Understanding the Token Economy and Token Design

source link: https://blockmanity.com/news/feature/understanding-the-token-economy-and-token-design/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

A robust economy is important for the success of a token, retaining community interest, and attracting interest to the project. The business of Evolution Finance, a lending market that targets a 10x market than any other DeFi operator, exceptionally ties in the token to make it a key part of the ecosystem.

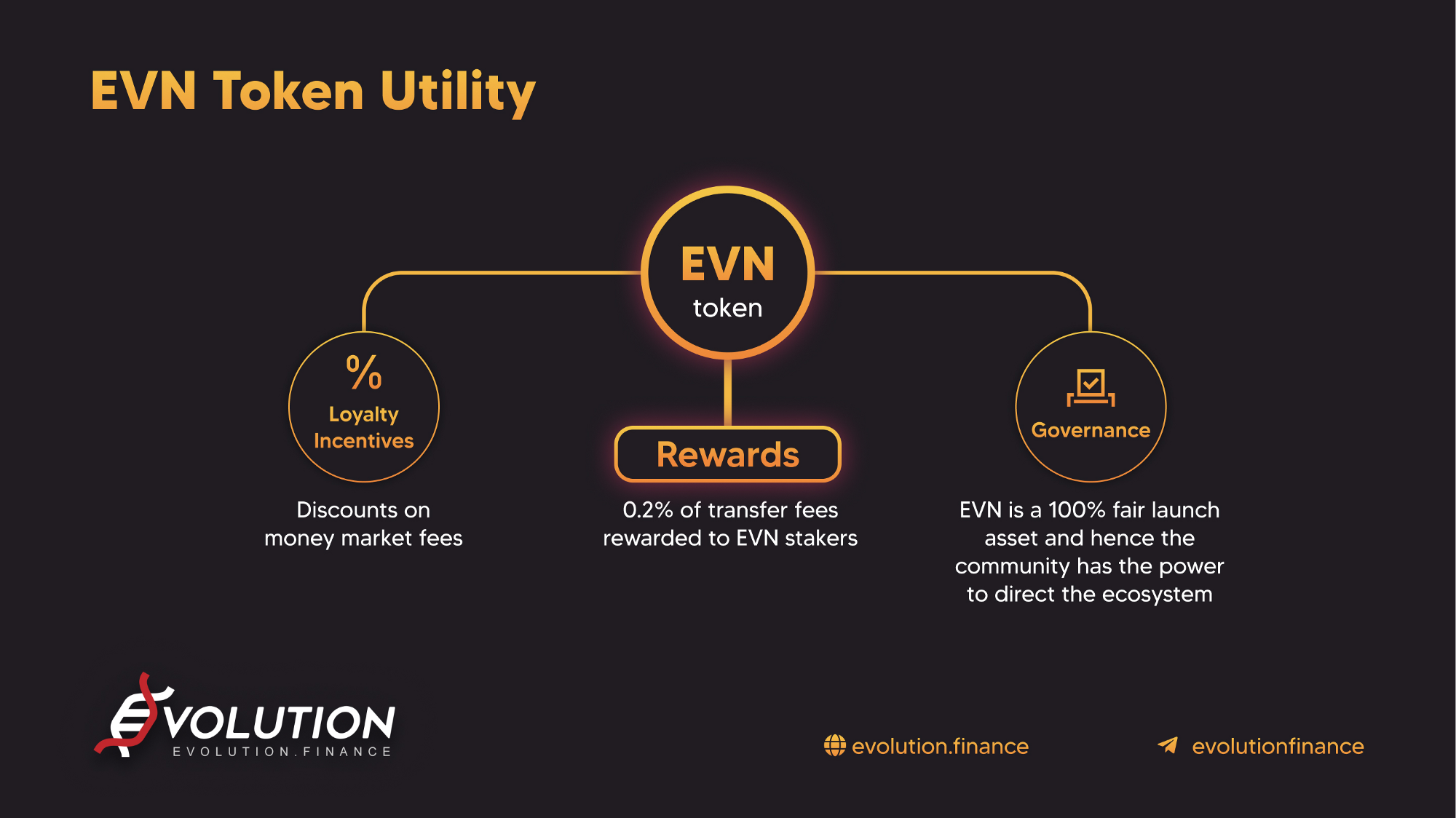

EVN holders benefit from loyalty incentives, rewards, and governance.

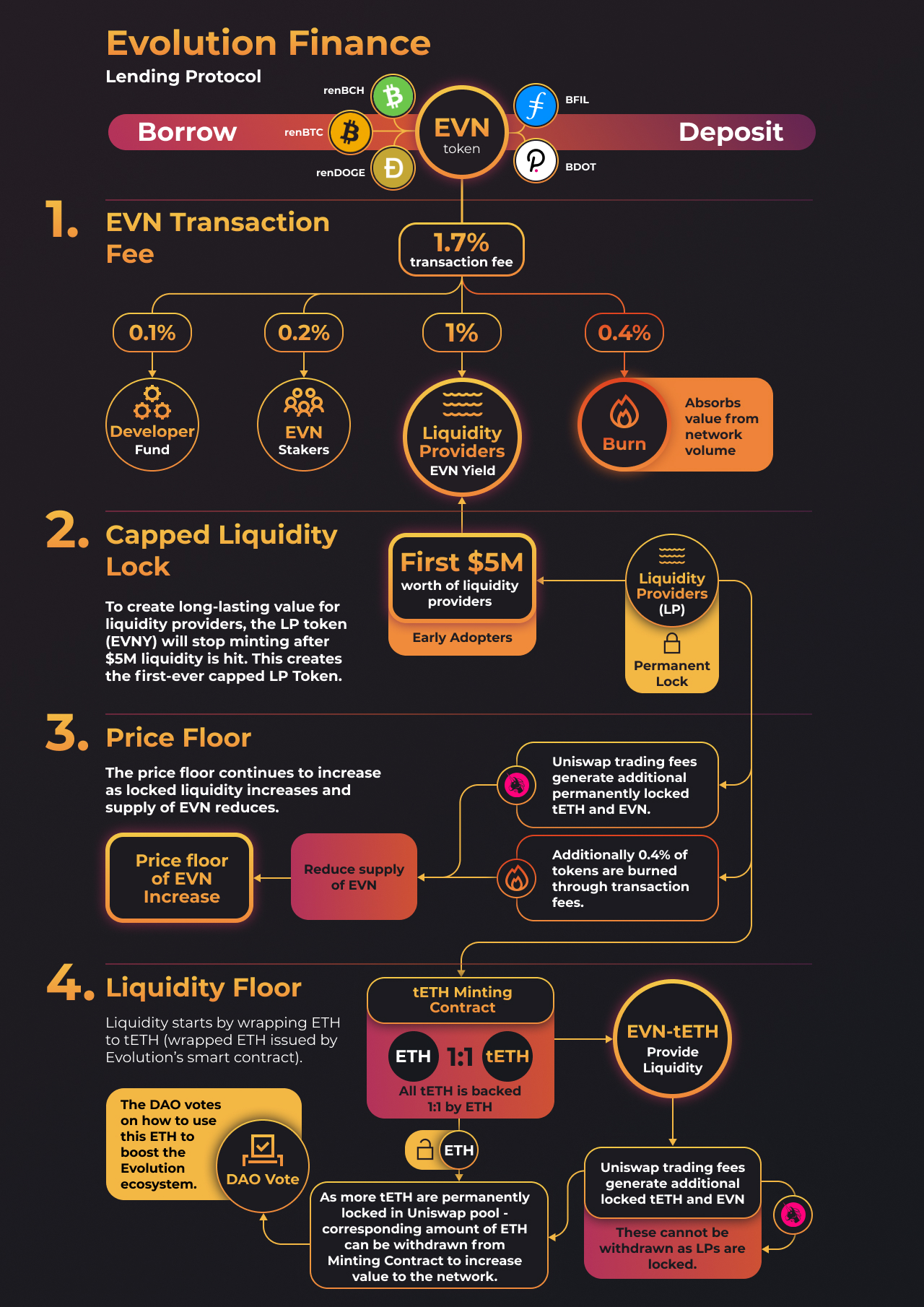

Meanwhile, EVN liquidity providers who hold the EVN Yield token (EVNY) benefit from the growing volume of the EVN token. Therefore, a growth in EVN demand due to the business growth of the ecosystem also benefits EVNY holders.

Rich in Utilities: Advantages of the EVN Token

The Evolution lending market is distinct from any other decentralized or centralized alternative.

DeFi lending platform primarily create a money market for other DeFi coins (like LINK, MKR, and ZRX). This approach overlooks the largest asset in the space, including DOT, XRP, LTC, BCH, FIL, and many more.

Evolution Finance is using proven wrapping solutions like renVM to port these assets on to Ethereum to integrate these into the most advanced money market in the DeFi space. Evolution is creating the first DeFi money market that targets a new roster of assets that collectively have a $50B+ market cap.

Holders of these assets will be able to access the only DeFi solution to use these assets as collateral and borrow money to leverage their portfolio for buying other assets or even participation in farming. At the same time, it will create the only means to acquire short sell positions for the supported large cap assets.

Like any lending market, fees are an essential segment of the ecosystem that keep lenders interested and borrowers accountable. Evolution Finance charges a small fee on the interest generated on the platform. However, EVN holders will enjoy a loyalty reward: a reduction on platform fees.

Furthermore, EVN holders can also enjoy rewards by staking the asset. 0.2% of the 1.7% reduced from any EVN transfer will be awarded to EVN stakers.

Finally, Evolution Finance is the most decentralized lending platform to date. Market incumbents like Compound and Aave made only 50% and 75% tokens accessible to the public, respectively. Further, Compound’s funding rounds behind closed doors to VCs made a stake of a large portion of its tokens incredibly off-limits. Meanwhile, Aave’s high market cap during its ICO gave wealthy individuals a privileged right to concentrating ownership of the asset.

EVN token is hosting a fair launch with 100% of its supply available to the public at launch. Control mechanisms will be in place to ensure the first few blocks after listing allow a controlled, wide distribution of the asset. Such a fair distribution model plays an important role in EVN’s final utility, governance.

The Unique Economics of Evolution Yield Token (EVNY)

The liquidity providers (LPs) of EVN tokens are granted a special token: Evolution Yield token (EVNY).

To acquire EVNY, liquidity providers have to permanently lock their liquidity, providing a permanent base of market support to the EVN token. In return, EVNY stakers are greatly rewarded.

For every transfer of the EVN token, 1.7% of the amount is deducted by the smart contract. 1% from this is generously distributed to EVNY stakers. This ensures providing permanent liquidity to the utility token of Evolution Finance is a rewarding opportunity.

Unlike any other LP token to date, EVNY has a hard cap. Specifically, EVNY will not be mintable once the EVN liquidity pool reaches $5M. This ensures the early liquidity providers of EVNY permanently claim their position in the network rewards, without worrying about dilution from future LPs.

EVNY is essentially the first-ever liquidity provider (LP) token with a hard cap.

Learn More

The development partners of Evolution Finance are DAO Maker, Ferrum Network, and Blockchain Strategy Team. The security partners are Arcadia Group and CipherBlade. One of the primary planned liquidity partners is HBK-GoChain, a $100m AUM fund.

Website: http://evolution.finance/

Telegram Chat: https://t.me/evolutionfinance

Twitter: https://twitter.com/evn_finance

Disclaimer: Blockmanity is a news portal and does not provide any financial advice. Blockmanity's role is to inform the cryptocurrency and blockchain community about what's going on in this space. Please do your own due diligence before making any investment. Blockmanity won't be responsible for any loss of funds.

Get the latest news on Blockchain only on Blockmanity.com. Subscribe to us on Google news and do follow us on Twitter @Blockmanity

Did you like the news you just read? Please leave a feedback to help us serve you better

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK