Bitcoin Nears 70% Market Share

source link: https://www.trustnodes.com/2020/12/24/bitcoin-nears-70-market-share

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

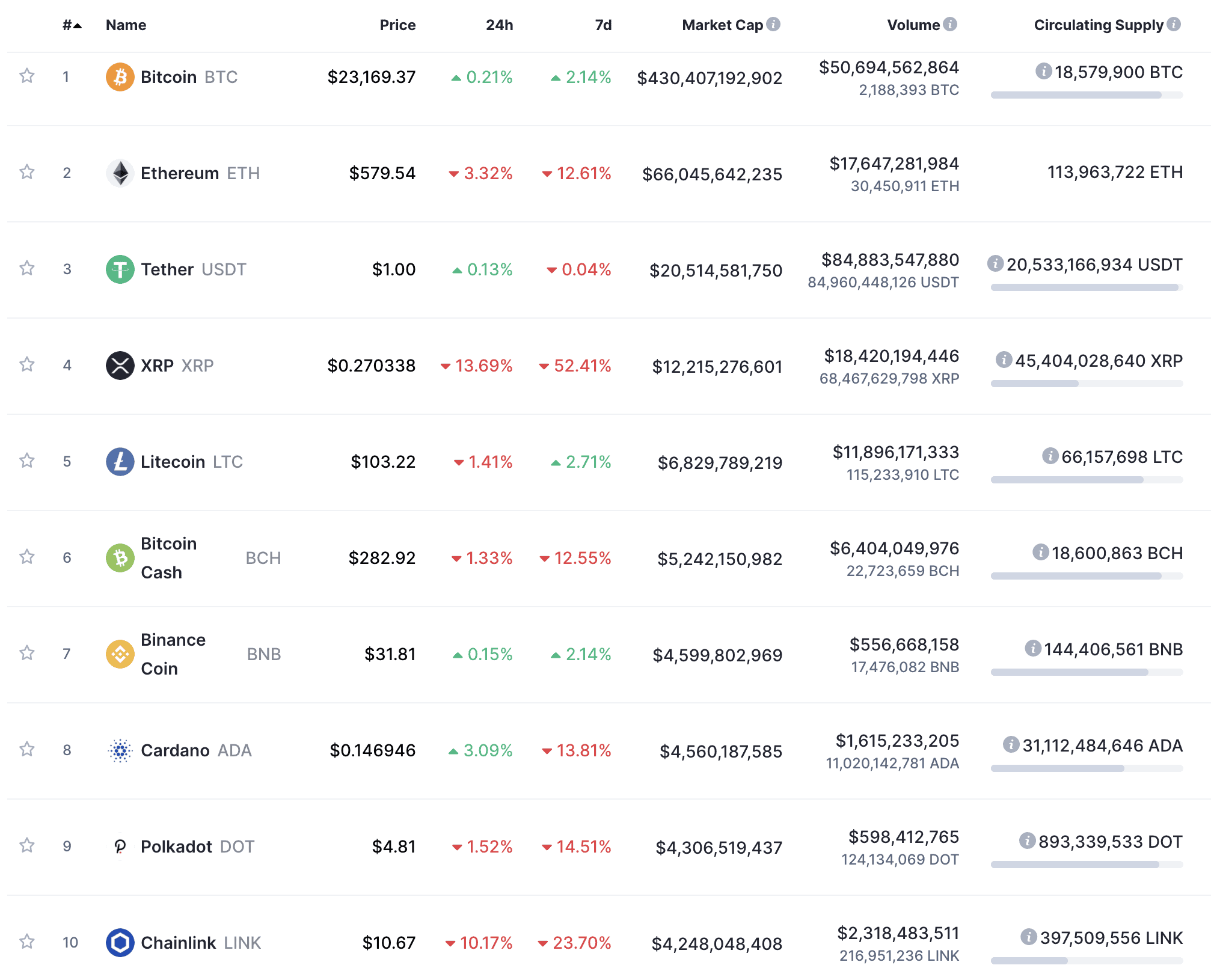

Bitcoin’s market share is close to the highest level since it began falling back in early 2017.

The digital gold has both maintained its value better and has risen more than potential challengers.

While bitcoin is more than 10% above all time high, ethereum is not even half way to its all time high.

BCH, once a contender for the top spot, is now below litecoin, the copy cat that no one minds.

XRP, which once briefly overtook BTC in market cap, is now decimated, below even tether.

Top ten cryptos, Dec 2020

Top ten cryptos, Dec 2020

Bitcoin on the other hand is grabbing big money attention, with the currency truly in a class of its own.

That’s most likely because it is the most trusted crypto when it comes to its fixed supply. Something that can’t very easily be re-created.

Ethereum for example doesn’t even have a fixed supply, and it has actually increased technically with the launch of eth 2.0, albeit countered by the locked amounts.

Something like Litecoin does have a fixed supply, but it also has a Charlie Lee who potentially could haphazardly change things.

In bitcoin, all devs are equal because neither has a founder’s influence. They do however have influence just as any professional has influence, but not to the point where the view of a particular bitcoin dev can amount to almost a diktat as it potentially could in ethereum for example.

Therefore changing the monetary limit in bitcoin would require a different amount of effort compared to any other coin.

That’s not to say that some don’t want to try, but the barrier to succeeding is just very high. Certainly compared to fiat, or something like gold which you can just put more resources to dig out or comet mine, but also compared to any other crypto.

That level of certainty, which only bitcoin can provide to a very high standard, is probably what makes it different from other cryptos and a class of its own.

Therefore its market share rising again to a dominance level is perhaps not too much of a surprise because what opens bitcoin to criticism is also its strength.

Namely the network is difficult to upgrade and change, to get the newest cool tech like smart contracts, but that difficulty to change and stability is precisely what makes it most appealing from a store of value perspective as it gives the certainty your unit of account won’t be devalued.

Has thus bitcoin won? The answer currently probably is yes, but not fully because ethereum’s defi does have its appeal especially when America has an activist SEC.

Just as bitcoin can provide those guarantees in regards to its unit of account, so too eth can provide the same level of guarantees in regards to smart contracts.

And only eth as it currently stands because the whole thing has been designed to provide that level of guarantees for smart contracts, with other networks needing to develop at least to the same level and due to network effects, probably even a higher one.

Making eth a class of its own as well in its own way, but bitcoin’s algorithmic guarantees where the unit of account is concerned is clearly making it far more valuable.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK