SkyBridge: “Bitcoin Is Better” Than Gold – Bitcoin Magazine

source link: https://bitcoinmagazine.com/articles/skybridge-capital-says-that-bitcoin-is-better-at-being-gold-than-gold

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

SkyBridge Capital Says That “Bitcoin Is Better At Being Gold Than Gold”

This week, Anthony Scaramucci’s SkyBridge Capital announced the launch of its investment thesis, presentation and full website for its new Bitcoin Fund LP. Unlike other investment firms, it went a step further in explaining why it is actively choosing bitcoin over gold.

SkyBridge Capital’s main fund, with $9.3 billion in assets under management (AUM), has invested a now-roughly $300 million position in bitcoin. In December 2020, it announced that it was raising a new, separate bitcoin-only fund and had already transferred about $25 million worth of bitcoin into it.

This week, it opened the fund to accredited investors with a minimum investment of at least $50,000. This bitcoin LP won’t trade, but you only pay a 0.75 percent annual fee and no premium. The portfolio is priced by Bloomberg’s fixed rate (XBT). This is in contrast to GBTC (a grantor trust) which trades OTC, has a 2 percent annual fee and includes a premium to bitcoin’s price.

SkyBridge’s website is a vast library of information. It has its offering memorandum, investment presentation and investment thesis. It also includes:

Toward the bottom of the website, it also takes a dig at GBTC’s premium and offers to walk through a “GBTC swap” to its fund. It understands the hurdles that many traditional investors face in investing into bitcoin and lean into them.

More enjoyable than reading the funny digs at GBTC, though, is reading the digs on gold. Because, as other large institutional investors have recently bought bitcoin, they have largely done so while also still holding gold.

An example is Ruffer’s ($27 billion AUM) recent $775 million bitcoin purchase through its multi-strategy fund, which was about 2.5 percent of the portfolio. This was a huge step, but still very small compared to its gold and inflation-linked bond holdings.

Another example was when the head of global equities at Jefferies recently cut the gold exposure in the long-only pension funds in favor of bitcoin. But even after this, bitcoin remains a 5 percent allocation vs. 65 percent gold bullion and gold mining holdings.

With a bitcoin-only LP, there’s no getting around the question of “why bitcoin vs. gold?” SkyBridge needs to tackle it head on, and it does. Its investment thesis is 10 pages (not including legal disclaimers) and about one-third of them focus on why gold is inferior to bitcoin and how bitcoin will be gold 2.0.

It quickly establishes that there is a need for a deflationary asset — increasing debt, increasing money supply and low interest rates.

It then quickly asks: “Is gold to the rescue?”

The major points it provide for pro bitcoin vs. gold are:

See Also

Its thesis also includes a summary graphic:

The SkyBridge presentation expands on gold 2.0 even further, beyond the investment white paper, explaining why bitcoin is superior and also using gold as an example of potential growth.

In its opening page, it states that “Bitcoin is better at being gold than gold” and cites gold’s existing market capitalization as an example of where bitcoin’s price could grow.

The presentation and thesis continue by covering Halvings, growing adoption and bitcoin as a portfolio diversifier. But the most interesting aspect remains the fact that an institutional investor directly addresses the question of “why bitcoin over gold?”.

All in all, the launch of the SkyBridge Bitcoin LP is another strong step in Bitcoin’s adoption by investors. It notes the problematic premium with GBTC for investors and addresses head on why an institutional investor would choose bitcoin over gold.

This is a guest post by Ellie Frost. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Ellie Frost is a former investment banker turned Altcoin Minimalist

January 6, 2021

2020 was unforgettable, especially for Bitcoin. To help memorialize this year for our readers, we asked our network of contributors to reflect on Bitcoin’s price action, technological development, community growth and more in 2020, and to reflect on what all of this might mean for 2021. These writers responded with a collection of thoughtful and thought-provoking articles. Click here to read all of the stories from our End Of Year 2020 Series.

The short, 12-year history of Bitcoin is filled with exciting times. From the immaculate conception birthed through Satoshi Nakamoto to the extreme polarity between face-melting pumps, catastrophic corrections, infamous exchange hacks and internal Bitcoin civil wars; not many years were as exhilarating for Bitcoiners as 2020 was.

As the infamous Bitcoin crowd has “Paul Revere’d” for years, it seems “the institutions” are finally coming. The new demand over the coming years will propel Bitcoin to become the next world reserve currency.

The Case For A Modern Store Of Value

As we approach the end of 2020, over 5 percent of the total supply of bitcoin is held as a treasury reserve asset on the balance sheet of 20-plus public and private companies, a trend that began to materialize this year.

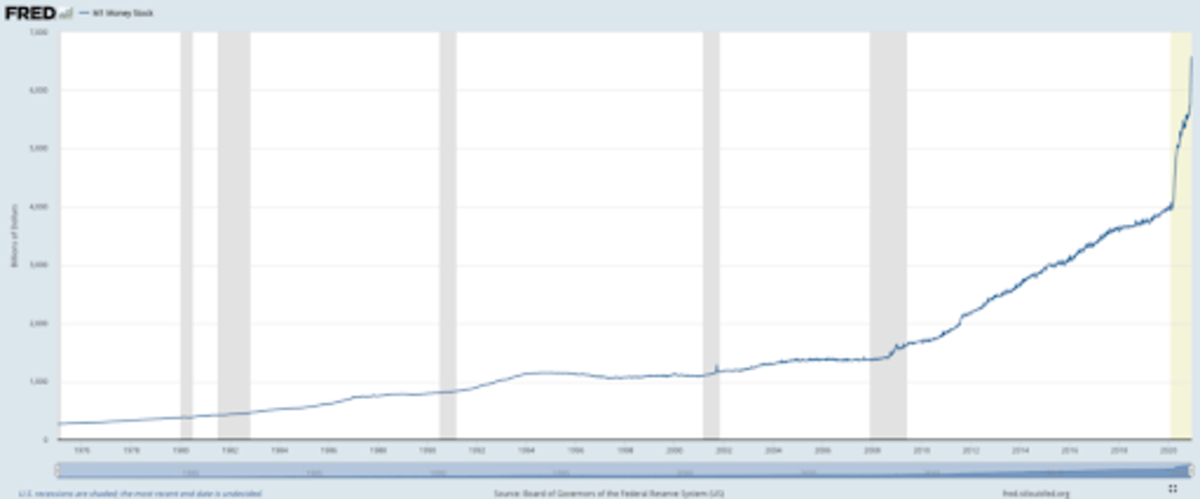

Over the same period, the M1 money stock of USD — a metric used by economists to quantify the amount of money in circulation in a particular country — increased by over 60 percent. The reckless monetary and fiscal policy instituted by central banks and governments as a global response to COVID-19 catapulted bitcoin into the limelight as a potential, new store of value.

This direct liquidity injection of USD into the United States and the broader global economy is known as quantitative easing (QE) or “printing money.” The Fed’s commitment to increase the money supply at will distorts price signals, reduces real wages, increases wealth inequality and ultimately destroys the free market. Savers are punished as their time and wealth is plundered out from under them through the cancerous process of inflation. Although the dollar’s global reserve currency status creates inherent demand, it does not seem this trend of monetary debasement can continue long into the future. The case for a currency with a hard-capped supply that cannot be manipulated at will by governments and institutions has never been stronger.

In steps the Bitcoin Bull Bull Bull, Gigachad Michael Saylor.

Saylor, one of the longest-standing CEOs of a publicly-traded tech company, became the Bitcoin rookie of the year this year after purchasing nearly $1.3 billion worth of Bitcoin (about 70,000) with the balance sheet of his company, MicroStrategy. He is not the only one spotting this trend.

Paul Tudor Jones, Stanley Druckenmiller, Scott Minerd — names all associated with institutional hedge funds — have opened their minds and portfolios to an allocation of bitcoin. Large, private banks such as CitiGroup have come out with $300,000 to $400,000 price predictions for the next year. As we continue to destroy the purchasing power of the USD, this game-theoretical trend of scarce asset allocation will only continue to increase in the future.

#Bitcoin is the world’s best treasury reserve asset & the emerging dominant monetary network. It is the solution to the store of value problem faced by every individual, corporation, & government on earth.

— Michael Saylor (@michael_saylor) December 16, 2020

Last, and certainly not least, the beautiful NgU (Number Go Up) technology integral to Bitcoin continues to drive us to new highs. On December 16, bitcoin broke the previous 2017 all-time high, rising above $20,000 for the first time. The further appreciation in bitcoin’s price over the next decade will drive the mainstream adoption of it as a corporate treasury reserve asset. A higher price will catch new eyes, leading to more awareness and eventually less volatility. Bitcoin remains a gleaming beacon of hope in a world built on monetary enslavement.

Protocol Improvements And Ecosystem Innovation

As a technologist, the improvements to the different layers in the Bitcoin protocol remain some of the most exciting advancements of 2020. Schnorr Signatures/Taproot/Tapscript, through a multitiered Bitcoin Improvement Proposal (BIP), was merged into the core codebase earlier this year. “Taproot,’’ as it is commonly known as, drastically improves the digital signature algorithm used by Bitcoin. Massive improvements in on-chain privacy, scalability and transaction efficiency are baked into the Taproot upgrade. This series of upgrades will further increase the adoption of the Lightning Network, multisignature transactions and CoinJoins, ultimately leading to a more secure and private Bitcoin experience.

Outside of the improvements to the core protocol, the ecosystem of innovation surrounding Bitcoin continues to improve the tools available to Bitcoiners. I’d like to give a shoutout to some of my favorites:

- Swan Bitcoin: A new way to buy bitcoin that forces you into a long-term mindset by dollar-cost averaging.

- Specter: A desktop interface that integrates with hardware wallets and enables easy-to-use multisig.

- Strike: A payment application that empowers users to pay an invoice in bitcoin using USD.

- ColdCard: A secure way to store private keys with a device not connected to the internet.

Outside of Bitcoin tools, developer grants through corporate and nonprofit entities have started to normalize throughout 2020. Organizations such as the Human Rights Foundation, Square, Kraken and more have started to sponsor developers to encourage them to work on improving Bitcoin full time. Sites such as BitcoinDevList and BitcoinACKs have incentivized your average Bitcoiner to contribute to the Bitcoin circular economy by donating sats to developers.

Finally, thought leadership continues to improve the Bitcoin educational experience, colloquially known as “falling down the rabbit hole.” Podcasts, books, articles, conferences and personalities on Bitcoin Twitter all continue to suffocate the complexity of Bitcoin with digestible and entertaining content suitable for precoiners and Bitcoiners alike. As more and more people commit their lives to Bitcoin, the influx of intelligence and ingenuity will slingshot humanity into the stratosphere of innovation in the coming decades. This synergy of thought leadership will improve all those who seek it.

Looking Forward: The Battle Ahead

As we approach the new year and imagine the road ahead, a few trends seem to be emerging. The first will be in the introduction of central bank digital currencies (CBDCs) which will seek to replace the private banking sector through a combination of central banking and fintech. New currencies such as the digital dollar and the digital yuan seek to accelerate the Orwellian future we are marching toward through direct taxation, capital controls, financial surveillance and a universal basic income.

I would like to be explicitly clear: These currencies are no more of a threat to Bitcoin than any fiat currency is today. Over 90 percent of U.S. dollars are already digital, with most governments looking to phase out cash completely in the next few years. Creating a CBDC does not solve the problem of monetary debasement or the problems of financial surveillance and censorship. Bitcoin remains the only incorruptible money that exists today.

The second trend will attempt to regulate Bitcoin. We are already starting to hear rumors of self-custody restrictions floating around. Full on self-custody bans are unlikely, but withdrawal limits and additional KYC regulations are almost certain. Over the next few years, there will be direct attacks on anyone who attempts to use Bitcoin privately. We must fight back on this. Privacy, in and of itself, is not illegal and is the bedrock for liberty. If Bitcoiners give up the ability to self custody their bitcoin by handing it over to institutions, this is one of the only real threats to Bitcoin.

The Bitcoin protocol is engineered on the binding incentives of social consensus. Anyone who chooses to use Bitcoin must agree to a set of rules which are validated by others on the network. When you self-custody bitcoin, you agree to these rules. When you run a Bitcoin node and verify your own transactions, you agree to these rules. When you mine bitcoin and contribute to securing the network through energy and work, you agree to these rules. Relinquishing the ability to self-custody bitcoin and independently audit the supply voids the social consensus of the Bitcoin protocol and allows those rules to be changed. Individuals must be willing to fight for what they believe in. I believe in Bitcoin and I am ready to fight for it.

Lastly, after all the attempts to counterfeit Bitcoin have failed, governments will have no choice left but to adopt it or risk facing obsolescence. This is the final stage left in the road to a Bitcoin Standard. Competing game theory will force the hands of governments to begin acquiring bitcoin by any means necessary, namely through mining. After all of the tools in governments’ arsenals are exhausted, a new world reserve currency will emerge. It will be bitcoin.

This is a guest post by Kaz Bycko. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK