If We Ruled the Tweets

source link: https://www.notboring.co/p/if-we-ruled-the-tweets?s=r

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Welcome to the 2,349 newly Not Boring people who have joined us since last Monday! If you haven’t subscribed, join 120,744 smart, curious folks by subscribing here:

🎧 If you’d rather listen to this essay, head over to Spotify or Apple Podcasts

Today’s Not Boring is brought to you by… Composer

It’s scary out there. While I remain optimistic, the day-to-day market activity is choppy.

Over $9 trillion has been erased from U.S. equities and the Nasdaq-100 is down 23% YTD.

With my focus on Not Boring Capital and the newsletter, and the fact that I’m not a great trader, I don’t have time to trade stocks. But I’m not going to watch this sell-off pass me by.

I’m shifting a significant amount of my liquid portfolio to a Rising Rates Risk Parity strategy on Composer that is only risk-on if both treasuries and SPY are stable - otherwise it invests in a basket of risk-off assets.

For those that don’t know, Composer gives the power of rules based trading (aka quant trading) to regular investors, 100% free to use.

Think tech has bottomed? Jump into Big Tech Momentum. Think Inflation is going to get worse? Dive into Inflation Spiral Hedge. Want to stay in stocks with more security? Try Paired Switching: S&P 500 and Gold.

Composer is the next generation of active investing. No code, no spreadsheets, no Robos and no YOLOs. Just smart investing for smart investors.

If you want access to the Rising Rates Parity strategy (it’s not publicly available on the website), use this private Not Boring link for a limited time.*

Hi friends 👋 ,

Happy Monday! And a very happy belated Mother’s Day to all the mothers out there, especially to Puja and both of our moms!

Speaking of mothers, today, we need to talk about the mama’s boy who brought his mom to the Met Gala… Elon Musk.

When the Twitter acquisition was a story about free speech and content moderation, I didn’t have much to say. Those are really hard problems about which I have no special insights to contribute. But over the past week, the story has evolved into one with which I’m much more comfortable: how to better monetize Twitter.

I have some ideas, one of which is that Twitter’s users should have a seat at the table, and upside in the outcome.

Let’s get to it.

If We Ruled the Tweets

Ok, hear me out… TweeterDAO.

On Thursday, a new amended 13D filing showed that Elon Musk rallied the troops to pony up $7.1 billion of his $44 billion Twitter bid.

This is interesting for a few reasons.

First and foremost, it means that Elon’s assertion that he “doesn’t care about the economics at all” no longer holds. He needs to care about economics now. Twitter will need to generate enough money to pay Elon’s debt service, and to generate a return for its investors, including VC firms a16z and Sequoia. VC firms don’t typically play for 2x returns; while Elon and Twitter make this a special case, their involvement signals that economics do matter.

Second, it cuts Elon’s margin loan from $12.5 billion to $6.25 billion, lowers the debt burden, and gives him some more room to experiment from a cash flow perspective. He can get a little more aggressive in this scenario.

Third, Elon is rumored to be telling investors that he’s stepping in as interim CEO. He’s not known for doing things in a small way.

Finally, crypto exchange Binance is a fascinating inclusion, particularly after its founder CZ tweeted, “Privatize it, issue a token, decentralize it” last month. While I think it’s unlikely that Elon decentralizes Twitter in the near-term, Binance’s involvement means more decentralized solutions may be on the table.

Speaking of which… Elon should give a DAO made up of Twitter’s power users a place on Twitter’s cap table and a seat on its board. Call it TweeterDAO.

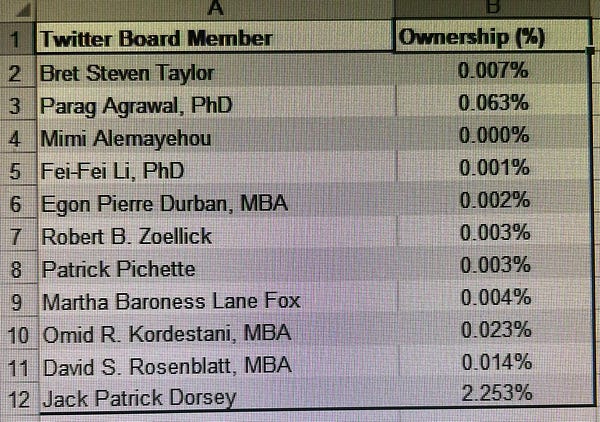

Giving TweeterDAO a board seat is a step short of issuing a token and fully decentralizing. It’s a step short of the direct democracy he thinks humans should use to govern Mars. But it’s a big step in the right direction from a board made up of people with practically no ownership and famously little usage of the product.

In a TED interview last month, Elon told Chris Anderson that he wanted as many Twitter shareholders as possible to retain ownership, so that they could share in the governance of the platform, and that he thought the SEC limited it to 2,000 people. This DAO structure might be a workaround.

Not surprisingly, I think that investing in the equity – directly or via DAO – of the new private Twitter is a compelling bet. It was one of my top picks at the Acquired Arena Show the night before the investment was announced.

I had no inside knowledge, just a longstanding belief that Twitter can and should be so much more than it is. Prognosticating on, and being overoptimistic about, Twitter’s future is a treasured pastime here at Not Boring. In July 2020, I wrote If I Ruled the Tweets. In February 2021, I followed up with How Twitter Got Its Groove Back. Hell, in March 2021, Marc Rubinstein and I even kinda defended Jack in Jack of Two Trades.

In If I Ruled the Tweets, I wrote, “Twitter is the most undermonetized product in the world, because it doesn’t know what it is.” While its ad business has grown and improved slightly since then, and it finally introduced some light subscriptions, the point stands. The delta between Twitter’s importance and its business performance is gaping.

But the company has seemingly infinite shots on goal to try to turn the business around because its power users are incredibly sticky (read: addicted to Twitter) and the magical experiences are unbelievably magical. It’s the home base for The Great Online Game.

Elon, my inspiration for that essay and a power user himself, has some thoughts on how to turn things around. Over the weekend, The New York Times shared information from a leaked pitch deck Elon is using to raise money for the deal. According to The Times, plans include:

Quintuple revenue to $26.4 billion by 2028.

Cut Twitter’s reliance on advertising to less than 50 percent of revenue.

Produce $15 million in revenue from a payments business, and $1.3 billion by 2028.

Increase average revenue per user by $5.39, to $30.22.

Reach 931 million users by 2028.

Have 104 million subscribers for a mysterious “X” by 2028.

Hire 3,600 employees — after shedding hundreds.

And of course, he expects there to be 69 million Twitter Blue subscription users by 2025. Nice.

While the projections are characteristically aggressive, and the underlying products (“X”) that would get Twitter there are vague, I don’t doubt that Elon will be able to multiply Twitter’s business. You don’t even need to be an Elon fanboy to believe that; you just need to agree that Twitter has been leaking value that a strong management team should be able to capture.

While Elon talks a lot about free speech, and I think he genuinely believes it’s a key reason for doing this, when he buys Twitter, Elon will also be buying one of the rarest assets on the planet: one of the few at-scale social graphs (in this case, the interest graph) where more of the world’s decision-makers shape ideas, and have their own ideas shaped.

That presents both an incredible financial opportunity, and a largely unprecedented governance challenge. Twitter’s users should be able to participate in both.

So today, we’ll cover three things:

What does Twitter think it is, and what is Twitter?

What New Twitter should build

TweeterDAO

What does Twitter think it is, and what is Twitter?

Twitter’s problems stem from confusion about what it is, and the advertising-based business model choices it’s made as a result.

In If I Ruled the Tweets, I wrote that Twitter’s main challenge was its confusion over its identity:

Twitter thinks it’s Facebook, but it’s LinkedIn.

Twitter thinks it’s an ad product, but it’s a subscription product. It thinks it’s an Aggregator, but it’s a Platform. It thinks it’s a social network, but it’s a professional network: one built for the Passion Economy, based on the strength of ideas instead of past experience.

Look, it was early 2020 and I was a newly-full-time *creator* and the Passion Economy was hot, so maybe I focused a little too narrowly, but two years later, the main point stands. Twitter isn’t a social network as much as it is a professional network.

In How Twitter Got Its Groove Back, I summarized why understanding what it is, who it’s for, and which business model was so important for Twitter:

If on ad-supported social networks, like Facebook, advertisers are the customer and users are the product, on LinkedIn, most users are the product, but power users are the customer. Only 18% of LinkedIn’s revenue pre-Microsoft acquisition came from ads; the rest came from selling tools to power users, both companies and individuals.

For Twitter, its power users, and the people who should be its customers, are the 10% of users who generate 80% of the tweets. We’ll call them Creators. The Creators’ Job-To-Be-Done is to get their ideas, products, newsletters, courses, videos, podcasts, investment ideas, and the other things they’re selling in front of people.

Again, Creator sounds too narrow and too 2020, but I’m referring to the users who create content on Twitter – individuals and businesses alike. And again, I think the argument stands.

Instead of an Aggregator that operates like a social network and monetizes through ads, Twitter should be a Platform that operates like a professional network and monetizes through subscriptions.

With a couple more years of evidence and wisdom, though, I think I undershot it. Because for as strong and focused as LinkedIn’s business is, it’s more focused and narrow than Twitter needs to be. Twitter is addictive, engaging, and valuable to its users in a way that LinkedIn isn’t.

Addictive. Twitter behaves like a professional network sometimes, but it’s also where many of the world’s most powerful people go when they’re feeling curious, feisty, inspired, or just bored. I don’t know anyone who checks LinkedIn as compulsively as Twitter.

Engaging. And when they check, they engage. This image that Ben Thompson included in his recent Back to the Future of Twitter captures the difference between how users interact with Twitter and Instagram well.

Valuable. There’s a question that goes around Twitter every so often that goes something like “How much would someone have to pay you to not use Twitter?” I asked it myself while I was writing this piece, and the answer is eye-popping but not surprising. Across over 1,100 responses to my very unscientific poll, 40% of respondents said they’d need to be paid more than $10,000 per year to not use Twitter.

Again, not scientific, but I think it’s directionally accurate for a subset of Twitter’s most valuable users – the “Creators” who send 80% of all tweets – and specifically the subset of that group whose business or income benefits from Twitter. For that 40%, Twitter is leaving so much money on the table that you can’t even see its current ARPU on the graph unless I make it really tall.

I don’t think Twitter should start charging power users $10,000 per year (Elon: please don’t start charging power users $10,000 per year), but there’s somewhere between the $0 it currently charges and the $10,000+ people would be willing to pay that Twitter can charge its users for a better user experience and access to better products from Twitter (or built on Twitter).

Twitter doesn’t need to build the biggest network in the world to be wildly successful. It just needs to make sure it serves its smaller segment of higher-value users better, and monetizes them much better, than it does today.

That view informs what I think New Twitter should build.

What New Twitter Should Build

With new ownership, particularly this new ownership, New Twitter is certainly going to look different than the Twitter we know and love/hate. Just what it’s going to look like is still up for debate.

There are a couple main schools of thought on what Twitter should do:

Open It Up.

Lean Into Subscriptions.

Open It Up

The Open It Up camp argues that Twitter should go back to the way things were: open up the API and the microservices, which Ben Thompson lists as:

A user service (for listing a user’s timeline)

A graph service (for tracking your network)

A posting service (for posting new tweets)

A profile service (for user profiles)

A timeline service (for presenting your timeline)

Third-parties could build clients and algorithms on top of Twitter, like this:

Ben goes a step further and argues that Twitter should split into two companies: TwitterServiceCo, to run all of the services and sell them to third-parties, and TwitterAppCo, which would build one of many competing app products on top of Twitter’s service and social graph. (I’m missing a lot of nuance by summarizing, you should read the full piece).

In Elon is Right: Twitter Should Open Up the Algorithm, Every’s Nathan Baschez makes a strong case that Twitter would be better off if it open-sourced the algorithm that ranks tweets in our timelines, as Elon has suggested, and created a marketplace for new algorithms.

Nathan argues that letting anyone create and market their own algorithms – you can imagine feeds with promises like NO THREADS!, Nuanced Conversation, Breaking News, etc… – would be better for Twitter through that “classic law of technology: commoditize your complement.” He, like Ben, believes that Twitter’s core product is its network of users and tweets, not the user-facing clients or the feed-ranking algorithms, and that by allowing more algorithms to compete, Twitter will actually create more demand for its core product.

In both the Ben and Nathan arguments, Twitter users get more choice, and Twitter itself gets to push off all the hairiness that comes with controlling the algorithm and content moderation to third-parties, who can independently build products that work for all types of people, markets, and legal regimes.

While Elon has discussed open-sourcing the algorithm, and flagging the rationale for human moderation decision, he hasn’t gone as far as saying that he’s going to open up to third-party clients or add developers yet. In fact, his leaked plan puts him more in the Lean Into Subscriptions camp.

Lean Into Subscriptions

Thanks to pitch deck leak, we now have a better understanding of Elon’s plans than we did coming into the weekend:

Lower ads’ share of revenue to under 50% in five years.

Grow the $3/month Twitter Blue to 69 million users.

Introduce payments.

Unleash top secret X Subscribers product and get 104 million subscribers.

Elon agrees that Twitter needs to lessen its dependence on ads and move into subscriptions.

The math is tempting. At $3/month across 69 million users, Twitter Blue, which is currently a weird hodge-podge of things like an Undo Tweet button, color choices, and ad-free articles, would generate an additional $2.48 billion, or a 50% increase, by 2025. An additional 104 million X Subscribers, at $5/month (assuming this is a more premium product), would generate an additional $6.2 billion in annual revenue by 2028.

Plus, the things that Twitter has optimized for seemingly because of the ads model drive so much of the shittiness on the platform. Moving towards a subscription model, especially if human users can get that Verified blue checkmark for $3/month and filter conversations to verified users, might make Twitter a more civil, healthier place.

When I wrote If I Ruled the Tweets, I was more in the Lean Into Subscriptions camp. My four recommendations, based on suggestions from other twitter users, were:

Table Stakes: Verify identity to clean up the conversation.

Twitter+ Subscription: Paid tools for Creators to find, create, and share ideas.

Twitter Create: Twitter should be the place to build subscription businesses.

Profiles as Creators’ Home: Develop the most underdeveloped real estate online.

Two years later, with Elon at the helm, I think that that was directionally correct, but that Twitter’s opportunity is bigger than that.

If I Ruled the Tweets

There are a few guiding principles behind what I think Twitter should do:

Make Power Users Happy, They’ll Keep Everyone Else Engaged.

Power Users Want to Do More in the Twitter Ecosystem.

The Twitter Graph is One of the World’s Most Valuable and Undermonetized Assets.

Twitter is More Than a Social Network.

With those in mind, here’s what I’d do.

First things first, I’d start by verifying all human and legitimate business users.

It is a truly bizarre artifact of Twitter’s dysfunctional history that only certain people are able to be verified, and that it’s more a signifier of elite status than of verified humanity. In Twitter’s early days, verification technology wasn’t very good, but it is now. Today, every crypto exchange and fintech product verifies users with third-party software that checks IDs; Twitter could incorporate something similar.

My friend Dror suggested this idea in response to my original question back in 2020:

Implementing that idea, and charging $3 per month to verified users, should be priority zero, one from which all other moves flow. By allowing filtering by verified users, Twitter could both keep bots away from people who don’t want to see them, and make the $3/month subscription product a no-brainer, must-have for power users.

Adding verification information to Twitter’s social graph makes it even more powerful, too. It might become the largest database of ID verified users in the world, something that third-party developers would love to tap into (with the personally identifying information hidden, of course).

Speaking of which, I agree with Ben and Nathan that Twitter should reverse its 2012 decision to limit (and ultimately cut off) third-party access to its APIs.

Twitter can charge third-party developers for API access to its microservices – like user, graph, timeline, and posting – and let them build independent third-party clients for Twitter, as Ben suggests. Giving people the choice of other experiences would mediate concerns around content moderation and Twitter’s centralized power.

It might also let developers build services that look nothing like core Twitter, but tap into its database of verified users and interest graphs to build things like recommendation services or dating apps.

I actually disagree, though, with separating out the Twitter App into a separate company. I think Twitter should go the opposite way and quadruple-down on the Twitter App product experience.

Part of that might be, as Nathan suggests, building a marketplace for algorithms so that people are able to control their own timeline experiences. This, too, would lessen free speech and content moderation concerns; if I want a feed that’s only unhinged political takes, I can build it or buy it. Twitter might even allow people to build algorithms that give them access to “banned” users’ tweets.

I think Twitter is thinking bigger than that, though, based on two clues in the leaked pitch:

Payments

More Headcount

As many people who actually know what they’re talking about re: engineering have pointed out, Twitter could run its current product with a much smaller team of engineers than it currently employs. But while Elon does plan to fire a bunch of people in the short-term, he plans to hire many more over the next six years.

He also plans to generate $1.3 billion in payments revenue by 2028, tapping into his experience from PayPal to build a much better payments product than the current tipping thing.

There’s not any precedent in the US for a combination social/professional network and payments product, but there is in China: WeChat.

Instead of just opening Twitter up to developers who want to build tweaks on the current product, I think that Twitter should and will build an app ecosystem like WeChat’s minis, all within the app.

Distribution is king, and while Twitter hasn’t done a great job of monetizing it, it’s the place where most information-based businesses go to find and communicate with their users. It needs to capture that value, and a Twitter app store could both help it do that and provide a better, richer experience for power users where they’re most at-home.

The fun thing about building platforms and primitives is that the swarm will figure out way more compelling projects than I can imagine sitting here, but the benefit to Twitter is clear: stop letting people discover things on-platform and purchase off-platform. A few obvious ones include:

Better DMs. Twitter can invest in better DMs itself, or it can allow third-parties to build DM clients within the Twitter app on top of its microservices. I, and many others, would pay good money for a great Twitter DM client, and Twitter could take a small cut. Beautifully, all clients could be interoperable since they’re built on the same graph, and might even bring in outside protocols like SMS, SMTP, and XMTP to provide one communication hub.

Podcasting and Newsletter Apps. Twitter’s value proposition to writers after its acquisition of newsletter app Revue was clear: we’ll get you more readers by plugging into your graph. The problem was, the last time I checked, the product itself wasn’t very good. I’d much rather pay a little bit to plug my Substack into the Twitter graph, and into my profile, more directly. Similarly, native podcasting apps might do a better job of connecting the discovery that happens on twitter to the listening experience, and even make it more social.

Note Taking and Knowledge Apps. Every so often, a product like Roam takes off, and when it does, it almost invariably happens on Twitter. It’s where the type of people who love to organize their notes hang out. Twitter could make it easier to discover knowledge apps, better integrate them into the product (i.e. a first-class “@readwise save thread”), and even connect the global knowledge graph like Roam has wanted to do.

Customer Service Chats. Instead of angrily tweeting at companies, people might communicate with them directly in a chat interface designed for customer service, like Intercom inside Twitter.

NFT Marketplaces and Crypto Exchanges. Crypto is another prime example of discovery happening on Twitter, and purchase happening off-platform. Twitter could make it incredibly easy to go from seeing an NFT or token in your feed, to purchasing it in a marketplace or exchange, to using it for token-gated commerce, all within Twitter. I think an open Twitter can serve a role in building better on-and-off-ramps and more seamlessly integrated wallet experiences.

Turn Profiles into Social Homes. Spaces has been a success for Twitter. It should double-down by letting third-party developers create all sorts of social experiences on the platform, and by letting users host people and experiences on their profiles, which I’ve called “the most underdeveloped real estate on the internet.” I could host an open world via Cyber, a room on Here, or even a co-working space with Teamflow where Not Boring readers could come hang out and work together. Twitter profiles could be the portal to the Open Metaverse. Again, I’d pay for my profile to better reflect who I am and what I care about, and to make it a cool place to hang out.

Some people might continue to spend $0 on Twitter and consume random ads for weeks-old touchdowns (maybe a higher ad load might be a way to pay for Verification for users who don’t want to pay $3/month), many of Twitter’s power users would happily pay a lot more money for a better, richer experience inside the app and the broader Twitter ecosystem. I know I would.

Now big caveat: I’m not a product person. While I would imagine Twitter would want many of these products to live inside the app, there’s also a world in which they’re built as standalone apps launched from inside the main app, or completely separately.

Inside the Core Twitter App, I think it’s crucial to preserve the simplicity of the Twitter Feed interface, but that there’s a lot more room to get experimental and weird in the back rooms and abandoned tabs that litter Twitter.

While I don’t think Twitter will build something as all-encompassing and central to peoples’ lives as WeChat is in China – it’s hard to imagine why I’d order a meal or an Uber inside of Twitter – it can do a much better job of serving the needs of its power users, making its value obvious to more potential users, and capturing some of the value that it creates and leaks away today. And who knows, maybe there are ways to make ordering food or a car as easy as sending a tweet that I’m not thinking about.

If Twitter can clean up verification, open up its APIs, build a thriving app ecosystem on top of its microservices, and take more and more of the $10,000+ its power users would spend to stay on the platform, the $44 billion Elon is buying Twitter for will seem cheap.

But I’m just one power user, and these are just my random ideas. I shouldn’t rule the tweets – no one person, including Elon, should – but I think that Elon needs a way to keep power users at the core of the conversation, and to let them share in the upside. I think we need a TweeterDAO.

TweeterDAO: If We Ruled the Tweets

Power users are the lifeblood of Twitter: 10% of users create the content that everyone else shows up to consume. They need to have a seat at the table.

Twitter board members are famous for sending their first tweet the day they get announced to the Board. They also don’t own very much of Twitter. They don’t have much skin in the game from a financial or product perspective, and that shows in the product.

With the chance to design a new board from scratch, Elon should give one seat to a group of Twitter’s power users. The easiest way to coordinate that would be through a DAO.

I’ve joked about using a DAO to buy Twitter for a while:

That was tongue-in-cheek. While I think that decentralizing Twitter is a good goal to pursue longer-term, for now, Twitter needs to remain laser-focused on turning the business around. It needs to make the hard decisions that small groups can make more easily than larger ones in order to build a healthier, more robust platform.

But I do think that there’s merit to the idea that my friends Sahil Bloom and Mario Gabriele have floated: using a DAO to let Twitter users invest in the company and take a board seat.

Doing so would achieve a few important goals for Elon & Co:

More Twitter Owners. Elon said that he wanted Twitter to have more than the 2,000 owners allowed by the SEC, and a DAO might be a way to do that.

Assuage Centralization Fears… Letting a representative of the DAO sit on the board, and therefore being willing to share private information with power users, would be a useful way for Elon to assuage fears related to the world’s richest man controlling its most influential platform.

…Without Fully Decentralizing. The DAO would only have one seat, so it couldn’t make decisions on its own and would give Elon the room to make hard calls.

A Voice for Power Users. Throughout this piece, I’ve highlighted the importance of power users to Twitter’s success, and with a lot of change clearly coming, involving them in decision-making would be one way to make sure that Elon & Co don’t push power users away. While it’s great that Twitter will be owned by a power user, his experiences probably aren’t exactly comparable to the average power user’s.

Novel Governance Structure. While this wouldn’t be important for most owners, it’s clear that part of the reason Elon is buying Twitter is because it’s a new challenge and experience. I think he’s among the most likely to be receptive to giving a DAO a board seat.

Thousands of People Invested in Twitter’s Success. Giving Twitter’s power users a seat at the table and a financial stake in the company’s success would establish a core of people empowered by having a voice and motivated to help the new Twitter succeed. That could be important as Twitter makes big changes.

So how would it work?

First things first, the DAO’s founders would need to negotiate with Elon’s team and agree on terms and structure – how much the DAO would invest, what information could be shared with the DAO, how the DAO would select its representative board member, etc…

With the provisional green light, the DAO founders would need to set up the entity and the tech stack, determine the governance model, and get a legal opinion around whether its members would be able to actually own a stake in Twitter (may be possible under a newly-discovered old structure) or if they would just have governance rights and governance tokens.

Importantly, it would need to figure out how to filter for power users. That’s why it’s called TweeterDAO – it’s for the ones who tweet. Maybe members would need to verify that they’ve tweeted in the past three months. Maybe just being online enough to know the DAO was happening, and how to contribute, and contributing would be proof enough.

It would need to raise the money to invest in New Twitter – probably somewhere in the $50 to $100 million range, but that would have to be negotiated.

And then… assuming it pulled all of that off, it would actually need to govern.

The DAO would have to elect a representative to serve on the Board, and show up to vote to inform how its representative votes on Twitter’s board. It would have to make proposals to the Board. It would have to organize itself to keep from devolving into a flash-in-the-pan shitshow.

This wouldn’t be a YOLO trade. The structure in mind might not even allow for the transfer of ownership. But it would be the opportunity to impact the future of a platform that many of us rely on professionally and even socially.

“Aren’t you just creating a public company again?” you might ask. And certainly, giving a big group of people ownership and a vote sounds a lot like owning equity in a public company, but there are a few differences:

Twitter is public, but its Board, the people who make the decisions, don’t represent Twitter users.

Given the much smaller ownership group involved in New Twitter, and the collection of individuals into a more cohesive DAO, the DAO would have a louder voice than a collection of retail investors.

Letting a DAO into the board room would demonstrate a commitment to openness that will be important in maintaining, or re-establishing, trust in Twitter.

Since Twitter will be private, this is the only way to give a large group of users ownership.

Currently, there’s nothing in the works beyond a vague idea, but the window is open. Elon is fundraising. Governance is at the heart of the conversation. And I think that a DAO made up of those most invested in Twitter’s success would be a powerful addition to Twitter’s ownership.

If you’d be interested in participating in a hypothetical TweeterDAO, head over to Twitter (where else), share this piece, and include #tweeterDAO. Power to the power users.

Thanks to Dan for editing!

Thanks to everyone who filled out the Not Boring Reader Survey last week! If you didn’t get a chance to, I’d really appreciate it if you took 3 minutes to do it now:

Thanks for reading, and see you next Monday,

Packy

*See important disclaimer

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK

Chris Bakke @ChrisJBakke

Chris Bakke @ChrisJBakke