DAO governance can and should move beyond offline models.

We think that DAO governance should be more like a biological process run at internet speed: Internet-Native Evolutionary Governance.

The goal shouldn’t be to recreate offline governance, online, after a period of trial-and-error. Internet-native organizations can’t and shouldn’t operate like geographic governments because they don’t face the same constraints. Once online governance models evolve past a certain point, they should be both different from and superior to offline ones because of the speed, scale, granularity, programmability, composability, and unboundedness of the internet, and the blockchain.

So what if we flipped the model?

What if we viewed the goal of DAO governance not as a way to agree on a limited number of decisions proposed from the top, but as a way to force people to disagree on a whole host of decisions proposed by the community—so that larger groups that are unwieldy to coordinate could continue dividing into smaller, more efficient ones while building value for each other?

The real promise of DAO governance might be forking: using governance to get people to disagree and through the process, discover subcommunities where they're aligned and create their own version of a project. Forking, in that sense, is the ultimate form of decentralization. And it enables governance to become the basis of social graphs where people find others who share their interests so they can pursue those.

In its simplest form, this kind of governance is just a process of decentralized curation to incentivize a community to share and rank its preferences: good governance is just good user research. Through healthy dissent, governance can be used to lead to the formation of subDAOs, and to encourage evolutionary growth in the ecosystem. As non-crypto people know, forking leads to procreation.

Viewed through that lens, governance mechanisms might become less defensive – focused less on protecting against hacks that threaten the entire DAO – and more offensive and fun – focused more on governance as a means of entertainment, social discovery, and propagation.

To be clear, there’s no one-size-fits-all model for DAO governance, and we’re not proposing that every DAO turn on its heels and encourage forking, which should often be a last resort. What we’re proposing is something else. Having different types of governance is a strength that lets different groups with different metrics optimize for what's important to them according to their own system. As in nature, biodiversity protects the entire ecosystem.

There are challenges with this model, too, most notably that fragmentation might reduce liquidity, lower talent density, and add complexity. We’ll discuss these, and ways that DAOs might address them.

But if we’re experimenting and making mistakes anyway, we should make productive mistakes. We should experiment in a direction that doesn’t lead to the same endpoint, and take advantage of new tools and lessened constraints to create new internet-native opportunities. Maybe one day, those new models will circle back and influence the way that humans coordinate offline. Maybe the lines between online and offline will blur to the point that governments and companies adopt new models born through this evolution.

Today, we’ll explore the history, present, and a proposed future of governance:

A Very Brief History of Governance

DAO Governance History and Challenges

Forking Governance

How Governance Might Work

Governance as a Social Network

Internet-Native Governance Evolution

To start our journey, let’s hop in the time traveler and head back to Ancient Greece.

A Very Brief History of Governance

First things first, what is governance?

Governance is the process of overseeing the control and direction of something, like a government, business, or organization. It’s how groups of people decide what their group should do, and ensure that those decisions get enacted.

Humans have been trying to figure out governance since the beginning of time. In Pieces of the Action, Vannevar Bush wrote of organizations:

When Eve joined Adam, there was formed the first organization in history. It is a simple one, yet its essential relations and the regulations governing it have not even today been fully worked out. And ever since Eden, man has been building more and more complex organizations with which to carry on his affairs.

“Building more and more complex organizations with which to carry on our affairs” is a good summary of the history of governance models, but we’ll take a slightly longer walk. Most of us learned this stuff in school, but it’s worth going over quickly in this context to ground ourselves in the basics before we get weird.

For most of human history, people lived under autocratic rule, a system in which the power over the state is concentrated in the hands of one person: a king, queen, empress, emperor, or dictator. Whatever the autocrat decrees, the people must follow. Oligarchic rule, also popular throughout history, feels similar to those being governed, but differs slightly in that the power is concentrated in the hands of a small group of people instead of one person. Autocratic rule was so popular early because it’s the simplest form of governance – one person decides and that’s it – but history has shown that it has some uhhh flaws.

In the 5th Century BCE, the Ancient Greeks implemented a new form of governance (one practiced by tribal societies far earlier): democracy. In Ancient Athens, one of democracy’s earliest homes, all citizens – defined as native-born free men – were requiredto take an active part in government. Those who didn’t were fined and occasionally shamed with a splash of red paint. Athenian democracy worked kind of like very long jury duty, in that each year:

Each year 500 names were chosen from all the citizens of ancient Athens. Those 500 citizens had to actively serve in the government for one year. During that year, they were responsible for making new laws and controlled all parts of the political process. When a new law was proposed, all the citizens of Athens had the opportunity to vote on it. To vote, citizens had to attend the assembly on the day the vote took place.

This form of governance, in which every citizen can vote on every decision, is called direct democracy. Every citizen has their say, and then all must follow what the majority decides. Direct democracy worked in Ancient Athens because the scale was small and local, and even then, the Athenians eliminated 70% of eligible voters (women, slaves, and immigrants) in order to maintain a small group.

Even though the Ancient Greeks introduced democracy 2,500 years ago, and Rome remained ruled by a republican government between 500 and 27 BC, autocracy remained the dominant form of governance around the globe, with a few exceptions, until the United States Constitution came into force in 1789.

But while direct democracy worked well enough in the context of ruling a city, the American experiment required a governance model that could handle 13 colonies (and eventually 50 states) spread over a large area. As Hall and Smith highlighted:

As James Madison wrote in Federalist No. 14, “In a democracy, the people meet and exercise the government in person; in a republic, they assemble and administer it by their representatives and agents. A democracy, consequently, will be confined to a small spot. A republic may be extended over a large region.”

New contexts require new forms of governance. America’s Founding Fathers built a republic, a form of representative democracy. The people elect their representatives, and the representatives propose and pass legislation.

Since then, the world has been on a bumpy but inexorable march towards representative democracy.

Source: Our World in Data

A 2019 Pew Research report found that 57% of countries with populations over 500,000 are democratic. Modern democracy is representative democracy.

Corporations, too, most often behave like representative democracies. Shareholders elect the board, and the board hires and fires the management team, who in turn hire and fire employees, and run the company day-to-day. Unlike a national election, votes in the corporate setting are weighted by the number of shares each party holds, and the number of votes each of those shares has.

While representative democracy has its issues, it appears less bad than previous forms of governance. As British Prime Minister Winston Churchill famously quipped, “Democracy is the worst form of government – except for all the others that have been tried.”

The whole history of governance has been a series of attempts to find solutions that are less bad than their predecessors, and that best fit the context and capabilities of their time. It would have been hard to imagine the rise of national representative democracy before the invention of the printing press, for example. As Thomas Jefferson wrote, “a well informed electorate is a prerequisite to a democracy.”

New tools, challenges, and constraint sets open the door for new models. The best system of governance for a large nation comprised of colonies connected by wagons and ships that needed to unify for economic and military reasons might not be the ultimate form of human governance, or the one best-suited to internet-native organizations with very different goals, challenges, and capabilities.

Governance can and should keep evolving. While it’s not easy for countries or even companies to try new forms of governance, DAOs have the opportunity to rapidly experiment in ways that are only possible on the internet.

DAO Governance History and Challenges

To date, however, DAO governance models have mostly been skeuomorphic versions of national and corporate ones. (For a primer on DAOs, check out Packy’s The DAO of DAOs.)

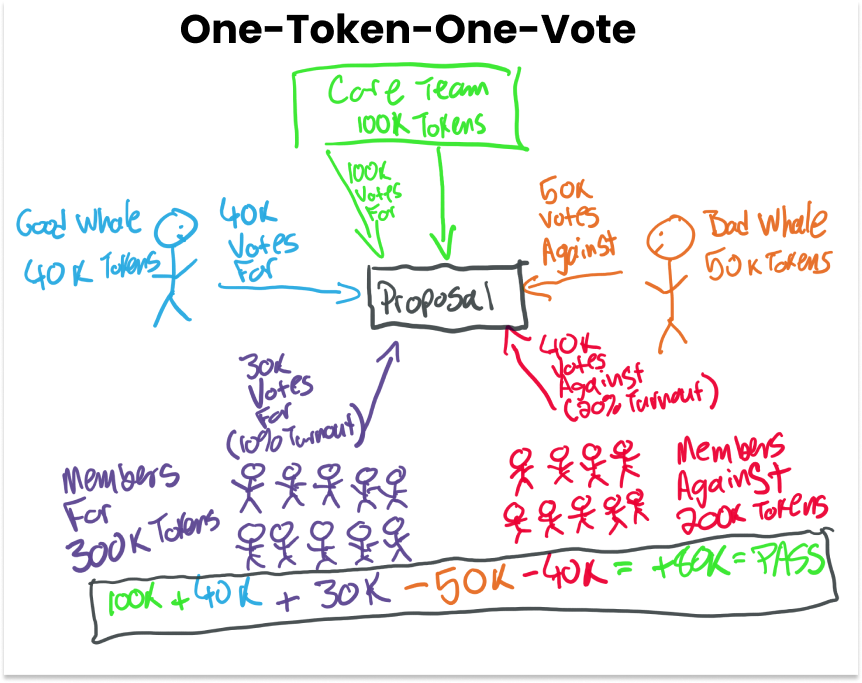

Most (if not all) governance mechanisms in crypto today revolve around some sort of implementation of the one-token-one-vote concept, akin to token-weighted direct democracy or shareholder democracy.

When DAOs have strayed from one-token-one-vote, mechanism designers have used novel on-chain capabilities to fortify the old model, as opposed to experimenting with entirely new ones. Among the more popular enhancements are:

One-Wallet-One-Vote: Akin to direct democracy, OWOV is an attempt to give an equal vote to each member. There are challenges here, including the fact that less well-informed voters or those with less skin in the game have the same voice as people with more knowledge or skin, and the fact that it’s often trivial for one person to set up multiple wallets to vote.

Quadratic Voting: Meant to decrease the voting power of large holders while still giving them more of a voice than smaller holders, QV increases the cost of each vote. One vote might cost one token, but two votes would cost four, three would cost eight, and so on.

Proof of Participation: Proposed by people including Vitalik Buterin, PoP would only give votes to those who have actively participated in the DAO or protocol, which should make it harder and more expensive to wage governance attacks.

There are others, but the majority of variations seem to focus mainly on deploying protection layers to improve productivity and mitigate or delay the effects of governance hacks – so called Optimistic Governance – but not much more. All are important improvements, but they don’t answer a key question: are the underlying governance frameworks adopted able to incentivise virtuous behaviors while tackling complex tasks?

Our guess is that, for the vast majority if not totality of DAO governance models out there, the answer is no.

Originally, most on-chain governance systems were designed to manage very simple decisions: e.g. whitelist a collateral token, modify a parameter, activate or deactivate an oracle feed. The task at hand of DAOs was well-defined and the role of the contributors was to just keep it working or maybe improve it slightly.

Ambition, however, is a human trait and with enormous financial success, protocols started to expand their grasp. What started out simple became complex, and direct democracy doesn’t do complex well.

Take, for example, MakerDAO. Originally intended to be a set of simple permissionless vaults to deposit crypto-collateral and get financed in $DAI, it soon tried to transform itself into a lender for all sustainable development in the real world.

Stopping climate change through immense financial resources might well be the most complex test for any human organization. Not surprisingly, Maker performed poorly in trying to do so. Sub-par institutions continuously pitched whatever they were doing as green while asking for huge sums of money, spamming all governance channels for months in order to legitimize their intentions in the eyes of the token holders. In a flat democratic system, and without clear checks and balances and specialization of tasks, it became impossible to separate the good actors from the bad ones.

Ultimately, Maker decided to put its infinite liquidity machine towards purchasing US government bonds—not exactly the most original nor environmentally-friendly investment strategy.

The problem, of course, isn’t Maker-specific. Lido’s recent proposal to sell $10m of $LDO governance tokens to Dragonfly (a crypto VC fund) generated a similar disordered reaction by the community and, after being dinged, is now in v2.

It is often impossible for the wider DAO membership to evaluate complex proposals —with significant financial implications– in a professional and unbiased manner. But in one-token-one-vote crypto governance systems, everybody’s voice matters and should be fought for.

Those systems are (pseudo-anonymous) winner-takes-all games, where those who rally enough votes and are ready to swallow the regulatory risk of voting get to say where everyone is going, at no additional cost for themselves. Additionally, transaction costs are still an issue for many small holders, and the sad reality of crypto today is that most token holders are more interested in farming yield than voting. My guess (Luca here) is that harvesting 10-20% of voting power is enough to decide the destiny of most DAOs: the voice of the winners might not be entirely representative of the majority of DAO participants.

Low participation is one of the most dangerous conditions of modern democracies. When DAOs are DeFi protocols that can divert immense financial resources, all those problems quantum-leap in intensity. Due to complexity, apathy, and simplistic governance frameworks, a handful of voters is enough to pass most proposals. Those with the largest holdings are not incentivized to invest additional financial resources to rally the troops—beyond purchasing and voting the token, they can keep all private benefits of a proposal they support, and mutualise any potential loss.

What does this mean? Think of Mr. Evil coming forward with a proposal to receive $1 billion from a protocol to fund a shady project. Mr. Evil can purchase $50 million worth of the same protocol’s governance tokens, and vote those tokens in favor of its own proposal. He could even defend the self-endorsing move as evidence of having skin in the game. If the $50 million worth of tokens are enough to tilt the vote towards the Yes, Mr. Evil can now run away with the whole $1 billion pot, leaving the rest of the token holders to bear the costs. It doesn't matter too much whether the $50 million worth of tokens purchased to tilt the vote will get lost in the process—$1 billion is way more than $50 million. In one-token-one vote systems with simple majority, the incentive to be (or to become) the bad guy is huge. Voting becomes a lobbying feast. For the nerds out there, we suggest checking Luca’s recent piece First Principle of Crypto Governance.

But what if, instead, assuming $1 billion is everything the protocol has, Mr. Evil’s 5% ($50M/$1B) vote only enabled him to abscond with 5% of the treasury for his nefarious project? He’d end up with the same $50 million he risked, minus gas and time. It wouldn’t be worth it.

Beyond DeFi, where large dollars create high-drama and high-stakes, DAOs more broadly face three common problems even without malicious actors like Mr. Evil. These are challenges faced by nearly every DAO, from DeFi to social DAOs: centralization, prioritization, and fragility.

Centralization. If your DAO is run like a cult prostrating itself before a high priest, is it really a DAO? The usual complaint about centralization in DAOs is that one-token-one-vote simple majority governance systems inevitably end in power bloat for founders and whales, and that’s fair enough.

But centralization is also the product of a process problem, because DAO governance has merely imitated traditional shareholder governance, in which a core team gets approval from a board to act as it pleases, rather than trying to incentivize communities to find and raise their own voices. In other words, we haven’t really seen actual decentralized governance that unlocks what’s most exciting about web3: super-charging interpersonal trust and offering the ability for anyone anywhere to contribute creatively to a system. Actual DAO-native governance should try to flip the script by letting communities submit proposals for the core team to execute, rather than vice-versa. If that sounds controversial, remember that even in web2, that’s been standard practice for user-research through platforms like Canny.

Prioritization. Let’s say you run an investment DAO that’s deciding whether to give funding to various proposals. In current DAO practice, you’d likely have a yes-no vote for each proposal to determine whether it receives funding—with some likely social stigma around publicly voting no on projects your friends all love, that have founders you might need to socialize with, etc.

What if instead of putting these proposals to a yes-no vote, you put them into a contest or tournament to see which proposals people like most?

A few things would happen. First, you’d get more granular metrics: you wouldn’t just measure whether a community liked a proposal, but how much they liked the proposal relative to others. Second, you’d mitigate social fears of voting against a proposal, since the only votes are positive votes—letting your community vote more honestly. Third, you would increase the cost of shilling your own project to get it approved. And ultimately, you could spare funding towards a lot of projects and focus them proportionate to the votes on the proposals that received the greatest support—in order to maximize your own efforts as a DAO.

Fragility. Fragile DAOs are easy to game. Fragility is independent from achieved decentralization or work efficiency. When a system is easy to hack by smart actors, it exposes the whole construct of work and resources to attacks. In crypto, we are used to financial hacks—where smart devs aim at stealing financial resources from wallets and smart contracts; governance hacks function the same way, but target decision making rather than financial resources directly. Effective DAOs should develop systems that are resilient to those types of attacks.

The simplest way to break down these three problems is at the point of submission and voting. Centralization is largely a problem of how we submit proposals. Prioritization is largely a problem of how we vote on them with yes-no votes rather than ranked-choice options. Fragility is a function of both submission and voting.

Let your community submit proposals, then let them vote on your favorites, and you’d go a long way towards solving both issues. And in fact (David here), this is exactly what we’ve built at jokedao as a new system for DAO governance.

It sounds simple enough and is simple enough, so why haven’t we seen this system before?

Well, readers well-versed in the history of corporate governance are likely to raise a finger here with a fatal objection to the so-called “problems” above. “Don’t you realize,” scoffs our hypothetical reader, “that getting random community members to compete against each other in dictating the direction of a community—that this incentivizes fragmentation and dissent while forcing experts to defer to the average ignoramus?” Experts, or politicians, lead teams for a reason. Partly, sure, it’s because they’re the visionaries who know what’s best. But it’s also more efficient to rule a kingdom than a commune; there is no greater productivity hack than tyranny.

But there’s a simple answer: yes, internet-native governance incentivizes fragmentation and dissent. Because internet-native governance should incentivize fragmentation and dissent.

That’s where forking comes in.

Forking Governance

The unlock here that’s unique to DAOs is forking—the process of creating a new version of a system by copying it under new ownership, much as one mutation of a species makes only minor tweaks to DNA to produce a whole new animal, but without eliminating its species of origin.

Forking isn’t a new concept in crypto.

The most famous fork, arguably, is Ethereum itself, which was forked into a new blockchain in 2016 to retroactively restore funds to users after The DAO hack. That fork is what we now call Ethereum, and as controversial as it was at the time, it demonstrated a perfect use case for violating the immutability of blockchains to create a better model based on social consensus. Subjectivity, not objectivity, it turns out, was at the basis of functioning governance systems. What, in hindsight, seems a linear incremental evolution was actually an almost-randomic spread of forks where only the fittest for the current environment survived. Forking is a way for nature to maximize the odds. The universe is no maximalist.

The simplest way to understand forking is an internet-native political function that we’ve never had in traditional states or governments: optionality to start your own online state with its own politics and currency.

Imagine you could opt-in and opt-out of different governmental regimes, and when you disagreed with your government’s decisions, you had the option to create your own version—with, of course, all the attendant hassle of trying to build social consensus around your vision. Back in the physical world, this is fairly impractical: to start your own government means managing land, fighting wars, and building social consensus with neighbors in your local bars and clubs.

But online, it’s just a matter of copying code and finding anyone else who agrees. And—we’ll come back to this point later—good online governance can actually help you find others who agree, maybe outside of your most immediate social circle.

In its own little way, the internet does let us speedrun governments. But it also lets us reduce the inefficiencies of traditional democracies. Forgive us a quick rant.

The popular complaint against democracy, extending from Herodotus to Andrew Sullivan, is that people don’t really know what’s good for them—we political yokels are not exactly experts, and we’re prone to the bickering whims of social media. Indeed, it’s all too tempting to look at the current state of America and Europe and conclude that democracy is caught between two terrible poles: violent cultural fracture, as the populace polarizes against each other, or bland committee consensus, in which only the most compromised bills get passed that neuter all contrarian, visionary proposals to solve pressing problems like climate crisis and health care.

Forking offers a third path. The contrarians might not win, but they can still get allocation from the community, or they can just start their own community dedicated to their goals—and if they’re right about their vision, they’ll succeed.

Of course, in a traditional company, incentivizing disagreement and splits would be corporate suicide. But in crypto, things can work differently: open-source, permissionless environments let small teams execute quickly by building off the work of others in the space, so small groups can execute efficiently, and just as importantly, value accrues to tokens rather than projects.

Incentivizing communities to fork in order to pursue separate visions of a token can actually help improve the prospects for its value.

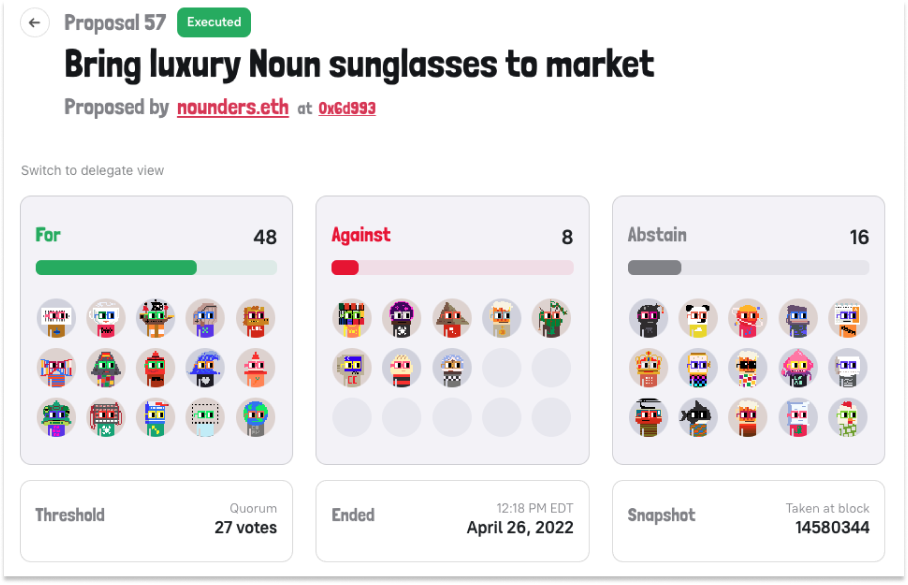

Often, new trends catch media and entertainment first, before moving to more complex businesses. Here, too, the best example that hints at the potential of DAO forking is an NFT project: NounsDAO.

Every day, Nouns auctions one NFT, and every day, going on 393 straight days, someone buys a Noun for anywhere from 80-100 ETH ($136-170k). The winner gets the Nouns NFT, and membership in the NounsDAO, which controls its 26,350 ETH ($45.3 million) treasury. NounsDAO members can propose and vote on grants from the treasury, often for offshoot projects that leverage Nouns’ cc0 license to permissionlessly create Nouns-based projects.

One well-known example is Nouns Vision, luxury physical sunglasses based on the Nouns’ iconic eyewear. In February, salvinoarmati proposed making a prototype of the sunglasses, and the DAO granted him 5 ETH. In April, prototype made, DAO member nounders proposed a grant of 7.2% of the treasury to bring 500 pairs to market, available to the first 500 Nouns holders. 48 members voted for, 8 voted against, and the proposal passed.

Beyond those 500, the creator of the sunglasses sells physical pairs on Nouns Vision for 0.44 ETH without the involvement of NounsDAO and with no money from sales going back to the NounsDAO treasury.

Why would a DAO fund a project that uses their IP but pays them nothing?

In the era of TikTok and memes, companies often depend on free user-generated content for marketing, virality, and decentralized brand-building. This user-generated content is, if you like, a fork—an alternate vision of a story, based on the core IP, remixed by the user. Nouns makes it as easy as possible – going so far as to pay from their treasury – for people to create with, and profit from, their IP.

Nouns is making a very 21st century internet-native bet: that by incentivizing anyone to fork its IP, for free, more value will accrue back to the core IP. By foregoing control and short-term revenue from projects like Nouns Vision, it thinks it can make the brand more valuable, and that that value will come back to the DAO in the form of higher auction prices and more demand for any projects the DAO spins up itself. In the world of crypto, forks are usually considered to be alternate versions of a blockchain with new tokens. But Nouns shows the power of a different kind of fork: a positive-sum fork that accrues value back to the original token and brand.

Nouns is not alone.

Squint a bit, and you might even see Ethereum rollups like Optimism and Arbitrum as sort-of-forks that augment a central function of Ethereum, execution, in order to drive more value to its token, whether or not they also produce their own.

EigenLayer, meanwhile, lets ETH holders who have already staked their ETH restake it—collateralizing their tokens to receive rewards for validating services well beyond ETH transactions. Fundamentally, if a project splits off into multiple projects that use the same token, then each is building value for that token, even if they hate each other and disagree.

Let’s wrap up this section with an important question.

Is the best governance system one that represents each individual’s private view? Or is it one that relies on publicly and collectively building social consensus among parties as they negotiate for shared objectives that they can rally behind?

In the current system, broad consensus is practically impossible, and small groups of powerful people whose back-room consensus impacts the entire populus is sub-optimal at best.

But the option set expands online, when forking is an option.

First, because internet-native governance gives us optionality to participate or leave systems, we arguably want to *incentivize dissent* by letting dissenting parties find each other and pursue *their* shared objective.

Second, forking also means that DAOs can continually break apart into subDAOs that are smaller and easier to coordinate than larger systems—more like the direct democracy of 500 Greeks than the representative democracy of millions of Americans.

Third, because forking enables a continual mitosis-like process of splitting bigger groups into originally smaller ones—with some destined to grow independently—governance now means that individuals can do the work of relationship-building, talking, and listening to determine shared goals, all of which have minimal effect in large democracies.

In this context, governance looks less like showing up at the voting booth once every couple of years, and more like an ongoing social activity.

Governance as a Social Network

In other words, internet-native governance is no longer just a reflection of decisions but a process of decision-making itself that actively builds relationships, gets people excited about shared goals, and increases the probability of completing these goals successfully. In that sense, the key part of governance to measure isn’t the vote, but the forums—the discussion that builds consensus. That’s what makes a DAO.

Think about Twitter here or any other major web2 social networks. They’re kind of governance platforms.

Each like is a vote on content to express that you approve it, would like to see more content like it, and would like others with your interests to see it as well. What is crucial is that these networks institutionalize the two major components of internet-native governance: forking (quote-retweets, copypastas, and TikTok remixes) and forums (where participants are incentivized to dissent and build consensus in comments).

In that sense, we need to start seeing successful governance as a great online game based on team formation, competition, rewards, and most importantly, fun. This is why David designed jokedao around contests, and built the site to feel social.

Gamifying governance means that the point of governance is no longer the outcome that we arrive at, but the process of governance itself—just like the point of playing a game is to play the game itself. This is what will allow governance to become a substrate underlying DAO and subDAO formation rather than an annoying layer on top that nobody wants to perform.

But just as significantly, good DAO governance can learn from these social networks while unlocking unique web3 properties that can give greater power to proven contributors, execute decisions on-chain, reward consensus and dissent, and in what might be the ultimate example of forking, let communities retroactively decide on different winners depending on the different metrics they use.

Because ultimately, this is the promise of forking: to get people to disagree and then find their subcommunity where they're aligned and can create their own version of a project. Good governance is, in effect, a kind of web3 social network—the basis of social graphs for people to find others who share their interests and pursue those in communities.

How Forking Might Work

All that forking sounds complicated, though. How might it work?

One quick answer is that dissenters should be able to find and communicate with each other on-chain: the ability of on-chain governance to surface correlations among voters, in other words, is arguably more important than the decision itself.

But then what? How do these dissenters fork?

We have already pointed at the development of scaling solutions (so called Layer 2s) as some sort of fork of the Ethereum ecosystem and $ETH token. Rather than campaigning and lobbying for drastic changes to Ethereum’s core in order to improve throughput or reduce transaction costs (at the expense of something else), scaling protocols decided to build on top of the core protocol, and in doing so, isolating most risks away from the core while continuing to accrue value to it. A successful Optimism would mean a more valuable Ethereum, but a disastrous Optimism wouldn’t necessarily translate into a systemic failure of Ethereum.

But this, and the Ethereum Classic fork, are very isolated examples. How instead would a continuous forking mechanism work in the context of a DAO?

Let’s look at two types of fork: a governance fork and a proposal fork.

Governance Fork

Imagine a DAO, let’s call it DAO X. DAO X performs a certain function (like providing funding or facilitating the exchange of a token for another) and accrues value within its treasury in exchange for its services. The treasury is controlled by the DAO’s governance token, let’s call it $DAO-X. By voting the token, holders can decide, among other things, how to use the resources available within the treasury. A proposal is now brought forward to governance—e.g. to develop a new swapping product—and two groups battle for Yes and No.

In our one-token-one-vote simple majority system, the winning group would decide what gets implemented and what doesn’t. It doesn’t matter if the group won the vote with 50.1% vs. 49.9%. The whole DAO has to comply with the results of the vote.

But imagine now a world in which continuous forking is allowed. Now the group losing the vote with 49.9% would instead gain rights over 49.9% of the value of DAO X’s treasury—decisions about what to do or not with this 49.9% would be assigned to a newly minted sub-governance token $DAO-X-LOSERS. The same would happen to those who retain the other 50.1% coordinated by the $DAO-X-WINNER token.

The fork would allow both groups to continue along the journey of protocol evolution they believe in, allocating financial resources that are proportional to the community’s approval. Forking would allow for experimentation and evolution, while limiting existential risk for the protocol. The forking process, obviously, could continue into infinity.

This type of forking system would face obvious challenges. Instead of hard-to-win battles for the entire treasury, hackers could wage smaller governance attacks to bite off smaller, but still significant, pieces of the treasury. In other words, a bad actor who controls 10% of a DAO couldn’t wage a governance attack to take over the whole treasury in a one-token-one-vote system, but they could run away with 10% of the treasury uncontested in the forking model.

But here’s an important thing to keep in mind: people can only vote tokens they control, and the choice may come down to dumping their tokens and leaving altogether, or forking those tokens to do something that has minimal risk, but possible upside, for the core DAO.

Take the Maker case described above. If 10% of the DAO passionately supported climate-positive lending, a group of people who are either passionate or specialists, or both, could fork 10% of the treasury to lend to climate-positive borrowers, and put their full focus on building systems to underwrite exactly that kind of project. In addition to the 10% of the treasury they control and bring with them, they might also attract exogenous capital who value Maker’s infrastructure, but would rather focus their dollars on climate-positive lending and not all of the other lending that Maker does. A token swap or fee system could be set up such that the subDAO is backed by Maker’s strength, and Maker benefits financially from the upside of potentially riskier loans.

Even absent malicious actors, forking might excessively fragment a protocol’s liquidity, which would have unintended negative implications for everyone involved. Who would like to pick among 100 different subtypes of Uniswap to exchange their tokens?

Solutions to those problems should be designed on a case-by-case basis. In some cases, DAOs might limit the maximum percentage of treasury available for forks, like a governance-based grants program. They may also introduce fees the subDAO must pay to the DAO, so that forks can have product control without the ability to abscond with the fees. The cost of forking should be minimized but not eliminated.

As always, the potential benefits should outweigh the potential harms. It should be prohibitively expensive to act maliciously, but easy to spin off positive forks. Easier said than done, we know.

From an investor or participant perspective, such a system would enhance visibility over which forces govern which resources within a DAO, and give them more specific options for their investments. Such an investor/ participant would always have the possibility to expose itself to the value accrued by all offspring, or actually isolate exposure and participation to specific groups, increasing internal uniformity.

But most of the time, it shouldn’t need to come to governance forking. DAO members should have the chance to not just vote on proposals, but to propose, tweak, submit, and re-mix them before they come to a binding vote.

Proposal Fork

Just as significantly, we can imagine a process of proposal forking. Let’s say 2/3rds of a group rejects a proposal for different reasons: 1/3 objects to the budget, and another 1/3 objects to the timeline. But what if different parties could submit alternate versions of each other’s proposals by changing the details, vote on their favorites, and then put that to a yes-no vote on-chain? Two things would happen.

First, the community would get a much clearer sense of an ideal implementation of a proposal. Whereas Lido DAO is currently resubmitting various versions of a treasury diversification proposal to a yes-no vote to see which one sticks, they could actually find out what the optimal proposal was if they enabled submissions from their community.

And second, that 67% that voted no might dwindle to 20% or 30% if there were a more popular version of the proposal to rally around. This process of “proposal forking” would result in far stronger social consensus, not only because parties could actively negotiate with each other to reach shared objectives, but because it would reveal commonalities rather than differences among the community. Not only would the proposal pass, but the community would likely be happier as a result.

All of this is possible on a governance platform like jokedao, and it’s simply the effect of incorporating community feedback into the process of governance itself. When people can express their own insights, they optimize for the best insights to win.

In some sense, this is what happens for applications building on certain blockchains. We are already living in a world of continuous governance forking—we need only to fully embrace this reality. A mechanism of continuous forking can maximize specialization of work, increase chances of financial survival, and maximize sense of belonging by progressively widening behavioral distance among sub-groups, while maintaining shared vision over the greater plans.

Governance forks and proposal forks are just two of the forking possibilities we can imagine. Celestia, a modular blockchain network, takes the concept a step further, proposing that forked communities shouldn’t just have their own subDAO, but their own chain as well.

Whatever the implementation, forking offers a new way to think about governance on, of, and for the internet.

Hyperspeed Evolution

This whole thing reminds us a little bit of Hamilton. A group of young, smart people tired of the status quo channel their youthful energy into … creating new governance models.

Hamilton, Jefferson, Burr, Madison, and the rest had one shot to get it right, and had to fight a bloody war to even get that shot. They had to try to form “a more perfect Union,” and codify their best attempt in a document that still reigns 233 years later. The ten Amendments in the Bill of Rights have proven as immutable as any rules written in code.

DAOs don’t have the weight of that responsibility or permanence. No DAO is responsible for a new nation. They don’t need to strive for perfection. They should optimize for evolution.

The recent debate over use cases in crypto has laid bare a hard truth: web3 isn’t as good at doing the things that web2 companies do as web2 companies are. That’s fine. Of course people aren’t impressed by DAO governance, and rightly point out that it’s just a messier implementation of ideas that already exist; recreating existing structures on-chain shouldn’t be the goal anyway.

Differentiation is important for any challenger, and DAOs should lean into the things uniquely enabled by crypto, even if they seem small, weird, chaotic, and niche at the start.

Companies can’t fork. DAOs can. Companies can’t easily swap equity with each other. DAOs can. Companies don’t treat their governance as a form of participatory entertainment and social network building (although maybe some activists do). DAOs can.

Because they live on the internet, and aren’t bounded by geographical or physical limitations, DAOs have the opportunity to be much faster and more experimental, to fork into myriad competing and cooperating sub-groups, and to evolve at a faster rate than humans or our institutions. Instead of striving for perfection, DAOs can strive to increase the number of mutations, let market forces decide which mutations are fittest, and even mix and match mutations in acts of digital reproduction.

Letting DAOs behave more like the internet-native organizations they are, freed from constraints and the pursuit of skeuomorphic governance implementation, can accelerate the simulation. This is true on two levels:

System level: More experimentation on the governance models themselves should help better models emerge more quickly.

subDAO level: More forks, backed by the resources of the parent DAO and the focused efforts of aligned subDAO participants, should lead to a flourishing of small but effective (and fun) efforts.

What that means for the financial prospects of each DAO, and for the potential of DAOs as investments, is complicated and probably deserves its own essay (a forked subESSAY, if you will).

DAO governance models that encourage dissent and forking might increase value directly or indirectly. They might provide a counterintuitive defense against bad actors who might try to abuse existing models to capture entire, juicy pies. They’ll create fertile ground for the kinds of unpredictable adaptations only possible when you give up control and let the system do its thing.

Maybe the most important impact won’t be financial, but an increase in each person’s options. In Politics, Aristotle said: “Now it is evident that the form of government is best in which every man, whoever he is, can act best and live happily.”

In the context of national or even corporate governance, no one can act best and live happily all the time. There are compromises and trade-offs. But on the internet, with its deep and rich niches of tightly-coordinated and decentralized subcommunities, people should be able to play, work, connect, invest, and govern in the communities most aligned with their best actions and happiness.

There’s clearly still a lot of thinking and real work to be done to play with new models, find what works, patch up new vectors of attack, and more. We hope this piece is a conversation starter. But reading about it is one thing; doing it is another.

Packy has agreed to write an essay based on your submissions via jokedao. Here’s how it works:

Drop your ENS by end of day on this tweet. Only ENS addresses will be accepted.

We’ll airdrop you 100 $NBESSAY tokens Tuesday morning on Polygon.

Tuesday noon ET - Thursday noon ET: submissions open for $NBESSAY holders. Submit an idea for an essay you’d like Packy to write. (Note: you might want to fork other submissions!)

You’ll need a bit of $MATIC to cover gas fees on Polygon. 1 $MATIC (currently $0.87 USD) should be way more than enough, and you can see some ways to get $MATIC and add it to your wallet here.

Thursday noon ET - Friday noon ET: voting opens for $NBESSAY holders (one-token-one-vote, yes). Distribute your 100 votes across different proposals.

Packy will attempt to write a piece based on the top-voted submission. No company-specific submissions will be accepted :)

Happy forking.

Thanks to Luca and David for all the good stuff in the piece, and to Dan for editing!

Have a great week, and see you back here later this week (baby permitting).

Thanks for reading,

Packy

“Track Record” is intended to provide Masterworks' internal estimate of the performance of the overall Masterworks portfolio for a given period with proportionate weight given to the size of each offering..This presents a measure of Masterworks performance assuming investment allocations proportional to the size of the offerings. Accordingly, Masterworks Track Record is the dollar-weighted aggregate average change in estimated fair market value of each issuer offered via the Masterworks platform on an annualized basis, excluding all offerings completed within the last six months of the given performance period which we believe are not reflective of Masterworks’ performance, after deduction of all fees and pro forma for estimated profit sharing represented by Class B shares held by Masterworks For Masterworks issuers that continue to own artwork, the estimated net asset value of the Class A shares sold to the public is based on Masterworks internal appraisals, which are performed on a quarterly basis as of the end of each calendar quarter. For offerings that were completed between six-months and one-year prior to the end of the applicable performance period and for which no public auction comparable sale has occurred, the fair market value of the artwork is appraised to be equal to the aggregate offering price which represents the price at which the artwork was sold to investors. If all offerings completed within the last six months of the performance period were included in the calculation of Masterworks’ Track Record as of June 30, 2022, the result would be 14.1%. For purposes of such calculation, the fair market value of the artwork included in offerings completed during the last six months of the performance period is appraised to be equal to the aggregate offering price. Artwork appraisals are performed by Masterworks in conformity with the 2020-21 Uniform Standards of Professional Appraisal Practice (USPAP) using a sales comparison approach, provided that Masterworks may have potential conflicts of interest. For more information on Masterworks appraisal methodology, potential conflicts of interest and other important considerations, click here. For issuers that sold a painting during the relevant period, actual realized returns, net of all fees and expenses, have been used. Masterworks may waive or forfeit fees to which it is entitled, but to date any such waivers or forfeitures, which affect all shareholders in a given issuer equally, have been immaterial. Transactions occurring on the Masterworks secondary market are not deemed relevant to the determination of Masterworks Track Record.

See important Regulation A disclosures

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK