Rollin’ (ARR-paid vehicle)

source link: https://alexdanco.com/2020/08/13/rollin-arr-paid-vehicle/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Rollin’ (ARR-paid vehicle)

One of the themes we talk about a lot in this newsletter, such as here and here and here and here and here, is how Silicon Valley is a “controlled bubble”.

It has to be! Startups have a major structural problem to overcome, independently of how risky or ambitious they are: you can’t know the value of what you’re building, and you can’t know how much capital you’ll have to raise to get there. If you can’t know either of those two things, then you can’t know the value of your own equity. So how are you supposed to sell it?

In a bubble, mind you, this problem goes away. We don’t care about fair value; we only care about trajectory. Bubbles are moments of temporary financial euphoria, but they contain within them a kind of clarity: startups get a lot easier to fund if everyone just agrees that numbers either go up or go to zero. It sounds ludicrous, and it’s hard to explain to people outside of tech, but it does work.

Is modern Silicon Valley a bubble? Not long ago, we had an argument about this almost every year. But we’ve settled into the right answer, I think, which is simultaneously yes and no. It’s clearly “bubble-like” in that the environment runs on hope, FOMO, and impossibly forward-looking narrative. If everyone stopped believing, it would all fall apart. So, yes, in that sense it’s a bubble.

But if you spend any real time there, you’ll realize this isn’t an ordinary bubble: there are rules. There are virtually no outright scams, there’s a strong social contract, and a complex system of overlapping incentives between founders, investors and operators that keep a healthy simmer but prevent any boiling over. Silicon Valley is a bubble with a superego.

One of the important parts of the system is that it’s pretty illiquid. Startups are not like publicly traded stocks; they do not have a price or a public sentiment index that moves up and down with the daily mood. That’s a really important feature. Startups need to maintain a suspension of disbelief over a long period of time in order to create something out of nothing; nothing kills suspension of disbelief like perception of anything going down. So the solution is for that not to happen. Fundraising and valuation steps occur on a discrete schedule, according to the company’s narrative. It’s locked up in the meantime.

Why is this important? Look at crypto. Crypto, particularly in frothy moments like the ICO mania of 2017 (and maybe now with DeFi and other things), is much more like a classic bubble. Individual stories get pumped and dumped, scams abound, money rushes in foolishly and out painfully. Crypto is a classic bubble, it’s hilarious, and it’s a giant mess. Silicon Valley, for better or worse, is not like that. There are rules, and one of the important rules is that you don’t want FOMO rushing in too fast, because that means it can rush out fast. And the way out is a lot more painful than the way in is fun.

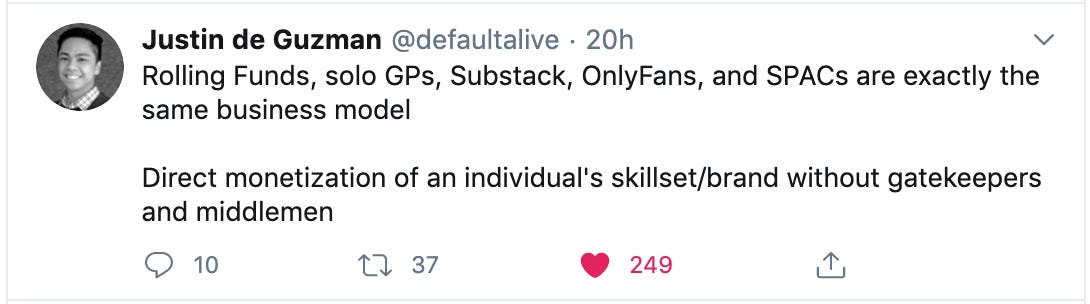

So! I’ve been really intrigued to watch this new trend called Rolling Funds lit up VC Twitter over the last couple weeks, which was a good reminder that this social contract and “useful friction” isn’t only in place between the VC and the startup, but also between the LP and the GP.

The “Rolling Fund” structure, as productized by Angellist, allows a solo GP to set up a fund that accepts commitments from investors on a quarterly basis, rather than raising the fund commitment all at once and then drawing it progressively through capital calls. They’ve been around for a little while, but didn’t really catch the zeitgeist until recently, when Sahil Lavingia raised one in a flash, with others quickly following:

It was June 11 — he remembers it well — when Lavingia got an email from AngelList co-founder Naval Ravikant encouraging him to launch his own Rolling Fund, which allows any accredited investor to raise money from friends, as long as they are accredited investors as well, on a rolling basis.

“The great thing about a Rolling Fund is you don’t need a cap or fund size,” Lavingia said. “Naval said, ‘Let’s start at $100k, and if it goes well, it’ll grow.’ So that’s what we did.”

Aiming to raise $100k to deploy in the fund’s first quarter, Lavingia instead raised more than $1M and maxed out the number of subscribers allowed by SEC rules.

“From never considering being a VC to having a fund that launches this month at over $1M a quarter — that’s pretty meaningful,” Lavingia said. “And it’s replicable. I think this is the future, and I hope people try it.”

With AngelList handling the legal, back-office, accounting, and other parts to managing a fund that he neither has interest or time to deal with (he still runs his company, after all), Lavingia was able to focus on the part he could do well:marketing his fund. (Emphasis mine).

He sent a Notion memo to friends and family and leaned on his Twitter following of 120k+ to get the word out. He recorded a Zoom webinar that to date has more than 4k views — all of which helped him max out his fund subscribers in a matter of weeks. That’s much faster than he thought possible, he said.

There are a few tricky issues with this setup: first, it’s actually kinda hard to deploy money on a rigorous schedule like that; deal flow is lumpy. Second, there’s the tricky issue of who’s actually in what investments, and who just barely missed because they got in the wrong quarter. (This also might skew carry way in favour of the GP; I hadn’t thought of this, thanks to Ali Hamed for bringing it up.)

But generally it’s is a big deal, for a couple reasons. First, it lowers the commitment barrier for a prospective small LP to invest into a fund, by a fair amount. We’re not talking institutional investors here; we’re talking successful tech employees who have disposable income each month that they want to invest back into the ecosystem, and might want to angel invest, say, $50k a year – partially for the (eventual) financial return, but mostly for the social status it conveys.

Second, this adds a whole new level of social dynamic to what it means to support an LP. The social status element of angel investing is well-understood; the highest status symbol you can buy your way into in Silicon Valley is scoring great angel investments. This is more of the same thing – just now at the micr0-LP/GP level. Backing an emerging manager is now just as accessible a status symbol as backing a startup.

This is quite a change for what it takes to raise a fund, and who’ll be successful at doing it. Sahil was able to raise this so quickly because he’s a great product. It’s honestly the same logic as Chamath raising a SPAC: “I’m interesting. People like what I have to say. So I should be a retail product.”

The third reason why it’s a big deal is that it flips the chicken/egg problem of attracting LPs in a really clever way.

On the surface, the attraction of rolling funds is that you can start a fund with only a small number of commitments and then spin it up as more people find out about it; maybe you score some hot deal flow or write a really impactful blog post, or for whatever reason, more people decide to invest into your microfund. In the good old days, this took time; you had to wait a few years to get into the next one. Not anymore! If the fund is accepting new money, you can just send money in for next quarter and get right in.

But in reality, it works in the opposite direction: the combination of rolling fund structure plus social status element of joining as an LP, paradoxically, makes it more important to get your commitment in first. In The Social Subsidy of Angel Investing, I wrote:

One of the biggest frustrations you face as a founder out fundraising is the refrain: “This sounds really interesting. I love it. Let me know when there are a bunch of other people investing, and then I’ll invest too.” From far away, it’s easy to label this behaviour as cowardly investing. But it happens for a reason. If I’m in this for the money, and I can get in at the same price later but with more validation from fellow investors and more confidence in the founder’s ability to get things done, then of course I’ll want to do that. This poses a chicken/egg problem that can hold up or block fundraising entirely.

But when you consider the social returns to angel investing, the equation flips. When you’re pursuing the status, credibility and social capital of being able to say “I gave this entrepreneur their first term sheet, when no one else would”, then you can’t afford to wait. It’s in your interest to get to conviction as quickly as possible, and then genuinely act like the well-connected, contrarian luminary you’d like to be seen as. (Even if you pass, founders can hit you up for introductions and you face social pressure to make good on them. If you don’t, it’s like admitting “my network actually isn’t that big.”)

The social returns to angel investing resolve our chicken/egg problem: they turn angel investing into a kind of “race to be first” that is much more aligned with the founder, and more conducive to breaking inertia and completing deals. The founder wants you to move first, and so do you.

So this is the exact same thing: on the surface, Rolling Fund structures are an easy way for people to sign up later; in reality, the social pressure they unlock puts pressure on you to get in first.

The easier it gets to become a micro-LP, and the more people can plausibly claim “I was an early investor in X” (even though what you own is a tiny sliver of a tiny sliver of the cap table), you might wonder whether that cheapens its value as a status symbol. That’s a fair question! But I don’t think it does. If anything, it augments the value of angel investing as a status symbol, because 1) it increases the total pool of people claiming it as a differentiator, while 2) creating intrigue around who really got a piece of the pie, versus who has crumbs.

This should sound familiar: it’s social fog of war. From earlier this year:

Social Fog of War is a counterintuitive concept: in order for status- and social capital- driven social systems to work optimally, they must be opaque. You can have a sense for who’s at the top and who’s near the bottom; but the exact position and relative rank of anyone’s social status in the community should never be precisely knowable. Social Fog of War means you should never actually know, at any given moment, who is above or below whom.

Think, by analogy, to the status symbol of wearing an expensive watch. If more people start wearing expensive watches, it doesn’t necessarily dilute the watch as a status symbol. Instead it creates intrigue, and fog, into whose watch is really the real thing, versus who’s just scraping into entry level, and who’s actually wearing a fake. The more obscure and hard to tell, the better. If big price tags suddenly appeared on everyone’s wrist and explicitly cleared the fog, now that would ruin their status power. The mystery is important, because it creates room for more people to join, while maintaining that suspension of disbelief.

So there’s an interesting question to ask here: let’s assume the obvious problems get worked out; I’m sure the rolling fund structure will end up being good for Sahil, and good for those who have raised them so far; I hope they all succeed and do great. But the question is: are rolling funds in breach of the Silicon Valley social contract? I was initially tempted to say yes. You generally don’t want to mess with where there’s friction, on purpose, that helps keep the pot simmering but not boil over. You don’t want mechanisms where money can rush in too easily. We choose not to be crypto.

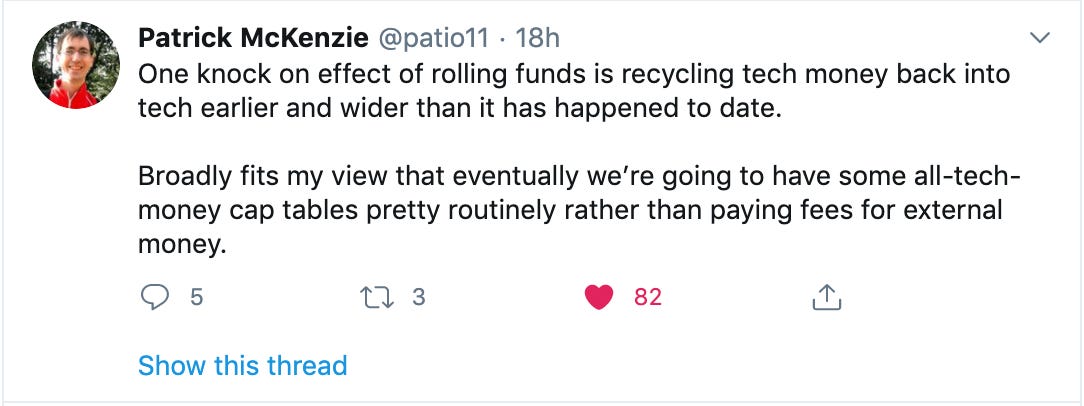

But this isn’t money rushing “in”. It’s simply moving from one place in the tech ecosystem to another. This is money that’s simply moving from one founder or engineer’s salary to another, getting multiplied and leveraged along the way into new companies and new shots on goal to build something big. It’s “fundraising”, but it’s not “inflow” in any conventional sense. This is a lot less like fast money flowing in through a promoter, and a lot more like Front’s Series C several months ago that was done entirely by software company execs personally – unthinkable 10 years ago, but now getting closer to routine.

In that sense, and here’s the twist conclusion – these rolling funds reinforce the social contract, if anything. They’re a way to successfully extend the social subsidy of angel investing into individual trendy managers, increasing the total number of brand-name startups that any individual can get social exposure to, without costing anything along the way except for carry.

Remember, the social returns to angel investing (and now, rolling fund investing) don’t respond to dilution the same way that financial returns do: follow-on investments don’t dilute your stake, they augment your cred. So unlike with “real” venture capital, where it’s not about your number or % of winners (it’s all about your percentage of dollars in the winners), here it just strictly becomes “how do I get into a many companies as possible, even if it’s a tiny amount that’ll get diluted into insignificance?” Rolling funds: maybe not so aligned with actual return on investment, but totally aligned on what really counts – empowering the maximum number of people to get to say they’re an investor in whoever next year’s version of Roam is. Or better yet, getting to say something like “Oh, I’m in Roam, I got in as an LP” or something eye-rolling like that. Just wait, people will start saying this.

Like this post? Get it in your inbox every week with Two Truths and a Take, my weekly newsletter enjoyed by 20,000 people each week.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK