Securing Financial Data With a Real-Time Database | Redis

source link: https://redis.com/blog/detecting-fraud-and-securing-financial-data-with-a-real-time-database/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Detecting Fraud and Securing Financial Data With a Real-Time Database

Fighting Financial Fraud with a Real-Time Data Platform, an essential white paper spotlighting the latest trends in financial fraud, how companies can fight back effectively, and how Redis is helping businesses achieve these goals. Download for free below.

The fraud epidemic is real and financial institutions are struggling to keep up with the ongoing onslaught and changing tactics of cybercriminals. As the global financial services landscape evolves, fraudsters are moving in tandem with digital banking transformations, finding innovative ways to steal or fake customers’ identities, and commit fraud.

Since the pandemic, around 35% of retail banking customers have increased their use of online banking (Deloitte, 2020), creating a quantum leap in its adoption. What’s more is that around 53% of the world’s population is expected to use digital banking by 2026 (Juniper Green, 2021).

As consumers transition to digital banking, online fraud has increased and the situation is getting worse. Recent surveys highlight that 47% of businesses have experienced fraud in the last couple of years (PwC, 2020), robbing them of an estimated $42 billion.

Banks and payment processors are working hard to detect fraud before it occurs but are struggling to keep up with the evolving tactics of criminals. This is because they have a continued dependence on static knowledge-based identity validation, rules-based systems, in addition to slow, siloed systems that enable fraud to occur through one channel without being connected to other channels.

Rules-only systems effectively detect simple, non-changing, known patterns such as validating black lists or user purchase profile histories. However, they do struggle to distinguish risk from normal behavior.

Identity theft, account takeovers, and the rigidity of legacy systems make them unable to adapt to evolving real-world scenarios. Banks and financial services institutions need to leverage digital identities and transition to a multilayer approach that will enhance rules-based fraud detection systems by adding complementary mechanisms, such as AI/ML transaction risk scoring, statistical analysis, and anomaly detection.

Machine learning (ML) algorithms and artificial intelligence (AI) predictive models can evolve and learn as they analyze and detect fraud based on historical and real-time transactional information. However, due to the size and complexity of data pipelines, the successful implementation of AI/ML depends not only on accurate models but also on the performance and resiliency of the surrounding data infrastructure.

Transaction Fraud

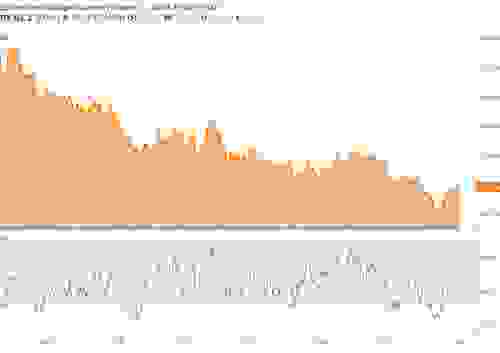

The meteoric shift to online banking has led to a surge in online fraud of all types. Recent studies underline the severity of the situation, highlighting that 33% of U.S banks’ fraud costs in 2021 came from online banking – a 26% increase from 2020 (ABA Banking Journal, 2022).

And during the first quarter of 2021, online banking made up 96% of all banking transactions, which accounted for 93% of fraud attempts (Security, 2021).

Many financial services organizations are turning to ML and AI technology to combat fraud and strengthen data security. AI/ML models use sophisticated mathematical and statistical algorithms to exploit patterns and derived inferences to identify risks and quickly determine a rank order and score of the relative likelihood that a specified outcome will occur. These algorithms are used to analyze individual components of a transaction and determine the probability that it is unauthorized, fraudulent, or coming from a stolen credit card.

AI/ML model algorithms can learn with each iteration, by storing inferences derived from prior transactions, which over time, improves the accuracy of the risk assessment and scoring. They can adapt to changing biometric behavior and transaction patterns to handle new fraud scenarios.

Using AI/ML, financial institutions can leverage an automated transaction scoring system to predict transactions, adjust credit scores, and detect fraud with hyper-efficiency. Real-time transaction scoring algorithms consider transaction details, user profiles, behavioral biometrics, geolocation, IP/device metadata, a user’s financial information, and more.

However, the effectiveness of AI/ML models hinges on the speed at which they can access the transaction data. Machine-learning algorithms make predictions from a combination of data derived from the offline and online feature stores – both of which play a crucial role in the data pipeline architecture.

Offline feature stores for fraud detection systems contain historical data, for example, on how each user interacts with their bank account. Each transaction by a user will be broken down into hundreds of different features to create a personal log of how that individual typically behaves. This log includes essential data, like the frequency of similar transactions, the requested amount, and the IP address of the location.

Patterns will be identified and a digital profile will be created to represent how each user interacts with their account. But this is static data and is updated periodically, making it insufficient for machine-learning models to make fraud predictions on transactions that are happening in real-time.

This is where online feature stores come into play. As a user makes a transaction, the online feature store will gather real-time data across different streaming sources and make a comparison with the historical data.

Machine-learning algorithms will use these comparisons amongst hundreds of different features to determine whether there are any inconsistencies. Should Ben, for example, be in Spain and make another purchase in Germany five minutes later, then the machine-learning algorithms will flag this as a potential case of fraud.

Yet the entire efficacy of these calculations is dependent on the online feature store providing real-time data. The decision to approve or reject a transaction needs to be accurate and instantaneous to shut off any fraudulent activity.

Leveraging an online feature store can help prevent fraud across various payment mechanisms, including:

- Credit and debit card payments

- Person-to-person transfers

- Bank account credits and debits

- Mobile wallets and e-payments

Know Your Customer

Banks have had to follow know-your-customer (KYC) regulations for some time now and these are still a favored method of combating financial fraud. But since many of them still rely on knowledge-based authentication (KBA), the data they use is static and isn’t updated frequently enough to be reliable or safe. The recent data breaches at Equifax and Capital One have shown that identity data can be stolen and used for fraud and account takeovers.

Banks need to be agile and have the speed to make fast decisions that can swiftly dispel fraudulent activity. Making these decisions based on KBA criteria such as names, addresses, and social security gives criminals enough wiggle room to out-maneuver bank data security systems.

More sophisticated technology is needed to create a more powerful form of cybersecurity, strengthen data security systems and mitigate the risk of data breaches – which is why many banks are turning to dynamic digital identities. Through these more modern approaches, document verification and biometric records can be combined with intricate behavioral patterns to create a digital identity for each user.

This puts a stronger padlock on accounts, making it much harder for criminals to fake or mimic digital identities. But once again, speed is the crucial factor. Digital identities are complex and are made up of a number of different sources and data types. The difficulty is being able to update everything quickly enough for banks to stay one step ahead of criminals without hampering the user experience.

This is even more challenging given the fact that the criminal underworld is evolving in unison with banks, discovering savvier ways to commit fraud by creating synthetic digital identities – a process that involves blending real and fake customer information into a new identity. This could be, for example, stealing a social security number and using it to create a fake date of birth or home address. The financial world is all too aware of the threat of synthetic fraud, this having cost U.S. banks $20 billion in 2020 alone (ABA Banking Journal, 2021).

Fraudsters know how to stay undetected by ensuring that all payments are paid on time and as well as building up a credit history to avoid exhibiting risk factors. This makes detecting synthetic fraud nearly impossible for banks. The best defense against this type of identity fraud is to detect it at the time when an account is created or during the early transaction/payment process.

This is important because should these criminals be given enough time, they’ll proceed to the next step of the fraud cycle by altering the fake information to create additional digital identities. In other words, they’ll formulate and create a network of fake identities that will eventually be connected and shared with one or more pieces of information such as bank accounts, phone numbers, social security numbers, and more.

This provides an opportunity for banks to detect fraudulent activity by identifying these connections between a user’s personal information.

The solution is to use a graph database that represents and stores data as a series of nodes and edges that model the relationships between data points. Fraud and data security analysts can then detect suspicious connections or patterns by traversing a graph of customers (digital identities) and/or transaction attributes preferably in real-time.

To stay ahead of these criminals, banks must leverage low-latency in-memory multi-model databases that can deliver the high throughput required to keep digital identities updated and build identity graphs to detect synthetic fraud in real-time.

This real-time database is faster and more flexible than the traditional relational databases and will give banks the best chance to identify customers correctly and flag any suspicious transactions.

Anti-Money Laundering (AML)

Dirty money needs to be laundered and banks are among the favored channels leveraged by fraudsters to accumulate wealth illegally. The reality is that money laundering is as pervasive as it is problematic. Although combating this plague remains a top-tier challenge, criminals are still finding ways to disrupt the system.

An estimated $2 trillion is laundered globally every year (Deloitte, 2020) and 50% of money laundering goes undetected across the industry as a whole (Renolon, 2022). Governments are tightening the squeeze on banks to become more vigilant and validate transactions through the introduction of more stringent AML regulations.

AML-related fines have been getting higher in recent years, with the total amount rising to $10.4 billion around the world by the end of 2020 (Compliance Week, 2020), highlighting the failure of financial institutions to comply with money laundering laws. But with 62% of compliance officers saying that criminal activity is getting harder to spot (Renolon, 2022), banks need to find new and innovative ways to clamp down on money laundering and strengthen their cybersecurity.

Many banks are leveraging AI and digital identity technologies to enhance transaction monitoring systems and weed out money launderers. Network analytics, for example, can help identify hidden links between entities that are more likely to be missed through traditional methods.

Yet the linchpin of any AML compliance program is a monitoring system that can provide transaction scoring across many variables in real-time. The data that needs to be analyzed is colossal, and the speed at which everything can be processed determines how successfully banks can identify suspicious transactions.

Banks Need a Real-Time Database to Clamp Down on Fraud

We live in a fast-paced environment where criminals have evolved and discovered savvier ways to steal and create fake identities to commit fraud. Banks need to adapt to the digital age and move away from rigid and slow legacy RDBMS systems that cannot support modern AI/ML-based fraud detection and dynamic digital identities.

As a result, many banks are turning to real-time databases to become more agile, responsive, and adept at tackling fraud. Redis Enterprise with native modules RedisJSON, RediSearch, RedisGraph, RedisTimeSeries, and RedisBloom have been leveraged by many financial services firms due to its ability to efficiently process multiple data models and identify suspicious patterns.

It empowers banks by providing fraud detection platforms with the real-time access required to quickly analyze patterns in transactions and augment KYC programs with new tools for digital identity. Redis Enterprise offers financial services companies a mission-critical, in-memory database with sub-millisecond performance, global scalability, 99.999% uptime, multicloud support, and more.

To discover more information about how Redis Enterprise powers real-time fraud detection, read this whitepaper.

Related Posts

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK